© Her Majesty the Queen in Right of Canada, represented by the Minister of Transport, 2017

Cette publication est aussi disponible en français sous le titre Les transports au Canada 2016, Rapport approfondi.

TP No 15357 E

Catalogue No T1-23/2016E-PDF ISSN 978-0-660-08415-2

Permission to reproduce

Transport Canada grants permission to copy and/or reproduce the contents of this publication for personal and public non-commercial use Users must reproduce the materials accurately, identify Transport Canada as the source and not present theirs as an official version, or as having been produced with the help or the endorsement of Transport Canada

To request permission to reproduce materials from this publication for commercial purposes, please complete the following web form: www.tc.gc.ca/eng/crown-copyright-request-614.html

Or contact TCcopyright-droitdauteurTC@tc.gc.ca

An electronic version of this publication is available at www.tc.gc.ca/eng/policy/anre-menu.htm

Table of Contents

Minister's Message

As Minister of Transport, it is with great pleasure that I submit Transportation in Canada 2016, the annual report on the state of transportation in Canada.

This report is based on the latest data and information in order to understand the challenges and opportunities facing Canada’s transportation system and its stakeholders. An addendum of useful transportation statistics and figures is also included.

- Minister’s Message

- Report Highlights

- Introduction

- About this report

- The Role of Transportation in the Economy

- The Transportation Sector

- Transportation and the Economy

- Transportation and Domestic Trade

- Transportation and International Trade

- Government Revenues and Expenditures

- Canada’s Trade and Transportation Corridors

- Western Corridor

- Continental Corridor

- Atlantic Corridor

- Air Transportation Sector

- Industry Infrastructure

- Industry Structure

- Safe and Secure Transportation

- Marine Transportation Sector

- Industry Infrastructure

- Industry Structure

- Safe and Secure Transportation

- Green Transportation

- Rail Transportation Sector

- Industry Infrastructure

- Industry Structure

- Safe and Secure Transportation

- Green Transportation

- Road Transportation Sector

- Industry Infrastructure

- Industry Structure

- Safe and Secure Transportation

- Green Transportation

- Transportation of Dangerous Goods

- Performance of the Canadian Transportation System in 2016

- Economic Drivers

- Productivity in the Transportation Sector

- Freight Transportation Flows

- Performance and Utilization of the Transportation System

- Travellers Traffic Flows

- Safe and Secure Transportation Performance

- Green Transportation Performance

- Financial Performance

- Outlook, Trends and Future Issues

- Key Trends in Transportation

- The Key Trends in the Canadian Context

- The Economic Outlook

- Key Commodities Outlook

- Air Passenger Outlook

- Annex A: Maps and Figures

- Annex B: List of Addendum Tables and Figures

Transportation plays a critical role in the Canadian economy by enabling Canadian products, services and people to access key markets, thus creating prosperity and economic opportunities for the middle class. A modern, safe, secure, reliable and environmentally responsible transportation system is essential to our economic wealth.

In 2016, the Canadian transportation system continued its strong safety track record, with accident rates below their 10-year average for all modes. In terms of environment, transportation-related greenhouse gas emissions have been stable over the past decade as the effect of increased activities has been offset by stricter standards. The transportation system also continued to perform well in 2016 in a period of reduced demand for Canadian merchandise, resulting from subdued global and domestic economic growth.

To continue building on these accomplishments, the Government of Canada, through its Transportation 2030 Strategic Plan, aims to create a safe, secure, green, innovative and integrated transportation system that supports trade and economic growth, a cleaner environment and the well-being of all Canadians.

In accordance with this Strategic Plan, we announced a number of initiatives in 2016 including the Oceans Protection Plan, which aims to create a world-leading marine safety system that helps prevent marine incidents and strengthens environmental protection. We also continued our work with provinces and territories in support of the Pan-Canadian Framework on Clean Growth and Climate Change to develop a concrete plan to achieve Canada’s international climate change commitments and drive innovation and growth.

While the system performed well in 2016, we must continue our efforts to strengthen transportation corridors to international markets and help Canadian businesses compete, grow and create more jobs for middle class Canadians. To that effect, we have announced a $10.1 billion investment over 11 years through the

Trade and Transportation Corridors Initiative, with the objective of improving the quality of trade infrastructure across Canada, strengthening the efficiency of the system and sharing evidence-based

information about the Canadian transportation system with Canadians and relevant transportation stakeholders.

I hope this report will provide Members of Parliament, stakeholders and the general public with useful information on the state of Canada’s transportation system and how it affects the life of every Canadian.

Sincerely,

The Honourable Marc Garneau, P.C., M.P.

Minister of Transport

Report Highlights

Summary:

- The relatively modest global and domestic economy growth in 2016 translated in lower transportation demand for key Canadian commodities.

- While some fl issues were reported at the Port of Vancouver in the fall of 2016, the Canadian transportation system did not experience any signifi bottlenecks.

- Contrasting with lower commodity volumes, passenger traffi was on the rise especially for international air passengers.

- Greenhouse gas emissions have been stable overall over the past decade. The Government of Canada put in place a number of initiatives to strengthen environmental protection, including the Pan-Canadian Framework.

- Canada continues to have a safe and secure transportation system with accident rates below their 5 to 10-year average. A number of initiatives aim to ensure a safe transportation system were established, including the new Oceans Protection Plan.

- In the coming years, Canada will face challenges and opportunities that will require transportation stakeholders to keep abreast of new developments and adapt to changing socio-demographic trends, key emerging technologies, and growing environmental concerns.

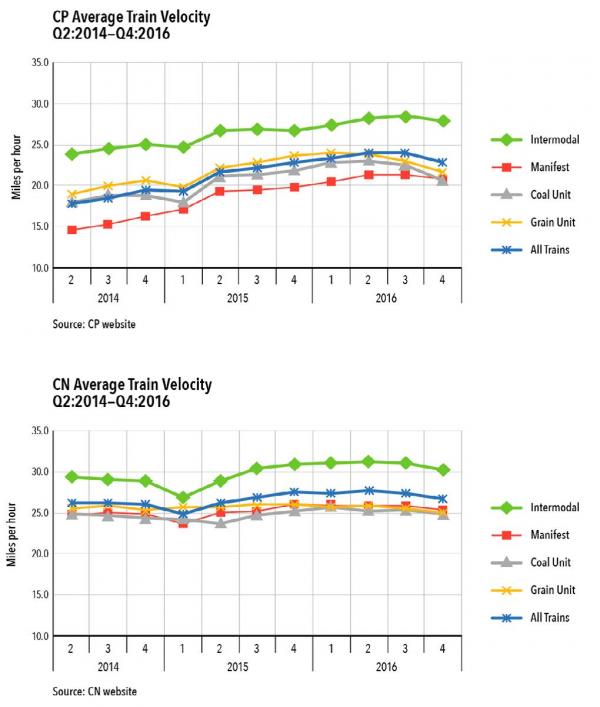

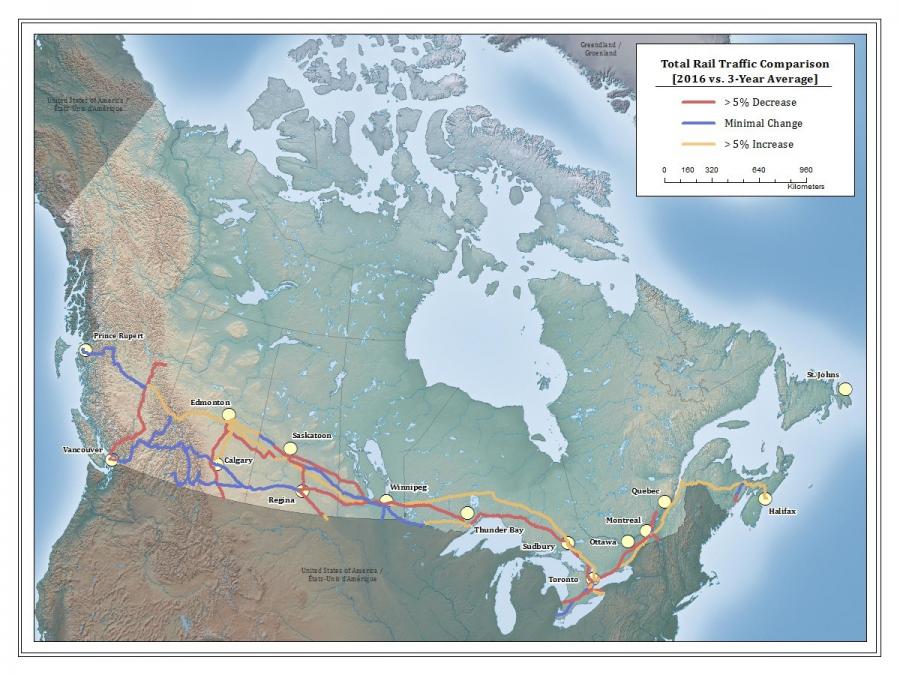

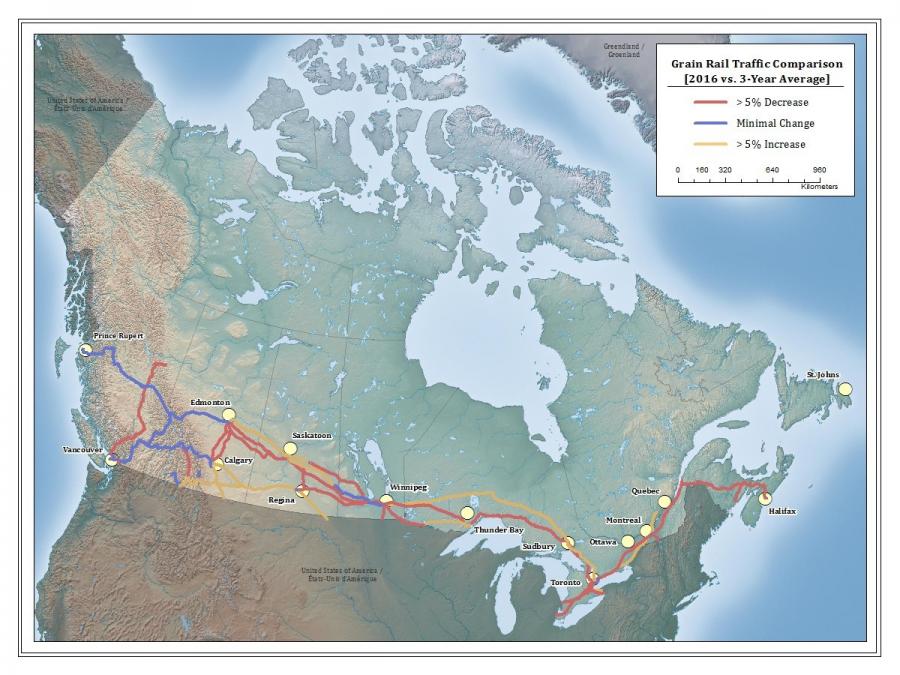

The Canadian economy continued to experience moderate growth in 2016. Modest global economic growth translated into lower traffic volume in the Canadian transportation system, especially in the first half of the year. Demand slightly picked up in the second half of 2016, but remained below 2015 level for key bulk commodities, intermediate and finished goods. This resulted in rail traffic declines (in tonnage) for petroleum products, metals, grain and fertilizers materials.

On the marine side, international waterborne traffic (in value) also decreased, as did volume handled at certain ports. This is especially true for the port of Vancouver, which observed declines for wheat, coal, potash and intermodal traffic. In contrast, East Coast ports, notably the port of Halifax and Montréal, experienced a growth in volume handled in 2016 supported by container and crude oil respectively. International air cargo exports (in value) decreased slightly in 2016, while trucking exports to the U.S. recorded a strong increase.

The Canadian transportation system did not experience any significant bottlenecks with respect to performance or capacity in 2016. The Port of Vancouver reported some fluidity issues at its South Shore in the fall, but the system was resilient enough to resolve the issue. No major labour disruptions or major weather related event significantly impacted fluidity at key ports or key railway corridors.

The lower volume of containers to handle over the year allowed fluidity to improve at key port terminals. Most container terminals remained below their effective capacity level throughout the year. Rail network velocity also continued to improve in 2016.

The Western grain supply chain remained fluid despite a late and abundant harvest. Some issues related to exporters having difficulties to source the right type of grain, especially the high-quality variety, caused more vessels to anchor outside the port of Vancouver.

Contrasting with lower merchandise volumes, the number of passengers increased in 2016 overall. Air passengers travelling on domestic and international flights recorded solid gains compared to 2015, while transborder sector growth remained the same. Benefiting from a low Canadian dollar, more foreign travellers came to Canada than in 2015. On the other hand, Canadian travellers to the United States (U.S.) declined across many modes. Intercity rail travel increased slightly from 2015.

Greenhouse gas (GHG) emissions have decreased for air and marine transportation over the past decade thanks to new initiatives, voluntary agreements and various international commitments by the Government of Canada. In contrast, rail and road transportation, the latter accounting for 83.5% of transport-related emissions, have increased their GHG emissions over the same period, mostly due to increased traffic.

Federal regulations have established progressively stricter GHG emission standards for passenger automobiles and light trucks of model years 2017 and beyond, building on the existing standards. The Government of Canada indicated it would continue its work to progressively establish stricter standards to further limit greenhouse gas emissions from new on-road heavy-duty vehicles and their engines in Canada starting with the 2021 model year.

Canada continues to have a safe and secure transportation system. The most recent figures show that accident rates are below their 5 to 10-year average for all modes. A number of initiatives aim to ensure a safe transportation system including the new Oceans Protection Plan which will increase capacity to prevent marine incidents, improve responses and strengthen environmental protection. For surface modes, the Government of Canada amended the Railway Safety Administrative Monetary Penalties Regulations, introduced a new Rail Safety Improvement program and upgraded the Motor Vehicle Safety Act. Safety in the transportation of dangerous goods was also strengthened across Canada, notably through increased inspections, regulations updates, and outreach and awareness to first responders, municipalities and the general public, amongst other initiatives. Canada also continued to take steps to facilitate the flow of legitimate travellers and goods while maintaining Canada’s high level of security through inspections, information sharing and stakeholder engagements.

In the coming years, Canada will face challenges and opportunities that will require transportation stakeholders to keep abreast of new developments in the continuously changing economy and adapt to changing socio-demographic trends, key emerging technologies, as well as growing environmental, safety and security concerns.

Experts expect emerging and developing markets (notably developing Asian countries) to lead global economic growth. With a growing middle class and strong infrastructure investments, these markets will stimulate demand for Canadian raw materials and merchandises and in turn, affect transportation patterns.

From 2016 to 2025, transportation for Canada’s 5 major bulk commodities (coal, potash, crude oil, wood products and grain) is projected to grow moderately. This growth reflects demand for rail shipment of crude oil and wood products in the near term and potash and grain in the longer term.

The number of air passengers in Canada should continue rising over the next decade, with the strongest increase in international passengers (other than the U.S.) supported by growth from emerging markets. On the domestic market, moderate economic growth, an aged population and moderate demographic growth will hinder the rise in air passengers.

The 2016 Transportation in Canada Annual Report presents the state of transportation in Canada with the most current available information.

Introduction

An efficient and modern transportation system has always been key to supporting a strong and competitive economy as well as to improve the quality of life of Canadians.

Transportation is essential for trade. It allows natural resources, agricultural products and manufactured goods to access domestic and international markets. It is also vital to supporting the service sector by helping Canada connect with its foreign business partners and represents a key pillar for the tourist industry.

The transportation sector also touches every aspect of our society and greatly affects our quality of life. It links communities and people by reducing the effect of distance and overcoming geographical barriers. It also affects decisions we make in terms of where we live, where we work, where we shop and what mode of transportation we use.

While transportation has such an interdependent role, it evolves over time as the environments change. This is especially true in an ever changing global economy where economic opportunities depend to a growing extent on the mobility of goods, people and the right information.

Transport Canada plays an integral role in monitoring and analyzing both the evolution and future trends in the Canadian transportation system by sharing data and information with the public through its main vehicle, the annual “Transportation in Canada” report.

About this report

As required by the Canadian Transportation Act of 2007 subsection 52, the Minister of Transport must table in both Houses of Parliament an overview of the state of transportation in Canada.

The report highlights the role of transportation in the economy. It presents a short overall assessment of the performance of the Canadian transportation system in 2016 looking at fluidity, utilization and capacity of the system. Subsequent chapters provide an overview of the four transportation modes (air, marine, rail, road) including major developments over the course of 2016. The report concludes with an outlook of foreseeable trends likely to affect the transportation system in the coming years.

Transport Canada bases the report and the corresponding Statistical Addendum on extensive factual transportation data from various data sources, which include a broad range of organizations. Great care and attention are given to data quality and reliability. However, the onus of data quality rests with the sources of data reported. While the most current information was used to produce the report, not all data reported was available for 2016. Providing a full picture of the state of transportation in Canada is a difficult task, restricted by access to data.

– TRANSPORTATION 2030 –

THE GOVERNMENT OF CANADA’S VISION ON TRANSPORTATION

The Government of Canada presented in 2016 its strategy for the future of transportation in Canada: Transportation 2030. This strategy integrates findings from the Canadian Transportation Act Review, as well as conclusions from extensive Minister-led public consultations during the spring and summer 2016.

TRANSPORTATION 2030 IS BASED ON FIVE THEMES:

THE TRAVELLER

Support greater choice, better service, lower costs, and new rights for travelers

SAFER TRANSPORTATION

Build a safer, more secure transportation system that Canadians trust

GREEN AND INNOVATIVE TRANSPORTATION

Reduce air pollution and embrace new technologies to improve Canadians’ lives

WATERWAYS, COASTS AND THE NORTH

Build world-leading marine corridors that are competitive, safe and environmentally sustainable, and enhance northern transportation infrastructure

TRADE CORRIDORS TO GLOBAL MARKETS

Improve the performance and reliability of our transportation system to get products to markets to grow Canada’s economy

As part of its Transportation 2030 Strategic Plan, the Government of Canada announced a number of initiatives to support a safe, secure, green, innovative and integrated transportation system that enables trade and economic growth, a cleaner environment and the well being of Canada’s middle class such as:

- The Trade and Transportation Corridors Initiative: $10.1 billion over 11 years in trade and transportation projects aim to improve the quality of trade infrastructure across Canada. Investments will be prioritized to address congestion and bottlenecks along vital corridors, and around transportation hubs and ports providing access to world markets. This initiative includes:

- A National Trade Corridors Fund: to support investments targeted at reducing congestion and inefficiencies at marine ports as well as along the busiest rail and highway corridors;

- Measures to modernize Canada’s transportation system: to develop regulations and establish pilot projects for the safe adoption of connected and autonomous vehicles and unmanned air vehicles;

- Trade and Transportation Information System: to fill significant information, data and analytical gaps in strategic elements of the transportation system.

- The Oceans Protection Plan: $1.5 billion over the next eleven years to improve marine safety and responsible shipping, protect Canada’s marine environment, and offer new possibilities for Indigenous and coastal communities.

- The Pan-Canadian Framework on Clean Growth and Climate Change: to achieve Canada’s international climate change commitments, create good, well-paying jobs and leave a cleaner, more prosperous economy for generations to come.

The Role of Transportation in the Economy

A healthy Canadian economy is strongly connected to a well-functioning transportation sector. Transportation provides mobility for products, services and people to access key markets at home and abroad, creating prosperity and economic opportunities.

The Transportation Sector

Transportation and warehousing is important to the Canadian economy, representing 4.5% of total Gross Domestic Product (GDP) in 2016. This sector grew by 3.0% in real terms in the past year, more than double the growth rate for all industries. The compound annual growth rate for GDP in the transportation sector over the previous five years of 2.9% also exceeds that of the economy as a whole (1.4%).

In 2016, 897,000 employees (including self-employed people) worked in the transportation and warehousing sector, up 0.6% from 2015.

Employment in commercial transport industries accounts for about 5% of total employment, a share that has remained stable over the past two decades. There were approximately 3.8 unemployed persons for every vacant job in the sector, compared to a ratio of 6.5 for the overall economy.

Transportation and the Economy

GDP measures only include the economic activities directly linked to for-hire or commercial transportation. However, transportation is not confined solely to the commercial sector, as transport functions throughout the entire economy. When viewing the transportation sector in its entirety, the impact is much broader (see Figure 1 in Annex A for a summary of the importance of transportation by mode in Canada).

In 2016, aggregate household final consumption expenditures on transportation (including insurance) amounted to $179.5 billion – second only to shelter, in terms of major spending categories. Household spending for personal travel accounted for about 10% of GDP.

Transportation and Domestic Trade

Of the produced goods that remained within Canada, over 875 million tonnes were transported by the commercial sector in 2015. Nearly 72% of this amount was carried by for-hire trucking, 21% by rail and 7% by marine.

In terms of value, interprovincial merchandise trade totaled $156 billion (current dollars) in 2015, down 10.9% from 2014.

Transportation and International Trade

Transportation is an important element of Canada’s trade with other countries. In 2016, total international trade amounted to $1,050 billion, a 1.0% decrease compared to 2015. The U.S. continued to be Canada’s top trade partner, with $673 billion in trade ($394.5 billion exported, $278.3 billion imported), down 2.2% from 2015. The U.S. accounted for 64% of total Canadian trade in 2016. This proportion has remained consistently between 63-66% each year over the past five years.

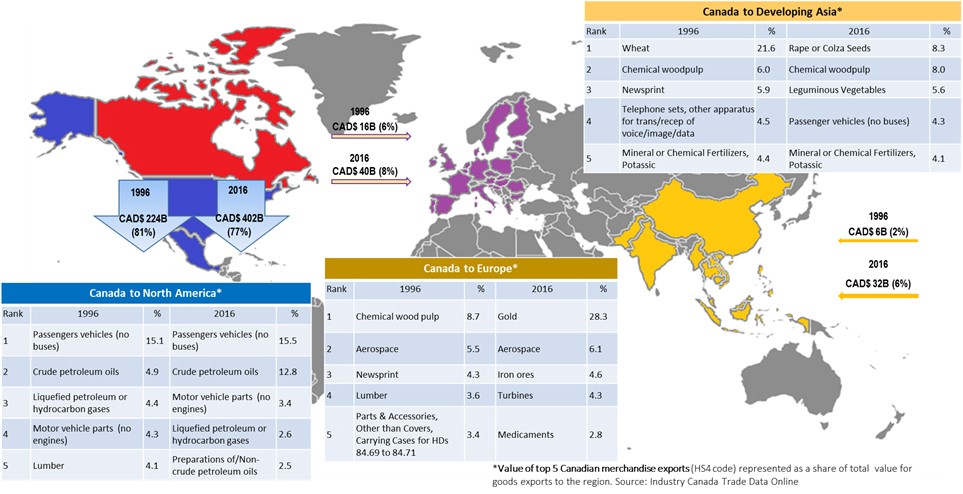

In addition to the U.S., Canada’s top 5 trading partners in 2016 included China, Mexico, Japan and the United Kingdom. The latter four nations accounted for 17.0% of Canada’s total international trade in 2016, eclipsing 16.8% in 2012 as the new high mark for this group. They have also remained constant as Canada’s second through fifth trading partners over the past five years. Figure 2 in Annex A presents top Canadian merchandise export flows to North America, Europe and Developing Asia.

Government Revenues and Expenditures

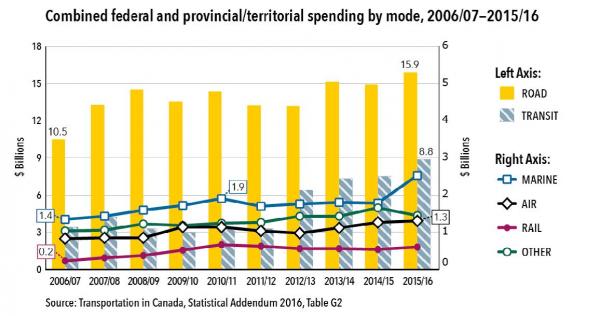

All three levels of government deliver and finance transportation infrastructure, programs and services.Footnote 1 Tables G1 to G6 of the statistical addendum provide more details on governments’ transportation expenditures and revenues.

Federal government

Total federal transport-related expenditures reached $6.9 billion in 2015-2016, a 18.1% increase from the previous year, the highest level since 2010-2011. This can be attributed to increased expenditures for the Canadian Coast Gard, Marine Atlantic, Fisheries and Oceans Canada’s Small Craft Harbours Program, and for the Windsor-Detroit Bridge Authority.

The three main federal departments in terms of transportation-related spending were Transport Canada, with $1.7 billion (24.0% of total federal spending), followed by the Canadian Coast Guard ($1.1 billion or 16.1%) and Infrastructure Canada ($0.8 billion or 11.8%). Federal spending included operating and maintenance expenses, capital expenditures as well as transfer payments. Transfer payments include transportation-related contributions made under funding programs such as the Gas Tax Fund and the New Canada Building Fund. Tax expenditures, such as the cost of the GST exemption for municipal transit and the Public Transit Tax Credit, are also included.

At the federal level, transportation-related revenues more than offset transportation-related spending. Federal revenues from transportation items totalled $13.8 billion in 2015-2016, a 1.6% increase from 2014-2015. This include $5.6 billion in fuel taxes and $6.7 billion in sales taxes on transportation-related household purchases. Overall federal user fees and other miscellaneous revenues, including major items such as the Air Travellers’ Security Charge ($755 million in 2015-2016) and lease payments by airport authorities ($324 million in 2015-2016) were up 11.4% compared to the prior fiscal year. Federal fuel tax revenues and transportation-related sales tax revenues rose by 0.7% and 0.4% respectively. Federal vehicle registration fees (from imported vehicles) fell by 50% relative to 2014-2015.

Combined federal and provincial/territorial spending by mode, 2006/07 - 2015/16 Graph Image Description

| mode (AIR... OTHER, ALL) | 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 |

| AIR | 830.5455 | 845.5595 | 852.5664 | 1146.376 | 1146.292 | 1037.179 | 975.9935 | 1123.866 | 1256.445 | 1305.852 |

| MARINE | 1353.09 | 1421.609 | 1591.749 | 1712.253 | 1895.657 | 1695.44 | 1747.028 | 1806.624 | 1779.802 | 2529.291 |

| RAIL | 230.1478 | 310.3841 | 372.4604 | 511.6561 | 655.6169 | 621.4656 | 554.2932 | 560.8266 | 536.7055 | 590.2279 |

| ROAD | 10509.98 | 13287.79 | 14513.5 | 13515.94 | 14360.09 | 13193.98 | 13141.03 | 15122.25 | 14870.72 | 15921.64 |

| TRANSIT | 3434.182 | 4221.481 | 3312.608 | 2996.158 | 3195.267 | 3253.782 | 6409.039 | 7341.196 | 7478.095 | 8849.861 |

| OTHER | 1039.726 | 1056.591 | 1214.821 | 1169.958 | 1243.745 | 1269.941 | 1435.728 | 1421.564 | 1658.336 | 1448.032 |

| ALL | 17397.67 | 21143.41 | 21857.7 | 21052.34 | 22496.66 | 21071.79 | 24263.11 | 27376.33 | 27580.1 | 30644.9 |

| Numbers are in billions | ||||||||||

Provincial-territorial governments

Provincial-territorial spending on transportation totaled $24.5 billion in 2015-2016, up 8.9% from the previous year. After netting-out federal transfer payments related to transportation, provincial/territorial spending was $23.8 billion, an increase of 9.2%. Nunavut reported the highest year-over-year increase (38.8%), along with New Brunswick (23.2%) and Manitoba (16.4%). Newfoundland and Labrador and the Northwest Territories were the only two jurisdictions reporting declines in transportation-related spending, down 1.7% and 6.9% respectively.

Provincial and territorial transportation-related revenues came from sales taxes on transportation-related household purchases, fuel taxes, license and registration fees, user fees and various other sources. In 2015-2016 revenues amounted to $25.4 billion, a 4.9% increase from the previous year. Fuel taxes made up for 38.5% of overall provincial-territorial revenues, with sales taxes contributing 40.3%.

Nunavut reported large increases in fuel tax revenues (up 64.3% versus 2014-2015), followed by Alberta (up 45.1%), New Brunswick (up 17.2%) and the Northwest Territories (up 11.4%). Saskatchewan reported a 7.0% decline in fuel tax revenues year-to-year.

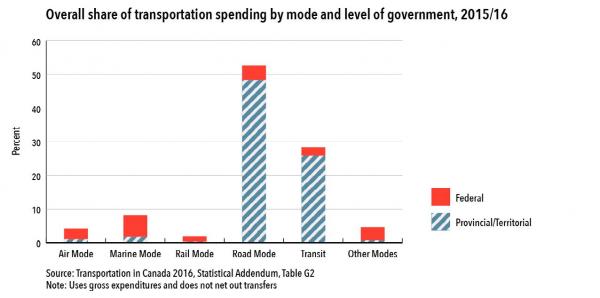

Federal-Provincial-Territorial Public Revenues and Expenditures by Mode

Combined federal-provincial-territorial expenditures (net of transfers) grew $750 million for the marine mode in 2015-2016, due mostly to federal investments in the Coast Guard. In contrast, provincial spending was responsible for most of the $1.4 billion increase in transit spending in 2015-2016 compared to 2014-2015, notably in Ontario and Québec.

Federal and provincial/territorial spending are not distributed evenly across modes. Taken together, the provinces/territories account for over 90% of expenditures for roads and transit, while the federal level contributes three-quarters or more of total expenditures on air, marine, rail and multimodal.

Overall share of transportation spending by mode and level of government, 2015/16 Graph Image Description

| Overall share of transportation spending by mode and level of government, 2015/16 | ||

| Federal | Provincial/Territorial | |

| Air Mode | 3.2 | 1.0 |

| Marine Mode | 6.4 | 1.8 |

| Rail Mode | 1.6 | 0.3 |

| Road Mode | 4.3 | 48.4 |

| Transit | 2.6 | 25.8 |

| Other Modes | 3.9 | 0.7 |

| 22.0 | 78.0 | |

| Source: Transportation in Canada 2016, Statistical Addendum, Table G2. | ||

| Note: Uses gross expenditures and does not net out transfers. |

In fiscal year 2015-16 for example, all levels of government combined, spent over $3.9 billion capital improvements to the National Highway System (a sub-component of total road expenditures), investments amounting to over $35.4 billion since 2006-07:

- provincial and territorial governments have invested about $30.2 billion (86%)

- the federal government has invested about $4.4 billion (12%)

- other sources have invested $0.7 billion (2%)

The road mode was the main source of revenues for both the federal and provincial-territorial levels of government, making up 94.4% of transportation-related revenues provincially-territorially and 78.7% federally.

The second-biggest transportation-related revenues in 2015-2016 was air for the federal government (accounting for 10.3%) and transit for the 13 provincial and territorial governments (with a 4.4% share).

Canada’s Trade and Transportation Corridors

Canada’s transportation and logistics system is comprised of key corridors, hubs and infrastructure that are crucial for ensuring the fast and safe movement of people and merchandise to domestic and international destinations.

As a large nation that depends on trade with the global market, Canada needs to ensure that people and merchandise can move quickly and safely through its transportation and logistics system in order to support economic growth and prosperity.

Building on Transport Canada’s “gateways” model, the Government of Canada has launched the new Trade and Transportation Corridors Initiative that will invest $10.1 billion over 11 years in trade and transportation projects aim to improve the quality of trade infrastructure across Canada. Investments will be prioritized to address congestion and bottlenecks along vital corridors, and around transportation hubs and ports providing access to world markets.

THE TRADE AND TRANSPORTATION CORRIDORS INITIATIVE

- A National Trade Corridors Fund,

- A Trade and Transportation Information System,

- Measures to modernize Canada’s transportation system,

- The Oceans Protection Plan, and

- Funding to undertake climate risk assessments and address the requirements of existing federally funded transportation assets (VIA Rail, Marine Atlantic and Eastern Atlantic ferries).

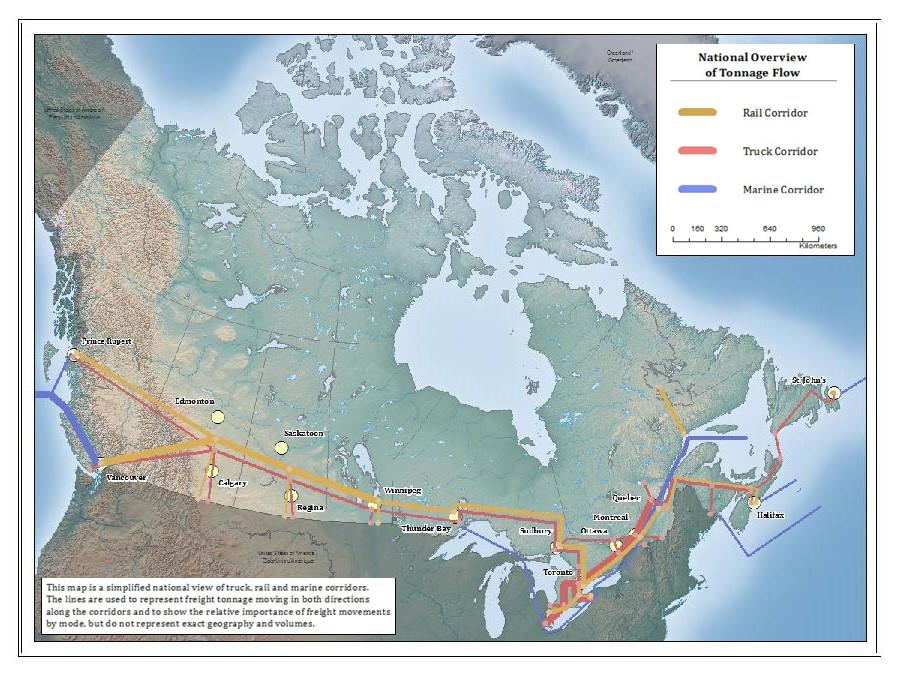

Canada’s transportation and logistics system can be divided into three strategic regions/ corridors (see Map 1 in annex A), including:

- the Western Corridor

- the Continental Corridor

- the Atlantic Corridor

While there are common characteristics among the three corridors with regards to facilitating trade and movement of goods and people, each corridor has its own unique features.

Western Corridor

The Western corridor is an important rail and marine transportation corridor in Canada. This corridor serves Canadian bulk commodities exports (crude oil, grain, coal, wood products, potash and copper), mainly destined to North American and Asian markets. The Western Corridor also links container imports from Asia to Central Canada, as well as to the U.S. Midwest markets.

In 2016, $101 billion worth of goods exports (excluding pipelines exports to the U.S.) were shipped through this corridor. This amount is down 1.3% from 2015 due to low commodity prices and lower global economic growth. In 2016, 51% of the value of merchandise exported through the Western Corridor (excluding pipelines) was destined for the U.S., 38% for Asia and 2% for Mexico.

The Port of Vancouver is Canada’s largest port in terms of traffic volume. It generated 135.5 million tonnes (Mt) of traffic in 2016, down 1.8% from 2015. Key generators of traffic include bulk commodities (coal, crude oil, wood products, potash and grain) and containers. The Port of Prince Rupert, Canada’s other main West Coast port, handled 18.9 Mt of traffic (mainly coal, grain and containers) in 2016, down 4% from 2015.

In 2016, Vancouver International Airport handled 257.1 thousand tonnes of cargo traffic, which amounted to 21% of Canada’s air freight traffic.Footnote 2

On the air passenger side, the Western Corridor is home to three of Canada’s top five busiest airports. In 2016:

- Vancouver International Airport had 21.4 million passengers (+8.9% from 2015)

- Calgary International Airport had 14.8 million passengers (+1.6% from 2015)

- Edmonton International Airport had 7.0 million passengers (-6.6% from 2015)

Vancouver International Airport and Calgary International Airport serve as hub airports for both Air Canada and WestJet, Canada’s two biggest airlines. In 2016, international passengers at Vancouver came from/went to:Footnote 3

- Asia (29%)

- United States (49%)

- Europe (14%)

- Other international (9%)Footnote 4

In 2016, international passengers at Calgary came from/went to:

- Asia (2%)

- United States (65%)

- Europe (18%)

- Other international (15%)Footnote 5

In terms of passenger rail traffic, Via Rail operates the Canadian train, a long-haul passenger route that operates between Toronto and Vancouver, stopping at major cities such as Edmonton, Saskatoon and Winnipeg along the way. The Canadian had 93 thousand passengers in 2016, up 3.9% from 2015. Other routes operated by Via Rail in the Western Region include Jasper to Prince Rupert, and Winnipeg to Churchill.

Continental Corridor

The Continental corridor, the busiest corridor in terms of surface traffic, serves Central Canada, the most densely populated and industrialized region in the country. The Continental corridor is a key enabler of international trade with the U.S. through its connections into the American Mid-West and Northeast. Using the Great Lakes and St. Lawrence Seaway, the Continental corridor is key to moves goods to and from Europe and other international markets. Key exports included automotive products and parts, wood products, and metal/minerals.

In 2016, the total value of merchandise exported through Ontario and Québec totaled $327 billion (excluding pipeline exports), an increase of 2.5% from 2015. In 2016, 80% of the value of merchandise exported through the Continental Corridor (excluding pipelines) was destined for the U.S., 11% for Europe, 5% for Asia, and 2% for Mexico

The Great Lakes and St. Lawrence Seaway System portion of the corridor is used for shipping bulk materials, transshipments of exports and container imports. Grain from the Prairies is typically shipped from the Port of Thunder Bay and carried to different Québec ports for international exports. In 2016, 11 million tonnes of grain moved through the St. Lawrence Seaway, up 3.7% from 2015.

In 2016, other commodities of importance to the St. Lawrence Seaway traffic include:

- iron ore (6.2 million tonnes, 17.8% of total traffic, mostly due to production in Northern Québec)

- coal (2.2 million tonnes, 6.4% of total traffic)

- petroleum products (2.4 million tonnes, 6.8% of total traffic)

- salt (2.5 million tonnes, 7.2% of total traffic)

- other processed products (4.2 million tonnes, 12.1% of total traffic)

The Port of Montréal is of strategic importance as it is the entrance to the St. Lawrence Seaway, which connects the lower St. Lawrence River to the Great Lakes. The Port of Montréal serves as a major hub for container traffic, mainly serving Québec, Ontario and the U.S. Midwest. In 2016, 13 million metric tonnes of container traffic moved through the Port of Montréal, down 0.2% from 2015.

Overall freight traffic at the Port of Montréal in 2016 was 35 million tonnes, up 10.4% from 2015.

Trucking activity plays a more important role in the Continental corridor, primarily moving food products, manufactured and other processed goods within the Québec City - Windsor corridor and to the American States surrounding the Great Lakes. Ontario and Québec have the busiest road border crossings in Canada. In the Continental corridor, 52% of total merchandise value were exported by road in the last five years, compared to 31% and 18% in the Western and Atlantic Corridors, which rely more on marine transportation.

In terms of air cargo transportation, Toronto (Pearson), Hamilton and Montréal (Trudeau and Mirabel) are active in cargo shipping and together accounted for 54% (667.7 thousand tonnes) of air freight traffic in Canada in 2016. This cargo travels mostly to the U.S., the United Kingdom and China. Since air cargo transportation is often reserved for high value merchandise, the most important cargo (in terms of value) exported by air out of the Continental Corridor include:

- pearls, precious metals and mineral (such as gold, diamond, coins.)

- airplanes, helicopters, and their parts

- turbo jets, turbo-propellers and other gas turbine

- pharmaceutical products such as medicaments

On the air passenger side, the Continental Corridor is home to Canada’s busiest and third busiest airports. In 2016:

- Toronto Pearson International Airport had 42.3 million passengers (+6.7% from 2015)

- Montréal-Pierre Elliott Trudeau International Airport had 15.4 million passengers (+4.6% from 2015)

Air Canada uses both airports as hub airports while WestJet uses Toronto Pearson as a hub airport. In 2016, international passengers at Toronto came from/went to:

- United States (44%)

- Europe (23%)

- Asia (9%)

- Other international (24%)Footnote 6

In 2016, international passengers at Montréal came from/went to:

- United States (35%)

- Europe (35%)

- Asia (1%)

- Other international (29%)Footnote 7

Most of Via Rail operations come from the Continental region, separated into two specific corridors.

- Corridor East operates trains between Québec City, Montréal, Ottawa, and Toronto. This is the busiest corridor, with 2.8 million passengers in 2016, up 5.8% from 2015.

- Corridor Southwestern Ontario operates trains between Toronto, London, Sarnia, Windsor and Niagara. It carried 953 thousand passengers in 2016, up 0.2% from 2015.

Via Rail also operates mandatory services in the Continental region, including trains between Montréal and Senneterre, Montréal and Jonquière, and between Sudbury and White River. Currently, mandatory service between Montréal and Gaspé is temporarily suspended until further notice due to infrastructure problems.

Atlantic Corridor

The Atlantic Corridor is strategically located to access global markets. The Port of Halifax, one of the few ports on the North American east coast that can handle fully laden post-Panamax container vessels, is also North America’s closest point of ice-free and minimal tide access to Europe and Asia (via the Suez Canal) from the east coast.

Key exports through the Atlantic Corridor include petroleum products and sea food products. In 2016, $24 billion worth of exported merchandise moved through the Atlantic corridor (excluding pipeline exports), down 5.5% from 2015. In 2016, 70% of the value of exported merchandise moving through the Atlantic Corridor (excluding pipelines) was destined for the U.S. and Mexico, 13% for Europe and 13% for Asia.

Containers account for an important part of the traffic, mostly transiting through the Port of Halifax. Containers handled at the Port of Halifax mainly serve the rest of Canada and the U.S. Midwest. Petroleum products also represent a large portion of traffic in this corridor, as offshore crude oil is often shuttled from the Hibernia and Terra Nova fields to the transshipment terminal at Whiffen Head, Placentia Bay. From there, the crude oil moves by conventional tankers, often heading to ports on the North American east coast and the Gulf of Mexico.

In the Atlantic Region, Via Rail operates the Ocean train, a long-haul passenger route that operates between Montréal and Halifax. The Ocean had 78 thousand passengers in 2016, down 2.7% from 2015.

Air Transportation Sector

Canada has 15 million km2 of airspace to manage, one of the largest in the world. The Government of Canada through its Transportation 2030 Strategic Plan is committed to providing greater choice, better service, lower costs, and new rights for travellers.

Industry Infrastructure

Canada is the third largest aerospace sector in the world, and has 15,000,000 km2 of airspace managed by the largest single Air Navigation Service provider in the world (NAV CANADA).

NAV CANADA is a privately run, not-for-profit corporation that owns and operates Canada’s civil air navigation system. It operates air traffic control towers at 41 airports and flight service stations at 55 airports.

The Canadian Airport System includes:

- 26 airports (see Map 6 in annex A) from the National Airport System (NAS):

- Calgary

- Prince George

- Charlottetown

- Québec

- Edmonton

- Regina

- Fredericton

- Saint John

- Gander

- Saskatoon

- Halifax

- St. John’s

- Iqaluit

- Thunder Bay

- Kelowna

- Toronto

- London

- Vancouver

- Moncton

- Victoria

- Montréal/Trudeau

- Whitehorse

- Montréal/Mirabel

- Winnipeg

- Ottawa

- Yellowknife

- 71 regional and local airports serving scheduled passenger traffic

- 31 small and satellite airports without scheduled passenger services

- 13 remote airports providing the only reliable year-round transportation link to isolated communities

- 11 Arctic airports (including the three territorial capital airports counted already in the NAS)

The Canada Flight Supplement and the Canada Water Aerodrome Supplement listed 1,594 certified and registered sites in 2016. They fall into three categories:

- 222 water bases for float and ski planes

- 370 heliports for helicopters

- 1,002 land airports for fixed-wing aircraft

Industry Structure

In 2016, 6.2 million aircraft movements took place at airports, 3.6 million of which were made by airlines. The other 2.7 million were itinerant and local movements made by general aviation companies.Footnote 8

There were 36,448 Canadian registered aircraft, 69,012 licensed pilots, and 2,233 licences held by 1,440 air carriers (42.7% Canadian; 57.3% Foreign) in 2016.

Canada has 17,278 aircraft maintenance engineers, 1,001 approved maintenance organizations, with 535 certified and 1,067 non-certified aerodromes.

AIR TRAVELLERS

As part of its Transportation 2030 Strategic Plan, the Government of Canada announced it will:

- Work with industry to implement clear and fair consumer protection rules for air travellers;

- Work with other federal departments to make the transportation system more accessible for persons with disabilities.

Air Canada

In 2016, Air Canada, Air Canada Express and Air Canada rouge accounted for 51% of available seat-kilometres in the domestic air market.Footnote 9

Air Canada, Air Canada Express, and Air Canada rouge operated on average 1,570 scheduled flights per day. The Air Canada network has three hubs (Toronto, Montréal and Vancouver) and provided scheduled passenger services to 64 Canadian destinations, 55 U.S. destinations and 87 other foreign destinations on six continents.

As of December 2016, Air Canada had a fleet of 168 aircraft, while Air Canada Express was using 152 aircraft, and Air Canada rouge operated 44 aircraft.

INTERNATIONAL OWNERSHIP OF CANADIAN AIR CARRIERS

The Government of Canada has announced in 2016 its intention to change the rules on international ownership for Canadian air carriers to encourage more competition in the air transport sector while ensuring that safeguards are in place to mitigate any associated risks.

WestJet

In 2016, WestJet and WestJet Encore accounted for 41% of available seat-kilometres in the domestic air market.

WestJet and WestJet Encore operated on average 641 scheduled flights per day. They provided scheduled passenger services to 38 Canadian destinations, 27 U.S. destinations and 34 destinations in the Caribbean and Mexico. In December 2016, WestJet had a fleet of 119 aircraft, while WestJet Encore recorded a fleet of 33 aircrafts.

Other carriers

In 2016, Porter Airlines, a regional carrier based at Toronto’s Billy Bishop airport, used a fleet of 26 turboprop aircraft to provide direct, non-stop scheduled passenger services to 15 destinations in Canada and eight in the U.S.

Air Transat was the largest leisure carrier in Canada for 2016, with a fleet of up to 34 aircraft (depending on the season) serving 68 international destinations in 32 countries.

Sunwing Airlines is Canada’s second largest leisure carrier. It operates a fleet of up to 32 aircraft (depending on the season) serving 37 international destinations in 15 countries.

Foreign operators offered 12.7 million scheduled seats from Canada on an average of 308 flights per day. This is no change from the 12.7 million seats also offered in 2015.

As of December 2016, Canada had air transport agreements or arrangements with 120 bilateral partners. In 2016, Canada concluded expanded agreements with key markets, including Mexico (ranked Canada’s second largest air travel market based on 2015 data) and China (sixth largest market).

Safe and Secure Transportation

Transport Canada delivers approximately 120,000 Civil Aviation services per year. In 2016-17 the Department delivered 23,573 Licensing requests, 646 operating certificates, 4,840 Aircraft Registration requests, 44,429 Medical Assessments, 3,754 UAV Special Flight Operating Certificates and thousands of inspections.

Marine Transportation Sector

The Government of Canada aims to build world-leading marine corridors that are competitive, safe and environmentally sustainable. A number of initiative were introduced in 2016 to improve marine safety and the environment, most notably the new Oceans Protection Plan.

Industry Infrastructure

According to the Chamber of Marine Commerce, Canadian shipowners have invested more than $4 billion over the last five years to modernize their fleets, introducing a new generation of efficient, environmentally-friendly vessels and retrofitting current vessels on the Great Lakes-Seaway System.

The Canadian Port System

Ports and harbours offer vital connections to promote domestic and international economic activity. As of December 2016, Canada had 559 port facilities and had 866 fishing harbours and 129 recreational harbours.

Transport Canada is involved in two categories of ports:

- 18 independently managed Canada Port Authorities (CPAs), shown on Map 7 in annex A

- Belledune

- Saguenay

- Halifax

- Saint John

- Hamilton

- Sept-Îles

- Montréal

- St. John’s

- Nanaimo

- Thunder Bay

- Oshawa

- Toronto

- Port Alberni

- Trois-Rivières

- Prince Rupert

- Vancouver

- Québec

- Windsor

- 48 port facilities currently owned and operated by Transport CanadaFootnote 10

Investments in new and existing port infrastructure has helped CPAs diversify their offerings as well as open up access to new global markets. Examples include:

- The Port of Montréal’s new Viau container terminal, funded in part by the Government of Canada, began operations in 2016, and will increase capacity by 450,000 TEUs (twenty-foot equivalent unit). It will also serve as an essential part of the port’s overall capacity optimization project.

- In October 2016, a contribution agreement was signed between the government of Canada and the St. John’s Port Authority. The government of Canada will contribute up to $6.4 million for the project. The project consists of the construction of a new steel pile supported Finger Pier at the junction of existing Pier 16 and Pier 17 with the capability of mooring, servicing and offloading two Offshore Supply or similarly sized ships.

The private sector also continues to invest in CPAs through privately-funded infrastructure projects, such as the $50-million G3 Canada Ltd. grain terminal at the Port of Hamilton, announced in 2015 and expected to be completed in 2017.

In March 2016, the Fraser Surrey Docks completed the Port Authority Rail Yard to promote growth and expansion of the Asia Pacific Gateway. Funding for the project was shared by Fraser Surrey Docks ($3.1 million) and the Government of Canada ($2.5 million).

The Great Lakes St. Lawrence Seaway System

As shown on Map 7 in annex A, the Great Lakes St. Lawrence Seaway System provides a strategic waterway system into the North American heartland which includes:

- The waterway between Lake Erie and the Port of Montréal (the St. Lawrence Seaway), with eight locks in the Welland Canal and seven locks between Montréal and Lake Ontario. This portion of the system (including five of the seven locks between Montréal and Lake Ontario) is managed by the Canadian St. Lawrence Seaway Management Corporation.

- The two remaining locks in the Montréal-Lake Ontario segment are in U.S. waters and managed by the Saint Lawrence Seaway Development Corporation.

The Great Lakes St. Lawrence Seaway System serves 15 major international ports and 50 regional ports that connect to more than 40 provincial or interstate highways and 30 railway lines. In 2016, more than 7 billion dollars in direct Canadian trade flowed through the Great Lakes-St. Lawrence Seaway system.

Industry Structure

International

According to the United Nations, 90% of the world’s trade travels by sea. This represented 10 billion tonnes in 2015, the highest level in history.

The financial crisis of 2008 marked the end of one of the longest positive shipping cycles. While world seaborne trade has recovered since its 3.2% decline in 2009, the average annual rate of growth is slowing from the historic long-term (1950-2008) rate of 4.3%. World seaborne trade increased 2.6% in 2015 and 2.3% in 2016.Footnote 11

The slowdown in global trade, the weakness in commodity prices, the number of new vessels and the introduction of mega-ships have created an important supply-demand imbalance that pushed freight rates to their lowest level in recent decades.

In 2016, this situation caused the bankruptcy of Hanjin Shipping and the merger of key players notably China Ocean Shipping Company (COSCO) and China Shipping Group. This environment has also triggered a series of new mega alliances between container carriers. Vessel sharing agreements are not new, but the new mega alliances now control almost 90% of container capacity on major trade lanes.

On June 26, 2016 the expanded Panama Canal began commercial services, doubling its capacity. The Canal, which can now accommodate Post-Panamax vessels with up to 13,000/14,000 TEUs, will likely divert some flows of international traffic from the North American West Coast to the East Coast. The increasing use of larger vessels in the global fleet requires ports to have sufficient capacity to service them. This in turn, requires matching surface connection capacity to ensure the efficient flow of goods along the supply chains.

Canada

In Canada, dredging occurs in many locations across the country. Most dredging activities focus on port and shipping channel maintenance while there are other areas of activities taking place in support of construction projects. In 2016, there were 54 Canadian registered dredging vessels located across the country. The main dredging operators in Canada include:

- Fraser River Pile and Dredge (Graymar Equipment 2008 Inc.)

- Ocean Group

- JJM Construction Ltd

- Dean Construction

- McNally Construction

- Dragage Acadien Ltée

The marine sector transports bulk and containerized cargo domestically and overseas. This sector also supports Northern resupply and resource development, passengers coastal and inland ferry services, and cruise ships. Many ferries are critical transportation links.

Canadian registered vessels are active in domestic commercial activities (carrying on average 98% of domestic tonnage) as well as in trade between Canada and the U.S. In contrast, Canadian shippers rely predominantly on foreign-based carriers for other international destinations.

A number of Canadian-based marine companies active in international trade use foreign registered vessels. The main ones are Fednav Ltd., CSL International (Canada Steamship Lines), Teekay Shipping (Canada), Canfornav and Kent Line. Domestic shipping serves four main geographical sectors.

1. The Pacific Coast

Most West Coast marine activity is trade-related, with Port of Vancouver and Port of Prince Rupert being the two main gateways for international trade. Nevertheless, domestic marine activities play an important role in British Columbia’s economy. The Pacific Coast geographic area is very diverse and includes many inlets and islands. Coastal communities located across this complex island shoreline rely on domestic tug and barge operations. Domestic marine carriers serve:

- the Fraser River and Burrard Inlet

- the coastal routes within the Gulf Islands

- the Strait of Juan de Fuca

- the inside Passage from Vancouver up to the Alaska Border

- the Haida Gwaii’s archipelago

Main carriers serving this sector are:

- Seaspan Marine

- Island Tug and Barge

- Pacific Towing Services

- SMIT Canada

- West Coast Tug and Barge

These carriers are also active in transborder trade to the states of Alaska, Oregon and Washington. Freight carried in this sector includes general cargo for community resupply, wood products, gravel and stones, construction materials and coal.

2. The Great Lakes and the St. Lawrence River

Domestic marine activity in the Great Lakes– St. Lawrence River covers a large area from its western point at Thunder Bay/Duluth (U.S.) through the Great Lakes and the Seaway System, ending at the opening of the Gulf of St. Lawrence.

Main domestic carriers in this sector are also active in trade with the U.S. They include:

- Algoma Central Corporation

- Canada Steamship Lines

- Groupe Desgagnés Inc.

- Lower Lakes Towing Ltd.

- McAsphalt Marine Transportation Ltd.

- McKeil Marine Ltd.

- Purvis Marine Ltd.

Freight carried in this area includes grain, coal, iron ore, petroleum products, salt, gravel and stones.

Canada and the U.S. have a history of close regulatory co-operation in this region, as shipping on the Great-Lakes St. Lawrence Seaway system is an important driver for both, the Canadian and the U.S. economies, directly supporting almost 100,000 jobs and over $33 billion (U.S. dollars) in business revenue.

3. The Atlantic Coast

While most of the East Coast’s domestic marine activity takes place within the Great Lakes–St. Lawrence River, many activities also take place in Canada’s four Atlantic provinces. Newfoundland and Labrador receive supplies in general commodities via different daily and weekly feeder services. Marine activities related to the mining industry are also important in the province such as the Voisey’s Bay Nickle Mine in Northen Labrador.

Main domestic carriers in this sector include:

- Irving/Kent Line

- Coastal Shipping Ltd.

- Oceanex (1997) Inc.

- Canada Steamship Lines

- Groupe Desgagnés Inc.

Most activities in this region relate to the petroleum industry in:

- Saint John (New Brunswick)

- Come by Chance (Newfoundland and Labrador)

- Newfoundland and Labrador’s current offshore oil project sites–Hibernia, Terra Nova, and White Rose

Nova Scotia has two gas production sites–Sable Island and Deep Panuke. Most activities in this sector relate to using specialized offshore vessels for research, construction (deepwater) and support development and production activities.

Main offshore operators in this region include:

- Atlantic Towing

- Maersk

- Secunda

Offshore operations in this region and transborder trades with the U.S. also contribute to marine activity. However, international marine carriers conduct most of this activity.

4. The Northern Region

Canada’s territories cover close to 40% of Canada’s area, but are home to just over 113,600 people (around 0.3% Canada’s population). This population is dispersed among numerous small communities often separated from each other by hundreds of kilometers of land and water. Since they are so remote, seasonally operated marine transportation plays a critical role in the resupply of basic necessities sourced from southern Canada. Resource projects similarly rely on marine transportation to move equipment and supplies from the south and to get their products to southern markets.

There are four distinct marine systems involved in resupplying northern Canadian communities:

- the Athabasca marine resupply system (A. Frame Contracting Ltd.)

- the Mackenzie River and western Arctic system (Northern Transportation Co. Ltd. and Cooper Ltd., Island Tug and Barge)

- the Inside Passage and Yukon system (Seaspan Marine)

- the Keewatin/Hudson Bay and Eastern Arctic system (Woodward, Nunavut Eastern Arctic Shipping Inc., Nunavut Sealink and Supply Inc., Desgagnés Transartik/PetroNav and Fednav)

Ferries

Ferries in Canada provide an important transportation link for coastal and island communities, as well as communities separated by rivers or lake crossings where crossing demands do not warrant building a bridge. Ferries also play a vital role in resupplying some communities across the country. There are ferry operators in most provinces, examples include:

- Marine Atlantic Inc.

- Northumberland Ferries Ltd.

- Société des traversiers du Québec

- BC Ferries

The Canadian Commercial Fleet

In 2016, Canada’s commercial registered fleet (1,000 gross tonnage and over) had 185 vessels with a total of 2.5 million gross tonnes.Footnote 12 The dry bulk carriers formed the fleet’s backbone, with 50% of the gross tonnage and 30% of vessels, followed by tankers and general cargo vessels.

There was also a large active fleet of 526 tugs (15 gross tonnage and over) and 2,026 barges (15 gross tonnage and over) operating in Canada, mainly on the Pacific coast.

According to the United Nations Conference on Trade and Development, as of January 1, 2016, Canadians owned 362 ocean going ships that trade internationally under foreign flags.

Safe and Secure Transportation

On November 7, 2016, the Government of Canada announced the $1.5 billion Oceans Protection Plan (see below).

In addition to new measures introduced as part of the Oceans Protection Plan in 2016, safety and security of seafarers was improved by introducing:

- Vessel Fire Safety Regulations published in Canada Gazette, Part I

- Regulations Amending the Small Fishing Vessel Inspection Regulations published in Canada Gazette, Part I & Part II,

- Regulations Amending the Vessel Operation Restriction Regulations (Columbia River) published in Canada Gazette, Part I & Part II, and

- Regulations Amending Certain Regulations Made Under the Canada Labour Code published in Canada Gazette Part I

As a core member of the Marine Security Operations Centres (MSOCs), Transport Canada continues to partner with other federal government departments and agencies to leverage our combined capability, capacity and authority to enhance Canada’s marine security.

THE OCEANS PROTECTION PLAN

The Oceans Protection Plan is designed to achieve a world-leading marine safety and coastal protection system that includes:

- Restoring and preserving the marine ecosystems,

- Strengthening partnerships with Indigenous communities, and

- Investing in evidence-based emergency preparedness and response.

Investments under the Oceans Protection Plan will:

- Increase capacity to prevent marine incidents and improve responses,

- Strengthen environmental protection,

- Create opportunities for Indigenous communities to participate and play an active role in responsible shipping and the marine safety regime, and

- Fund additional research that draws on the expertise and experience of the science community, both in Canada and abroad.

Green Transportation

In 2015, the Government of Canada announced funding to install shore power:

- $6 million to the Port of Vancouver, to service container vessels at two container terminals

- $5 million to the Montréal Port Authority

These projects are currently under construction. The shore power technology reduces fuel consumption, fuel costs, GHG and air pollutant emissions from vessels by providing ship operators an alternative to running diesel auxiliary engines.

In 2013, Canada adopted a number of measures to reduce air pollutant and GHG emissions from ships, developed at the International Maritime Organization (IMO).

Since January 1, 2015, under the North American Emission Control Area in coastal waters, vessels operating in Canada must use fuel with a maximum sulphur content of 0.1% or use technology that results in equivalent sulphur emissions, to reduce air pollutants. In the Great Lakes St. Lawrence Seaway System, progress continued under the Fleet Averaging Regulatory Regime to reduce sulphur emissions from domestic vessels. We expect these measures will reduce sulphur oxide emissions from ships by up to 96% from 2013 levels.

The Energy Efficiency Design Index requires vessels on international trade that were constructed after January 1, 2015, to meet energy efficiency targets to reduce GHG emissions.

To protect Canadian waters from invasive species, Transport Canada:

- requires ships to manage their ballast water

- conducts joint inspections with U.S. authorities to verify that all vessels from overseas entering the Seaway meet ballast water regulations

Joint inspections found that 97% were compliant, while the remainder needed to take corrective action before entering the Seaway.

In 2010, Canada ratified an international Convention to further increase protection. In 2016, this Convention met the applicable requirements for entry into force, and will do so on September 8, 2017. Transport Canada is working to amend the Ballast Water Control and Management Regulations to give effect to the Convention in Canada.

Rail Transportation Sector

The Government of Canada continues its work to build a safer and more secure rail system through a number of measures including amendments to the Railway Safety Administrative Monetary Penalties Regulations and a new Rail Safety Improvement program.

Industry Infrastructure

The Canadian Rail System currently has 45,199 route-kilometers (km) of track, as illustrated on Map 7 in annex A:

- CN owns 49.1% (22,186 km)

- Canadian Pacific (CP) owns 25.6% (11,574 km)

- Other railways own 25.3% (11,439 km)

The Rail System also includes:

- 19 intermodal terminals operated by either CN or CP to run truck/rail and container intermodal services

- 27 rail border crossings with the U.S

In the last 10 years (2007-2016), 2,600 km of track were officially abandoned and 845 km transferred, mainly to new short line rail operators. CN has acquired some track in takeovers of Class II carriers.

On a system-wide basis, railways invest about 20% of their revenue into infrastructure, averaging approximately $1.8 billion annually over the past 5 years.

Industry Structure

The rail transportation sector specializes in moving heavy, bulk commodities and containerized traffic over long distances.

Its passenger function includes providing commuter, intercity and tourist rail services.

Over 60 railways operate in Canada. About half of them operated under the federal jurisdiction in 2016, including three Canadian Class I and several U.S. railways:Footnote 13

- CN

- CP

- VIA Rail a Crown corporation established in 1977, which operates Canada’s national passenger rail service on behalf of the Government of Canada. VIA Rail operates intercity passenger rail services, mainly over CN and CP track

- AMTRAK, the U.S. National Railroad Passenger Corporation, which provides two cross-border passenger rail services to Montréal and Vancouver and a joint cross-border service to Toronto with VIA Rail

- Some large U.S.-based carriers with freight rail operations in Canada. Examples include the BNSF Railway Company, CSX Transportation Inc., and the Union Pacific Railroad Company

Note: The BNSF rail line is a strategic link in the trade route between Canada, the United States and Mexico. Its service to Canada’s Pacific Gateway gives Vancouver with unique strategic advantage of being the only port on the west coast served by three Class I railroads.

Other federally regulated railways include short line railways. These are line-haul carriers that provide point-to-point haulage services across distances of between 20 and 450 kilometres, though some have shorter or longer networks. Short lines typically connect shippers to Class I railways, other short lines and/or ports to move products across longer distances. For example, Québec North Shore and Labrador Railway (QNS&L), a wholly-owned subsidiary of Iron Ore Co. of Canada, offers freight services between Labrador City, Emeril Junction and the port of Sept-Îles. Some short lines also provide passenger rail services, including Rocky Mountaineer Railway.Footnote 14

In terms of equipment, Class I railway carriers had over 2,700 locomotives in 2015, with 51,600 freight cars (mainly hopper cars, boxcars, flatcars and gondolas).

Under the Safe and Accountable Rail Act, Transport Canada adopted a strengthened rail liability and compensation regime which came into force on June 18, 2016. The strengthened regime establishes risk-based minimum insurance levels for federally regulated freight railways ranging from $25 million to $1 billion; and a shipper-financed compensation fund that would be accessed in the case of an accident involving crude oil or other designated goods, when the costs exceed a railway’s insurance level.

As well, in August 2016, the Fair Rail for Grain Farmers Act was extended by one year to allow the Government to plan for the upcoming crop year under predictable conditions and enable the Government to assess the CTA Review report. In November 2016, the Minister announced the intention to introduce legislation in Spring 2017 for a more transparent, balanced, and efficient rail system that reliably moves Canadian goods to global markets. The legislation will strengthen the freight rail policy framework by striking a proper balance between supporting rail customers and delivering continued investments in the system.

Safe and Secure Transportation

Amendments to the Regulations Amending the Railway Safety Administrative Monetary Penalties Regulations (Grade Crossing Regulations) came into force in April 2016. These amendments give the Minister of Transport a full set of safety compliance and enforcement tools.

In December 2016, the Prevention and Control of Fires on Line Works Regulations were introduced, and will come into force in June 2017. These regulations will improve the Rules for the Control and Prevention of Fires on Railway Rights-of-Way.

In October, 2016, the Minister of Transport announced the $55 million Rail Safety Improvement program. This new program increases funding, expands lists of eligible recipients and broadens the scope of three Transport Canada rail safety programs:

- the Grade Crossing Improvement Program

- the Grade Crossing Closure Program

- Operation Lifesaver

In addition, Transport Canada continued applying regulations that had previously come into force, such as the:

- Administrative Monetary Penalties Regulations

- Railway Operating Certificate Regulations

- Grade Crossings Regulations

- Railway Safety Management System Regulations, 2015

- Amendments to the Transportation Information Regulations

In response to recent terrorist attacks in various countries (e.g. Brussels airport and metro system in March 2016), Transport Canada continues to conduct inspections at major passenger rail and urban transit stations across Canada. In 2016, Transport Canada also held several multimodal classified briefings and a Canadian Surface Security Roundtable with key industry stakeholders to increase information sharing, discuss best practices and enhance stakeholder engagement to improve the security of Canada’s transportation system.

Green Transportation

In 2013, Transport Canada and the Railway Association of Canada renewed a memorandum of understanding to encourage voluntary emission reductions from the Canadian rail sector during 2011-2015. In 2015, the memorandum was extended until the end of 2016. The latest annual report published under this memorandum shows the intensity of GHG emissions from rail freight operations in 2014 improved by 3.6% compared to 2013. In addition, Transport Canada and the U.S. Environmental Protection Agency are working with key stakeholders to advance efforts under the Canada-U.S. Regulatory Cooperation Council Locomotive Emissions Initiative.

Road Transportation Sector

As most passengers and goods in Canada travel by road, the Government of Canada has taken actions to strengthen the safety of the network by amending the Motor Vehicle Safety Act, and to ensure the reduction of GHG emissions through the stricter standards.

Industry Infrastructure

There are more than 1.13 million two-lane equivalent lane-kilometres of public road in Canada.Footnote 15 Approximately 40% of the road network is paved, while 60% is unpaved.Footnote 16 Four provinces—Ontario, Québec, Saskatchewan, and Alberta — account for over 75% of the total road length.

In 2015, the National Highway System (NHS) included over 38,075 lane-kilometres:Footnote 17

- 72.7% was classified as Core routes

- 11.8% as Feeder routes

- 15.5% as Northern and Remote routes

As shown on Map 6 in annex A, the NHS consists mainly of interprovincial and international road linkages. In 2015, the NHS accounted for nearly 40% of vehicle-kilometres travelled.

Four important highway projects were completed in 2016:

- In October, the Highway 104 Phase 2 twinning project in Nova Scotia opened to traffic. The Government of Canada gave $55 million towards the $159 million phased project. The multi-phased project is a new 14.5-kilometre four-lane highway that stretches from west of Addington Forks Road to the east point of Taylor’s Road, Antigonish County. It will improve safety, ease congestion and cut travel time for drivers.

- In 2016, the final stretch of Autoroute 73 connecting Lévis to Saint-Georges in Québec was completed. The Government of Canada gave $126.5 million towards the $531 million project. This project will enhance the security and fluidity of moving people and goods, and will make it easier to export products to the United States.

- In July, the Philip Avenue overpass in Vancouver, British Columbia opened to traffic. The Government of Canada contributed $10.8 million towards the $27 million project. The new overpass reduces traffic congestion in the area and improves safety by eliminating the Pemberton Avenue at-grade rail crossing.

- The Government of Canada gave $16.7 million towards highway improvements between Monte Creek and Pritchard on the Trans-Canada Highway near Kamloops, completed in 2016. The highway improvements were made in a manner that was sensitive to aboriginal artifacts found on-site.

Industry Structure

Most passengers and goods in Canada travel by road. This is particularly true for the transport of manufactured goods.

As of December 2016, there were 66,751 businesses whose primary activity was trucking transportation. Trucking includes many small for-hire carriers and owner-operators, and some medium and large for-hire companies that operate fleets of trucks and offer logistic services.

Trucking companies were concentrated in four provinces: Ontario (41.1%), Alberta (16.3%), Québec (15.1%), and British Columbia (14.6%).

The trucking industry is involved in three main types of trucking activities.

- For-hire trucking services, which fall into two main categories:

- less-than truckload, i.e. the transportation of relatively small-sized freight from different shippers in a truck

- truckload, i.e. transportation of a shipment from a single shipper in a truck

- Courier operators, which specialize in transporting parcels. As of December 2016, there were 11,764 companies with courier or messenger services as their main line of business.

- Private carriers, where businesses maintain a fleet of trucks and trailers to carry their own goods (e.g., Walmart, Costco). These carriers’ activities are not tracked, as they are part of companies whose main line of activity is not trucking.

Trucking companies can also be classified as intraprovincial or extraprovincial (i.e. ones that routinely cross provincial or international boundaries).

Owner operators are independent business people (e.g. drivers) who own or lease their trucks/road tractors and haul goods for either a private (e.g., manufacturer, retailer, wholesaler) or a for-hire carrier.

In 2015, more than 23.9 million road motor vehicles were registered in Canada, up 1.6% from 2014. Most (92.2%) were vehicles weighing less than 4,500 kilograms (mainly passenger automobiles, pickups, Sport Utility Vehicles (SUV) and minivans), while 4.4% were medium and heavy trucks weighing 4,500 kilograms or more, and 3.3% were other vehicles such as buses, motorcycles and mopeds.

The Memorandum of Understanding (MoU) on Vehicle Weights and Dimensions is the main tool for harmonizing truck weights and dimensions across Canada. It was first signed by federal, provincial and territorial transportation ministers in 1988, and has been amended nine times since. The most recent amendments were approved in September 2016 by the Council of Ministers Responsible for Transportation and Highway Safety to allow longer maximum wheelbase tractors for:

- category 1 trucks (a tractor pulling a single semitrailer) from 6.2 to 7.2 metres

- category 3 trucks (a tractor pulling two semitrailers) from 6.2 to 6.8 metres

Also in 2016, an agreement was signed between Ontario, Québec, New Brunswick and Nova Scotia to harmonize requirements for long combination vehicles. This agreement will allow carriers to transport goods more easily and efficiently across the four provinces while reducing fuel consumption and emissions.

In December 2016, Canadian Tire unveiled 53 and 60-foot prototype trailers for use on Canadian highways. Max-Athas (an Ontario-based company) developed two other prototype models. All were easy to operate with one hand, a key design requirement. The designs easily alternate between 53- and 60-foot configurations and are both expected to reduce manufacturing and overall transportation costs. CP Rail has successfully tested one of the prototype units on its network. The use of transport 60-foot trailers is awaiting the approval of individual provinces and territories.

Safe and Secure Transportation

In 2016, Bill S-2, an amendment to the Motor Vehicle Safety Act was tabled to:

- enhance defect and recall powers

- provide an administrative monetary penalty system

- provide some flexibilities for introducing new technologies

In 2016, Canada upgraded the Motor Vehicle Safety Regulations with several new and updated regulations. For example:

- a new requirement will mitigate the ejection of vehicle occupants. It requires that side curtain air bags to remain inflated during a rollover collision

- updated regulations for side impact protection, which will improve vehicle occupant safety

Green Transportation

In 2016, the Pan-Canadian Framework on Clean Growth and Climate Change included a commitment for federal, provincial, and territorial governments to work with industry and other stakeholders to develop a Canada-wide strategy for zero-emission vehicles by 2018.

In 2016, the Government of Canada indicated it would continue its work to implement emissions standards for post-2018 model year heavy-duty vehicles and engines, building on the first-ever regulations covering model years 2014 to 2018. On March 4, 2017 the Government of Canada published proposed amendments to the existing Heavy-duty Vehicle and Engine Greenhouse Gas Emission Regulations. These proposed amendments would:

- establish progressively stricter standards to further limit greenhouse gas emissions from new on-road heavy-duty vehicles and their engines in Canada beginning with the 2021 model year

- introduce new standards for new trailers hauled by on-road transport tractors in Canada beginning in the 2018 model year

Transportation of Dangerous Goods

As part of a series of transformative changes, the Transportation of Dangerous Goods (TDG) Program continues to work to improve all areas of its Program with the overarching objective of ensuring that the appropriate TDG related regimes are in place to protect public safety.

Safety in the transportation of dangerous goods was strengthened across Canada through the following measures and initiatives undertaken by Transport Canada:

- Increase in inspection regime, resources and capabilities required to respond to the significant increase of flammable liquids transported by rail to ensure that high risk sites handling dangerous goods continue to be identified, inspected and, as required, that corrective measures are taken to further protect public safety.

- Completion of phase 2 of its chlorine release study (Jack Rabbit II) to address rapid large-scale releases of pressurized, liquefied Toxic Inhalation Hazard (TIH) gases from a railcar.

- Launching of a collaborative research project on crude oil, in partnership with the U.S. Department of Energy, Department of Transportation, and Sandia National Laboratory. The project will assess sampling and analysis methods to ensure an accurate characterization of crude oils in transport. It will also investigate fire properties of different crude oils.

- Publication of regulations in the Canada Gazette, Part I. These regulations will update parts of the Transportation of Dangerous Goods Regulations in order to:

- Align with the 20th edition of the United Nations (UN) Model Regulations for the Transportation of Dangerous Goods (UN recommendations).

- Address the classification of dangerous goods and new dangerous goods safety marks.

- Introduce ambulatory references for:

- UN recommendations;

- International Maritime Dangerous Goods Code; and

- International Civil Aviation Organization (Technical Instructions).

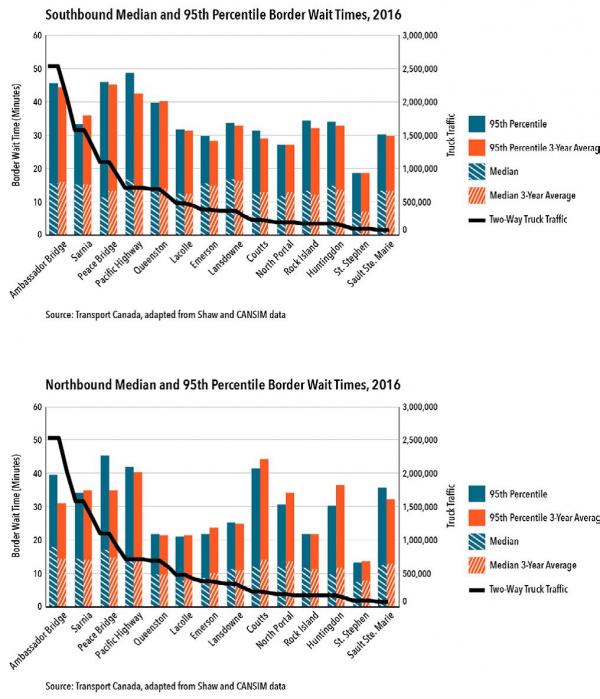

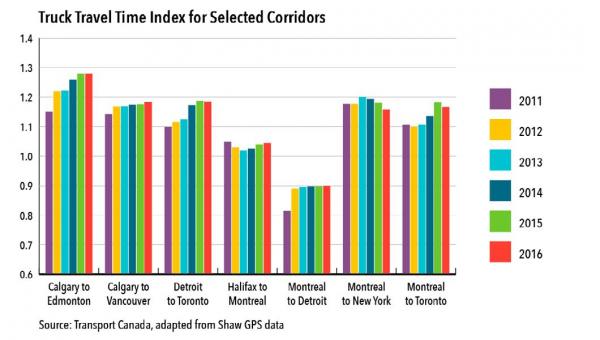

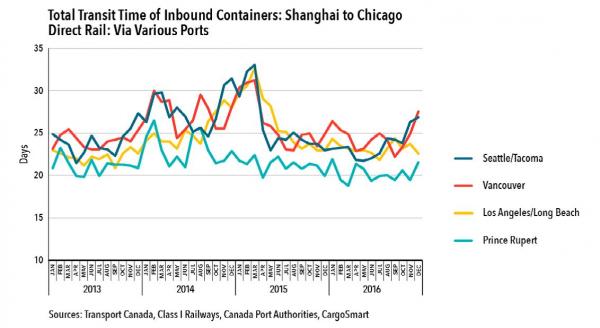

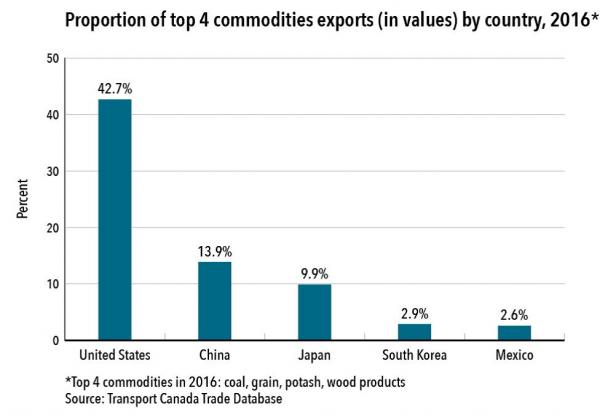

- Update safety standards for the design, manufacture, selection, and use of Means of Containment (MOC).