A number of data and metrics are used to monitor and assess the performance of Canada’s transportation system. Merchandise and traffic volumes indicate how busy the system is from a national and regional perspectives. Time-based indicators, such as end-to-end transit time and travel time index, are used to assess the system’s fluidity and supply chain competitiveness.

In addition to efficiency measures, this chapter also presents Canada’s environmental performance measures, such as greenhouse gas emissions. It also presents safety and security performance measures, such as accident rates.

While this chapter presents an overview of the performance of the Canadian transportation system over 2020, the Transportation Data and Information Hub of the Canadian Centre on Transportation Data publishes a large number of traffic and performance indicators, updated on a monthly basis.

Freight transportation: overview of challenges

The transportation system faced unprecedented challenges in 2020. Following a difficult start of the year with railway blockades, a global pandemic and a recession, the system was then taxed by additional challenges such as a labour dispute at one of Canada’s top ports and blockades.

Despite these disruptions, the system was resilient and was able to swiftly recover and adjust to spike in demand as well as new safety protocols and operational procedures. By the end of the year, freight volume was back to 2019 levels in some regions of the country and for some modes.

Ministerial order and blockades

January 2020 was marked by periods of extreme cold across Western Canada which forced railways to impose speed and train length restrictions to ensure safety. In early February, following a crude oil derailment in Saskatchewan, which was the second one in the same area in 2 months, the Minister of Transport, the Honourable Marc Garneau, ensued a ministerial order on speed limits for trains carrying dangerous goods.

Cycle time for shipments of dangerous goods such as crude oil and propane increased by an estimated 30 to 50%. The capacity of the network was reduced by an estimated 15 to 20 % with significant regional and commodity differences as the speed reduction indirectly impacted the movement of other commodities. Additionally, it impacted the movement of passengers, as VIA Rail operates on the same corridor.

In early February, railway blockades started erupting in different locations across Canada and challenged an already fragile transportation system. The blockades lasted for around a month and their impact on the system was exacerbated by their randomness which prevented stakeholders from developing a coordinated response. The blockades had a major impact on passenger movements, freight logistics and trade corridors.

CN was forced to shut down its eastern network with major consequences for multiple economic sectors, such as agricultural, oil and mining. Additionally, the blockades halted rail shipments of perishable food, chlorine for water treatment, propane and raw materials for manufacturers. Port operations on both coasts were also impacted due to the limited ability to move goods across the network. VIA Rail and CN had to temporary layoff around 1,000 and 450 workers, respectively.

COVID-19 pandemic

In March and April, the imposition of public health measures across the country to limit the spread of COVID-19 resulted in dramatic disruptions of economic activities, with real GDP dropping 11.3% in Q2 – the largest quarterly decline since the series started in 1961.

This decline reflected sharp decreases in household spending, business investment, and international trade owing to widespread shutdowns of non-essential businesses, border closures, and restrictions on travel and tourism. Exports fell 29.7% to $32.7 billion in April, the lowest level in more than 10 years. Imports were down 25.1% to $35.9 billion, a value not seen since February 2011.

The fragile economic situation led to lower demand for transportation across the network, notably for non-essential goods and energy products. In contrast, demand for bulk commodities including grain, and potash remained robust.

In the spring, the reemergence of China from initial lockdowns as well as the increase in consumer demand for durable goods and medical supplies led to a surge in inbound container volumes, specifically through western ports. This led to a global container imbalance in a period of high demand for containers. Canadian exporters faced challenges obtaining empty containers to be stuffed with cargo such as forest products and grain. This situation continued well into 2020 with container freight rates increasing to a point where some ocean carriers opted to export the containers empty, for more timely returns of containers back to Asia.

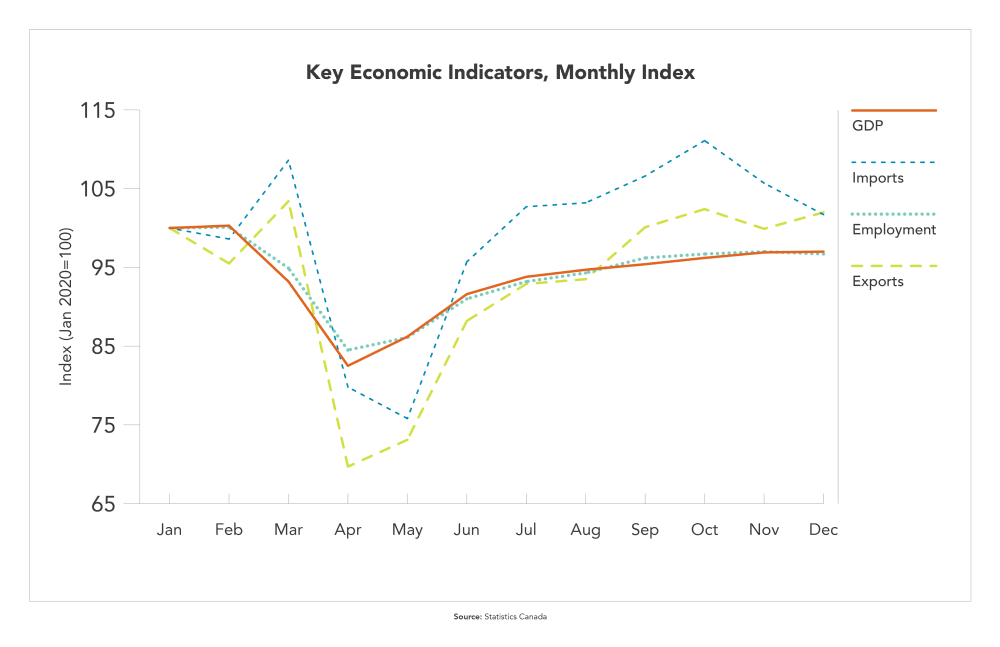

Image description - Key economic indicators, monthly index

The line chart shows the key economic indicators for 2020. Key economic indicators include the GDP, employment, imports and exports data.

| Month | GDP | Employment | Imports | Exports |

|---|---|---|---|---|

| Jan | 100.0 | 100.0 | 100.0 | 100.0 |

| Feb |

100.3 |

100.1 | 98.6 | 95.5 |

| Mar | 93.2 | 94.9 | 108.6 | 103.4 |

| Apr | 82.5 | 84.5 | 79.8 | 69.7 |

| May | 86.2 | 86.1 | 75.8 | 73.1 |

| Jun | 91.6 | 91.0 | 95.7 | 88.2 |

| Jul | 93.8 | 93.2 | 102.7 | 92.9 |

| Aug | 94.7 | 94.3 | 103.2 | 93.5 |

| Sep | 95.4 | 96.2 | 106.6 | 100.1 |

| Oct | 96.2 | 96.7 | 111.1 | 102.4 |

| Nov | 96.9 | 97.0 | 105.7 | 99.9 |

| Dec | 97.0 | 96.7 | 101.7 | 101.99 |

Sources: Statistics Canada

Over the summer, the Canadian economy started recovering. In Q3, Canada’s gross domestic product increased 8.9%. Exports of key essential sectors (like grain, lumber, potash) and some imports (like machinery, electronics, home furnishings) experienced a robust recovery. Rebound in demand in the summer and into fall lead to mismatches between demand and access to transportation services, particularly in the northern regions of western provinces, as railways brought capacity back online to meet the needs of shippers.

Strike at the Port of Montreal

The system faced different disruptions in the late summer and early fall. A longshoremen strike at the Port of Montreal in August significantly impacted fluidity of the eastern and central gateway. The 12-day labour dispute caused disruptions to container movements with vessels diverting containers away from Montreal to be unloaded in Halifax. This had a significant negative impact on cargo volumes handled at the port of Montreal.

Container imports and grain shipments

In the fall, container volumes on the west coast were higher than usual for this time of the year. This situation resulted in some congestion at container terminals, with ports having to adapt to this new reality. The grain supply chain performed well with rail grain shipments up 18% compared to last year for the beginning of the crop year (August-December).

A multimodal transportation system that is productive, competitive and connected can better provide fast shipment times, lower costs and more reliable transportation for freight and passengers. In 2019, Transport Canada launched a study of the impacts of transportation regulations on Canadian supply chains. With this study, Transport Canada is taking a comprehensive approach to identifying freight bottlenecks and seizing future opportunities along Canada’s major trade corridors. This initiative is one of the 24 initiatives announced as part of the Regulatory Review Roadmap on Innovation for the transportation sector.