[ Next: Chapter 1 ]

SUMMARY

Objective and approach

The objective of this study is to identify strategies that could enhance the competitiveness of Canada’s Pacific marine container terminals relative to those in the United States. Canadian container terminals are competitive when they are able to sell their services in a competitive marketplace while earning a sufficient return on shareholders’ invested capital.

We used the competitiveness indicators: industry structure, service quality, environmental sustainability, innovation, prices, and profitability. Information was obtained from public reports, 105 telephone interviews, and 60 site visits.

Surface transportation issues

Opportunities for forest products and crops- Containerization of forest products, metal concentrates and chemicals has been very successful and is growing rapidly in Canada. A new marine terminal at Prince Rupert and inland terminal at Prince George will help further expand source loading of forest products. However Canada seems to lag behind the US in source loading containerized agricultural crops. Containerization has the potential to achieve higher quality at a lower price than bulk shipping.

Inland terminals could spur competitiveness- Ocean shipping prices from the US and Canada to Asia are competitive but there are extra costs in Canada for transferring forest and agricultural products from rail cars arriving in Vancouver into containers and then trucking the containers to the shipping terminal. US prices are currently lower because more export containers are loaded close to the source of the products. In Canada, revenue from rail transport of grains is fixed thereby limiting opportunities for containers.

Railways are adding stronger higher capacity container rail cars- For example, for its Prince Rupert route, CN Rail purchased 2,250 new cars built to exactly suit fully loaded 40-foot international containers to help meet the needs of crop exporters. In October, 2007 American President Line began using stronger 53 foot containers on their Asia to Los Angeles route and to reduce transloading and increase train density.

Transport Canada’s aid to truckers is appreciated- Transport Canada’s contributions to establishing fee schedules for truckers has resulted in a significant gain in transportation reliability and are being emulated in the US. Transport Canada’s role in fostering cooperation between North American exporters and all of the Pacific container terminals is appreciated.

Marine terminal issues

Canada’s terminal tariffs and overall shipping prices are competitive- The Canadian marine terminal tariffs and the ocean shipping, rail, and off-dock service fees related to each terminal are competitive with prices at US terminals. The shipping price depends on the route, volume of business, contents, shipping line and other factors. However, the average price for shipping a 40-foot container from Shanghai to Chicago or Toronto is about $4,000. The price for returning a container of exports is about $2,800. Marine terminal related tariffs make up about 10 percent of import shipping prices and about 30 percent of export shipping prices. Thus terminal related charges are very significant from an exporter’s point of view. General economic conditions have the biggest impact on prices. For example, import containers to the US Pacific Coast terminals are down 3 percent this year and exports are up 14 percent due to weakening of the US economy and dollar. Canadian import containers are up 5% and exports are up 3%.

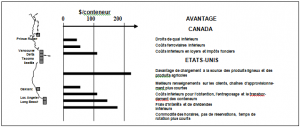

Some of the price advantages for Canada and the US are shown graphically in Exhibit 1. Canada has the advantages of lower lease and property tax payments, lower import rail costs and lower wharfage costs. The US has the advantages of less costly source loading of exports, faster truck turn times, lower interest and dividend costs, lower railcar to container transfer costs, and better customer information systems.

Exhibit 1 - Canadian container terminal competitiveness

On the Pacific coast, Canadian terminal productivity is equal to the US- Although US terminals are generally more spacious with more equipment and capacity than Canadian terminals, productivity levels per berth and crane are similar. On the Pacific coast, Canadian productivity of 24 lifts per crew per hour is comparable to the US, but there is room to improve. American President Line’s container terminals in Yokohama and Kobe, Japan, and Kaohsiung, Taiwan, achieve 36 lifts per stevedoring crew per hour. In Canada, more containers move by rail and this helps maintain high productivity.

However, one productivity concern is that the speed of service to truckers at Canadian terminals lags far behind the Los Angeles and Long Beach terminals with turn-around times in Canada averaging over an hour. US regulations limit the wait time to 30 minutes and in many terminals there are no waits. In Los Angeles and Long Beach truck driver pick-ups and deliveries are spread out though out the whole day and containers are stored on truck chassis allowing drivers to pick them up quickly.

Higher afternoon tariffs and reservation system are areas of concern- Vancouver and Delta terminal customers and truckers are dissatisfied with the higher prices for afternoon operations; the long waits for truck loading and unloading; and the counter-productive truck reservation system. Afternoon prices at two of the three terminals for exports are 27% higher for evenings and 54% higher on Saturdays than normal day rates. In Canada, these higher prices are based on lower volumes and labour agreement shift differentials. In California prices are higher in the day to reduce congestion rather than being linked to labour costs.

Innovation, Research and Development- Many stakeholders admire the way some US terminals and Centerm in Canada use advanced information technologies to improve terminal accessibility and to provide real time information about container locations. Centerm’s use of technologies has contributed to its Number One ranking in the volume of containers moved through the Port of Vancouver. Vanterm and Deltaport are also improving their information technologies. The trend towards the use of electronic commerce tools by the international shipping lines may indicate an opportunity for Canadian exporters, particularly wood products and specialty crop producers, to enhance their own capabilities in this field.

Lower wharfage, lease rates and property taxes give Canadian terminals an advantage over the US- The total of lease payments, payments in lieu of taxes, and municipal property tax to host municipalities averages $4 million per year per terminal in Canada compared to $15 million per year per terminal in the US. Canada’s 35 year average lease terms are more than double the 15 year term in the US and Mexico. The average size of the terminals in the US and Canada is about the same 0.9 million TEUs per year. Wharfage, lease rates and taxes are higher in the US because the terminal land is owned by the host municipality whereas in Canada the land is owned by the Federal government. Cities such as Los Angeles, Long Beach and Oakland have more control of port activities than the City of Vancouver, Corporation of Delta and City of Prince Rupert and the US cities receive far greater direct financial benefits.

US terminals are more integrated with shipping operations- Global shipping companies control most of the marine terminal leases in the US whereas Canadian terminals are controlled by financial institutions. For example, leases for Deltaport and Vanterm are owned by the Ontario Teachers’ Pension Fund and the lease for Fairview Terminal in Prince Rupert is owned by the Deutche Bank. The six major shipping competitors- the CKHY Alliance, New World Alliance, Grand Alliance, China Shipping, Evergreen Shipping and Maersk- each have their own terminals in Seattle or Tacoma, Washington and Oakland, Long Beach, and Los Angeles, California but not in Canada.

Sale of terminals may increase prices- The recent terminal purchases indicate the value of Canada’s four major Pacific Coast container terminals has grown from a total of $0.2 billion current assessed value to more than $2.3 billion market value. The new capitalization indicates a blended cost of capital of 8 percent equivalent to a $0.2 billion per year cash cost plus principal repayments. The new financing allows Canada’s terminals to be expanded but, depending on container traffic growth rates, has the potential to increase prices. For example, $0.2 billion per year cost of capital on 3.7 million TEUs per year total throughput is equivalent to an added cost of $54/TEU, about 14% of the current average export terminal service tariff.

Sustainability input

California ports have cooperated to restore international bird flyways and wetlands thereby capturing both public and strong political support. In Canada, a popular suggestion was made by representatives of Environment Canada and the BC Naturalists’ Federation to purchase 400 hectares of land to expand the existing Federal bird and wildlife sanctuary on Westham Island near Deltaport at an estimated cost of $84 million.

Presently there are thirteen options under consideration by private and public sector stakeholder to improve the competitiveness of Canada’s marine terminals.

Conslusions and Options

Assisting containerized exporters

Our conclusion is that existing marine terminals are managed primarily in favor of importers and containerized exports are a secondary consideration. Marine terminal related tariff makes up about 30% of export shipping prices compared with only 10 percent of import shipping prices.

Options

- Government support for source loading of crops such as recent investments in terminal access roads at Regina and Saskatoon.

- Forest products and mine export terminals.

- Deregulate grain container transport revenue.

- Deregulate empty container use.

- Second container terminal at Prince Rupert.

Improving terminal service in Vancouver

Canada’s terminal service for trucks is less accessible and slower than many US terminals.

Options

- Higher daytime tariffs to reduce congestion.

- Performance standards.

Stimulating research and innovation

There is a rapid trend towards the use of electronic commerce tools by the international shipping lines. Transport Canada already funds research to apply technologies in this area.

Options

- Encourage the use global positioning systems on all trucks and containers to help speed truck service.

- Support applied research and development that expands the use of electronic commerce tools by Canadian exporters.

- Further data gathering and field trips to existing crop loading sites would be useful to accurately describe containerized export marketing and to compile shipping price breakdowns.

Private sector initiatives in Vancouver

Changes are underway that will benefit container transport and possibly open up waterfront areas similar to those in Oakland, Long Beach and Los Angeles.

Options

- Renovations of the Alliance Terminal could possibly reduce rail tracks directly in the Vancouver downtown core.

- Waterfront public amenities could be provided by development of the privately owned Rogers Sugar property.

Expansion in Delta

The Port of Vancouver has proposed to build Terminal 2 at Roberts Bank to expand capacity by 1.9 million TEUs per year.

Options

- Exporters using Proposed Terminal 2 would benefit if the terminal were owned by a shipping company with a strong Asia Pacific customer service organization.

[ Next: Chapter 1 ]