Prepared for:

Transport Canada

Research conducted: October 2023 – February 2024

Submitted: March 2024

Published: November 2024

Prepared by:

DesRosiers Automotive Consultants

80 Fulton Way, Suite 101, Richmond Hill, ON, L4B 1J5, Canada

www.desrosiers.ca | info@desrosiers.ca

+1 (905) 881-0400

This publication showcases the made to order and online vehicle purchasing trends in Canada.

Aussi disponible en français sous le titre : « Tendances de la production sur commande et des achats en ligne »

Information contained in this publication or product may be reproduced, in part or in whole, and by any means, for personal or public non-commercial purposes without charge or further permission, unless otherwise specified. Commercial reproduction and distribution are prohibited except with written permission from Transport Canada.

For more information, contact:

Transport Canada

330 Sparks Street

Ottawa ON Canada K1A 0N5

Zero-emission vehicles (canada.ca)

© His Majesty the King in Right of Canada, as represented by the Minister of Transport Canada, 2024.

Cat. No. T42-34/2024E-PDF (Electronic PDF, English)

ISBN 978-0-660-71719-7

Cat. No. T42-34/2024F-PDF (Electronic PDF, French)

ISBN 978-0-660-71720-3

Table of Contents

- Project Introduction

- Executive Summary

- Section 1: Literature Review

- Definition

- History and Background

- Impact of the Pandemic and Vehicle Shortages

- Impact of New Players and ZEVs

- Future Projections

- Definition

- History and Background

- Impact of the Pandemic and Vehicle Shortages

- Impact of New Players and ZEVs

- Future Projections

- Section 2: Build to Order Research

- Section 3: Online Sales Research

- Section 4: Other Issues and Additional Context

- Section 5: Conclusions and Next Steps

Project Introduction

The purpose of this study was to explore, gather, and compile information on two key areas within the Canadian light vehicle market: build-to-order and online sales. Both qualitative and quantitative methodologies were employed in the research program.

On the qualitative side, DesRosiers Automotive Consultants (DAC) reached out to key stakeholders in the automotive industry falling into three categories: OEMs (the vehicle companies in Canada), consumer representatives for the industry, and the dealer community. The results of these interviews are anonymized and specific individual responses are kept confidential.

On the quantitative side, a variety of sources are gathered including proprietary surveys carried out by DAC. Beyond this, DAC has included, where appropriate, additional industry and associated data to add further context and to better explore the key issues in this study.

The information gathered on these topics represents an analysis of the Canadian automotive market as it exists at present. We would caution that the current market is in a highly dynamic situation resulting from:

- The semi-conductor related vehicle shortages which were most evident Spring 2021 – Summer 2023 created a notable supply/demand mismatch in the light vehicle market to an extent that had never been previously experienced.

- The industry is in a period of major structural change with the move to ZEVs resulting in new entrants, new distribution channels, new product dynamics, and new approaches to retailing.

Given this highly fluid and dynamic environment, there is significant uncertainty as to the nature and path of future industry evolution. New paths are being explored and new business models tried, with great uncertainty as to the eventual direction the industry will take. As such, further research on these topics is recommended in the near and medium term, both to track changes in dynamics and in order to differentiate short-term adjustments to atypical market situations from longer-terms structural changes.

The surveys conducted by DAC will continue to track these topics in the years to come in order to understand and monitor how these trends develop as the market recovers and moves forward in a time of significant structural shifts. We would recommend that this data be tracked moving forward to monitor dynamics and to see how dealers and consumer views change as the market returns to a more balanced supply and demand perspective.

The report presented below contains five key sections:

- Existing Literature Review: DAC compiled an analysis of existing literature on both build-to-order as well as online sales from the perspective of the automotive industry. This section is broken out into key topics across the two distinct subjects.

- Built-to-Order (BTO) Research and Analysis: Containing a distinct quantitative and qualitative section, DAC explored the topic of BTO as it applies to the automotive industry. While the definition and expression of BTO varies significantly, the general automotive industry definition was applied: vehicles ordered ahead of time with a waiting period before delivery vs. the traditional ‘drive it off the lot’ sales flow.

- Online Sales Research and Analysis: Containing a distinct quantitative and qualitative section, DAC explored the topic of online sales from the perspective of the automotive industry. As a high overall cost industry from the typical consumer perspective, the automotive industry is a distinct topic of study in the online sales space and is the primary focus of the report.

- Other Issues and Additional Context: This section covers topics that are related but outside the two main areas of study or overlap the two main areas of study for this report.

- Conclusion and Next Steps: A brief summary of the key takeaways from the report including the potential next steps in better understanding and tracking the key issues highlighted within.

Executive Summary

The purpose of this study was to explore, gather, and compile information on two key areas within the Canadian light vehicle market: build-to-order and online sales. The report draws from a range of sources including existing literature as well as quantitative and qualitative research. On the qualitative side, DAC reached out to key stakeholders in the automotive industry falling into three categories: OEMs (the vehicle companies in Canada), consumer representatives for the industry, and the dealer community.

The information gathered on these topics from stakeholders represents an analysis of the Canadian automotive market as it exists at present. We would caution that the current market is in a highly dynamic situation resulting from:

- The semi-conductor related vehicle shortages which were most evident Spring 2021 – Summer 2023 created a notable supply/demand mismatch in the light vehicle market to an extent that had never been previously experienced.

- The industry is a period of major structural change with the move to ZEVs resulting in new entrants, new distribution channels, new product dynamics, and new approaches to retailing.

Given this highly fluid and dynamic environment, there is significant uncertainty as to the nature and path of future industry evolution. New paths are being explored and new business models tried, with great uncertainty as to the eventual direction the industry will take. As such, further research on these topics is recommended in the near and medium term, both to track changes in dynamics and in order to differentiate short-term adjustments to atypical market situations from longer-term structural changes.

It should be noted that there are no clear and precise definitions or boundaries between Build-To-Order (BTO) and Build-To-Stock (BTS) business models. BTO vehicle orders in the automotive space can often take the form of a vehicle that is already scheduled to be built by the OEM, or indeed already built and in transit. As such, the main distinguishing factor for BTO in the automotive industry is that the vehicle was not bought from pre-existing dealer inventory. As this is the common auto sector definition, this is the one that will be used throughout this report.

Initial examination of existing literature in regards to BTO pointed towards what was historically a limited sales process for the “traditional established OEMs” in the North American market; popular for heavy-duty vehicles and the high-end luxury market, but not necessarily for the mass market. Estimates have BTO at only approximately 5% of the N. American light vehicle market historically.

The emergence of new ZEV focused OEMs dramatically changed this dynamic, as these companies brought not only new product to consumers but also new approaches to retailing. The leading ZEV manufacturer, Tesla, initially entered the market with all sales being made via BTO. While the company has since broadened its approach to sell small volumes of product from inventory – it is still very heavily weighted toward BTO.

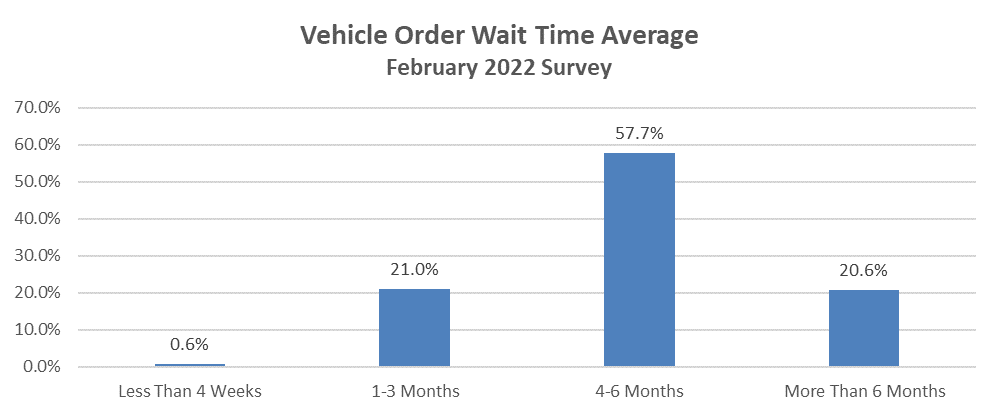

For the traditional OEMs it was the semiconductor shortage and its resulting light vehicle shortages that emerged in April 2021 that exploded the use of BTO. By February 2022, Canadian dealers cited that for 57.7% of vehicle sales, wait times were in the 4–6-month range, while for 20.6% of sales it took more than 6 months for delivery. Dealer inventory levels themselves dropped to 19.4% of pre-pandemic levels according to survey results in February 2022 and had only recovered to 42.3% in February 2023.

DAC estimates for battery-electric vehicle sales showed that 84.6% were undertaken through BTO in 2023. This figure is obviously heavily influenced by Tesla, the company that by far leads the BEV market and primarily relies on the BTO inventory model. This shows that for some manufacturers, a lack of dealer inventory does not inhibit BEV sales.

Consumer representatives were generally positive about BTO in general as long as wait times are limited (less than 2 months) and some vehicles were available immediately for emergency purchases if required, such as replacements for write-offs. Consumer representatives did also raise the issue that vehicles needed to be available for test drives – although obviously this was not expected to be in every trim level combination. Consumer groups viewed BTO and its more personalized experience as a better sales environment that consumers in the higher ends of the luxury market have long been accustomed to. Consumer groups mentioned that the traditional high pressure, buy from inventory, dealer sales experience is one that a significant portion of the population finds undesirable.

Dealer sentiment regarding BTO was somewhat mixed. For dealers that were hesitant about the BTO sales process, their concerns were encompassed within 2 broader industry dynamics:

- The emergence of new OEMs (Tesla, Rivian, etc.) some of whom have rejected the franchise dealer model.

- What is seen as an attempt by certain existing OEMs to restructure the OEM/dealer relationship and move more toward a more Direct-To-Consumer (DTC) approach.

It should be noted that this view was not held by all dealer representatives. There were many who viewed the move to BTO as a positive evolution of the existing dealer system rather than a systematic threat. For this group BTO represented a path toward greater profitability in which the dealer still played a key role.

While dealer sentiment was mixed in regard to BTO, the views of OEMs were more coalesced around the positive opportunities it represents. Most of the new OEMs are focused on a DTC approach and utilise corporate stores or alternate retailing approaches. Such approaches tend to skew toward being BTO heavy, as there is no incentive for the OEM to “push” excess vehicles down through the distribution channel.

For established OEMs the goal is more focused on reduced inventory levels – a goal in which BTO is an invaluable tool. Rather than the traditional 60-90 day inventories these companies have in some cases openly stated a preference for levels of 30 days or less, with minimal inventory at dealerships. As an example, Jim Farley, CEO of Ford has said, “I want to make it extremely clear to everyone: we are going to run our business with a lower day supply than we have had in the recent past because that’s good for our company.”Footnote 1

In the long term, the majority of the market is likely to reach a balance between BTO and traditional BTS in order to better manage the flow of vehicles from manufacturer to consumer. The specific balance between these two methods will inevitably vary from company to company. However, BTO sales will become powertrain neutral as the market matures with little to no sentiment from the industry pointing to segmented approaches between ICE and ZEV vehicles.

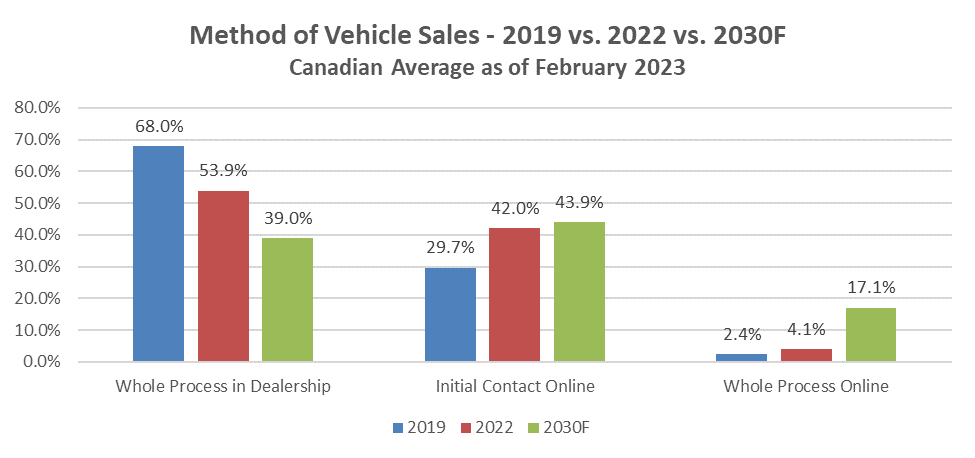

Pure online sales in Canada saw rapid growth in the past few years (albeit from a very low base), rising from 2.4% in 2019 to 4.1% in 2022. In addition, a hybrid sales approach with initial contact online, and then final sale in the dealership exploded from 29.7% in 2019 to 42.0% in 2022. Canadian dealers indicate that the move to more online activity will continue with online-only sales forecast to account for 17.1% of sales by 2030.

Online sales are expected to grow in prominence as part of a general move toward an omni-channel approach to retailing. While the ability for consumers to interact with a local outlet directly will remain a distinct requirement for many for the foreseeable future, the OEMs desire a more varied approach that allows the consumer the degree of online (or bricks and mortar) interaction that they choose. While having vehicles in inventory is not crucial for sales (as Tesla demonstrates), having vehicles available for test drives and retail locations for consumers who desire them, are both important. As a result, the long-term push from the market is for an omnichannel approach that mixes in-person and online sales, leaving the choice up to the consumer to what extent they wish to complete the process remotely. As with BTO, this shifting dynamic is expected to become powertrain neutral – with ZEVs and ICE vehicles heading toward the same endpoint.

Section 1: Literature Review

1.1: Build to Order

Definition

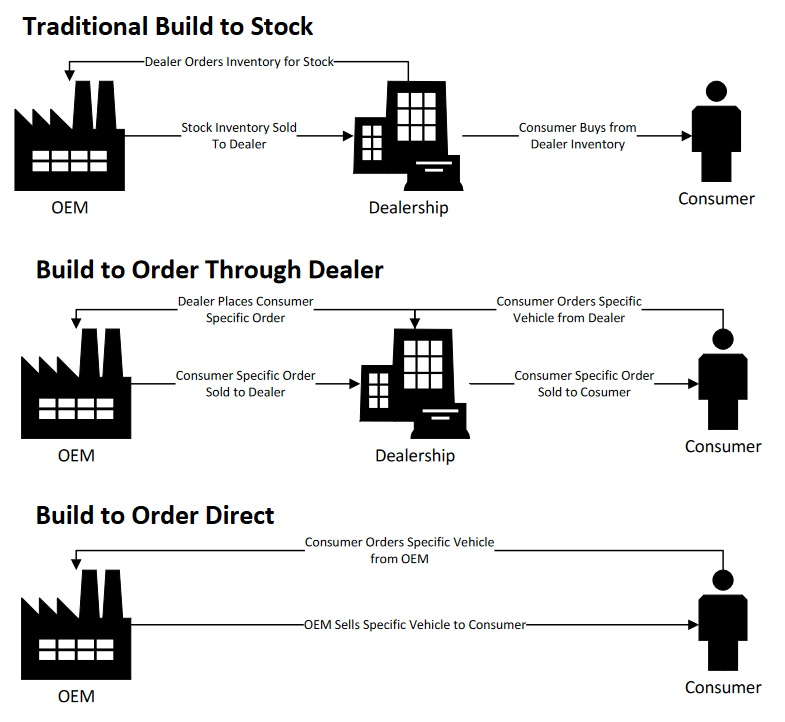

A made or built to order system (BTO), in general economic terms, is an on-demand production system where consumers order a product that is built based on direct customer demandFootnote 2. This is in contrast to a build to stock (BTS) system – where inventory is manufactured and shipped to distributors, and then consumers buy directly from inventory. These two frameworks are also referred to as push (BTS) and pull (BTO) systems.

The automotive market has traditionally operated under a system of OEMs (the vehicle companies themselves), customers, and dealer intermediaries. In North America the dealers have historically almost always been franchisees. The dealers purchase and stock an inventory of vehicles—that consumers purchase, often directly off the lot; a build to stock (BTS) system. Dealers may trade between one another where appropriate – but the system has historically been largely BTS – with a consumer purchasing from inventory. Build to order (BTO) processes, meanwhile, do not require holding a large inventory of vehicles on hand as dealers order vehicles that the consumer waits for.

Another characteristic of BTO in the automotive space is the greater degree of customization versus relying on available vehicles in inventory. Customers who purchase through BTO can design and choose vehicle specifications to meet their specific needs and wantsFootnote 3.

It should be noted that there are no clear and precise boundaries between BTO and BTS. The traditional definition of BTO requires the product to be wholly manufactured once ordered by the customer. However, this is not necessarily the way the bulk of these orders work in the automotive market. The existence of standard parts and modules in the automotive space has elements closely related to a configure-to-order supply chain structureFootnote 4. Moreover, BTO vehicle orders in the automotive space can often take the form of a vehicle that is:

- Already scheduled to be built by the OEM.

- Already built to the specifications of the country where the consumer resides and in transit.

Assuming it meets the consumer’s specific criteria it can be simply routed to the dealership where the purchase was made. This too is referred to as build-to-order within the automotive space.

In conclusion the main distinguishing factor for the sake of automotive industry shorthand is that the vehicle was not bought from pre-existing dealer inventory. As this is the common auto sector definition, this is the one that will be used throughout this report.

Text description

Vehicle purchase methods

Traditional Build to Stock (BTS) is when a dealership orders inventory for stock from the original equipment manufacturer (OEM). This stock inventory is then sold to the dealership, who then sells vehicles from their inventory to consumers. Build to Order Through a Dealer is when a consumer orders a specific vehicle from a dealership, who then places the order with the OEM. The specific vehicle is then sold to the dealership and is utilmately sold to the consumer. Build to Order Direct is when a consumer can order a specific vehicle directly with the OEM, who then sells the vehicle directly to the consumer, thus removing dealerships from the equation.

Source: DesRosiers Automotive Consultants Inc.

History and Background

While BTO is likely one of the oldest methods of product delivery, large corporations across many sectors have long preferred an inventory heavy approach; in other words, build to stock. For a long time, BTS allowed for greater adaptability to shifting conditions as well as a perceived competitive advantage brought about through readily available inventory. The advent of the internet enabled the refinement of BTO strategies and one of the earlier major successful implementations at scale was found with Dell’s process for selling computers, as well as similar success in the wider tech spaceFootnote 5. The shift from holding traditional inventory to some version of a BTO supply chain has been a frequently discussed topic across several industries.

Custom orders (BTO) of automobiles have been an option for decades as well, however early research showed that custom orders—at least in the United States—were fairly unpopular, accounting for as little as 5% of salesFootnote 6. The traditional mindset of driving a vehicle off the lot was persistent in North America especially. However, for the highest ends of the luxury spectrum in the automotive space, BTO has long been a more frequent option with consumers paying top dollar and frequently expecting very specific and unique configurations and this trend of customization in the luxury space has been growingFootnote 7. An example of this would be ultra luxury brands such as Rolls-Royce which allow highly customizable and extremely specific builds for their customer’s vehicles. In the regular luxury space, companies like Porsche also offer an extensive list of customization options, down to minute trim pieces and materials in areas that other manufacturers—and many customers—put limited focus on.

In the heavy truck side of the new vehicle market, BTO is the norm. Heavy truck customization is comparatively exhaustive due to numerous specific requirements dependent on customer preference, usage requirements and industry. Enabled in part by the higher costs involved, the BTO sales and delivery process on the commercial side is well developed and closer to the more specific definition of orders aligned directly with customers.

Impact of the Pandemic and Vehicle Shortages

The pandemic itself did little to influence BTO in the automotive space. Rather the main impact of the pandemic, and the shutdowns it necessitates, was more significant on online purchases. Online purchases of light vehicles are discussed in more detail in section 2.

It was the semiconductor shortage that followed the initial wave of the pandemic in 2021 and 2022 which caused significant shifts in BTO. As new vehicle supply dried up, consumers were not able to take quick possession of a vehicle already available on their dealer’s lot (or traded with a nearby dealer). Consumers were forced to place orders and wait for their vehicles to be delivered, cross-shop with more readily available vehicles, or even switch to the used vehicle side of the marketFootnote 8.

Manufacturing was immediately impacted by the pandemic and attempts to re-start it back to pre-pandemic norms generally failed as parts availability limited output. OEMs were forced to take on a more agile approach both in terms of sales and manufacturing wherein vehicle production more closely targeted clear demand from consumersFootnote 9.

As a result, the long-standing mindset of picking up a vehicle at the dealer on the same day or relatively soon hit an inevitable wall of vehicle shortages. Consumers were forced to adapt to a new paradigm in the vehicle buying process. These delays saw some correction in 2023 as vehicle supply improved, but many dealers still report some vehicles requiring significant wait times before customers can take possession of themFootnote 10.

Impact of New Players and ZEVs

When Tesla entered the automotive market and began to attain market presence, it did so chiefly through an integrated sales process. Tesla did not have traditional franchise dealers, instead it sold vehicles through (as the automotive industry frequently calls them) corporate storesFootnote 11. This means that consumers purchased Tesla vehicles directly from Tesla themselves – and that the dealers do not have ownership of the vehicles. This allows Tesla to allocate production capacity to vehicles on a per-order basis rather than building to the demands of dealers looking to stock inventory. In short, it afforded Tesla greater control and the consumer a more theoretically seamless purchasing process.

Consumers were happy to order vehicles and wait in the context of a Tesla purchase, likely influenced by the novel experience of EV ownership and the shifting paradigm in the automotive market. In other words, the traditional expectations did not necessarily apply. This in effect, began the process of normalizing BTO for Canadian consumers before the semiconductor shortages left little other choice.

It is of note that almost all the new brands that have entered the market in recent years have followed the Tesla model of corporate stores and BTO. An example of this is Rivian which allows customers (currently) the option of pulling a vehicle from a limited inventory or waiting for a reserved custom build. Lucid Motors’ method of vehicle delivery occurs heavily online in Canada, with an order filled out on their website and confirmed via phone call with the option of limited corporate stores much like Tesla.

In the midst of the semiconductor shortage and the limited new vehicle supply across the Canadian market, EVs in particular saw wait times for vehicle orders well in excess of the norm, in some cases taking over a year or more to deliverFootnote 12. However, as overall vehicle supply began to improve in step with rapidly growing EV production, the supply situation for EVs improved notably in both Canada and the USA, outpacing demand in some regardsFootnote 13. As such while the BTO model has been seem most extensively in regard to ZEVs it’s outlook is not limited to the technology and indeed some ZEVs have now reverted to a combination with a BTS system. Notable differences from traditional automotive practices do still exist however due to the absence of a franchise dealer system for the majority of new entrants with vehicle ownership remaining with the OEM until sale to consumer.

Future Projections

The Canadian automotive light vehicle sales market has yet to fully rebound from the low sales of previous years. While new vehicle supply has—in general—began to bounce back, delays in the vehicle purchasing process remain quite normal and consumers are, in many cases, still forced through the BTO pipeline. Inevitably, according to DAC research, new light vehicle inventory levels have begun to correct and dealers have, at least in part, began to put vehicles back on the lots where possible.

How this pattern develops in the future will be dependent on a variety of factors including the pace of new vehicle supply recovery, shifts in economic conditions, dealer financial performance, and more. At the dealer level, dealers will need to take a closer look at sales performances of vehicles that are readily available versus vehicles that have to be BTO. The benefits of keeping lower inventory levels are clear, with less financing (known as “floor-planning”) required on the part of the dealers and therefore potential wider profit margins. However, if consumer demand shows a clear preference towards more readily-available vehicles then this will act as a direct counter-force.

Survey data from the US cited that while 58% of dealers felt consumers were willing to wait several months for their vehicles, only 28% of consumers were comfortable with a significant several month delay. This figure shifted with age group with Boomers at 42%, Gen X at 32%, older Millennials at 22% and younger Millennials and Gen Z at 15%Footnote 14.

From 2019 to 2022, the share of vehicles that US dealers delivered through BTO increased from 19% to 59%Footnote 15. While dealers will continue to seek the traditional competitive advantage of holding inventory as supply continues to improve, the prevalence of BTO in the North American market will more than likely persist in some form.

One impact of increasing EV sales is the decreased revenue from parts and servicing for dealerships as EVs will require less traditional maintenance. In line with this, dealerships are expected by OEMs to improve image standards, training, and infrastructure as EVs gain prominence, which will further impact profitFootnote 16. In light of this, saving money on large inventories and opting more for BTO may seem like a reasonable option for many dealers.

1.2: Online Purchasing

Definition

Online purchasing, or e-commerce, is a broad definition that encompasses the buying and selling of goods over the internet. While online purchasing can be a full replacement for brick-and-mortar traditional stores, many companies opt to do bothFootnote 17. For the automotive market, online purchasing exists in two major forms.

- Sales with initial contact through the internet but with the sale closed in-person.

- Sales of vehicles conducted entirely online.

The former can range from interacting with a posting to delving well into the purchasing process, but regulatory and policy standards can interfere in the process. Regulatory and policy standards for physical signatures, in some cases, demand that partial online deals must close in-person and at an official registered location such as a dealershipFootnote 18. The requirement for physical signatures remains a point of contention and regulatory imbalance between provinces that can act to impede the full development of online sales across Canada. For Canada, Quebec is a province where standards for physical signatures are stricter, and the pathway to full online sales and compliance remains at least somewhat unclear. This same regulatory imbalance exists in the United States as wellFootnote 19.

The focus of the automotive industry at present is not to switch over to fully online dealerships or sales processes, but rather to offer that as an option in a broader integrated “omnichannel” approach. The purpose of the omnichannel approach is to integrate and offer both on and offline information and purchasing with consistent quality in experienceFootnote 20.

History and Background

Internet integration has long been a part of the vehicle buying process, especially so with resources like AutoTrader that advertise used vehicle sales and connect buyers and sellers. OEM websites, too, increasingly offer local inventory checks and can connect potential consumers with dealers in their area, starting the initial sales process online.

The used vehicle market outpaced the new vehicle market in terms of wholly online sales with companies such as Canada Drives or Clutch offering to conduct the full process online alongside pick-up or drop-off used vehicles directly to the customer’s address. This novel method of used vehicle purchasing was not entirely successful, with Canada Drives seemingly struggling to competeFootnote 21. Financial concerns on the business side and the difficulties of developing novel processes play a significant role in the development of this market, and early difficulties may not indicate the real demand in the market for sales of this nature. However, adoption of entirely online purchasing in the new vehicle side of the market has been even slower.

A significant step in the acceptance of online sales within new vehicle sales came from the rapid growth of Tesla. Tesla operates a fully online sales process though the sales forms may be completed on a screen within one of its company-owned stores. As a partial response to initial success by disruptors like Tesla, select OEMS have begun to facilitate online-only new vehicle purchases. Genesis (the luxury division of Hyundai) and Polestar, an EV-focused brand branching from Volvo, initially launched with a fully online process – though both have evolved somewhat as sales have grown. Individual dealers and dealer groups—such as Car Nation Canada—have also begun to facilitate online-only purchases as wellFootnote 22. One unique approach out of the US has been Hyundai integrating their sales process with Amazon, allowing for the sale of their vehicles through that marketplace starting in 2024Footnote 23.

Impact of the Pandemic and Vehicle Shortages

As soon as the pandemic got into full swing, lockdowns were initiated that made it extremely difficult to purchase a vehicle in the traditional physical way. This impacted the supply side at the same time as consumer hesitation in the face of health concerns impacted the demand side. As a result of this, dealers both new and used that were not already doing so rushed to adapt online sales processes to address the need for no-contact car purchases. As an immediate solution, vehicle purchases were conducted over the phone, or by special appointment with existing ‘build and price’ online options supplementing the processFootnote 24.

According to survey data from OMVIC (The Ontario Motor Vehicle Industry Council), 72% of dealer survey respondents did not complete online vehicle transactions pre-pandemic with this figure shifting down to 60% in 2020, a significant change in the short-termFootnote 25.

As the fears and immediate reactions to the pandemic eased off, the impacts of shutdowns and supply chain disruptions gave way to serious shortages in the new light vehicle market. The need to purchase a vehicle with limited or no contact fell back in consumer focus to some degree but not necessarily so for OEMs and dealers. What was before a slowly growing trend towards online sales stemming from disruptive pressure and a slow trajectory towards an omnichannel approach accelerated as industry stakeholders sought to build out more resilient processes that—at the same time—addressed shifting consumer preferences towards online vehicle purchases.

Impact of New Players and ZEVs

The process of buying a vehicle online has long been discussed in the industry right alongside the increasing prominence of the internet. However, due to corporate inertia, risk-aversion, and regulatory roadblocks, the adoption of online vehicle sales in Canada saw only slow marginal growth. Well before the pandemic, it was Tesla’s full entry into the market that caused the first waves.

The first push Tesla needed to make before online sales could be a major factor in the process was winning the regulatory battle to be able to bypass dealers, largely in the USFootnote 26. With laws in place to ban or limit the sales of vehicle directly to consumers across most US States, Tesla faced legal opposition from dealers and dealer groups in its attempts to bypass the long-established norms of the US auto industry. In Canada this hurdle was far less of a factor with the initial Tesla corporate stores seeing limited pushback from dealer groups or regulatory bodiesFootnote 27.

With Tesla leading the way with successful corporate stores and online purchases available through a well-established omnichannel approach, other EV-focused brands to enter that market later followed suit, either with omnichannel approaches or online-focused sales. Examples of this are Lucid, Polestar, and Rivian. VinFast, by contrast, appears open to working with dealers in a more traditional arrangementFootnote 28. Among non-EV specific brands, Genesis entered the market and offered robust online sales processes quickly despite being under the umbrella of its parent company Hyundai.

In short, it was the emergence of Tesla and the growth of ZEVs that led much of the push towards online sales of vehicles. The market at present, is in a state of flux as OEMs and dealers adapt and plan for the shifting environment, often opting for progress towards an omnichannel approach.

Future Projections

The pandemic offered a significant boost to e-commerce and online shopping in general, accelerating growth and pushing consumers who have had little interaction with e-commerce into the spaceFootnote 29. The broader economy, which has been adapting slowly, was forced to accelerate the changes necessary to accommodate this. Online shopping, by most accounts, is expected to continue to grow in the future.

For the automotive market, while the pressures of lockdowns and zero-contact sales have abated as has the immediate need to adapt for those who have not already done so, the mindset for change has remained. Automotive marketplaces like AutoTrader and readily available new vehicle information sources are here to stay, and while online-focused used vehicle dealers have had a difficult time in the market, the low-pressure process will continue to create opportunity for future growthFootnote 30. In the new vehicle side of the market, Tesla and the brands that followed their non-traditional model have normalized online purchases for a significant portion of the Canadian public.

One potential roadblock that will need to be addressed before online sales can fully flourish for the mainstream brands is the different management software utilized by various dealers selling the same brand as this may present challenges for standardizing and integrating the online sales process. Once issues like this alongside regulatory concerns, such as the need for physical signatures, are addressed, this method of vehicle purchasing is set to grow as part of the ongoing consumer shift towards e-commerce in general.

While online sales have been increasing relatively slowly in the automotive market, the prevailing mentality among industry stakeholders is that online shopping will be a major factor in the future. Developing a thorough omnichannel approach is a necessity for the future and the online sales of vehicle will continue to grow in the long termFootnote 31.

Section 2: Build to Order Research

2.1: BTO - Quantitative

DAC conducts an annual survey of Canadian new vehicle dealers which reaches out to all 3,500 franchise light vehicle dealers across the country. The survey covers key developments in the automotive market that are influential in influencing the current market circumstances and the development of the Canadian automotive market into the future. In the most recent survey, conducted in February 2023, DAC reached out to dealers to get their perspective on both build-to-order/made-to-order sales methods as well as the development of online sales for new vehicles. These topics will be further explored in subsequent surveys in 2024 and beyond.

Vehicle Order Wait Times

Text description

|

Less Than 4 Weeks |

0.6% |

|---|---|

|

1-3 Months |

21.0% |

|

4-6 Months |

57.7% |

|

More Than 6 Months |

20.6% |

Source: DesRosiers Automotive Consultants Inc. and CADA

New light vehicle shortages that stemmed from the semiconductor shortage were first widely evident in the Spring of 2021. Reflecting on that year, DAC surveyed dealers regarding the average wait times for new vehicle orders through their dealerships. On average, just 0.6% indicated wait times of less than four weeks, with 21.0% of respondents citing 1-3 months. The majority cited wait times of 4-6 months, accounting for 57.7% of responses. A further 20.6% noted wait times in excess of half a year. Results across the major Canadian regions were mixed as vehicle allocations were distributed unevenly although this was also influenced by consumer preferences in those regions. Among different dealer sizes, large dealers had an easier time fulfilling orders more quickly.

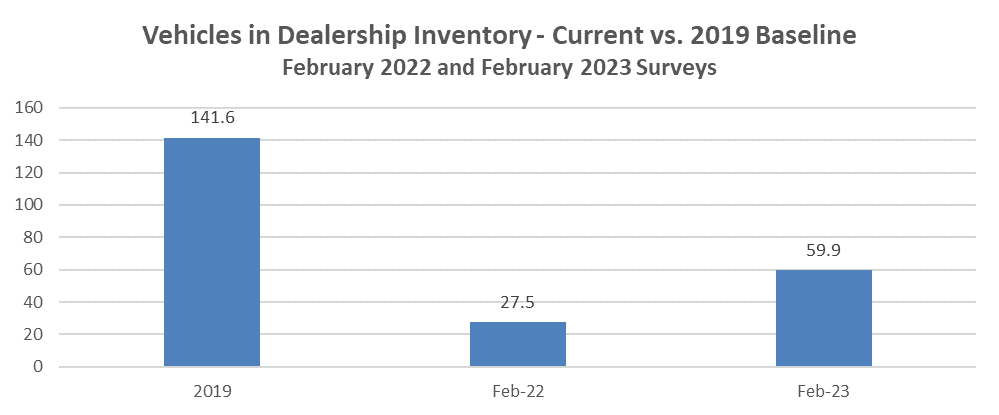

Inventory Levels

Text description

|

2019 |

141.6 |

|---|---|

|

Feb-22 |

27.5 |

|

Feb-23 |

59.9 |

Source: DesRosiers Automotive Consultants Inc. and CADA

With the onset of the new light vehicle shortages that followed the pandemic, one key shift in the day-to-day operations of the new vehicle sales side of the market was the dramatic decrease in inventory levels. Dealers cited a standing inventory level of 59.9 units on average in 2022 against a typical pre-pandemic average figure of 141.6 units on dealer lots. In 2021, according to the February 2022 survey, the average inventory across Canadian dealers dropped to an average of 27.5 units. While the inventory situation has improved throughout 2023, inventory remains a concern throughout much of the market with OEMs struggling to build adequate supply and dealers finding it difficult to sell vehicles off the lot as they have—largely—become accustomed to.

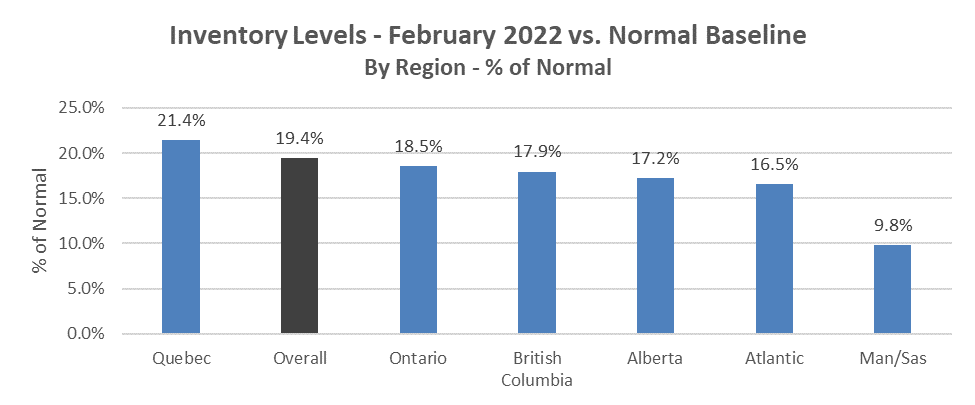

Text description

|

Quebec |

21.4% |

|---|---|

|

Overall |

19.4% |

|

Ontario |

18.5% |

|

British Columbia |

17.9% |

|

Alberta |

17.2% |

|

Atlantic |

16.5% |

|

Man/Sas |

9.8% |

Source: DesRosiers Automotive Consultants Inc. and CADA

In the February 2022 survey, reflecting experiences in 2021, dealers noted an average inventory level across Canada at 19.4% of what it would normally be. Across the key Canadian regions, Quebec fared slightly better, showing inventory levels at 21.4% of normal. Ontario fell to 18.5% with BC, Alberta, and the Atlantic region not far off. Manitoba and Saskatchewan jointly fell below the Canadian average with inventory levels falling to just under ten percent of normal.

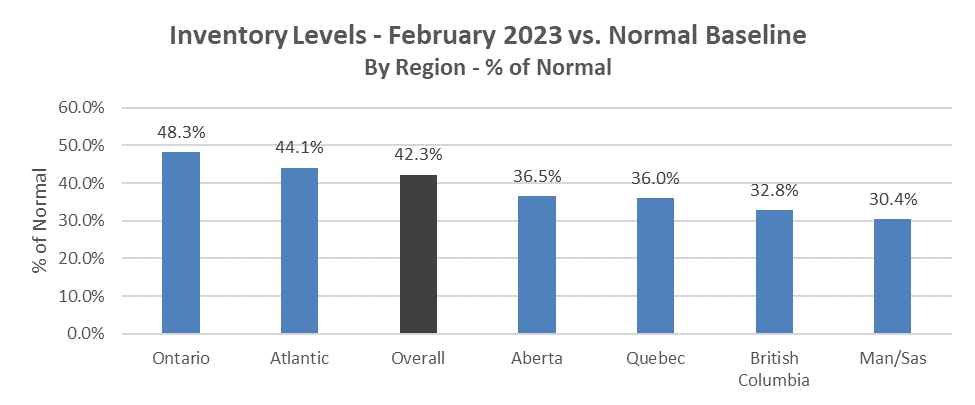

Text description

|

Ontario |

48.3% |

|---|---|

|

Atlantic |

44.1% |

|

Overall |

42.3% |

|

Alberta |

36.5% |

|

Quebec |

36.0% |

|

British Columbia |

32.8% |

|

Man/Sas |

30.4% |

Source: DesRosiers Automotive Consultants Inc. and CADA

In the February 2023 survey, reflecting experiences in 2022, dealers noted an average inventory level of 42.3% of what it would normally be across Canada. Ontario pulled ahead of the rest of Canada with inventory at 48.3% of normal. The Atlantic region showed improvement both in absolute and relative terms, with inventory at 44.1% of normal across dealer in the region. As with the year before, Manitoba and Saskatchewan fell noticeably below the Canadian average with inventory levels at 30.4% of normal. These pervasive inventory issues changed the common method of vehicle sales, shifting away from existing inventory towards pre-orders or BTO vehicles by necessity.

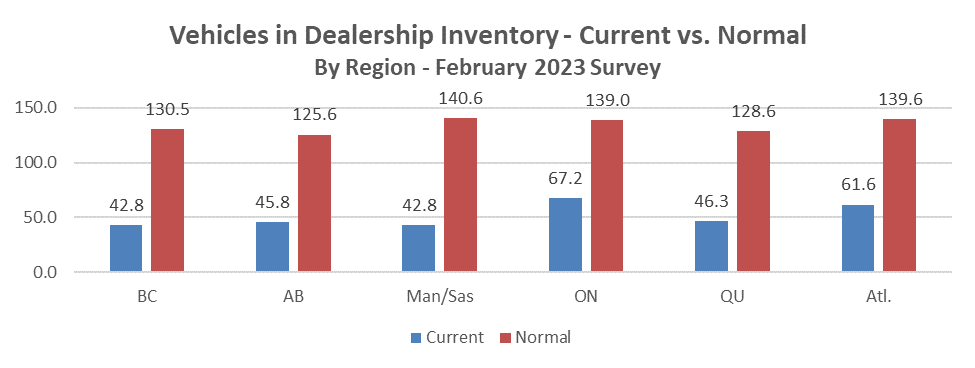

Text description

|

Current |

Normal |

|

|---|---|---|

|

BC |

42.8 |

130.5 |

|

AB |

45.8 |

125.6 |

|

Man/Sas |

42.8 |

140.6 |

|

ON |

67.2 |

139.0 |

|

QU |

46.3 |

128.6 |

|

Atl. |

61.6 |

139.6 |

Source: DesRosiers Automotive Consultants Inc. and CADA

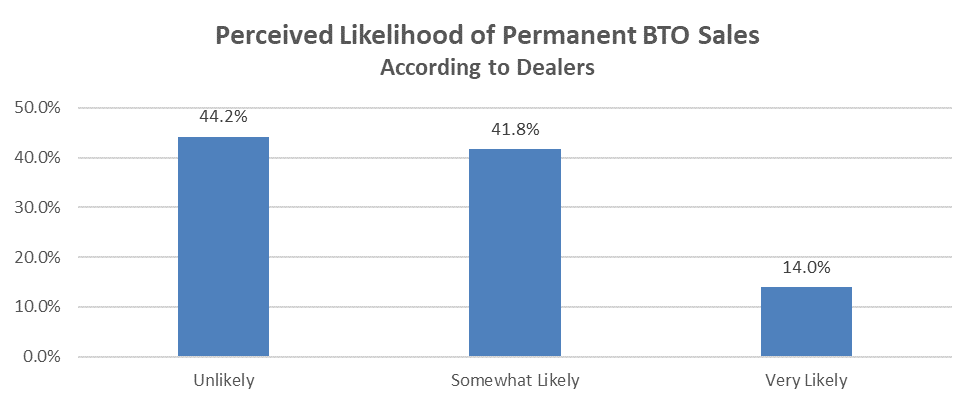

BTO Perceived Likelihood

Text description

|

Unlikely |

44.2% |

|

Somewhat Likely |

41.8% |

|

Very Likely |

14.0% |

Source: DesRosiers Automotive Consultants Inc. and CADA

In the February 2023 survey, dealers were asked about their opinion on the likelihood of BTO sales processes becoming a permanent fixture of the sales process and dealers operating at greatly reduced inventories. Together more than 55% of dealers thought that such a change was somewhat likely or very likely comprised of 41.8% viewing this shift as somewhat likely and 14.0% of dealers believing the shift was very likely.

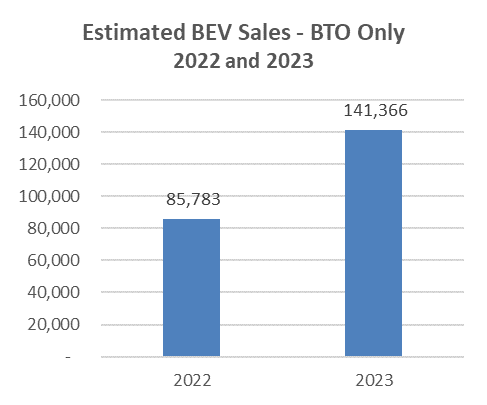

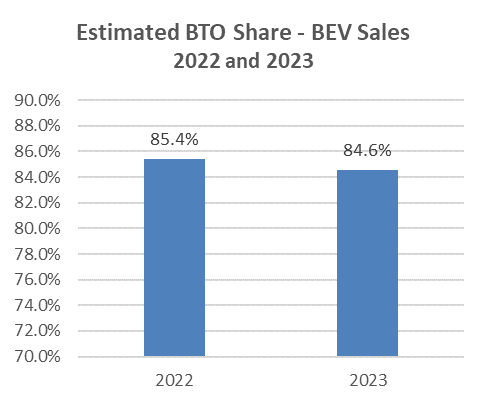

Estimated BEV Sales Through BTO

Text description

|

2022 |

85,783 |

|

2023 |

141,366 |

Text description

|

2022 |

85.4% |

|

2023 |

84.6% |

Source: DesRosiers Automotive Consultants Inc.

Using proprietary DAC sales modelling techniques, we have been able to build a model that details the prevalence of BTO in regard to BEV sales in Canada. While some BEV inventories did build up to some extent in the latter part of 2023, BEVs have and largely remain reliant on the BTO purchase process. Through direct feedback from the industry, DAC was able to compile approximate estimates of the volume of BEVs sold through BTO in 2022 and 2023 as well as the share of overall ZEV sales. For 2022, an estimated 85.4% of BEVs were sold through BTO with this ratio shifting slightly to 84.6% for 2023 as select models saw above average availability. It is important to note that these figures are heavily influenced by Tesla, the leading seller of BEVs in Canada.

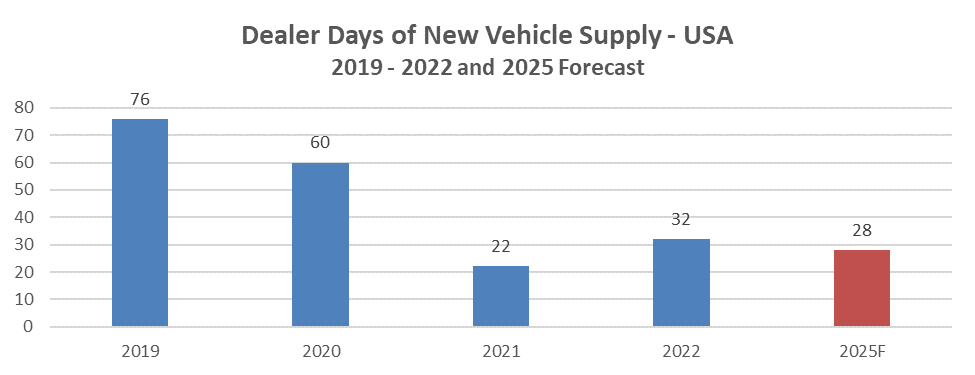

Days of Supply and BTO Sales Share – USA

Text description

|

2019 |

76 |

|

2020 |

60 |

|

2021 |

22 |

|

2022 |

32 |

|

2025F |

28 |

Source: DesRosiers Automotive Consultants Inc. and BCG

Dealer survey data from the USA indicates a broadly similar trend to Canada in terms of supply levels with a sharp decrease in 2021 followed by an increase in 2022. While signs do point towards improvement, dealer sentiment itself points towards significantly restricted supply in the coming years in the USA as OEMs attempt to maintain a business model with lower inventory levels.

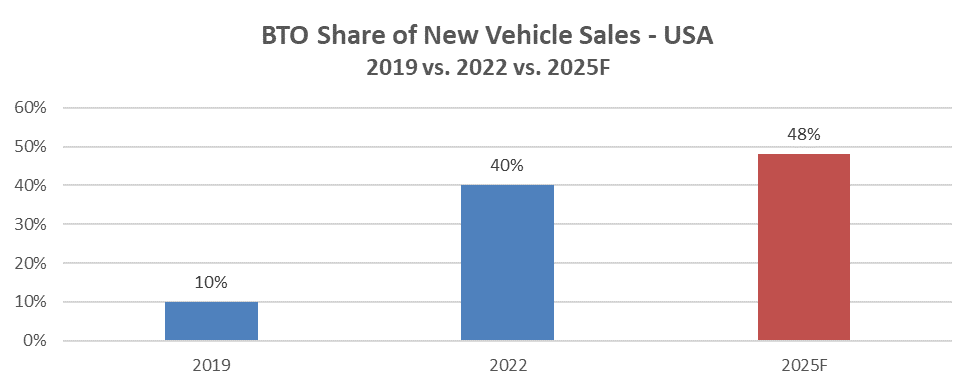

Text description

|

2019 |

10% |

|

2022 |

40% |

|

2025F |

48% |

Source: DesRosiers Automotive Consultants Inc. and BCG

Building on the data above, dealer sentiment out of the USA points to the share of BTO in new vehicle sales rising from 10% in 2019 to 40% in 2022 with the overall figure expected to rise even further in 2025 to 48%. This US dealer feedback aligns with the expectation of further supply limitations in the coming years. However, dealer sentiment out of the USA does not align with the plans from the bulk of Canadian OEMs which are expecting at least some pullback in BTO and rising inventory in the short-term. More on this topic is explored below.

2.2: BTO - Qualitative

DAC reached out to many of the Canadian automotive OEMs as well as other key industry stakeholders in order to get their perspectives on the topic of build to order. The following section contains aggregate industry views on this topic based on stakeholder feedback with additional analysis by DAC interspaced where applicable to add further context.

Shortages

As discussed in the literature section above, while BTO has existed in the automotive market for decades in one form or another, it has long remained a fairly small aspect of overall volume largely constrained to special models and the higher ends of the luxury market. However, this changed—by necessity—after the onset of the pandemic. The semiconductor shortages that followed the initial hits of the pandemic disrupted global supply chains and severely impacted the supply of new vehicles in the Canadian market.

Dealers would historically hold approximately three to four months’ worth of inventory on their lots but the semiconductor and related shortages forced a drastic reduction in dealer inventory levels. DAC surveyed dealers on their February 2022 inventory levels and, on average, dealers indicated that their inventory levels sat at 27.5 units against a normal level of 141.6. In terms of inventory levels as a percentage of baseline, Canada overall saw dealers sitting at 19.4% of their normal volume with the regional split ranging from Quebec at 21.4% to Manitoba and Saskatchewan together at 9.8%.

These dramatically lowered levels of inventory impacted new light vehicle sales significantly with 2021 sales settling at 1.64 million and 2022 sales settling at 1.49 million compared to a 2017 peak of over two million. However, despite the significantly lowered sales, there were still massive volumes of vehicles being purchased by consumers at the same time that inventory levels were a mere fraction of their normal levels. In effect, OEMs and dealers had to collaborate in order to enable a rapid increase in the scale of their BTO sales. Consumers would, typically, order a vehicle at a dealer and would wait a given period of time, ranging from a few weeks to well over a year depending on the particular vehicle they were interested in, to take delivery.

In short, the rapid development of BTO sales processes in the Canadian automotive market was a consequence of necessity brought about by the shortages and enabled by the cooperation of the dealers and OEMs as well as the willingness to adapt by the Canadian consumer.

Consumer Perspective

Canadian consumers, much like the OEMs and dealers, had little choice but to adapt to the realities in the Canadian automotive market as shaped by far more global factors. The traditional and long-held expectation in the mass market of driving a new vehicle off the dealer lot was very much the norm and in many ways the expectation of many Canadians. This changed with the vehicle shortages of 2021-23. Looking forward, consumer representatives had generally positive views of the potential for future BTO prevalence although with one major concern.

In regard to that concern the key issue raised was the ability of the consumer to access the vehicle they desire within a timely period. Clearly the delays of 2021/22 in which some consumers had to wait 6 months or more were seen as unacceptable. Consumer representatives indicated that a wait period of 1-2 months would not be burdensome for most consumers as long as some vehicles were available immediately for emergency situations. Consumer representatives did also raise the issue that vehicles needed to be available for test drives – although obviously this was not expected to be in every trim level combination – but rather a small number covering major models.

Consumer representatives also saw distinct advantages for them as well in a BTO process. Consumer groups viewed BTO and its more personalized experience as a positive, equating it to the environment that consumers in the higher ends of the luxury market have long been accustomed to. The longer buying process enabled more customization and choice in terms of models, trim, paint, and options without the added pressure of picking a vehicle that was readily available. The longer sales process was also seen as allowing for a lower pressure transaction between consumers and (typically) dealers as the longer timelines relieved some of the impact of timing a particular deal offered on a particular vehicle.

Consumer groups mentioned that the high-pressure dealer “haggling” experience is one that a significant portion of the population finds unpleasant. Numerous studies have shown that when given a choice, consumers in the US and Canada will prefer fixed pricing models versus the price negotiation that remains the norm in the automotive marketFootnote 32. In this light the move to BTO and a more professional, and less rushed purchase process, was seen as a definitive positive for the majority of consumers.

Dealer Sentiment

Dealer sentiment regarding BTO was somewhat mixed – with some dealer representatives being in favour of the structure while others were opposed. For dealers that were hesitant about the BTO sales process, most of the resistance emerged from concerns as to any change whatsoever in the business model which has served them so well over the past decades. These concerns were also encompassed within 2 broader industry dynamics:

- The emergence of new OEMs (Tesla, Rivian, etc.) who have unanimously rejected the franchise dealer model.

- An attempt by existing OEMs to restructure the OEM/dealer relationship toward a more DTC focus.

These issues are discussed in more detail elsewhere in this report. Specifically in regard to BTO, the dealer representatives that were most opposed to it viewed it as a central element to removing the dealer from the automotive distribution system and a step along the path to a “direct-to-consumer” model as employed by, for example, Tesla.

It should be noted that this view was not held by all dealer representatives. There were many who viewed the move to BTO as an evolution of the existing dealer system rather than a systematic threat. For this group BTO represented a path toward greater profitability in which the dealer still played a key role. This group saw BTO as offering potential benefits including:

- BTO by definition requires lower inventory levels – the financing of which is a major cost for dealers and removing this cost was seen as a significant financial gain.

- In addition, BTO sales were generally seen as higher margin – without the need for the dealer to discount and sell well below MSRP as is usually the case for sales from inventory.

- BTO offers the potential for a smaller real estate footprint for the dealer – again a major dealer cost.

- BTO sales also facilitates the option of varied selling locations such as shopping malls, targeted retail locations, etc.

As such, these dealer representatives welcomed increased BTO and saw it as a natural evolution of the sales process and one in which they still played a critical role.

OEM Sentiment – Existing Players

While dealer sentiment was somewhat mixed in regard to BTO, the views of OEMs were more coalesced around the positive opportunities it represents. OEMs recognized that the inventory levels in the 2021-22 period had become too low with delays in vehicle delivery often exceeding 6 months. However, the significantly large inventory levels seen pre-pandemic were not seen as the goal as OEMs scale inventory levels up. While pre-pandemic inventory levels in the 60–80-day level were seen as ideal and 80-100 days was often common, the OEMs now viewed much tighter inventories as desirable. This has been reflected in public statements made by the OEMs. For example, Mary Barra, CEO of General Motors, has stated a desire for much lower inventory:

“We’ll never go back to the inventory levels that we were in the past,” Barra said in a recent online chat with Rod Lache, the managing director of business analyst firm Wolfe Research, as quoted by The Detroit Free Press. “In all the tragedy that surrounded COVID, we have learned a lot on how to strengthen our business, run leaner, work with the dealers, use data analytics to make sure dealers are ordering the right vehicle. There are so many elements where we’ve learned to run more efficiently that we’ll never go back from.”

Similarly, Jim Farley, CEO of Ford has said, as cited by The Guardian, “I want to make it extremely clear to everyone: we are going to run our business with a lower day supply than we have had in the recent past because that’s good for our company.”Footnote 33

It is of note that the OEMs often do not specifically limit their comments to BTO in their discussions in this area. Their attention is very much focused on lower inventory – which will require a number of broader changes in their approach to market but will definitely include BTO. Along with traditional, if somewhat reduced, inventory levels, BTO will likely remain a significant factor in the automotive sales process in the Canadian market with the more hybrid approach allowing for a greater degree of flexibility for both the dealers and the OEMs.

New Market Entrants

Newer entrants into the market, such as Genesis, Tesla, as well Rivian and Lucid which in broad strokes followed the Tesla model of corporate stores and heavy BTO saw less disruption in terms of consumer perception as the bulk of the market was forced to adapt to the low-inventory environment. The main result of the spread of BTO in recent years has been to normalize the process for the broader consumer base, likely resulting in a net benefit for these new market players in the long-term. In terms of the ZEV-focused entrants, many in the initial wave of ZEV adopters were comfortable with the corporate store or direct from manufacturer BTO-heavy sales process and their desire to establish a different (and more efficient) purchasing process. As this initial wave of ‘Tier 1’ ZEV consumers gives way to a more cautious mass market, the normalization of BTO in recent years should, at least for these brands, make the process of ZEV adoption more familiar.

ZEVs

One of the main points of discussion with the major Canadian vehicle companies was the treatment of ZEVs through the lens of the BTO process. Vague sentiment from outside of the industry pointed towards a more BTO-heavy approach for ZEV sales, even among the traditional OEMs. However, across the industry, ZEVs are being treated as a normal part of the product line-up, at least where the sales process is concerned. If BTO is scaled down as planned in the short to medium term, the same will be true for ZEV sales and any potential plans to scale BTO up in the future will be applied in a largely uniform manner across the product line-up as OEMs are hesitant to increase the complexity in the logistics chain and increase difficulties in the OEM/dealer relationship.

Regardless, BTO, and wait times for ZEVs were not seen by the industry as the major factors in the development of the ZEV market as the consumer base for those products shifts from early adopters to the mass market. As has been the case since their introduction, pricing, vehicle range and capabilities, and charging infrastructure will remain the major concerns limiting sales from a mass market perspective.

Future Projections

As discussed above, the short-term plan across much of the automotive industry is to scale BTO sales down as inventory improves. The goal, in broad strokes, is to strike a balance in inventory levels that allows for quick transactions as has been the norm in the automotive industry for decades as well as reducing the unnecessary costs associated with excess inventory. BTO, in effect, will act as a lever that would enable balancing this process and avoiding both supply shortages which necessitate excess wait times and oversupply which complicates the dealer/OEM relationship and feeds back into supply issue through inefficient allocation of resources throughout the supply chain. The newer market entrants, or at least a portion of them, are inversely exploring more traditional arrangements for vehicle sales with the likes of Fisker and VinFast exploring the dealership model and Polestar aiming for a hybrid approach (discussed further in Section 4). The exact end-point of these transitions—especially at the level of individual companies—remains to be seen as the industry, the ZEV market, and global and local forces continue to influence sentiment and business approaches.

Section 3: Online Sales Research

3.1: Online Sales - Quantitative

DAC conducts an annual survey of Canadian new vehicle dealers alongside CADA (the Canadian Automobile Dealers Association) which reaches out to 3,500 dealers across the country. The Trendsetter survey covers key developments in the automotive market that are influential in influencing the current market circumstances and the development of the Canadian automotive market into the future. In the February 2023 survey, DAC reached out to dealers to get their perspective on both build-to-order/made-to-order sales methods as well as the development of online sales for new vehicles. These topics will be further explored in subsequent surveys in 2024 and beyond.

Method of Vehicle Sales – Canada

Text description

|

2019 |

2022 |

2030F |

|

|---|---|---|---|

|

Whole Process in Dealership |

68.0% |

53.9% |

39.0% |

|

Initial Contact Online |

29.7% |

42.0% |

43.9% |

|

Whole Process Online |

2.4% |

4.1% |

17.1% |

Source: DesRosiers Automotive Consultants Inc. and CADA

Canadian new vehicle dealers were asked about the prevalence of online sales, both those that are completed entirely online and those that see initial contact online but are completed at a dealership. In order to establish a pre-pandemic baseline, dealers were asked about these trends back in 2019. Complete online sales in 2019 accounted for just 2.4% of sales but sales with initial contact online were far more likely at 29.7%.

Pure online sales saw 70% growth in the past few years (albeit from a very low base), rising from 2.4% in 2019 to 4.1% in 2022. In addition, a hybrid sales approach with initial contact online, and then final sale in the dealership exploded from 29.7% in 2019 to 42% in 2022.

Dealers were further asked for their perspective on the online/offline sales split in 2030. On average, Canadian dealers indicated slow but steady growth for entirely online sales, rising to occupy 17.1% of sales in 2030. Dealers felt that sales conducted partially online will reach 43.9% in 2030, accounting for the largest portion of sales. However, entirely offline sales are still expected to account for 39.0% of total sales out by 2030.

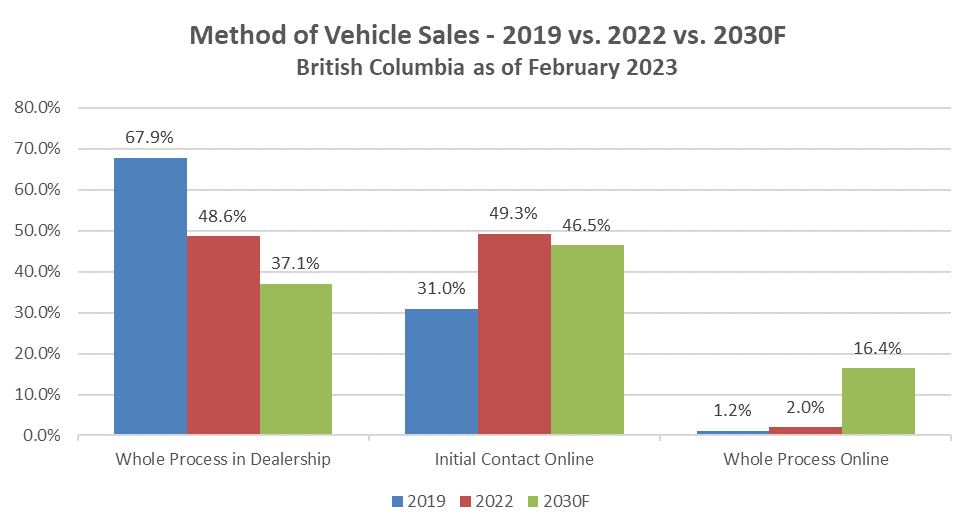

Method of Vehicle Sales – by Province

Text description

|

2019 |

2022 |

2030F |

|

|---|---|---|---|

|

Whole Process in Dealership |

67.9% |

48.6% |

37.1% |

|

Initial Contact Online |

31.0% |

49.3% |

46.5% |

|

Whole Process Online |

1.2% |

2.0% |

16.4% |

Source: DesRosiers Automotive Consultants Inc. and CADA

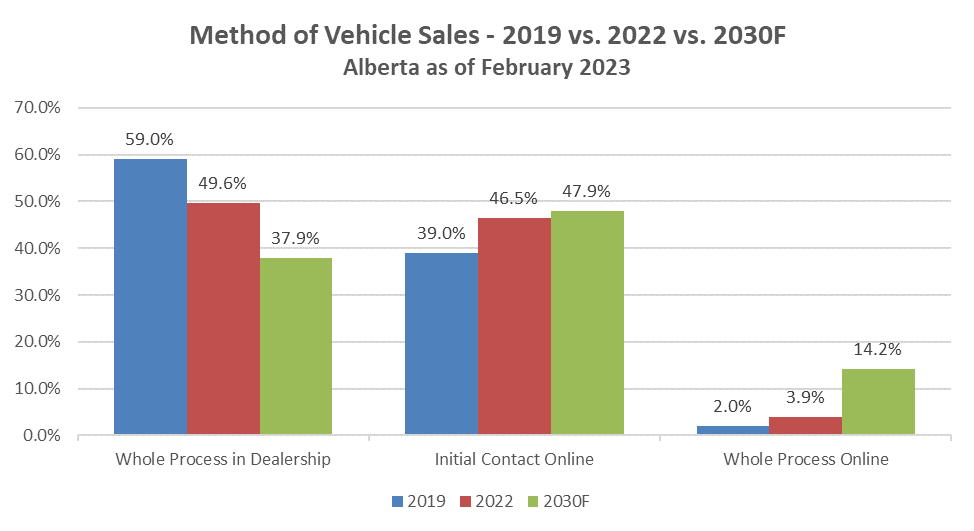

Text description

|

2019 |

2022 |

2030F |

|

|---|---|---|---|

|

Whole Process in Dealership |

59.0% |

49.6% |

37.9% |

|

Initial Contact Online |

39.0% |

46.5% |

47.9% |

|

Whole Process Online |

2.0% |

3.9% |

14.2% |

Source: DesRosiers Automotive Consultants Inc. and CADA

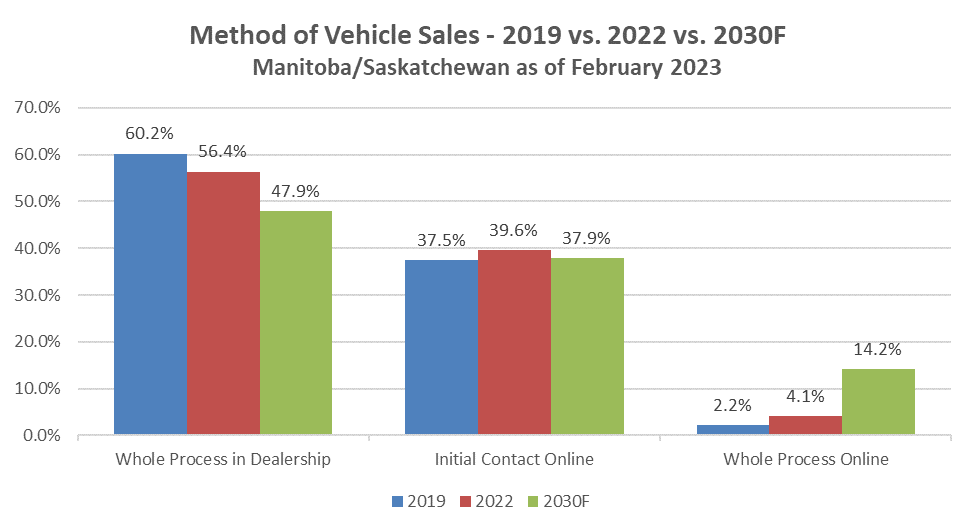

Text description

|

2019 |

2022 |

2030F |

|

|---|---|---|---|

|

Whole Process in Dealership |

60.2% |

56.4% |

47.9% |

|

Initial Contact Online |

37.5% |

39.6% |

37.9% |

|

Whole Process Online |

2.2% |

4.1% |

14.2% |

Source: DesRosiers Automotive Consultants Inc. and CADA

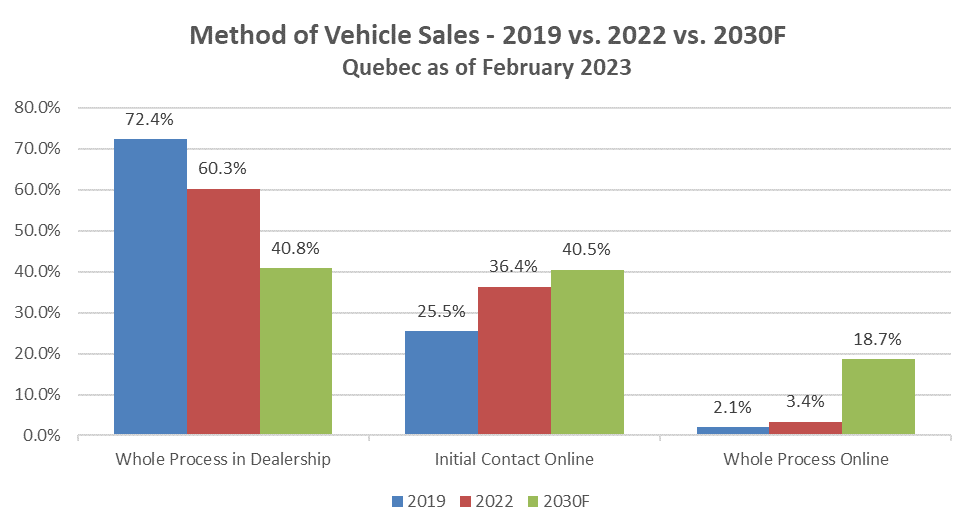

Text description

|

2019 |

2022 |

2030F |

|

|---|---|---|---|

|

Whole Process in Dealership |

70.1% |

52.3% |

38.3% |

|

Initial Contact Online |

27.4% |

43.8% |

46.4% |

|

Whole Process Online |

2.5% |

3.9% |

15.3% |

Source: DesRosiers Automotive Consultants Inc. and CADA

Text description

|

2019 |

2022 |

2030F |

|

|---|---|---|---|

|

Whole Process in Dealership |

72.4% |

60.3% |

40.8% |

|

Initial Contact Online |

25.5% |

36.4% |

40.5% |

|

Whole Process Online |

2.1% |

3.4% |

18.7% |

Source: DesRosiers Automotive Consultants Inc. and CADA

Text description

|

2019 |

2022 |

2030F |

|

|---|---|---|---|

|

Whole Process in Dealership |

72.7% |

51.1% |

35.2% |

|

Initial Contact Online |

22.4% |

43.8% |

46.2% |

|

Whole Process Online |

4.9% |

5.2% |

18.6% |

Source: DesRosiers Automotive Consultants Inc. and CADA

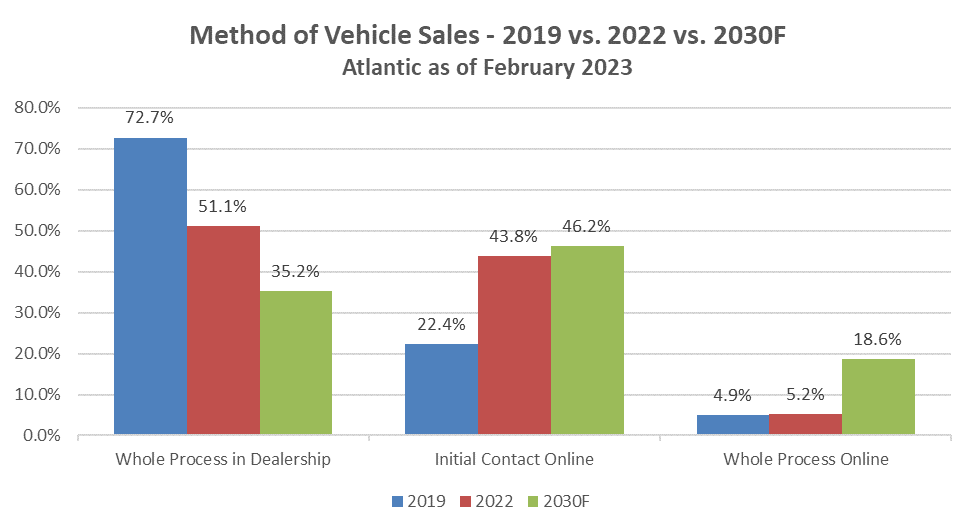

The regional split between traditional, partially online, and fully online sales showed some variation. Completely online sales in 2019 were most commonly cited by dealers in the Atlantic region at a share of 4.9% with Ontario following at a distance at 2.5%. Partial online sales were very common in Alberta and Manitoba/Saskatchewan, accounting for shares of 39.0% and 37.5% respectively.

Looking across the key Canadian regions, it was once again the Atlantic region that saw the highest share of entirely online sales, accounting for 5.2% for 2022. For sales conducted after an initial online contact, it was British Columbia that pulled ahead of the average at a share of 49.3%. Alberta followed closely at 46.5%. In the case of both Alberta and British Columbia, online (full and partial) sales pulled ahead of traditional fully in-person sales by a slim margin.

Dealer perspectives across the key Canadian regions showed some key differences when asked about the prominence of online sales out to 2030. Dealers in Quebec and the Atlantic region indicated the highest forecast share for entirely online sales at 18.7% and 18.6% respectively. Dealers from Alberta and Manitoba/Saskatchewan noted the lowest shares, both groups at 14.2%. Dealers in Alberta, British Columbia, and Ontario cited the highest expectations for partial online sales at 47.9%, 46.5% and 46.4% respectively. Dealers in Manitoba/Saskatchewan expect traditional in-person sales to still account for 47.9% of overall sales by 2030.

Method of Vehicle Sales – EV vs. ICE – USA

Text description

|

In-Person |

Mix |

All Online |

|

|---|---|---|---|

|

New EV Buyer |

15% |

69% |

16% |

|

New ICE Buyer |

55% |

39% |

6% |

Source: DesRosiers Automotive Consultants Inc. and Cox Automotive

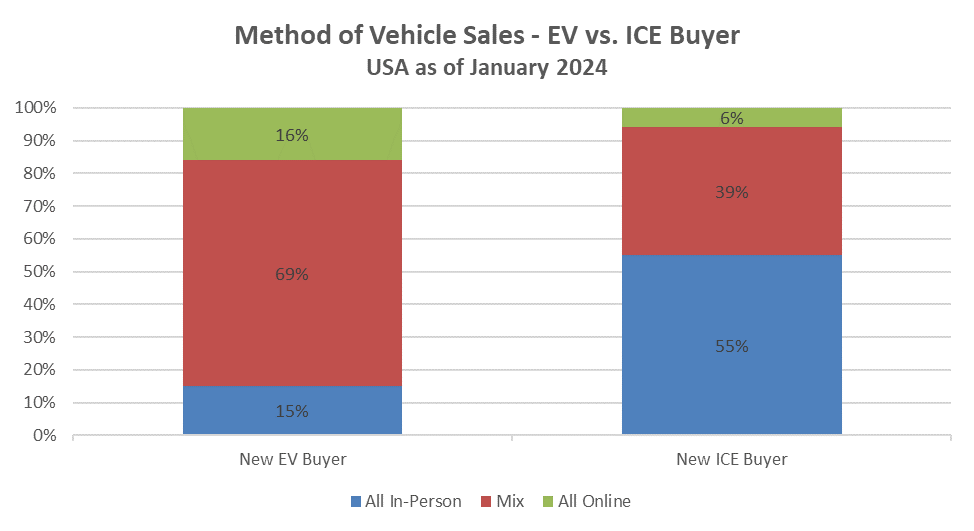

Consumer survey data from the US highlights the difference between the prevalence of online sales between EV and ICE vehicle consumers. For EV buyers, entirely online sales accounted for 16% of total sales compared to 6% for ICE vehicles. Similarly, a mix of on and offline was noted by 69% of EV buyers against 39% of ICE buyers. It is of note that the data above represents a survey of consumers in the US who may cite online activities such as initial research and build-and-price whereas the bulk of the data in this section represents DAC’s survey of Canadian dealers themselves who hold different criteria of what constitutes an online component of a sales interaction. Also, clearly the data will be influenced heavily by Tesla, which leans heavily toward an online approach to sales.

3.2: Online Sales - Qualitative

DAC reached out to many of the Canadian automotive OEMs, dealers and consumer representatives in order to get their perspectives on the topic of online sales. The following section contains aggregate industry views on this topic based on stakeholder feedback with additional analysis by DAC interspaced where applicable to add further context.

The Pandemic

As discussed in the literature review, the main cause that led to the increased focus on online sales in the light vehicle market was the COVID-19 pandemic. Lockdowns and social distancing restrictions, at least for a short period, made the process of selling both new and used vehicles extremely difficult through the traditional dealer process.

The support behind online sales processes has been slowly gaining traction in the background for years but there was little impetus to invest heavily in fully online sales. The pandemic acted as a motive to, if not adopt the process, at least begin laying the foundation for the future. The more immediate approaches were varied with some brands already positioned to sell online (such as Genesis and Tesla) and other brands seeing initiatives stemming from their dealers who established their own online sales processes for their organizations. But altogether, the pandemic moved the needle on actual functional online sales to a limited degree, rising from just 2.4% to 4.1% of total sales according to dealers between 2019 and 2022. Online sales, as they pertain to light vehicle sales in the automotive industry, remain a potential future target rather than an immediate concern.

Consumer Perspective

From the consumer perspective, the option for online sales of new vehicles is seen as a potentially positive change. Consumer representatives argue that more consumer choice is generally a win/win scenario both for businesses and consumers with consumers better able to conduct themselves as they wish during the purchasing process and businesses often seeing increased sales and satisfaction.

While some doubt remains due to the sheer financial size of a vehicle purchase, consumers are becoming increasingly comfortable with larger and larger online transactions. Evidence of this can be seen in the real estate market with mortgage agreements conducted online and wealthier real estate investors buying investment property sight unseen.

However, test drives, sitting in the car, kicking the tires, etc. have long been staples of the car buying process and consumer representatives argue that the demand to do this, at least by a large portion of consumers, is unlikely to go away. Building sentiment points towards the idea that online sales do not necessarily have to be sight unseen. It is not difficult to imagine a scenario where dealers—for example—can facilitate a test drive and the consumer can complete the purchasing process with them online at their own time, creating a lower pressure purchasing process. However, the human element of a vehicle purchase is likely not going away any time soon as consumers themselves still to a large extent prefer it.

Consumer representatives also raised the issue that for many consumers the high-pressure dealership selling process is viewed negatively, and that any option to give consumers choice of alternate selling approaches would be welcome.

Dealer Sentiment

Dealer sentiment toward online selling was again decidedly mixed. Among dealer representatives there was a group which were largely hesitant about the change. As with BTO this group expressed concerns as to any change whatsoever in the business model which has served them so well traditionally. These concerns were encompassed within 2 broader industry dynamics:

- The emergence of new OEMs (Tesla, Rivian, etc.) who have unanimously rejected the franchise dealer model.

- An attempt by existing OEMs to restructure the OEM/dealer relationship.

These issues are discussed in more detail elsewhere in this report. Specifically in regard to online selling, the dealer representatives that were most opposed to it viewed it as a potential path that the OEM could “cut them out” and move toward a more “direct-to-consumer” model as employed by Tesla, etc.

It should be noted that this view was not held by all dealer representatives. As with BTO, there were many who viewed the move to online selling as a natural business evolution and not a fundamental threat. These dealers recognize that consumers are increasingly used to online selling through Amazon and similar platforms and that for the dealers to reach younger consumers especially it was necessary to embrace this change. Indeed, such dealers mentioned the positive attributes of online selling including the potential for a lower cost of sales, and the ability to communicate easily and effectively with customers on a highly targeted basis.

OEM Sentiment – Existing Players

Amongst the existing OEMs, sentiment toward increased online selling was almost unanimously positive. These companies were largely focused on an omni-channel approach, wherein the consumer has options as to how to research and conduct the transaction. Industry representatives did raise concerns regarding barriers that exist in implementing an omni-channel sales vision. For one, such a reality requires integration between the dealerships’ Dealer Management Software and the OEMs own internal IT and web infrastructure. Such barriers, however, are seen as manageable with the pandemic having given significant impetus to addressing such issues in the near to medium term. Specific challenges were raised regarding the complexity of the automotive transaction also. It is often not only about the consumer selecting a vehicle, but also arranging financing, and evaluating a trade-in vehicle. Again, such complexity was seen as eminently manageable however with numerous players in other industries (and indeed in the used vehicle space) having addressed similar issues already. Generally, the OEMs recognise that online retailing in general has extended from “early adopters” to all segments of society and that they need to offer options in this regard if they are to meet consumer needs.

To be sure, the OEMs want to maintain dealer locations where consumers can visit, test drive vehicles, and speak to a sales representative. Beyond that however they also want to offer the consumer choice as to how the actual transaction is conducted from fully online to fully in a brick-and-mortar location.

New Market Entrants and ZEVs

The new (and relatively new) entrants into the market found themselves untethered by the traditional physical OEM-dealer-consumer sales process. Tesla entered the market with corporate stores, and online sales and other ZEV-focused players followed suit. Even Genesis, which entered the market as part of a “traditional” OEM and with traditional ICE vehicles, facilitated online sales purchases from the start. Tesla stands out as an obvious success story in terms of attaining sales volumes and market share with consumers more than happy to purchase a Tesla vehicle through non-traditional means – technically all Teslas are purchased online. However, Tesla has moved to build-out its network of physical locations – so that if the consumer is more comfortable completing the online sales forms on a computer in a Tesla store guided by a salesperson – they have the option of doing that.

Novel Approaches

As the online sales space develops within the automotive market, so too will new attempts to attract and grow online sales. One recent example was the publicly announced deal between Hyundai and Amazon in the United States that will enable the sales of Hyundai vehicles on Amazon’s platform. Customers will be able to select, customize, and order a vehicle through Amazon and then pick the vehicle up from a dealer. While this is a novel approach that can certainly build excitement and attract attention, a method like this functions as—in essence—lead-generation for the existing pool of dealers. The broader implication of this is that the growth of online sales will lead to new experimentation in marketing and sales tactics as OEMs and dealers attempt to adapt to the changing picture for automotive retail. The consensus in the industry was clear that the path will be toward an ever-increasing breadth of options for the consumer – as the industry moves to an omni-channel approach within which specific consumers can choose the path that best suits their needs.

Section 4: Other Issues and Additional Context

The Relationship Between OEMs and Dealers

While this topic is addressed throughout the report above where appropriate, this section exists to add additional context to the relationship between the traditional manufacturers/OEMs and their dealers. This context is seen as critical as it is this relationship that is the underlying dynamic that will shape many initiatives in the industry such as BTO and online sales.

In the traditional BTS scenario, OEMs produce, ship, and sell vehicles to their dealers. It is the dealer that is the OEM’s customer - performing functions that traditionally the OEM was unwilling or unable to carry out – specifically inventorying the vehicles and retailing them to consumers. For carrying out these responsibilities the OEM gave up a significant share of their overall margin on vehicles to the dealer.

The automotive industry is in a state of flux arguably greater than any period in it’s 100-year history. The shift to ZEVs will transform many aspects of the industry and has led to a range of new entrants bringing both new product, and new ways of distributing and retailing the vehicles.

Franchise dealers obviously view these new entrants and new approaches as a fundamental threat to their existence. Moreover, faced with these challenges, the traditional OEMs have themselves begun to explore new approaches to the traditional franchise dealer model. Both are discussed further below:

The New Entrants – DTC, Agency Model & Other Approaches

The majority of these new players have followed Tesla and selected a distribution and sales approach using corporate stores and a Direct-To-Consumer (DTC) model that shuts out franchised dealers. Modelled on the “Apple Store” approach to retailing Tesla operates corporate owned locations that usually do not have inventory on site and function primarily as an information hub where consumers can interact with salespeople and in some cases the vehicles themselves. They obtain information on pricing, technical specifications, options, upcoming tech, and generally interact with a salesperson who can also, if needed, guide them through the existing sales process.

However, there are also alternate models that provide a different approach to retailing - an example is Polestar which has pioneered an agency model of retailing. As part of the agency model, Polestar has begun to open “spaces” as their answer to traditional dealerships through the lens of an online brand. Breaking away from established franchise dealer model, while still meeting the consumer needs for physical interaction with the vehicle, spaces are meant to offer a place where consumers can get expert feedback on the vehicles, interact with the product, and perform test drives before purchase. But spaces are not marketed as a sales-oriented location like a typical dealership and more of an information and service hub. Polestar represents a fairly novel approach in retailing in the rising EV market, but these are distinct limitations to the approach in regards to brand adoption given the potential servicing challenges that result from limited geographical coverage.

The agency model in general has been receiving consideration from across the automotive industry. In general, the agency model provides a means of direct-to-consumer sales between the OEM and consumer. The role of ‘dealers’ in this case is to facilitate limited parts of the sales in exchange for a flat fee with the dealer not owning the vehicle as in the traditional franchise model. The model in general remains a work in progress among the different OEMs across various jurisdictions. As this trend develops, it is likely that lines will blur between the different specific approaches and definitions as OEMs and dealers continue to experiment with new retailing methods in order to address the needs of a shifting market.

The “Traditional OEMs” - Changing Dealerships and Retail Models

While there have been a number of players examining the changing structure of the OEM/dealer relationship one of the most visible has come from Ford. This program formally came into place Jan 1, 2024, and is known as the “Model e” program. The program sets out specific requirements for dealers if they want to be able to sell ZEVs for Ford in the future. The dealers who choose to comply with the guidelines will be allowed to sell ZEVs and are noted as such on the Ford website. Dealers who do not comply will be limited to ICE vehicles only.

While reports in 2023 indicated approximately 80% of Ford’s Canadian dealers have complied, only 226 (approximately 52%) signed up as Certified Elite, 'with full sales and service capability,' and 112 (approximately 26%) chose the cheaper Certified Model e, plan 'with full-service capability, limited sales'. In the US, the figure is only about 53% that have signed up for the full electric vehicle certification program. Some difficulties have already presented themselves in the US in regards to EV charging infrastructure delays with requirements as a part of the program being pushed out into the summer of 2024. Plans for Lincoln at present appear to be on hold.

Smaller dealers continued to highlight concerns with the cost of the program and the low perceived return on investment. In Canada the cost is $1.3 million for Certified Elite dealers and $560,000 for Model e Certified dealers, encompassing both EV charger installations as well as staff training. Many of the concerns regarding return on investment, especially from the USA, came from smaller rural dealers who had concerns about general EV infrastructure in their areas and the implications for EV adoption in the short term.

Clearly initiatives such as Ford are creating significant tension in the traditional OEM/franchise model. There is a segment of the dealer population that views such dynamics as an effort by the traditional OEMs to reduce dealer counts and move closer to the DTC approach adopted by new entrants. This atmosphere is clearly creating tension with a number of lawsuits that have come forth from dealers in North America regarding this issue. In Illinois, the state’s motor vehicle board determined that Ford’s EV certification requirements were potentially unlawful. The Arkansas Automobile Dealers Association filed a formal complaint against Ford. Similarly, several dealers in New York filed a lawsuit against the program.