Organizational Profile

Appropriate Minister: Marc Garneau, Minister of Transport

Institutional Head: Jean-François Tremblay, Deputy Minister

Ministerial Portfolio: Transport Canada

Transport Canada is part of the Transport Canada Portfolio Endnote ii, which includes Transport Canada, shared governance organizations (e.g., the St. Lawrence Seaway Management Corporation Endnote iii), Crown corporations (e.g., the Great Lakes Pilotage Authority Endnote iv, Canada Post Corporation Endnote vi) and administrative tribunals/agencies (e.g., the Transportation Appeal Tribunal of CanadaEndnote vii). Grouping these organizations into one portfolio allows for integrated decision making on transportation issues.

Enabling Instrument: Department of Transport Act Endnote viii(R.S., 1985, c. T-18)

Transport Canada administers over 50 laws related to transportationEndnote viii and also shares the administration of many others. Access to the full text of federal acts and regulations is provided by Justice Canada, which is responsible for maintaining the Consolidated Statutes of CanadaEndnote ix.

Year of incorporation / Commencement: 1936

Organizational Context

Raison d'être

A safe and secure transportation system provides reliable and efficient movement of goods and people across the country and around the world. In an environmentally responsible way, it meets the challenges posed by topography and geography, linking communities and reducing the effects of the distance that separates people. These vital roles reflect transportation’s interdependent relationship with all sectors of the economy and society.

OUR VISION

A transportation system in Canada that is recognized worldwide as safe and secure, efficient and environmentally responsible.

Transport Canada’s Departmental vision of a sustainable transportation system integrates social, economic and environmental objectives. Our vision’s three guiding principles are to work towards the following objectives:

- The highest possible safety and security of life and property, supported by performance-based standards and regulations;

- The efficient movement of people and goods to support economic prosperity and a sustainable quality of life, based on competitive markets and targeted use of regulation and government funding; and

- Respect of the environmental legacy of future generations of Canadians, guided by environmental assessment and planning processes in transportation decisions and selective use of regulation and government funding.

Responsibilities

Transport Canada Portfolio Endnote xi is responsible for the Government of Canada’s transportation policies and programs. The Department develops legislative and regulatory frameworks, and conducts transportation oversight through legislative, regulatory, surveillance and enforcement activities. While not directly responsible for all aspects or modes of transportation, the Department plays a leadership role to ensure that all parts of the transportation system across Canada work together effectively.

The federal government, with Transport Canada in the lead, has sole responsibility for matters such as aviation safety and security; for other matters, we share responsibility with other government departments, and provincial, territorial and municipal governments. We must also work with trading partners and in international organizations to understand and harmonize policy and administrative frameworks, so as to protect Canadian users of the global transportation system while encouraging efficiency.

In areas for which Transport Canada does not have direct responsibility—for example, for building and maintaining road networks—we use strategic funding and partnerships to promote the safe, efficient and environmentally responsible movement of people and goods into and across the country. In this way, we play a leadership role to ensure that all parts of the transportation system across Canada and worldwide work together effectively and efficiently.

Strategic Outcomes and Program Alignment Architecture (PAA)

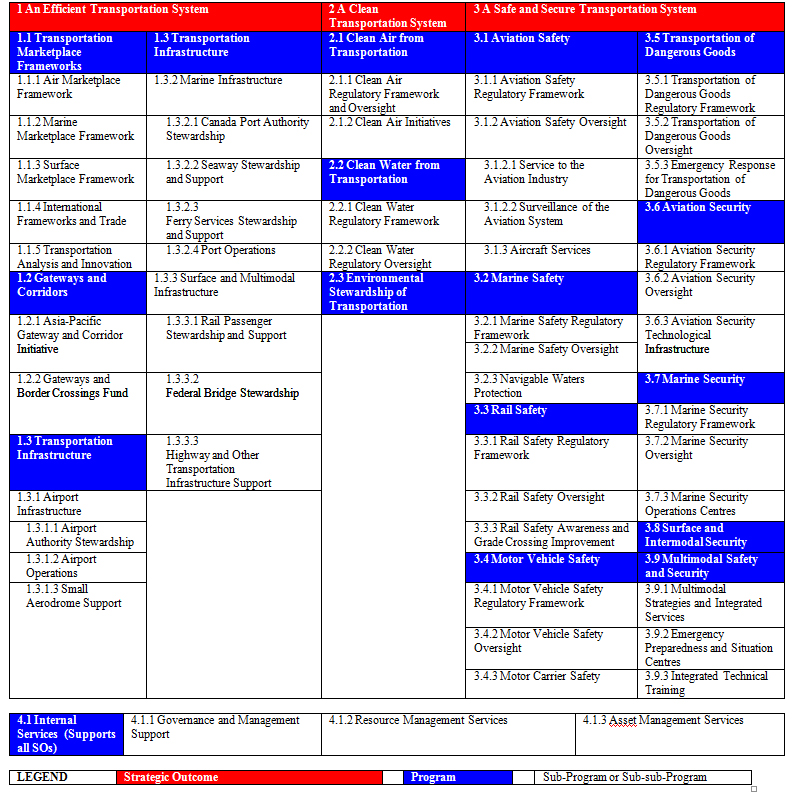

As illustrated in Figure 1, Transport Canada’s Program Alignment Architecture includes 15 Programs that contribute to achieving the following three Departmental Strategic Outcomes:

- An efficient transportation system;

- A clean transportation system; and

- A safe and secure transportation system.

The 16th program, Internal Services, supports all three strategic outcomes.

To better align itself to the Government of Canada outcome areasEndnote xiithe Department has modified its Program Alignment Architecture. Revisions from 2013-14 to 2014-15 include the following:

- Transfer of Program 1.4, Transportation Analysis and Innovation under Program 1.1, Transportation Marketplace Frameworks, to create a new sub-Program 1.1.5, Transportation Analysis and Innovation; and

- Deletion of sub-Program 3.1.3, Airports Capital Assistance program, and merging of activities within sub sub-Program 1.3.1.3, Small Aerodrome Support.

Figure 1: Transport Canada 2014–15 Program Alignment Architecture (PAA)

Organizational Priorities

In the Report on Plans and Priorities, Transport Canada identified five priorities for 2014-15. These priorities align with Government of Canada (GoC) priorities, help the Department achieve our Strategic Outcomes and address risks. Over the course of the year, senior management paid special attention to the plans developed to meet these priorities and achieve results.

| Priority | TypeFootnote 1 | Strategic Outcomes and Programs |

|---|---|---|

| Refine and strengthen Transport Canada’s safety and security oversight | Ongoing | SO3 A Safe and Secure Transportation System (All programs) |

Summary of Progress

- We further strengthened railway safety and safe transportation of dangerous goods by rail in Canada by issuing several Emergency Directives, Protective Directions, and Ministerial Orders. These actions were informed by the Transportation Safety Board’s interim and final investigation reports on the 2013 Lac-Mégantic accident, as well as a Standing Committee on Transport, Infrastructure and Communities study on the Canadian Transportation of Dangerous Goods regime and the role of Safety Management Systems (SMS) across all modes of transportation.

- Specifically, we implemented key safety and oversight-related measures that include:

- mandating the removal of the least crash-resistant DOT-111 tank cars from dangerous goods service;

- introducing new safety standards for DOT-111 tank cars while ordering the retrofit or phase-out of those that do not meet new standards;

- requiring companies to slow trains transporting dangerous goods;

- implementing emergency response assistance plans for tank cars carrying certain flammable liquids;

- mandating the provision of information from railways to municipalities on dangerous goods transported through them;

- creating a task force to strengthen emergency response capacity;

- requiring railways to apply and test handbrakes on locomotives and rail cars;

- increasing the number of audits conducted on railways’ SMS; and

- amending the Railway SMS Regulations, the Railway Operating Certificate Regulations, and the Railway Safety Administrative Monetary Penalties Regulations.

- The purpose of these amendments is to ensure the railways have a robust SMS in place, and to grant Transport Canada stronger powers to issue administrative monetary penalties or revoke operating certificates for non-compliance with safety requirements or SMS regulations.

- We completed 23 Aviation Safety People Management Action Plan initiatives, including the development of the “Leadership in a Technical Environment” course, which we will implement nationally across all modes.

- We developed new human resources plans that strengthen recruitment within the Department, and created new inspector positions along with new training tools and programs to enhance enforcement capacity.

- We assessed and developed a Multimodal Training Blueprint and established the Safety and Security Multimodal Core Learning Continuum.

- We created the Centre of Enforcement Expertise, supported by a national enforcement policy, to deliver a balance of authority and advisory functions with more consistent direction and guidance in support of the TC’s enforcement regime. The Centre will promote effective, predictable, transparent and fair enforcement practices, founded on a risk-based and a graduated approach to enforcement, supported by procedures, training and tools that will be applied across all programs and regions.

- We also refined our National Inspection Plans to provide a clearer picture of each program’s oversight regime and to include reporting on quality control checks. Work is ongoing as part of the Safety and Security Transformation Agenda to strengthen methodologies and continuous improvements supporting risk-based inspection planning.

Work in Progress

- Transport Canada continues to strengthen its human resources planning practices and is taking concrete steps to further strengthen oversight capacity, including adjusting the number of inspectors, where required.

- Transport Canada, in collaboration with key stakeholders, is working with the U.S. Department of Transportation, the U.S. Environmental Protection Agency and the U.S. Coast Guard to implement eight work plans as part of the second phase of Regulatory Cooperation Council (RCC) to support department-to-department commitments included in the Joint Forward Plan, released on August 29, 2014.

| Priority | Type | Strategic Outcomes and Programs |

|---|---|---|

| Continue to contribute to the Government’s Responsible Resource Development agenda | Ongoing |

SO2 A Clean Transportation System (All Programs) SO3 A Safe and Secure Transportation System (Programs 3.2 and 3.9) |

Summary of Progress

- Transport Canada contributed to the “Whole-of-Government” approach to environmental assessment, Aboriginal consultation and regulatory review of major resource projects, including working closely with other government departments to ensure a coordinated and efficient approach to applying Major Projects Management Office (MPMO) and Northern Projects Management Office (NPMO) processes. We:

- supported the MPMO in the renewal of the MPMO initiative, announced in Budget 2015;

- were involved in completing three transitional comprehensive studies and two review panels within the legislated timelines; and

- are currently involved in 56 of the 89 MPMO projects and 32 of 35 active NPMO projects.

- In addition, to delivering training and awareness sessions for key groups across the Department, we drafted several guidance documents connected to our roles and responsibilities under the Canadian Environmental Assessment Act, 2012 and the northern environmental assessment regimes. Examples included:

- guidance relating to our role as a Federal Authority under the Canadian Environmental Assessment Act, 2012;

- operational guidance on our Environmental Assessment Monitoring and Oversight Program; and

- guidance on what constitutes submerged federal lands.

- We implemented the new Navigation Protection Program with streamlined approaches for reviewing major resource development projects—the new Navigation Protection Act came into force on April 1, 2014.

- We supported the Government of Canada’s commitment to implement the World-Class Tanker Safety System initiative to enhance Canada’s robust marine safety system by strengthening ship-source spill prevention, preparedness and response, and liability and compensation. The World-Class Tanker Safety System initiative achieved a number of important accomplishments:

- We met our commitment to review Canada’s ship-source spill preparedness and response regime. The Tanker Safety Expert Panel concluded its review and in spring 2015, the Panel’s second report was released. It includes recommendations on ship-source spills in the Arctic, hazardous and noxious substances across Canada, and marine incident management, which will help inform the Department’s consideration of next steps in further strengthening Canada’s regime for ship-source spill prevention, preparedness, and response.

- We strengthened regulatory oversight of marine shipping. In May 2014, the Government announced new measures as part of the World-Class Tanker Safety System initiative, and in December 2014, Parliament successfully passed the Safeguarding Seas and Skies Act, which will strengthen regulatory requirements for oil handling facilities and expand the Department’s range of enforcement tools

- We engaged First Nations in technical dialogues to identify issues and potential solutions to concerns related to marine shipping of proposed liquefied natural gas projects.

- We replaced the policy on equivalent protection for the double-hulling of oil barges with an updated technical guidance document.

Work in Progress

- Transport Canada continued to contribute to timely and effective reviews of major resource projects, most notably the large number of proposed energy infrastructure projects.

- Our work continued under the World-Class Tanker Safety System initiative including:

- the World-Class Inspection Policy, Procedures and Work Instructions we drafted over the last year, and which are currently under review along with the training course materials;

- the regulatory project associated with Safeguarding Canada’s Seas and Skies Act is underway, including activities such as defining classes of oil handling facilities;

- delivery of a new contribution program for Ocean Networks Canada (ONC)’s Smart Oceans initiative to help ONC transform the oceanographic data it collects into navigational safety information; and,

- continued engagement with local/regional stakeholders and Aboriginal groups to designate Kitimat as a public port to enhance vessel traffic control.

| Priority | Type | Strategic Outcomes and Programs |

|---|---|---|

| Improve Canada’s competitiveness and critical transportation infrastructure | Ongoing |

SO1 An Efficient Transportation System (Program 1.2) SO3 A Safe and Secure Transportation System (Program 3.6) |

Summary of Progress

- Transport Canada promoted Canada’s Gateways initiatives, including the Asia-Pacific Gateway and Corridor Initiative, the Atlantic Gateway and Trade Corridor, and the Continental Gateway and Trade Corridor objectives, through domestic and international outreach, stakeholder engagement, and creation/ distribution of promotional and marketing materials.

- We supported the Asia-Pacific Gateway and Corridor Transportation Infrastructure Fund (APGCTIF) activities. Also, TC launched an open-call for proposals for the remainder of the Atlantic Gateway International Marketing Fund, a component of the Gateways and Border Crossings Fund (GBCF).

- Oversight responsibility for the new bridge over the St. Lawrence was transferred to Infrastructure Canada as a result of an Order in Council signed in February 2014.

- The Department continued to play a key role in implementing the Beyond the Border Action Plan, to install border wait-time measurement solutions at the top 20 high-priority land-border crossings. To date, border wait-time technology is installed bi-directionally at seven of these crossings:

- four between British Columbia and Washington;

- two between Ontario and New York; and

- one between Ontario and Michigan.

- We also fulfilled our annual commitment by adopting a risk-based screening program, harmonized with that of the Transportation Security Administration in the U.S., for NEXUSFootnote 2 and other low-risk travellers at the Canadian Air Transport Security Authority trans-border screening checkpoints at four major Canadian airports.

Work in Progress

- The Gordie Howe International Bridge (renamed from Detroit River International Crossing on May 14, 2015) project continued to advance to the procurement stage. All agreements with Michigan and U.S. federal inspection agencies were concluded. Property acquisition in Michigan is underway and the Windsor-Detroit Bridge Authority continues to advance the project.

| Priority | Type | Strategic Outcomes and Programs |

|---|---|---|

| Ensure that Transport Canada’s policies, programs and activities will meet the needs of the transportation system in the long term | Ongoing |

SO1 An Efficient Transportation System (All Programs) SO2 A Clean Transportation System (All Programs) SO3 A Safe and Secure Transportation System (Program 3.6) Program 4.1 Internal Services |

Summary of Progress

- We completed a review of marine policies and identified and addressed several issues to support economic growth. For example:

- adopted amendments to the Canada Marine Act to support port-related economic development by enabling port asset transfers and project development at Canada Port Authorities;

- supported the Canada-European Union Comprehensive Economic and Trade Agreement negotiations; and

- began to develop amendments to the Coasting Trade Act to implement the relevant negotiated outcomes.

- Canada and the U.S. concluded and signed a new preclearance agreement covering all modes of transportation on March 16, 2015.

- Canada maintained minimum grain volume requirements on the railways to protect our reputation as a reliable source of high quality grains.

- Also, we developed options for a stronger third-party liability and compensation regime for rail in response to a 2013 Speech from the Throne commitment. Bill C-52 was introduced in Parliament on February 20, 2015 and was passed in June 2015.

- We pursued a targeted approach in carrying out initiatives under the umbrella of the Innovation Strategy, including:

- advancing joint research projects through Canada-China and Canada-India Innovation Cooperation agreements;

- sharing best practices including on Intelligent Transportation Systems technologies; and

- successfully hosting Chinese and Indian working group delegations.

- Several important climate change adaptation initiatives were undertaken including:

- collaboration with Natural Resources Canada and experts across Canada, to create an Advisory Committee, and initiated the Assessment of climate risks and adaptation practices for the Canadian transportation sector, including seven chapters such as the north, regional and urban areas;

- engagement with academics, federal, provincial, territorial and municipal governments by developing networks, and initiating assessments of transportation system vulnerabilities;

- the initiation of Transport Canada’s adaptation webinar series to strengthen knowledge and capacity, with the first two webinars reaching 129 and 54 participants respectively from the three levels of government, professionals and other interested stakeholders in Canada;

- continued implementation of Transport Canada’s Adaptation Plan; and

- better integration of climate and extreme weather considerations into Departmental planning processes.

Work in Progress

- The Canada Transportation Act Review Panel continued consultations with stakeholders and undertook research projects to support the work required under its mandate.

- We launched a review of the Grain Monitoring Program on March 28, 2015, that will be completed in 2015-16 before the start of the new crop year. It will determine how we can collect more effective data to find efficiencies in the supply chain.

| Priority | Type | Strategic Outcomes and Programs |

|---|---|---|

| Adopt the Government of Canada’s efficiency and renewal measures | New | All SOs and programs |

Summary of Progress

- Transport Canada achieved its planned savings by taking efficiency measures and reducing programs in order to align resources to its core mandate. This was achieved focusing on long-term benefits, optimizing some business processes; better risk identification and mitigation strategies; as well as engaging employees to minimize the effect on them and on Canadians. Examples include:

- organizational realignments, including workforce management and major reorganizations, in support of Budget 2012 decisions, consolidating of back office functions and other major change initiatives;

- a budget normalization exercise to align regional human resources services. This initiative has further evolved and TC is now using a new Human Resources Service delivery model focused on a national portfolio approach; and

- successful implementation of all seven process areas of the Common Human Resources business process.

Risk Analysis

Risk refers to the likelihood and impact of an event that could affect the achievement of an organization’s objectives. A number of risks could affect the Canadian transportation system as it involves multiple jurisdictions, private sector stakeholders and users, and is exposed to global threats and ongoing social, economic and environmental changes.

Transport Canada’s (TC) practices must always respond to shifting conditions in an ever changing transportation system. Potential non-compliance to safety requirements and increasing security threats continue to pose challenges to all modes of transportation that TC regulates. The accident at Lac-Mégantic, Quebec, in July 2013 underscores the complexity of issues that TC must address. The Corporate Risk Profile is a key tool to ensure that TC continues to remain abreast of continuing changes in the transportation system through strengthened internal governance and appropriate oversight processes to ensure safety and security risks are adequately mitigated.

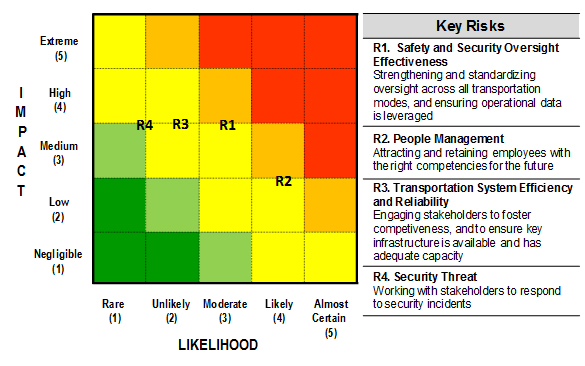

In 2013, we identified and assessed the following four risk areas as part of TC’s Corporate Risk Profile (CRP):

Figure 2: Transport Canada's Corporate Risk Profile

Key Risks and Risk Responses

Transport Canada applies risk management to support its decision making and business practices, including how we develop policy, set priorities, allocate resources, deliver programs, and conduct day-to-day activities. Part of our risk management approach includes ongoing risk monitoring and a semi-annual report on progress and overall performance of risk responses. For example, we launched several measures in order to facilitate advancing:

- The Beyond the Border Action Plan;

- Climate Change Adaptation;

- The Gordie Howe International Bridge (formerly known as the Detroit River International Crossing); and

- The Action Plan for Rail Safety as set out in the 2013 Report of the Auditor General.

Progress and key results on risk responses we took in 2014-15 are presented in the following table:

| Risk | Key Results of Risk Response Implementation | Link to Program Alignment Architecture |

|---|---|---|

| R1. Safety and Security Oversight Effectiveness |

|

SO3 - A safe and secure transportation system |

| R2. People Management |

|

Across all three SOs and Internal services |

| R3. Transportation System Efficiency and Reliability |

|

SO1 - An efficient transportation system SO2 - A clean transportation system |

| R4. Security Threat |

|

SO3 - A safe and secure transportation system |

The Canadian transportation system continues to be affected by pressures which present both challenges and opportunities for TC.

In terms of strengths and opportunities, TC has continued to demonstrate leadership in promoting a national vision by supporting greater harmonization and integration across transportation modes and with partner jurisdictions (e.g., harmonization of oversight activities continues through the TC Directive on Safety and Security Oversight, harmonization of regulations with the U.S. continues through the Canada-U.S. Regulatory Cooperation Council).

Additionally, the workplace renewal initiative, including Destination 2020, has helped TC to promote innovation and advance communications with its employees, partners and the public through social media, web and mobile technologies which, in turn, enhanced collaboration.

The proactive and continuous management of safety and security risks remains important to Canada’s economy, in reducing threats and enhancing public confidence. TC has implemented strengthened measures to reduce incidents that may negatively affect the transportation system, as well as Canada’s economic growth and competitiveness.

Actual Expenditures

The following table gives a summary of Transport Canada’s total budgetary financial resources for the fiscal year 2014-15. For more details on Financial Resources, including adjustments, please visit Transport Canada’s website.

| 2014–15

Main Estimates |

2014–15

Planned SpendingFootnote 3 |

2014–15

Total Authorities (available for use) |

2014–15

Actual Spending (authorities used) |

Difference

(planned minus actual) |

|---|---|---|---|---|

| 1,655,682,494 | 1,667,473,998 | 1,917,924,654 | 1,605,081,311 | 62,392,687 |

We attribute the variance between planned and actual spending to a number of factors including:

- an increase in funding received (over 2014-15 RPP levels) for the statutory payment to the St. Lawrence Seaway Management Corporation ($23.6M) and additional funding for the Gordie Howe International Bridge ($12.9M);

- new initiatives such as a replacement vessel for the MV Princess of Acadia ($75.9M); and

- the renewal of the ferry services contribution program ($27.6M) and the Port Asset Transfer Program ($9.2M).

The increase in plans was offset by lower than anticipated planned spending under the Gateways and Border Crossing Fund and the Asia-Pacific Gateway and Corridor Initiative, particularly as a result of:

- delivery delays of infrastructure projects; and

- delays in property acquisition, schedule changes due to complex utility relocation, and due diligence activities in Michigan associated with the Gordie Howe International Bridge.

The following table gives a summary of Transport Canada’s total human resources (Full-time equivalents—FTEs) for the fiscal year 2014-15.

| 2014–15

Planned |

2014–15

Actual |

Difference

(planned minus actual) |

|---|---|---|

| 5,222 | 4,976 | 246 |

The planned FTE information in Transport Canada’s Departmental Performance Report (5,222 FTEs in 2014-15) is mostly based on historical information and government decisions that either increase (e.g., new programs) or decrease (change in mandate or priorities) the number of TC employees.

Budgetary Performance Summary for Strategic Outcomes and Programs (dollars)

The following tables present the:

- Planned spending for 2014-15 and for the next two fiscal years, by Program, in support of each Strategic Outcome;

- Total actual Departmental spending for all Programs for 2014-15 and for the previous two fiscal years; and

- Program contribution alignments of Strategic Outcomes 1, 2 and 3 to the Government of Canada outcomes.

Planned spending includes Operating, Capital, Grants and Contributions and Statutory Votes as per the Main Estimates as well as $11.8 million in planned spending for paylist (maternity, severance) items. For explanations of planned spending, please consult Transport Canada’s 2014-15 Report on Plans and Priorities Endnote xiii.

Total Authorities (available for use) represent the year-end budgets as per Public Accounts. It includes Operating, Capital, Grants and Contributions and Statutory Votes as well as all frozen allotments.

Actual Spending (authorities used) represents the spending for the full fiscal year as per Public Accounts, which includes expenditures in the Operating, Capital, Grants and Contributions and Statutory Votes.

As the tables in Section II illustrate, some Programs appear to have exceeded the total resources available for their Program. A contributing factor to the variances is that the planned spending figures do not reflect internal realignments deemed necessary to fund emerging issues, departmental priorities and adjustments in program delivery.

| Strategic Outcomes, Programs and Internal Services | Government of Canada Outcomes | 2012-13 Actual Spending (authorities used) | 2013-14 Actual Spending (authorities used) | 2014-15 Planned Spending | 2014-15 Main Estimates | 2014-15 Total Authorities (available for use) | 2014-15 Actual Spending (authorities used) | 2015-16 Planned Spending | 2016-17 Planned Spending |

|---|---|---|---|---|---|---|---|---|---|

| Strategic Outcome 1: An Efficient Transportation SystemFootnote 4 | |||||||||

| 1.1 Transportation Marketplace Frameworks | A fair and secure marketplace | 9,041,585 | 11,917,295 | 24,854,622 | 24,854,622 | 27,650,224 | 28,290,806 | 24,473,890 | 21,393,723 |

| 1.2 Gateways and Corridors | Strong economic growth | 395,779,632 | 336,988,453 | 702,272,494 | 702,272,494 | 711,748,677 | 448,362,484 | 576,569,290 | 110,140,965 |

| 1.3 Transportation Infrastructure | An innovative and knowledge-based economy | 309,656,203 | 363,848,205 | 333,815,823 | 333,815,823 | 497,706,340 | 455,366,393 | 399,495,001 | 350,031,572 |

| 1.4 Transportation Analysis and Innovation | An innovative and knowledge-based economy | 9,471,905 | 12,885,608 | 0 | 0 | 0 | 0 | 0 | 0 |

| Strategic Outcome 1 SubtotalFootnote 5 | 723,949,325 | 725,639,561 | 1,060,942,939 | 1,060,942,939 | 1,237,105,241 | 932,019,683 | 1,000,538,181 | 481,566,260 | |

| Strategic Outcome 2: A Clean Transportation System | |||||||||

| 2.1 Clean Air from transportation | A clean and healthy environment | 18,760,359 | 27,755,589 | 38,992,028 | 38,992,028 | 31,358,409 | 24,011,027 | 29,417,677 | 4,506,789 |

| 2.2 Clean Water from transportation | A clean and healthy environment | 6,947,514 | 16,198,195 | 18,074,900 | 18,074,900 | 28,553,438 | 24,421,705 | 31,902,400 | 26,896,996 |

| 2.3 Environmental Stewardship of transportation | A clean and healthy environment | 20,059,193 | 29,431,954 | 29,171,557 | 29,171,557 | 43,124,602 | 44,745,522 | 33,906,726 | 10,734,397 |

| Strategic Outcome 2 SubtotalFootnote 6 | 45,767,066 | 73,385,738 | 86,238,485 | 86,238,485 | 103,036,449 | 93,178,254 | 95,226,803 | 42,138,182 | |

| Strategic Outcome 3: A Safe and Secure Transportation SystemFootnote 7 | |||||||||

| 3.1 Aviation Safety | A safe and secure Canada | 198,628,602 | 184,628,770 | 170,709,221 | 170,709,221 | 189,711,582 | 188,941,065 | 173,447,956 | 172,861,136 |

| 3.2 Marine Safety | A safe and secure Canada | 56,492,575 | 59,638,305 | 56,003,982 | 56,003,982 | 69,597,720 | 69,847,859 | 57,475,536 | 53,463,452 |

| 3.3 Rail Safety | A safe and secure Canada | 34,213,510 | 29,250,946 | 34,265,437 | 34,265,437 | 36,881,268 | 35,333,175 | 35,707,671 | 35,525,338 |

| 3.4 Motor Vehicle Safety | A safe and secure Canada | 22,458,347 | 26,152,233 | 20,905,007 | 20,905,007 | 24,090,043 | 25,940,392 | 22,723,248 | 20,089,942 |

| 3.5 Transportation of Dangerous Goods | A safe and secure Canada | 12,756,370 | 14,663,095 | 14,727,734 | 14,727,734 | 21,122,353 | 22,740,646 | 15,322,623 | 15,279,721 |

| 3.6 Aviation Security | A safe and secure Canada | 33,706,392 | 29,743,295 | 31,672,052 | 31,672,052 | 35,624,038 | 32,722,389 | 29,791,738 | 29,516,367 |

| 3.7 Marine Security | A safe and secure Canada | 14,005,041 | 12,331,970 | 12,788,946 | 12,788,946 | 14,765,418 | 14,429,160 | 12,872,129 | 12,782,279 |

| 3.8 Surface and Intermodal Security | A safe and secure Canada | 3,967,849 | 4,280,788 | 4,739,231 | 4,739,231 | 5,099,930 | 5,096,531 | 4,703,731 | 4,573,144 |

| 3.9 Multimodal Safety and Security | A safe and secure Canada | 0 | 10,722,526 | 11,153,164 | 11,153,164 | 18,322,753 | 19,315,574 | 10,890,897 | 10,785,344 |

| Strategic Outcome 3 SubtotalFootnote 8 | 376,228,686 | 371,411,928 | 356,964,774 | 356,964,774 | 415,215,105 | 414,366,791 | 362,935,529 | 354,876,723 | |

| 4.1 Internal Services | 186,533,092 | 170,195,608 | 163,327,800 | 151,536,296 | 162,567,859 | 165,516,583 | 156,311,765 | 147,614,053 | |

| Internal Services SubtotalFootnote 9 | 186,533,092 | 170,195,608 | 163,327,800 | 151,536,296 | 162,567,859 | 165,516,583 | 156,311,765 | 147,614,053 | |

| TotalFootnote 10 | 1,332,478,169 | 1,340,632,835 | 1,667,473,998 | 1,655,682,494 | 1,917,924,654 | 1,605,081,311 | 1,615,012,278 | 1,026,195,218 | |

Alignment of Spending with the Whole-of-Government Framework

2014-15 Actual Spending by Whole-of-Government-Framework Spending Area (dollars)

| Spending Area | Government of Canada Outcome | Total Planned Spending | Total Actual Spending |

|---|---|---|---|

| Economic Affairs | Fair and secure marketplace | 24,854,622 | 28,290,806 |

| Strong economic growth | 702,272,494 | 448,362,484 | |

| A clean and healthy environment | 86,238,485 | 93,178,254 | |

| An innovative and knowledge-based economy | 333,815,823 | 455,366,393 | |

| Social Affairs | A safe and secure Canada | 356,964,774 | 414,366,791 |

| International Affairs | Not applicable | 0 | 0 |

| Government Affairs | Not applicable | 0 | 0 |

Departmental Spending Trend

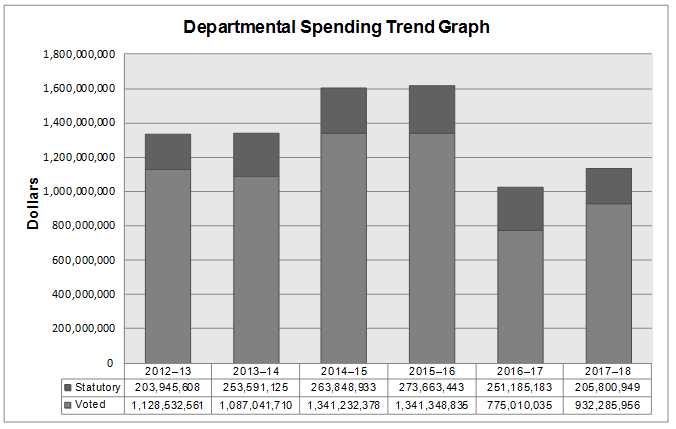

Figure 3 shows Transport Canada’s spending profile from 2012-13 to 2017-18. The profile shows expenditures of:

- $1,332 million in 2012-13;

- $1,341 million in 2013-14; and

- $1,605 million in 2014-15.

We attribute most of the increase to the expenditures for two major initiatives: the Asia-Pacific Gateway and Corridor Initiative and the Gateways and Border Crossings Fund. Increased spending, from previous years, on these initiatives was partly offset by reduced spending related to implementing Budget 2012 cost reduction measures.

Transport Canada’s planned spending:

- increases to $1,615 million in 2015-16;

- decreases to $1,026 million in 2016-17; and

- increases again in 2017-18 to $1,138 million.

As the Asia-Pacific Gateway and Corridor Initiative, the Gateways and Border Crossings Fund, the Next Generation of Clean Transportation, and the Federal Contaminated Sites Action Plan, approach their maturity dates, spending begins to decline. However, there is a slight increase in spending in 2017-18 as a result of planned expenditures for Gateways and Border Crossings Fund.

Figure 3: Spending Trend for Transport Canada

Expenditures by Vote

For information on Transport Canada's organizational voted and statutory expenditures, consult the Public Accounts of Canada 2015, which is available on the Public Works and Government Services CanadaEndnote xiii website.