This is an overview of the federal landscape regarding the transportation sector in Canada, including key facts and performance, emerging trends, authorities and levers available to the Minister of Transport, and key issues for consideration in transportation policy moving forward. It provides context to help inform decision-making on how to implement the Government’s mandate priorities related to transportation, particularly components of the Minister’s mandate letter (note: this overview was prepared in advance of ministerial mandate letters being issued).

Transportation in Canada

Canada’s widely dispersed population and vast land mass make an efficient and accessible transportation system particularly important to connect people and facilitate economic activity. Canada’s multi-modal transportation system consists of a number of strategic assets and networks that span all regions of the country.

Transportation plays a vital role in the daily lives of Canadians and Canada’s economy. It links people to jobs, delivers products to consumers, connects regions and communities to each other and international markets, and serves as an integral component of supply chain flows that function as the backbone of domestic and international trade. In moving large volumes of people and goods, the transportation sector has a direct impact on the safety, security and economic and social well-being of Canadians and their communities.

Air

- Sector was subject to extreme disruptions due to the COVID-19 pandemic in 2020 and 2021, with volumes ranging from approximately 97% below 2019 levels in April 2020, to roughly 90% below 2019 levels in April 2021; passenger volumes have recently started to rebound

- Over 1,300 air carriers operating in, or to and from Canada (40% Canadian, 60% international)

- Nearly 37,000 Canadian registered aircraft and over 31,000 licensed pilots

- 296 certified land airports, 5 certified water airports, and 264 certified heliports

- 26 National Airport System airports and 71 regional/local airports

- 89 airports designated for Canadian Air Transport Security Authority (CATSA) security screening and 565 certified aerodromes

- $31 billion in annual revenues generated pre-pandemic by the third largest aerospace sector in the world, creating over 215,000 jobs in Canada

Image description - Air Transportation Network

The map of Canada shows the 26 airports of the National Airport System. Each airport, represented by a black plane in a white circle, is identified geographically to illustrate basic air infrastructure. Seven of these airports are located in the Atlantic Provinces, three in Québec, four in Ontario, six in the Prairie Provinces and three in British Columbia. Three other airports are found in the capital of each territory.

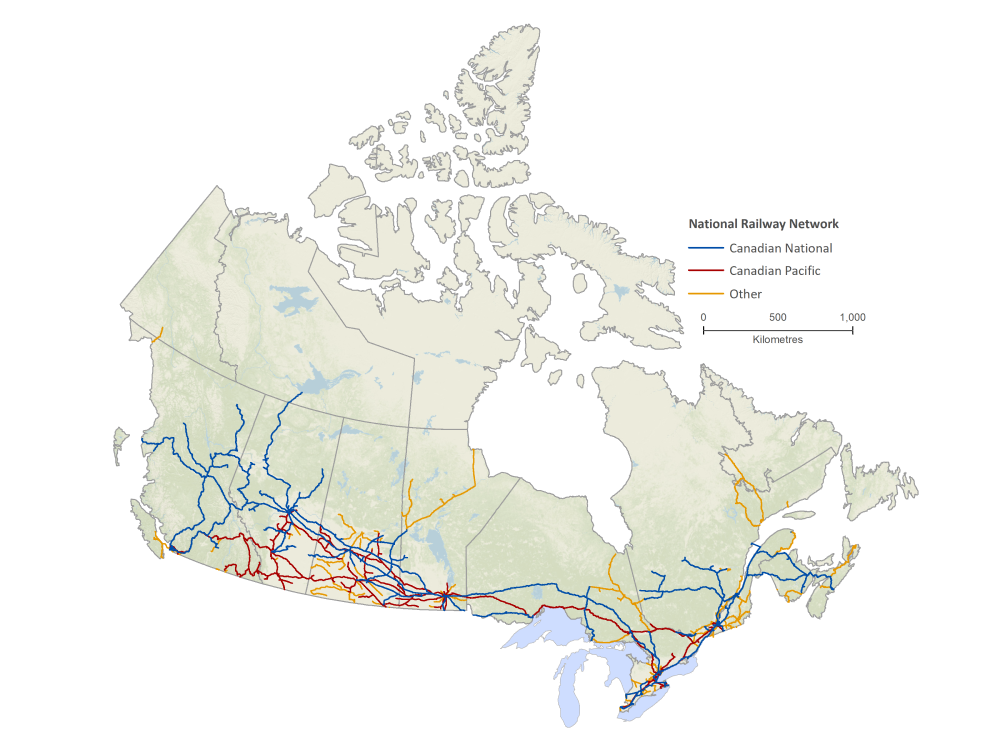

Rail

- Canada has two major Class I railways, Canadian National (CN) and Canadian Pacific (CP), which are responsible for most freight rail traffic; large US-based carriers also operate in Canada

- With 43,065 route-kilometres of railway track, Canada has the third largest railway system in the world:

- CN owns 50.8% (21,878 km)

- CP owns 30.4% (13,094 km)

- other railways own 18.8% (8,094 km)

- Moved more than 324.7 million tonnes of freight in 2020, a 1.7% decrease from 2019

- 1.2 million intercity rail passengers in 2020, the majority on services provided by VIA Rail Canada Inc., a decline of more than 76% from 2019

Image description - Rail Transportation Network

The map of Canada shows the layout and extent of the Canadian rail system. This system currently has over 43,000 route-kilometres of track broken down into Canadian National track (50.8 per cent of the system, represented by blue lines), Canadian Pacific track (30.4 per cent, represented by red lines) and other railways track (18.8 per cent, represented by orange lines).

Marine

- Over 42,000 active registered commercial vessels, including 6,100 active tugs and barges operating in Canada

- Close to 20,000 registered pleasure craft

- Over 560 port facilities, excluding fishing and recreational harbours, of which 17 are Canada Port Authorities (CPAs)

- Across all CPAs, the total volume of cargo handled was over 346 million tonnes (a 0.5% decrease from 2019), with approximately 42% handled by the Port of Vancouver, Canada’s largest and busiest port

Image description - Marine Transportation Network

The map of Canada shows the approximate location of the 17 CPA. Each is represented by an anchor in a blue circle. The CPA ports are (in alphabetical order): Belledune, Halifax, Hamilton-Oshawa, Montréal, Nanaimo, Port Alberni, Prince-Rupert, Québec, Saguenay, Saint John, Sept-Îles, St. John's, Thunder Bay, Toronto, Trois-Rivières, Vancouver Fraser and Windsor. Four of these ports are located in the Atlantic Provinces, five in Québec, four in Ontario and four in British Columbia.

Road

- Most dominant mode for moving freight and passengers in Canada

- Over 25 million road vehicles registered in Canada

- More than 1.1 million two-lane equivalent lane-kilometres of public road

Image description - Road Transportation Network

The map of Canada shows the location of the NHS. The NHS includes over 38,000 kilometers of Canada’s most important highways from coast to coast. Core routes (which represent 72.8 per cent of the NHS) are illustrated by blue lines, Feeder routes (which represent 11.7% of the NHS) by orange lines and Northern and Remote routes (which represent 15.5 per cent of the NHS) by red lines.

Emerging Trends and Pressures

The COVID-19 pandemic has had unprecedented impacts on Canada’s economy and social fabric. The resiliency of the transportation sector was tested across modes and regions, with a slower recovery in demand for air travel and similar passenger sectors. While the operating environment and supply chains have become increasingly more complex and interconnected, Canada continues to showcase one of the safest and most secure transportation systems in the world. With global shifts towards mitigating the impacts of transportation activities on the environment, adapting to a changing climate, and technology-driven solutions accelerated by the pandemic, the performance of the transportation sector remains vital to Canada’s economic prosperity and the well-being of Canadians.

World-Class Transportation Safety and Security

Delivering World-Class Safety and Security for Canada’s Transportation System by Transforming Regulatory and Oversight Regimes

- Canada has one of the safest and most secure transportation systems in the world

- Road casualty collisions have decreased, as have aviation and marine accidents; however, progress on improving rail safety outcomes has stalled

- Safety and security risks to the transportation system are becoming more complex and multifaceted, with the time and costs to mitigate them increasing

- Upholding public confidence in the safety and security of Canada’s transportation system will be critical to supporting the recovery and viability of the sector, particularly air travel, as the border gradually re-opens and restrictions are lifted

- Safety and environmental stewardship are intrinsically connected, given that accidents have the potential to cause significant harm to both humans and the environment, including wildlife

More info

Protecting the safety and security of Canadians during the COVID-19 pandemic and rebuilding public confidence in domestic and international travel will be critical to supporting Canada’s recovery and will remain a top near-term challenge. In moving forward, the opportunity exists to strengthen Canada’s leadership as a World Class Safety and Security regulator by modernizing oversight and enforcement regimes into the next generation to remain vigilant as risks to the system evolve and new threats emerge.

Domestic and International Leadership

Canada has one of the safest and most secure transportation systems in the world. However, as freight and passenger volumes grow and transportation networks become more interconnected and complex, the risks to the system continue to evolve, and new risks emerge. Ongoing efforts to modernize regulations, strengthen oversight and enforcement, and sustain vigilance are essential to ensure world-class safety and security for Canadians.

Most of the headline indicators of transportation safety are moving in the right direction. Looking at trends over the last decade, road accidents causing injury have declined significantly, as have aviation and marine accidents. There has also been progress in rail safety over this period, but it has been slower, and some indicators have plateaued recently. Human factors continue to be a primary contributing cause of transportation accidents in Canada. As a world-class safety regulator, Transport Canada (TC) is committed to continue modernizing regulatory standards and oversight to improve safety performance in all transportation modes (particularly in rail) to make transportation safer for all Canadians and the communities they live in.

The Transportation Safety Board (TSB) is completely independent of TC, and reports to Parliament through the President of the Queen’s Privy Council. It has a significant role in advancing transportation safety in Canada through its independent investigations of occurrences (either accidents or incidents) in the air, marine, rail and pipeline modes. The findings of the TSB’s investigations, along with its biennial Watchlist of issues posing the greatest risk to the safety of Canada’s transportation system, play an important part in informing TC’s work to address evolving risks to the transportation system.

Safety and security risks to the transportation system are becoming more complex and multi-faceted, with the time and costs to both government and industry to mitigate them continuing to rise. This underscores the importance of monitoring risks and responding to safety and security incidents in a timely and robust manner. High-profile accidents, such as the deadly July 2013 train derailment in Lac-Mégantic, Québec, along with the October 2018 Lion Air Flight 610 accident and March 2019 Ethiopian Airlines Flight 302 accident that subsequently led to the global grounding of Boeing 737 MAX 8 aircraft, have raised public awareness and interest in transportation safety. In response to the January 2020 downing of Ukraine International Airlines Flight 752 (PS752) by an Iranian surface-to-air missile, which resulted in the deaths of 176 individuals, including 55 Canadian citizens and 30 permanent residents, TC is working closely with Global Affairs Canada and other partners seeking justice and accountability for the victims. It has launched Safer Skies, an international initiative in partnership with like-minded countries and international associations to prevent similar tragedies in the future. Reforms are also being pursued by TC to the International Civil Aviation Organization’s accident investigation regime (ICAO Annex 13) to improve the credibility and transparency of such future safety investigations so that families and the public can have confidence in their findings and recommendations.

Canada’s rail network is confronted with complex and emerging risks, including an increase in the volume of dangerous goods transported by rail, growing concerns about the reliability of supply chains, and rising cases of security disruptions (e.g. tampering, sabotage). The recent extreme heat and wildfires in British Columbia demonstrated the broader set of risks facing the rail network and community safety throughout Canada, along with the potential disruptions that a changing climate can have on critical transportation corridors and supply chains. It also highlighted the importance of ongoing engagement with rail safety partners, Indigenous groups, communities, and other stakeholders. While interim measures were put in place to reduce risks to public safety and the integrity of the railway tracks and infrastructure, TC is working with railway companies to incorporate these fire risk reduction measures on a permanent basis into the existing regulatory framework for railway operations in Canada.

Opportunity also exists to further strengthen Canada’s marine safety, particularly with marine traffic volumes projected to grow by 50% by 2030. Public and Indigenous expectations are rising when it comes to marine traffic risks being actively managed in a comprehensive, integrated and inclusive manner. Interconnected safety, environmental and economic priorities requires prudent management, with pressures heightened in certain regions, such as the Salish Sea, the Gulf of St. Lawrence, and the Arctic.

COVID-19: Protecting the Safety of Canadians and the Transportation System

Reducing the spread of transmission of the COVID-19 virus and its evolving variants has been a critical priority shared by countries and health organizations across the globe. In Canada, significant importance has been placed on taking a robust and layered approach to protect the safety of the passenger travel system and the fluidity of the freight transportation system, including those working in transportation and shipping, and those travelling for essential purposes, such as truck drivers. This risk-based and measured approach has reflected close monitoring of available data and scientific evidence, such as the vaccination rate of Canadians and the epidemiological situation, along with extensive engagement internationally to collaborate and coordinate the safe resumption of international travel and enable a gradual re-opening of the border as conditions permit.

In the aviation sector, measures have included mandatory face coverings, health checks, temperature screening, and restrictions on international travel, such as limiting international passenger flights to certain Canadian airports and temporarily suspending flights from certain countries experiencing high COVID-19 case counts or variants of concern. Safety measures in line with public health guidance were also put in place for other modes of transportation, such as cruise ships, ferries and intercity rail.

With the gradual recovery expected of Canada’s domestic and international travel markets, rebuilding the public’s confidence in Canada’s transportation system will be critical to supporting a full recovery and viable sector, particularly for air transportation. To foster a COVID-safe recovery of the air travel system, advancements are being made to facilitate investments at Canadian airports in COVID-19 testing infrastructure and the implementation of modern technologies that enable touchless and more secure air travel, such as digital identification and biosecurity.

Security in the Digital Age

Advances in technology and the commercial application of innovative products, including biometrics, digital identification, Remotely Piloted Aircraft Systems (RPAS or “drones”), as well as connected and automated vehicles (CAVs), require modernization of safety and security frameworks that enable innovation and inspire public trust. Demonstrating to the public that regulators are actively working with developers to ensure that safety and security are of highest priority will be critical to sustaining the trust of Canadians when it comes to the successful adoption of new and emerging technologies in the transportation sector. An effective regulatory regime can also enable economic growth. For example, Canada’s $31 billion advanced aerospace manufacturing industry is heavily export-oriented, and it depends crucially on the fact that TC certification of their aerospace products is recognized in export markets around the world.

With the pandemic accelerating pressures and global interests in adopting advanced technologies to facilitate touchless and secure air travel, the implementation of digital identity and biosecurity in Canada provides an opportunity to modernize the air passenger journey in a manner that is COVID-safe while supporting efforts to rebuild public confidence in the safety and security of air travel.

Upholding the confidence and high expectations of Canadians regarding the privacy of their personal data, whether collected by governments or industry, is critical to maintaining the safety of the transportation system, as new technologies come on stream. Modern vehicles have become highly complex digital and physical systems, and the combination of computers and connectivity has made vehicles more vulnerable to hacking and data theft. As manufacturers continue to work towards the testing and deployment of CAVs, governments, in collaboration with manufacturers, will need to address cyber-security vulnerabilities and threats given the potential implications for public safety and security.

Security incidents in the aviation sector, in particular, generate significant international attention and have focused government regulators on enhancing global aviation security standards in recent years.

Canadians rightfully expect that the system for transportation safety and security is world-class; the swift pace of innovation and technological change demands continued work and integrating approaches with other jurisdictions, at home and abroad. Ensuring world-class safety and security standards while minimizing regulatory burden and enabling innovation in transportation solutions is an ongoing challenge that requires constant work in modernizing the system.

Economic Recovery and Transportation Supply Chains

Supporting Post-COVID Economic Recovery by Enhancing Supply Chain Resiliency and Resolving Bottlenecks in Transportation Infrastructure

- In 2020, many events, such as the pandemic, rail blockades and a labour dispute at one of Canada’s major ports, contributed to a challenging year for the transportation system; despite these events, freight volumes remained relatively strong

- The transportation sector represented approximately 3.8% of Canada’s Gross Domestic Product (GDP) ($72 billion) in 2020, a decline from roughly 4.5% ($88 billion) annually prior to the pandemic; employed nearly 1 million people, down over 8% from 2019

- While Canada has an extensive and increasing global trade network, continued diversification will be essential; export growth opportunities are shifting to overseas markets

- Approximately $1.07 trillion worth of goods moved to international markets in 2020, a 10.9% decrease from 2019

- Growing commodity demand from emerging markets is putting increased pressure on key corridors to expand capacity, particularly in Western Canada

More info

In a global economy where economic opportunities are increasingly related to the efficient mobility of people and goods, the performance of the transportation system is vital to Canada’s economy and its ability to grow. With rising traffic volumes intensifying congestion pressures, bottlenecks, and inefficiencies in Canada’s supply chains, there is an opportunity to help foster Canada’s global competitiveness by decreasing delays, uncertainty and risk. Facilitating solutions to address these system fluidity issues, which are becomingly increasingly more complex and multifaceted, can help drive results by lowering costs for Canadian businesses and passengers, along with strengthening Canada’s reputation as a reliable trading partner.

Canada’s transportation system and supply chains were stress-tested on many fronts by COVID-19 pressures, including in responding to pressures related to securing personal protective equipment (PPE) and food supply, which demonstrated the critical importance of having reliable and resilient supply chains. Challenges brought upon by varying border restrictions and public health and safety measures imposed across economies around the world at the onset of the pandemic exacerbated many supply shortages, causing disruptions to global supply chains and impacts stretching across a number of industries. For instance, lumber shortages affected the construction industry, while microchip shortages have impacted the automotive manufacturing and consumer electronics sectors. More recently, the devastating events of extreme heat and wildfires in British Columbia exposed some vulnerabilities, particularly in how extreme weather driven by climate change can quickly escalate the risks of transportation activities to community safety and lead to extended disruptions in economic activity. Adding to the complexity has been supply constraints of marine shipping containers due, in part, to increased competition in the international market driven by pandemic-related demand for consumer products that has resulted in higher costs and fewer shipping options over the past year for some exporters.

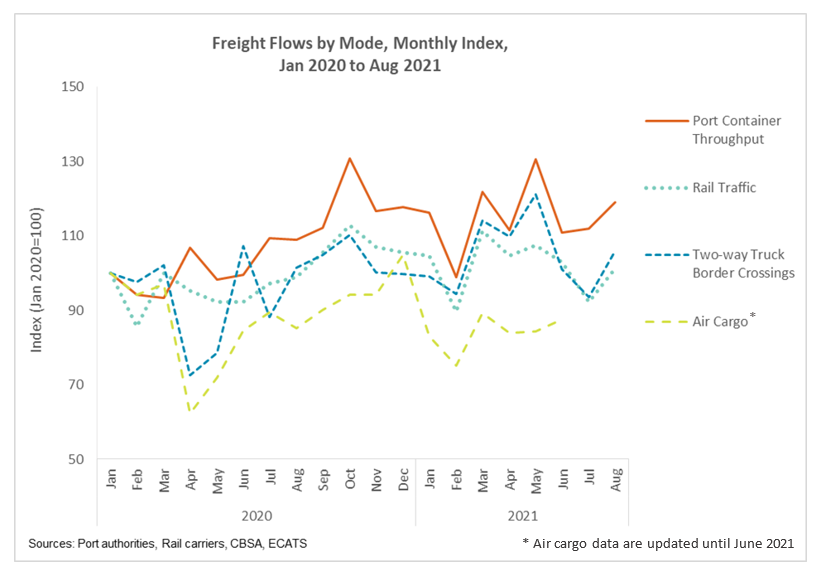

Image description - Chart: Freight flows by mode, monthly index (Jan 2020 to Aug 2021)

The line chart shows the freight flows indicators by mode for the period of January 2020 to August 2021. Freight flows indicators include the Port Container Throughput, Rail Traffic, Two-way Truck Border Crossings and Air Cargo.

|

Year |

Month |

Port Container Throughput |

Rail Traffic |

Two-way Truck Border Crossings |

Air Cargo |

|---|---|---|---|---|---|

|

2020 |

Jan |

100.0 |

100.0 |

100.0 |

100.0 |

|

Feb |

94.3 |

86.7 |

98.2 |

94.1 |

|

|

Mar |

93.3 |

103.2 |

101.6 |

96.9 |

|

|

Apr |

106.9 |

94.5 |

73.5 |

62.3 |

|

|

May |

98.3 |

90.7 |

79.6 |

71.8 |

|

|

Jun |

99.6 |

91.9 |

98.4 |

84.6 |

|

|

Jul |

109.3 |

95.7 |

101.8 |

89.6 |

|

|

Aug |

108.9 |

96.1 |

103.0 |

85.2 |

|

|

Sep |

112.2 |

103.1 |

106.5 |

90.3 |

|

|

Oct |

130.7 |

110.3 |

110.6 |

94.4 |

|

|

Nov |

116.6 |

104.0 |

100.6 |

94.6 |

|

|

Dec |

117.9 |

103.7 |

100.3 |

104.0 |

|

|

2021 |

Jan |

116.2 |

104.8 |

99.1 |

83.1 |

|

Feb |

98.9 |

89.7 |

94.5 |

75.1 |

|

|

Mar |

121.9 |

111.3 |

114.1 |

89.4 |

|

|

Apr |

111.6 |

104.8 |

109.8 |

84.0 |

|

|

May |

130.6 |

107.5 |

121.1 |

84.3 |

|

|

Jun |

110.9 |

102.9 |

101.0 |

87.6 |

|

|

Jul |

112.0 |

92.2 |

93.7 |

|

|

|

Aug |

119.1 |

101.3 |

106.0 |

|

Note: Air cargo data are updated until June 2021

Sources: Port authorities, Rail carriers, CBSC, ECATS

Despite a large initial decline in freight demand at the outset of the pandemic, followed by a strong recovery, the transportation system and supply chains demonstrated considerable resilience. However, intensifying global competition is leading to increasing demand by shippers to have their goods move efficiently, reliably and securely to wherever their customers exist, making for complex needs and supply chains.

International trade is critical to the success of the Canadian economy. Canada’s multi-modal supply chains and transportation corridors are fundamental enablers of trade and play a significant role in connecting Canadian products to global markets. While the United States remains Canada’s top trading partner, accounting for approximately 75% of all Canadian exports, trade networks have been broadening and diversifying, particularly overseas with opportunities expanding following recent trade agreements such as the Comprehensive Economic and Trade Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. Canadian trade with Europe increased by 21% between 2015 and 2019, while trade with the Asia-Pacific market rose by nearly 18% during the same period. These shifting growth opportunities are potential drivers for Canada’s GDP growth in the coming years.

Image description - Chart: International merchandise trade growth and value, by key partner, 2020

The bubble chart shows merchandise trade value (size of the bubble) and 2020 growth rate (vertical axis) for Canada's key trading partners (United States, China, Mexico, United Kingdom and Japan). The United States is Canada's most significant trading partner in terms of merchandise value, with $648 billion. China was the second most important trading partner in terms of merchandise value.

|

Country |

Growth rate |

Trade value |

|---|---|---|

|

United States |

-13.8% |

648 |

|

Mexico |

-18.8% |

36 |

|

China |

3.4% |

102 |

|

United Kingdom |

-4.4% |

28 |

|

Japan |

-10.9% |

26 |

|

Others |

-6.8% |

225 |

Note: Trade value is expressed in billions of Canadian dollars

Source: Statistics Canada, Table 12-10-0011-01

Over the past decade, overseas exports have been steadily increasing by an average of over 5% annually, with British Columbia being a key gateway of Canada’s trade. While capacity has expanded significantly as a result of investments by governments, port terminal operators, and railways, these investments have not been able to fully keep pace with the increase in overseas trade. As a result, there is a continued need to extend the capacity of Canada’s trade corridors through strategic investments and data sharing in the transportation supply chain.

Capacity constraints in Canada’s Western supply chain, particularly in the Lower Mainland of British Columbia, are creating challenges for the movement of key commodities, with heavy rail and road traffic servicing the Port of Vancouver, which is Canada’s largest and busiest port, handling over 50% of all traffic at CPAs in 2020, and $1 out of every $3 of Canada’s trade in goods transiting outside North America. Any congestion around the Port of Vancouver affects shippers far beyond British Columbia, such as natural resource and agriculture developers in western Canada, and risks undermining Canada’s reputation as a reliable and efficient exporter.

As the transportation sector endeavours to fully recover from the impacts of the pandemic and grow over the longer-term in support of the Canadian economy, it is beginning to face greater challenges finding qualified workers in key positions, including trucking, marine shipping and aviation. Canada’s aging workforce is adding to the labour shortage challenge in transportation, which is also the case in other sectors.

Freight transportation demand at the national level is forecast to recover later this year, with some regional differences, as Western Canada is expected to lead the recovery. Overall, Canada’s GDP is expected to reach pre-COVID levels in 2022.

Improved Mobility

Ensuring the Viability and Competitiveness of Canada’s Intercity Passenger Markets through Modernized and Interconnected Mobility Systems

- Transportation is the second largest household expense after shelter, accounting for over $160 billion in 2020

- The impacts of the pandemic on the transportation system have been widespread and varied; operators heavily reliant on passenger volumes, such as airlines and international bridge and tunnel operators, have experienced significant declines and slow recovery

- Growth in population, urbanization, and economic activity is intensifying congestion challenges in Canada’s largest urban areas, particularly on corridors shared by both freight and passenger operations where volumes are heavy

- Remote working practices adopted during COVID-19 could have longer-term impacts on travel patterns if they are sustained post-recovery (e.g., commuting congestion, business travel, etc.)

More Info

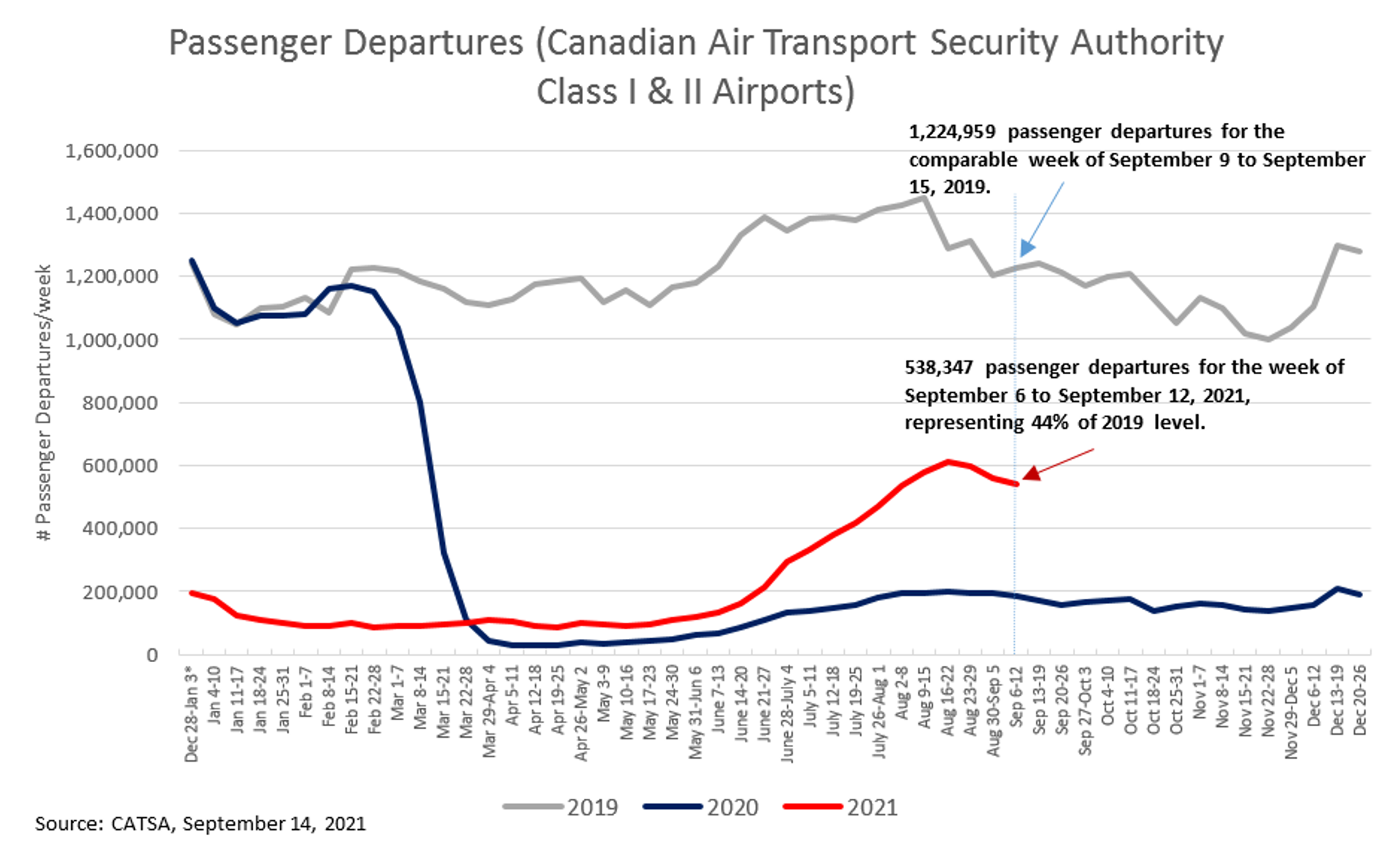

Recovery of Canada’s Air Sector and Other Modes

Canada’s air sector is recovering from an extraordinary crisis. During 2020, the pandemic led to a catastrophic contraction on air services due to the collapse in demand by air passengers. This collapse had ramifications that cascaded throughout the air transportation supply chain, creating an unprecedented situation. Air carriers reduced the size and scope of their networks; airport authorities, which operate on a not-for-profit, user-pay basis, sought relief from their debt obligations; and NAV CANADA, also operating on a not-for-profit basis, had to raise its fees. Throughout most of the pandemic, air passenger volumes have remained below 2019 levels by approximately 90%, with signs of recovery only recently emerging as a result of COVID-safe measures, the gradual re-opening of the border, and high rates of vaccination in the population.

The air sector is particularly important to Canada given the vast landscape and dispersed population. Canada is the world’s third-largest aviation market geographically, with 18 million square kilometres of airspace managed by NAV CANADA, and employed approximately 107,000 Canadians prior to the pandemic.

Image description - Chart: Passenger Departures (Canadian Air Transport Security Authority Class I & II Airports)

The line chart shows a comparison of the number of passengers screened for departures at class 1 and class 2 CATSA airports for the years 2019 to 2021.

|

Reference Date |

2019 |

2020 |

2021 |

|---|---|---|---|

|

Dec 28-Jan 3* |

1,240,587 |

1,250,074 |

192,863 |

|

Jan 4-10 |

1,079,552 |

1,097,061 |

176,687 |

|

Jan 11-17 |

1,048,908 |

1,053,360 |

122,564 |

|

Jan 18-24 |

1,101,105 |

1,072,763 |

108,911 |

|

Jan 25-31 |

1,103,402 |

1,077,130 |

101,771 |

|

Feb 1-7 |

1,130,846 |

1,078,221 |

91,697 |

|

Feb 8-14 |

1,085,334 |

1,158,420 |

92,262 |

|

Feb 15-21 |

1,219,654 |

1,168,630 |

97,817 |

|

Feb 22-28 |

1,226,873 |

1,151,364 |

85,442 |

|

Mar 1-7 |

1,218,593 |

1,037,641 |

91,718 |

|

Mar 8-14 |

1,184,378 |

800,534 |

91,627 |

|

Mar 15-21 |

1,162,506 |

322,974 |

94,740 |

|

Mar 22-28 |

1,118,507 |

110,760 |

101,191 |

|

Mar 29-Apr 4 |

1,110,018 |

43,900 |

108,446 |

|

Apr 5-11 |

1,128,520 |

29,107 |

103,071 |

|

Apr 12-18 |

1,176,388 |

28,585 |

90,954 |

|

Apr 19-25 |

1,183,078 |

30,421 |

86,585 |

|

Apr 26-May 2 |

1,193,622 |

38,311 |

98,043 |

|

May 3-9 |

1,118,141 |

35,767 |

95,926 |

|

May 10-16 |

1,155,851 |

39,063 |

92,098 |

|

May 17-23 |

1,109,155 |

42,680 |

95,080 |

|

May 24-30 |

1,163,730 |

46,030 |

108,443 |

|

May 31-Jun 6 |

1,181,551 |

63,682 |

121,341 |

|

June 7-13 |

1,230,008 |

67,436 |

132,039 |

|

June 14-20 |

1,330,339 |

85,419 |

161,687 |

|

June 21-27 |

1,388,579 |

107,723 |

213,030 |

|

June 28-July 4 |

1,343,797 |

135,202 |

295,189 |

|

July 5-11 |

1,381,488 |

139,035 |

329,890 |

|

July 12-18 |

1,387,870 |

146,225 |

377,999 |

|

July 19-25 |

1,379,297 |

156,349 |

415,686 |

|

July 26-Aug 1 |

1,411,263 |

179,334 |

467,155 |

|

Aug 2-8 |

1,426,390 |

193,684 |

536,190 |

|

Aug 9-15 |

1,448,141 |

194,974 |

577,919 |

|

Aug 16-22 |

1,286,330 |

197,925 |

610,738 |

|

Aug 23-29 |

1,312,330 |

196,992 |

599,157 |

|

Aug 30-Sep 5 |

1,201,002 |

197,091 |

560,729 |

|

Sep 6-12 |

1,224,959 |

183,658 |

538,347 |

|

Sep 13-19 |

1,241,876 |

169,303 |

|

|

Sep 20-26 |

1,211,877 |

158,683 |

|

|

Sep 27-Oct 3 |

1,168,147 |

164,192 |

|

|

Oct 4-10 |

1,197,309 |

168,968 |

|

|

Oct 11-17 |

1,208,296 |

177,336 |

|

|

Oct 18-24 |

1,124,961 |

138,547 |

|

|

Oct 25-31 |

1,050,074 |

153,771 |

|

|

Nov 1-7 |

1,133,333 |

160,325 |

|

|

Nov 8-14 |

1,099,434 |

156,688 |

|

|

Nov 15-21 |

1,020,682 |

143,045 |

|

|

Nov 22-28 |

1,000,083 |

135,734 |

|

|

Nov 29-Dec 5 |

1,039,460 |

147,408 |

|

|

Dec 6-12 |

1,104,574 |

158,679 |

|

|

Dec 13-19 |

1,296,206 |

209,432 |

|

|

Dec 20-26 |

1,279,947 |

188,737 |

Source: CATSA, September 14, 2021

The pandemic created particular challenges for Northern and remote communities, given their higher reliance on air transportation due to their remoteness and dependence on supply chains for the delivery of essential goods, services and connectivity. As the pandemic evolves and efforts continue to work towards recovery and travel restart post-pandemic, it will be important to continue close engagement and collaboration with partners, including provincial and territorial governments, Indigenous communities and the air industry, to address the unique needs of these communities. Collaboration will help to ensure that essential transportation and supply chains for Northern and remote communities are protected for the health, safety and social and economic well-being of all Canadians.

As Canada moves forward with the safe, gradual return of activity in the aviation sector, both domestically and internationally in a way that continues to support the health, safety and security of Canadians, it will be imperative to ensure a vibrant and competitive air sector. In this context, the pandemic provides an opportunity to address structural impediments and help ensure the viability of the sector by re-imagining the passenger experience of the future, especially in light of the important role played by transportation in attracting and retaining talent and investment, fueling the ability of Canada’s economy to grow over the long-term. While significant progress has been made to strengthen air passenger rights, additional refinements to address issues that have arisen during the pandemic could further support efforts to rebuild public confidence and the future prospects of Canada’s air sector.

While Canada’s air travel sector has been hardest-hit by the pandemic, the impacts on the marine and surface passenger transport modes has been widespread and varied due primarily to the introduction of COVID-19 public health and safety measures, the closure of borders to all but essential travel starting in March 2020. Passenger transport operators that provide primarily passenger services (e.g., intercity bus and rail, cross-border motor coach and rail, ferries and cruise ships) have been severely impacted by the decline in passenger trips during the pandemic, which has exposed vulnerabilities in the resiliency of these operations, along with the transportation system as a whole due to the interconnected nature of the system, particularly aspects where revenues are generated by a mix of passenger and freight traffic, such as international bridges and tunnels.

Challenges of sustained regional connectivity across modes have arisen during the pandemic as a result of operators either reducing or eliminating services, impacting the availability of transportation options for some communities.

Countries across the world have taken wide-ranging and often significant measures in responding to the economic pressures brought upon by the pandemic and supporting recovery to help ensure the viability of industries that have been deeply impacted. In Canada, the transportation sector has been supported by general economic support mechanisms, such as the Canada Emergency Wage Subsidy (CEWS), as well as measures specific to the sector, including a suite of measures for the air travel system, which have involved rent relief for airport authorities and financial assistance packages for air carriers that have been made contingent on strict conditions to protect Canadians and the public interest, particularly refunds for flights cancelled and the restoration of regional air services that had been suspended. Further support towards the air sector has also been made available to ensure the continuity of essential air access to remote communities through the development of bilateral agreements with provinces and territories. Other measures that have been taken have primarily involved providing relief to support revenue shortfalls and ensure continued operations for the Confederation Bridge operator, Strait Crossing Bridge Limited, along with VIA Rail Canada Inc. and the Federal Bridge Corporation Limited.

Strategic transportation infrastructure investments also provide significant opportunity to support economic recovery and improve the flow of both goods and people in Canada by reducing bottlenecks and congestion on critical transportation corridors. While important investments are being made as part of the National Trade Corridors Fund through more than $4 billion of federal funding, advancing high frequency rail in the Quebec City-Toronto corridor, Canada’s most densely populated region, also provides a significant opportunity to support economic recovery and transform intercity passenger travel in this market by offering faster, more reliable service, while helping to encourage a shift to rail from more polluting modes of transportation.

Intercity Passenger Mobility

Strong international connectivity and efficient, modern transportation hubs that include major airports with seamless passenger connections to other modes of transportation are vital for Canadian cities to attract and retain talent and investment in support of long-term growth as they increasingly compete with other cities globally.

While Canada has a relatively small population spread over a vast area, the country is becoming increasingly more urbanized, with over 80% of Canadians living in urban areas. This is placing significant pressure on existing infrastructure and creating congestion, especially on corridors and infrastructure where passengers are competing with the transportation of freight. The Greater Toronto Area (GTA) provides a clear example of this phenomenon, as round trip commute times prior to the pandemic were already 20 percent longer than they were twenty years ago. If travel patterns return to pre-pandemic levels once Canada’s economy has fully recovered, the situation threatens to become even more problematic as the population of the GTA is projected to increase from approximately 7 million to nearly 10 million by 2041.

Recent trends that have been accelerated by the pandemic such as growth in e-commerce and the use of smaller, courier-type operations to fulfill last-mile deliveries to end customers can be expected to create additional pressures beyond those associated with population growth. However, these congestion pressures could be partially offset if teleworking and remote working practices adopted during COVID-19 were to meaningfully continue going forward over the long-term.

The surface mobility landscape continues to evolve on a global scale with the advent of new technologies and service models. As a result, carriers using traditional models are required to adapt in order to remain competitive. People are also increasingly looking for faster, easier, and more affordable options to get them to their destination.

In the North, there remains a need for basic transportation infrastructure that is resilient in a rapidly changing environment in order to improve the quality of life for Northerners and enable economic development. Challenges also exist in maintaining and providing access to affordable and reliable transportation services for rural and remote areas, particularly as opportunities to apply traditional business models are limited and consumer choice is reduced. For instance, the availability of surface passenger transportation services to a number of rural and remote communities has seen a decline in recent years.

Mitigation and Climate Change Adaptation

Mitigating the Impact of Transportation Activities on the Environment to Support Canada’s Net-Zero Commitments while Improving System Resiliency to a Changing Climate

- Decarbonization of the transportation system is a key challenge given domestic and international commitments to reduce greenhouse gas (GHG) emissions and achieve a net-zero emission economy

- Transportation sector is the second largest source of Canada’s GHG emissions, accounting for approximately 25% of total GHG emissions, with most from on-road vehicles (passenger and freight)

- Emission reductions are likely to be uneven across modes and over time; progress is being made to move to zero-emission vehicles in the light-duty vehicle sector, and it will be important to maintain the momentum to meet ambitious targets

- Domestic aviation and marine emissions account for 4% and 2% of transportation emissions, and domestic measures to reduce them need to take into account ongoing efforts at the International Maritime Organization and the International Civil Aviation Organization given the global nature of these modes

- Canada is warming at twice the global rate, while the Arctic is warming three times as fast; changes are leading to more extreme weather events, permafrost thaw, sea level rise, and increased wildfires and flooding

- Important to build resiliency and redundancy into Canada’s transportation system across regions, including adapting operations, practices and infrastructure

- The Arctic and remote northern communities face unique challenges, such as more intense climate change and increasingly unpredictable weather conditions, small and scattered populations, and supply chain and infrastructure limitations

- Degradation of ecosystems is putting increased pressure on biodiversity; reduction of transportation impacts on wildlife (e.g., whales), as well as better management of waste (e.g., plastics) and spill risks (e.g., oil, marine fuel) continue to be a focus of efforts within the transportation sector

More info

Mitigating the Impacts of Transportation Activities on the Environment to Support Canada’s Net-Zero Commitments

Growth in transportation activities will continue to exert pressure on key corridors and congestion in urban areas, exacerbating environmental issues and public expectations for sustainable development. Risks and potential harm as a result of accidents can also have significant implications on both safety and the environment. The transportation sector poses direct, indirect and cumulative environmental impacts for which mitigation is complex and multidimensional. Therefore, coordination across federal departments, jurisdictions, stakeholders and other sectors is an important element of any mitigation approach.

The Canadian transportation system relies almost entirely on the use of fossil fuels to move passengers and freight across the country and internationally. As a result, the sector is the second largest source of Canada’s GHG emissions after the oil and gas sector, accounting for about a quarter of total GHG emissions, with over 80% generated from on-road vehicles carrying people and goods. As a result, the transportation sector plays a critical part in contributing towards Canada’s overall emissions reductions commitments, including under the Paris Agreement and, more recently, the Leaders’ Summit on Climate Change where Canada announced that it was increasing emission reduction targets to 40-45% below 2005 levels by 2030, which was confirmed in Canada’s submission to the United Nations of its Nationally Determined Contribution. Canada also committed to achieving a net-zero emission economy by 2050, enshrined in the Canadian Net-Zero Emissions Accountability Act.

Transportation emissions have increased by 16% since 2005, from 160 megatonnes (Mt) to 186 Mt in 2019, due primarily to increasing population and economic activity, as well as demand for passenger vehicles and freight moved by emission-intensive heavy-duty trucks. Despite a projected decrease by 6% by 2030 from 2005 levels, the transportation sector will become the largest source of Canada’s emissions.

In order to encourage the adoption of zero-emission vehicles by Canadians and Canadians businesses, TC’s Incentives for Zero-Emission Vehicles (iZEV) Program provides consumers with incentives of up to $5000 for eligible vehicles. Across Canada, many provinces and territories are also offering zero-emission vehicle incentives, including British Columbia, the Yukon, the Northwest Territories, Quebec, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

Decarbonizing the transportation sector will remain a challenge as the economy and population grow, transportation equipment and assets have high capital costs and long life spans, and new technologies and alternative fuels take time and resources to implement. Significant efforts have been made in addressing transportation related emissions, through incentives for the purchase of zero-emission vehicles and energy efficiency requirements for new vehicles and heavy trucks, and also through operational improvements. Continued collaboration, investment and government policy will be required to support the scale-up of new low-carbon technologies and alternative fuels from early adopters to the mainstream market, and enable and accelerate the shift needed to transition the sector away from fossil fuels and support Canada’s long-term decarbonization objectives.

Healthy ecosystems are a key factor in securing a safe and responsible environment. Future shipping trends will increase pressure on biodiversity as the degradation of some sensitive ecosystems are unfolding. International and domestic demands to protect marine ecosystems are putting increased pressure on governments to reduce transportation impacts on wildlife (e.g., whales) and better manage waste (e.g., plastics) and spill risks (e.g., oil, marine fuel). For its part, while Canadian ship-based sources of marine plastics represent only a fraction of the larger global issue, Transport Canada’s focus has centered on waste associated with the shipping sector, such as abandoned and wrecked vessels and the Department continues to play a role in the advancement of the International Maritime Organization’s Action Plan to Address Marine Plastic Litter from Ships.

Modern safeguards have been put in place to protect coastal communities and the right to navigate on Canada’s waterways while respecting our partnerships with Indigenous peoples, stakeholders, and other provincial jurisdictions. Accordingly, legislation is in place to help keep Canada’s navigable waters open for transport and recreation and to allow the Department to address vessels of concern which may appear on Canada’s waterways.

Resiliency and Adapting to the Impacts of a Changing Climate

The quality of life for Canadians and Canada’s future growth are deeply tied to the environment. A cleaner, more sustainable future has become intrinsically connected with objectives around an affordable cost of living and resilient communities.

While international leaders adopted the Paris Agreement in 2015 with the objective to limit global temperature increases below 2°C and, if possible, to 1.5°C, scientific research shows that climate change is disproportionately affecting Canada, causing the country to warm two times faster than the global average, and three times faster in the North.

The World Economic Forum’s 2021 Global Risks Report identifies “extreme weather” and “climate action failure” as two of the highest likelihood global risks over the next ten years. A 2019 Canadian Council of Academies report on “Canada’s Top Climate Change Risks” found that climate risks to Canada are most acute in six areas, three of which relate directly to transportation – physical infrastructure, coastal regions and northern communities.

Given the global nature of climate change and the lag in the climate system’s responses to mitigation efforts, even as measures are put in place and emissions are reduced, the climate will continue to change. For Canada, this involves a range of changes, such as more extreme heat, less extreme cold, longer growing seasons, shorter snow and ice seasons, thinning glaciers, thawing permafrost, and rising sea levels. The frequency, intensity and duration of extreme weather events such as heat waves, wildfires and flash floods are projected to increase over the coming decades.

The recent extreme heat wave and wildfires in Western Canada have underscored the urgency of adapting to climate change. In the North, thawing permafrost is challenging traditional ways of life and infrastructure. In other parts of Canada, farmers continue to lose crops to both drought and flooding, and coastal communities are grappling with stronger storm surges and coastal erosion. As warming continues, these types of events will become more frequent and demonstrate the need for an accelerated pace of adaptation action alongside continued mitigation efforts.

With the potential safety risks and disruptions to economic activity that can result from extreme weather events, it further highlights the important need to build resiliency and redundancy into Canada’s transportation system across all regions, including adapting our operations, practices and infrastructure. The transportation sector is at various stages of readiness to address these growing needs.

Canada’s North faces unique realities, such as increasingly harsh and unpredictable weather conditions, small and dispersed populations, supply chain complexities, and infrastructure limitations. Rapid warming also represents an immediate and considerable threat to transportation reliability, as well as safety and food security in the North, including through deteriorating surface conditions from permafrost degradation, shorter winter operating seasons, and unpredictable marine navigation due to unanticipated ice conditions. The global COVID-19 pandemic exposed the unprecedented challenges that Northern and remote communities can face in light of their dependence on reliable supply chains for the delivery of essential goods and services, with transportation serving as a lifeline for these communities, along with their social and economic development.

Innovation

Keeping Pace with Innovation as a Safety and Economic Regulator While Fostering Smart Mobility Solutions to Enhance Canada’s Global Competiveness and Quality of Life

- Appropriate adoption of new and emerging technologies, such as artificial intelligence (AI) and automation, could be key enablers to optimizing supply chain efficiency, mobility of people, and safety

- Connected and automated vehicles (CAVs) and remotely piloted aircraft systems (RPAS or “drones”) have the potential to bring far-reaching social, economic and safety benefits

- But there are also risks with these new technologies that may reduce effectiveness or worsen trends, such as congestion and vehicle emissions, or create new safety risks; avoiding these risks requires effective planning, engagement and thoughtful policies

- Upholding the privacy of data will be critical to the successful adoption of new transportation technologies to meet expectations of Canadians that their personal data will be kept safe and secure

More info

As COVID-19 has accelerated the pace of adoption of technological solutions, expanding the integration of digital technologies, such as artificial intelligence (AI) and automation, could serve as key enablers to optimizing supply chain efficiency and the mobility of goods and people. Supporting Canada’s economic recovery and global competitiveness will require balancing objectives of reducing regulatory burden and enabling innovation while ensuring world-leading safety, security and environmental standards are upheld.

The way that people and goods travel, particularly in urban areas, is approaching an inflection point, driven by a series of converging technological and social trends. Harnessing technological improvements is increasingly a means of achieving competitive advantage. The next generation of transportation and infrastructure will define the way people, goods, services and data move in the 21st century, and will be critical to Canada’s global competitiveness and leadership in the technology-driven global economy.

These new technologies and models can help address the mobility needs of Canadians, including an aging population, and change how and where goods are produced, which could potentially have significant implications for trade flows and transportation demand. Legislative and regulatory regimes will need to be agile and smart in balancing technological advancement with the high standards of transportation safety and privacy expected by Canadians.

An example of the significant potential that technologies can bring to the transportation sector is the advancement of connected and automated vehicles (CAVs), which could have far-reaching social, economic and safety benefits. This opportunity has led to intense global competition for leadership in CAV design, development and deployment. In addition, Remotely Piloted Aircraft Systems (RPAS or “drones”) are another innovation that could have widespread benefits, with the technology offering a broad scope of potential uses, ranging from last mile commercial deliveries (e.g., Amazon’s Prime Air) to supporting public safety and law enforcement operations (e.g., border surveillance), including inspections and other oversight activities by Transport Canada (TC) and other federal organizations.

COVID-19 has accelerated digitalization, creating an opportunity to invest in new technology, data, and cross-industry collaboration to better optimize supply chains and gain a collaborative view of the infrastructure that supports it, thereby increasing capacity. There are increasingly sophisticated applications being created through the development of technologies such as AI and the Internet of Things. These technologies and applications have shown promise to enable greater optimization and responsiveness, enhance productivity, and lower costs in logistics, transportation, borders and information transfers – generating higher throughput capacity and yielding better end-to-end visibility across the value chain.

For example, new AI solutions are being integrated in advanced transportation systems, cargo inspection, and the processing of transport documentation. Blockchain innovations have been finding success as a base for global supply chain management, while IoT devices and sensors can track shipping containers in real-time, improving efficiencies and transparency for the movement of goods.

Leveraging new technologies can also help solve urban transportation challenges, as fostering smart mobility solutions presents significant opportunities, with possibilities including: digital infrastructure, sensors and connectivity to change the way roads are used and managed; new modes of transit and improvements to existing services with the introduction of on-demand, shared, electric – and eventually, CAVs that connect to and complement transit; and new mobility hubs, with a range of travel options, to address first- and last-mile challenges and deliver a more seamless travel experience (e.g., mobility-as-a-service).

However, while these promising technologies and business models are likely to have many benefits, without strong government leadership, some associated risks may reduce their effectiveness or even worsen existing trends. For example:

- As cities evolve and adapt to the rising use of CAVs, shared mobility services, and micro-freight deliveries (e.g., Amazon), these improved transportation and delivery services also present a risk of negative impacts, such as increased congestion that could result without adequate federal, provincial and municipal planning. There are also challenges associated with meeting the increased demands on both physical infrastructure (e.g., machine-readable lane markings, traffic signs) and digital infrastructure (e.g., 5G, infrastructure-to-vehicle communication technologies), needed to deploy advanced transportation technologies like CAVs.

- Upholding the privacy of data. Addressing this risk will be a critical element to the successful adoption of new and emerging technologies (e.g., 5G) in an increasingly connected transportation environment, as Canadians and businesses have high expectations that personal and commercial data, whether collected by governments or industry, will be kept safe and secure. In its role as a regulator, TC has a key responsibility to maintain a strong cyber resilience posture within its own operations and establish itself at the forefront of developing expertise, guidance and advancing policies to support the transportation industry.

To remain competitive in the global economy post-COVID while optimizing security and rebuilding public confidence in the air transportation sector, there would be a need to harness innovation, data analytics, information sharing, and to strengthen partnerships to respond to increasing passenger and cargo volumes, the evolving threat and risk environment, and escalating passenger expectations. Technological advancements, such as biometrics, support identity verification and present an opportunity to strengthen transportation security to better facilitate the efficient movement of people, particularly at airports and other major transportation hubs. Using advanced technologies will also allow TC to respond and keep pace with international partners and heightened passenger expectations for fast, seamless, touchless and paperless service – while protecting privacy.

Governance and Policy Frameworks

Renewing Transportation Governance and Policy Frameworks to Assure Greater Transparency, Efficiency and Accountability in the Transportation Sector

- The Minister of Transport is responsible for the largest federal portfolio of Crown corporations, shared governance organizations (e.g., airport authorities, Canada Port Authorities (CPAs)), agencies and tribunals

- The Minister plays an important role in selecting qualified candidates for over 300 Governor in Council and ministerial appointments across this large portfolio for a wide-range of positions (e.g., chairs, CEOs, etc.)

- Transport Canada’s (TC) continues to build and deliver on its transformation by modernizing its authorities and leveraging new digital technologies, particularly in light of COVID-19 impacts, to ensure policy frameworks and service delivery meet the evolving needs of the transportation sector and Canadians

More info

TC’s mandate is to serve Canadians everyday by ensuring the transportation system is safe and secure, efficient and environmentally responsible.

The Department was created by the Department of Transport Act in 1936. Until the mid-1990s, TC’s mandate included owning and operating key transportation infrastructure assets, including CN Railway and numerous airports and ports. Over the past 30 years, Canadian governments have taken a number of concerted actions affecting the transportation sector, including: the deregulation of markets; the divestiture of assets; and the liberalization of international trade and investment. The current structure and mandate of the Department reflects these changes. The decentralization of operational responsibilities and resulting fundamental reinvention of TC has allowed the Department to focus on being a leading regulator, as well as the development and promulgation of federal policies and programming. Shared-governance organizations, particularly airport and port authorities, have been established to take on responsibilities that are more operational in nature, as these authorities are better placed to make operational decisions in consideration of local realities. The Department continues to build and deliver on its transformation by modernizing its authorities and by leveraging new digital technologies so that its legislative, policy, and service delivery frameworks are agile, smart and trusted in order to meet the rapidly evolving needs of the transportation sector and Canadians.

With the Transport portfolio being one of the largest in the federal government, encompassing Crown corporations, shared governance organizations, agencies and tribunals, it is prudent to ensure that the governance frameworks and policy approaches remain modernized, particularly in light of the impacts of COVID-19, which has stress-tested Canada’s transportation marketplace frameworks.

To preserve fairness and access to justice, the portfolio includes two tribunals, including the Canadian Transportation Agency and the Transportation Appeal, offering recourse mechanisms in accordance with authorities set out under various pieces of federal transportation legislation. Two “funds” also exist that are administered at arm’s length to determine the scope of financial remedies for accidents, which include the Ship-source Oil Pollution Fund and the Fund for Railway Accidents Involving Dangerous Goods. These organizations are quasi-judicial in nature, with the ability to render binding decisions on matters under their respective authorities. While the Minister of Transport is not involved in decision-making carried out by these organizations, the Minister is accountable to Parliament for their performance, including appointments of leadership positions and ensuring sufficient funding.

A number of external pressures have surfaced over time, including as part of COVID-19 pressures, which have impacted transportation entities both within and external to the Transport portfolio, including:

- Heightened Service Expectations: CPAs are facing pressure from marine users to address strained capacity and congestion, along with outdated governance. Additionally, the volume of complaints being made under the Air Passenger Protection Regulations is placing increased demands on the capacity of the Canadian Transportation Agency to address them in a timely manner. Furthermore, many freight shippers are “captive” to Canada’s two main freight railways and seek more timely access to remedies under the Canada Transportation Act.

- Funding Pressures: COVID-19 has severely impacted passenger operators in Canada, which includes several federally appropriated portfolio entities facing financial challenges to deliver services, such as VIA Rail, Marine Atlantic Inc., and the Canadian Transportation Agency. Additionally, TC’s cost recovery framework requires modernization to help sustain the Department’s services, while new fees require consideration of the impacts of COVID-19 on the transportation sector.

- Demand for Engagement and Partnerships: Consultations and engagement activities are particularly important for a sector defined by transportation providers and users, which requires a balanced approached. For instance, while the Transportation Modernization Act made important changes to foster improved transparency and efficiency in the rail sector, challenges remain in balancing the demands of rail customers and the railways. Additionally, commitments to advance reconciliation with Indigenous peoples involves significant transportation assets and infrastructure that often reside within or in close proximity to reserves and traditional territories, such as ports, airports and railway lines.

- Evolving Governance: Opportunities exist to modernize some elements of the Transport portfolio to better ensure entities are able to effectively deliver on their mandates and provide greater transparency, efficiency and accountability in the transportation sector.

Federal Authorities and Levers

The Minister of Transport has a number of authorities and levers available to carry out and advance the Government's agenda and priorities, including legislation, regulations, funding, convening power, information and data, and international engagement.

Legislation and Regulations

- Minister of Transport has authority to propose and enforce laws and regulations to ensure safe, secure, efficient and environmentally responsible transportation

- One of the largest federal regulators (50 statutes, 236 sets of regulations)

More info

In exercising the federal government’s jurisdiction over transportation, the Minister of Transport is responsible for 50 Acts of Parliament, such as the Canada Transportation Act, Aeronautics Act, and Canada Marine Act, and Railway Safety Act. Legislative authorities provide the federal government with jurisdiction to regulate safety, security, economic activity, and the environment related to a wide-range of issues pertaining to air, marine, rail, international bridges and tunnels; strategic federal assets such as major airports and ports; and standards for motor vehicles, child seats, and tires.

TC is the second largest federal regulator after Health Canada. With responsibility for the administration of 236 sets of regulations, TC has a significant role in overseeing and modernizing the transportation system to the benefit of Canadians. Oversight and enforcement activities carried out by TC’s inspectors and regulatory experts across the country are central to the Department’s mission of ensuring world-class safety of the transportation system for Canadians.

TC, similar to other federal departments, has legal obligations anchored in Section 35 of the Constitution Act, 1982, that recognizes and affirms existing Indigenous and treaty rights. Negotiated agreements, including modern treaties, and Court decisions interpreting Section 35 inform TC’s legal obligations, notably including the legal duty to consult Indigenous peoples.

Jurisdictional Landscape

Transportation in Canada is a shared jurisdiction with provinces and territories (PTs), and varies by mode. TC develops the legislative and policy framework concerning air (e.g., airlines, airports, air navigation services), significant aspects of marine (e.g., shipping lines, ferries, ports, pilotage, St. Lawrence Seaway), interprovincial and international rail, and international bridges and tunnels, along with some aspects of interprovincial trucking and bus. PTs generally have legislative jurisdiction over intra-provincial transportation undertakings, public transit systems, and local roads and bridges.

TC exercises a key national and international mandate for the components of the transportation system within federal jurisdiction, particularly in air (exclusively federal) and marine (shared but mostly within federal jurisdiction). Transportation assets are owned, maintained and operated by a mix of public (municipal, PT, and federal) and private sector partners and agencies.

Funding

- Select number of targeted funding programs support economic, safety, security and environmental objectives

- For instance, TC administers the National Trade Corridors Fund (NTCF), which creates funding partnerships to build critical infrastructure that improves the overall mobility of people and goods in Canada and build stronger, more efficient transportation corridors to international markets

More info

The federal government can achieve key priorities with respect to the transportation program through funding certain activities and agreements, such as securing strategic investments in transportation infrastructure in order to advance national objectives related to economic growth and trade. For instance, the NTCF is a merit-based competitive program to make strategic transportation infrastructure investments that reduce bottlenecks and build more efficient and fluid trade corridors to global markets. The NTCF was initially launched in 2017 with a plan to invest $1.9 billion over 11 years, although an additional $400 million was provided for the North in Budget 2019, along with a further $1.9 billion in Budget 2021. In addition to the NTCF, TC also administers targeted funding programs that support economic, safety, security and environmental objectives, such as the Airports Capital Assistance Program, Rail Safety Improvement Program, and Abandoned Boats Program.

Convening Power

- Bringing public and private sector partners, stakeholders and Indigenous groups together in roundtables and other venues to build a better transportation system for Canadians. National leadership in transportation involves a strong partnership with provincial and territorial partners given transportation modes are interconnected and jurisdiction is shared, particularly with respect to surface transportation

More info

There are opportunities for TC to carry out its mandate and provide national leadership on key issues by exercising its convening power through engagement and partnerships with governments, Indigenous peoples, experts and stakeholders. For instance, TC chairs a Commodity Supply Chain Table to facilitate collaboration and information sharing amongst supply chain stakeholders (e.g., producers, shippers, railways, ports, etc.) with the objective of improving the efficiency and reliability of transportation corridors in moving Canadian commodities to market. The Minister of Transport is also a permanent co-chair of the Council of Ministers Responsible for Transportation and Highway Safety, which is the principal intergovernmental forum in Canada for discussion and coordination of multi-jurisdictional transportation issues.

With an increasingly interconnected transportation system and growing stakeholder and public interest in transportation issues, particularly in urban areas, along with expanded federal commitments regarding partnerships with Indigenous groups, collaborative and integrated planning is important to enable economic growth and enhance the efficiency and reliability of Canada’s trade and transportation corridors.

Information Broker

- TC is a national resource for transportation data, and has legal authorities to collect and disseminate third party data

- Data has become a crucial resource in the planning and operation of the transportation system; reliable and efficient transportation services increasingly rely on real-time digital sharing of data among the transportation value chain partners

More info

With increasing global competition and the rapid pace of technological change, significant importance and industry interest is being placed on greater and more timely data and information, notably real-time data, to support planning and decision-making, particularly to promote and help facilitate the fluid and reliable mobility of people and goods. While TC has legal authorities to collect and disseminate third party data, it often works in close collaboration with federal partners, other levels of government, and the transportation industry to improve access to authoritative sources of information on multi-modal transportation and performance measures. For instance, TC worked closely with Statistics Canada to create the Canadian Centre on Transportation Data in order to make transportation data and information more accessible to support policy and decision makers, industry players and transportation users.

International Engagement

- International relationships are key to TC’s ability to deliver on its national mandate

- TC is actively engaged as a constructive partner in multi-lateral bodies that establish international standards, such as the International Civil Aviation Organization (ICAO) and International Maritime Organization (IMO); the Department works closely with national transportation regulators and policy authorities in other countries, with a particular emphasis on the United States (U.S.), and achieving regulatory alignment in transportation across the Canada-U.S. border

More info

International Engagement

While Global Affairs Canada is the overall lead federal department for international relations, TC represents Canada’s interests, as primarily related to the safety, security and efficiency of transport elements of trade agreements, and at multilateral transportation institutions such as the International Civil Aviation Organization (ICAO), International Maritime Organization (IMO), and International Transport Forum (ITF), among other multilateral organizations.

Some Key Considerations Moving Forward: Response, Recovery and Re-Imagining

Canada’s ability to effectively respond to and promote an integrated and connected transportation system that offers safe, secure, cost-effective, resilient and environmentally sustainable transportation solutions is important to foster economic prosperity and meet the mobility needs of Canadians. In looking ahead over the coming years, there are some key considerations facing the transportation sector that could help inform how the Government decides to move forward to implement mandate priorities and commitments related to transportation.

(Note: this overview and the considerations below were prepared in advance of mandate letters being issued)

Transport Canada (TC) possesses the knowledge, expertise and, increasingly, the data to play a key leadership role in convening and collaborating with stakeholders and other levels of government, and partnering with Indigenous groups. The Department has the ability to deliver effective regulations, funding programs, and policy advice, as well as establish meaningful partnerships, all with the goal of advancing key government mandate priorities related to transportation. Optimizing the use of federal authorities and investments, while targeting areas of greatest impact, would provide benefits to the overall system – improving the fluidity, reliability and efficiency of moving people and goods while protecting the environment.

Delivering on mandate priorities and strengthening Canada’s transportation system will require integrated solutions that resolve the pressures among inter-related economic, social, environmental, safety and security objectives. Some examples include:

- Reducing regulatory burden and enabling innovation in the sector while ensuring world-leading safety, security and environmental standards are maintained;

- Enhancing the mobility of goods and people in urban areas while minimizing impacts on citizens; and

- Addressing the different transportation pressures among large urban, small remote and northern communities.

Going forward, it will be important to examine and, in some cases, augment, the tools available to be able to respond quickly and effectively to anticipated and unforeseen challenges that may arise in the future, whether caused by supply chain disruptions, global events, extreme weather impacts or other factors. With global competition rising, economies that have safe, efficient and resilient supply chains and are able to quickly adjust to shifting pressures will be well-situated to enable longer-term economic growth.

Response

COVID-19 is not over; protecting the safety of Canadians and responding to the needs of the sector will remain critical

Recovery

Could involve concerted efforts to support recovery of hardest hit areas of the transportation sector while also leveraging opportunity to build back better

Re-imagining

Potential opportunity exists to consider a re-set of long-term policy frameworks for the future of transportation in Canada and potential areas of focus, including how Government operates

In this context, as the Government moves forward on its mandate priorities related to transportation, a key consideration involves how to ensure that Canada’s transportation safety, security and environmental frameworks meet or surpass the high standards that Canadians have come to expect as freight and passenger volumes continue to increase and disruptive new technologies are introduced into the system.

[ Redacted ]

To successfully deliver on government priorities and provide better services to Canadians, TC must continue to transform how it works, and continue to make progress in its current efforts on digital service innovation, particularly across the many business lines where it provides services to citizens and businesses.