Estimating inventories in Canada: 2024 update

Prepared for:

Transport Canada

Submitted: March 2024

Published: November 2024

Prepared by:

Dunsky Energy + Climate Advisors

50 Ste-Catherine St. West, suite 420

Montreal, QC, H2X 3V4

www.dunsky.com | info@dunsky.com

+ 1 514 504 9030

This publication showcases the availability of zero-emission vehicles at dealerships across Canada.

Aussi disponible en français sous le titre : <Disponibilité des véhicules zéro émission - Estimation des stock au Canada : Mise à jour de 2024.>

Information contained in this publication or product may be reproduced, in part or in whole, and by any means, for personal or public non-commercial purposes without charge or further permission, unless otherwise specified. Commercial reproduction and distribution are prohibited except with written permission from Transport Canada.

For more information, contact:

Transport Canada

330 Sparks Sreet

Ottawa ON Canada K1A 0N5

Zero-emission vehicles (canada.ca)

© His Majesty the King in Right of Canada, as represented by the Minister of Transport Canada, 2024.

Cat. No. T42-33/2024E-PDF (Electronic PDF, English)

ISBN 978-0-660-71717-3

Cat. No. T42-33/2024F-PDF (Electronic PDF, French)

ISBN 978-0-660-71718-0

Executive summary

This report summarizes the seventh, eighth, ninth, and tenth Canada-wide primary data collection efforts to quantify the zero-emission vehicles (ZEVs) in inventory across the country on behalf of Transport Canada. The report presents data that was collected in four separate periods—February 2023, June 2023, November 2023, and February 2024—with focus placed on the two most recent periods, and details on the two earlier periods provided in Appendix A. Dunsky has also collected similar datasets for six previous periods: February 2022, February 2021, November 2020, February 2020, November 2019, and December 2018.

In this report, we highlight absolute inventory numbers, contextualized using historical sales rates to measure inventory in terms of days of supply. Inventory levels are analyzed by province and automaker. Additional data is presented related to powertrain types, the number of vehicles per dealership, and, for dealerships with no ZEVs in stock – the wait time to receive a vehicle.

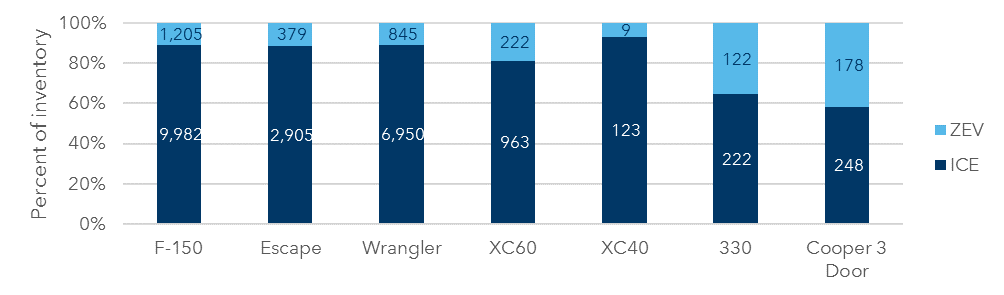

The data presented in this report was collected through online inventory databases and dealership phone surveys. Between these two methods, data on ZEV inventory levels were collected for 4,240 dealerships across Canada. In all cases, both plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) were counted (collectively referred to as ZEVs). Additionally, limited inventory data on comparable internal combustion engine (ICE) vehicle models were included for benchmarking purposes for the February 2023 and June 2023 reporting periods, as detailed in Appendix A.

Several key observations emerge from the latest sets of data collected, namely:

- Inventory and sales increased significantly for both November 2023 and February 2024 compared to previous periods and reports. Making record highs, both November and February saw significant inventory improvements across most automakers and provinces. In five provinces, inventory levels were at target-supply, four were at over-supply, and one province was at under-supply. This increase in inventory bodes well for ZEV customers, who represented 11.7% of the total light-duty vehicle market in 2023 and are expected to account for an increasing share moving forward.

- As global supply chain issues subside, automakers have significantly increased and continued to invest in their ZEV manufacturing output - providing Canadians with greater options, both at the make and model levels. Increased production levels of ZEVs by the larger automakers may further invigorate competition, leading to additional price cuts for certain vehicle classes. Greater economies of scale within the next few years may also enable certain manufacturers to eventually compete on pricing with their ICE counterparts.

- Automakers are showing a marked increase in initiatives to satisfy and expand the market for zero-emission vehicles. Notably, Ford, Jeep, and BMW have the most substantial ZEV inventories in Canada, with the first two consistently ranking among the top five in ZEV inventory over the last three years. Conversely, while ZEV inventory is catching up with sales, there is still uneven participation among automakers; the top three automakers in ZEV inventory contribute to more than half of the inventory, while some large manufacturers remain underrepresented.

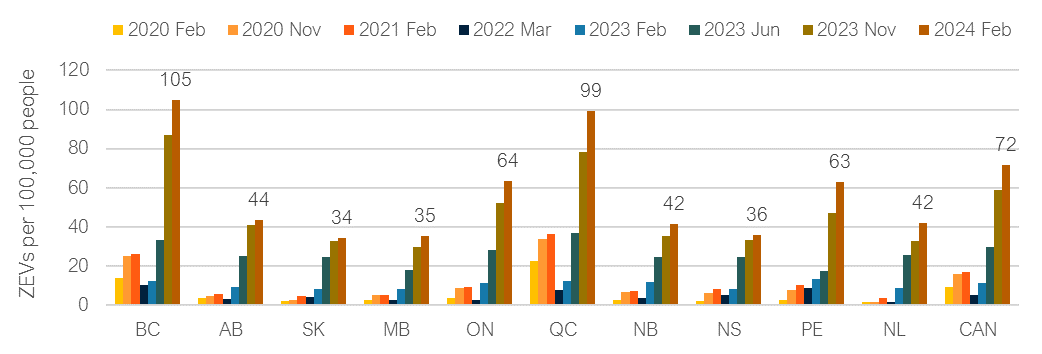

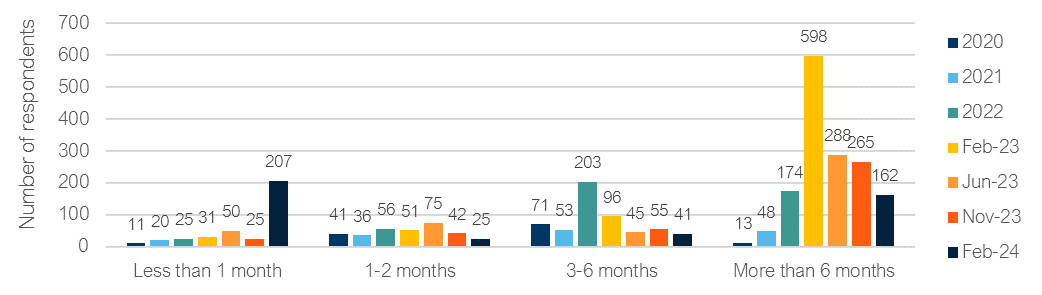

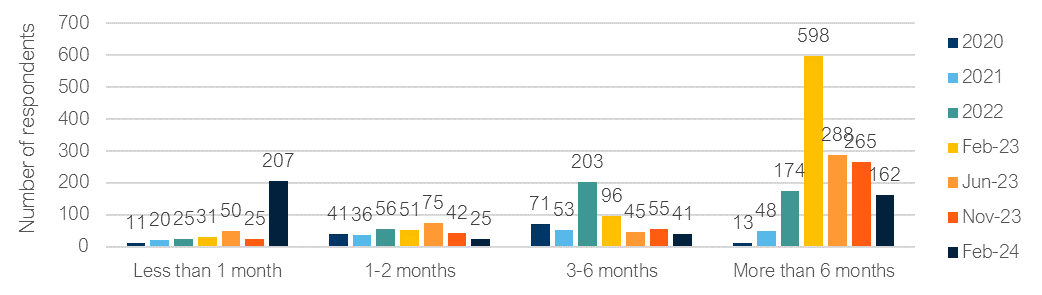

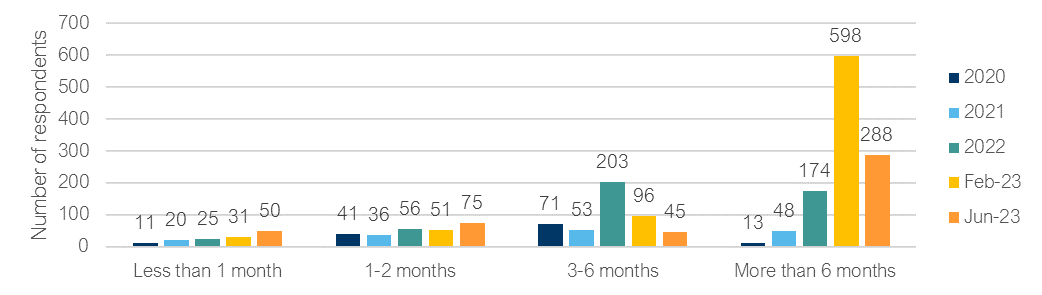

- After peaking in February 2023, wait times appear to continue decreasing. However, this observation is derived from a smaller sample of respondents and hinges on the premise that the contacted dealerships have no ZEVs in stock. This trend is inversely correlated with the increasing availability of ZEV inventory and its enhanced distribution across provinces and vehicle makes.

We elaborate on each of these findings below.

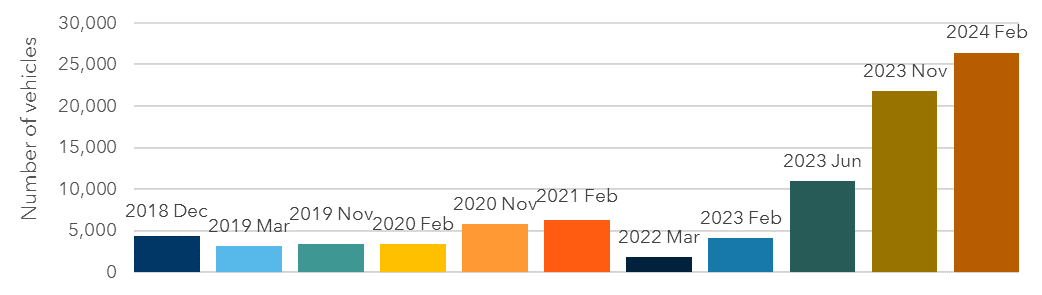

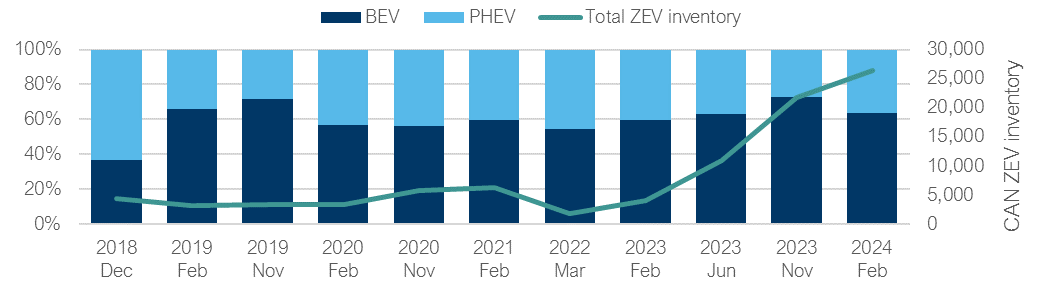

Inventory and sales increased significantly for both November 2023 and February 2024 compared to previous periods and reports. Making record highs, both November and February saw significant inventory improvements across most automakers and provinces. This increase in inventory bodes well for ZEV customers, who represented 11.7% of the total light-duty vehicle market in 2023 and are expected to account for an increasing share moving forward.

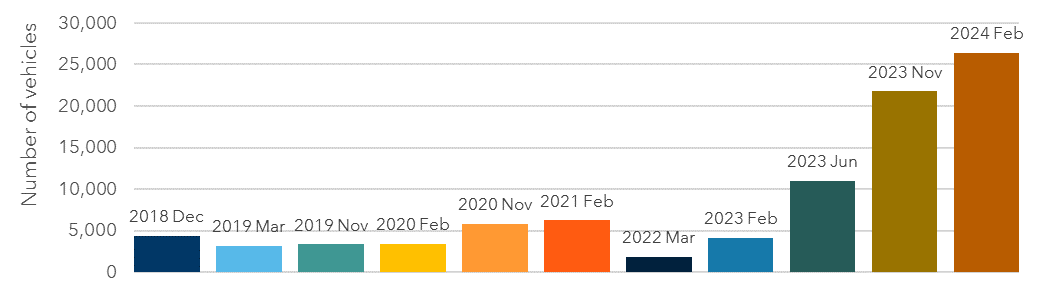

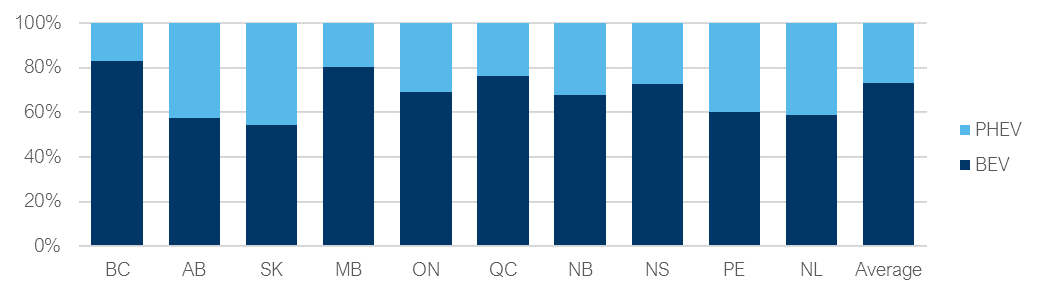

1.1.1.1 Figure ES-1. Vehicle Inventory Canada-wide – all results

Text description

|

Time period |

2018 Dec |

2019 Mar |

2019 Nov |

2020 Feb |

2020 Nov |

2021 Feb |

2022 Mar |

2023 Feb |

2023 Jun |

2023 Nov |

2024 Feb |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Number of Vehicles |

4398 |

3193 |

3351 |

3414 |

5809 |

6241 |

1839 |

4143 |

11030 |

21786 |

26432 |

With global supply chain issues subsiding, automakers have significantly increased and continue to invest in their ZEV manufacturing output - providing Canadians with greater options, both at the make and model levels. Increased production levels of ZEVs by the larger automakers may further invigorate competition, leading to additional price cuts for certain vehicle classes. Greater economies of scale within the next few years may also enable certain manufacturers to eventually compete on pricing with their ICE counterparts.

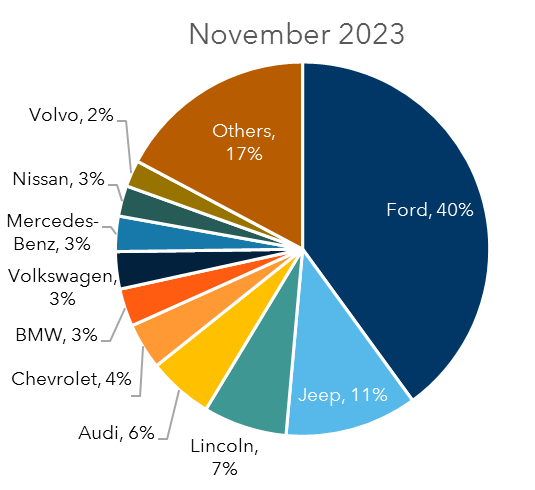

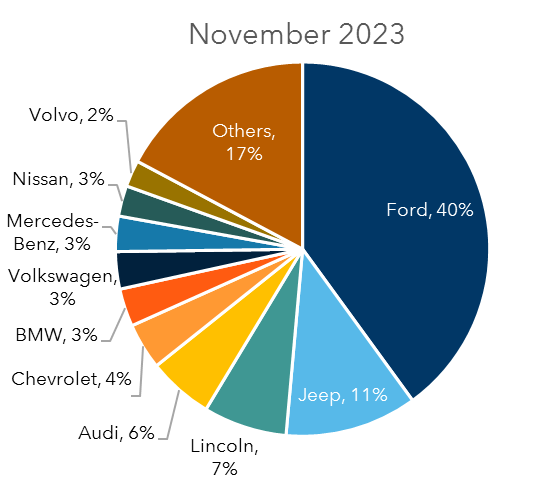

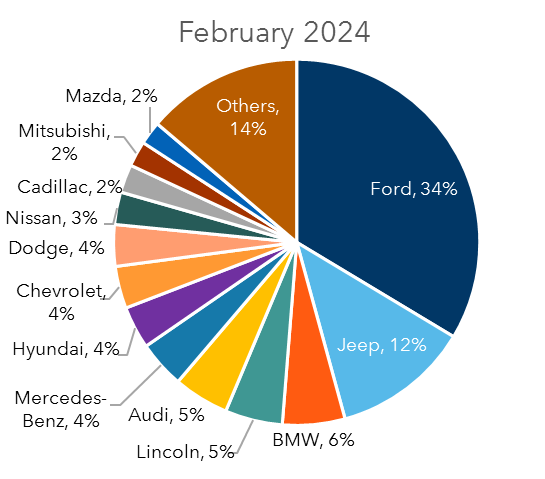

There are signs of increasing efforts to meet and grow ZEV demand from automakers. For example, Ford, Jeep, and BMW possess the highest ZEV inventory levels in Canada—with the former two landing within the top five manufacturers with the highest levels of ZEV inventory for the past three years. Meanwhile, BMW has 10 different ZEV models available on the Canadian market and has made efforts to supply every one of its dealerships with at least one ZEV model in February 2024 – ensuring that everyone visiting a BMW dealership can see a ZEV. Unfortunately, there is still uneven participation among automakers; the top three automakers in ZEV inventory contribute to more than half of the inventory, while some of the world's largest manufacturers remain underrepresented.

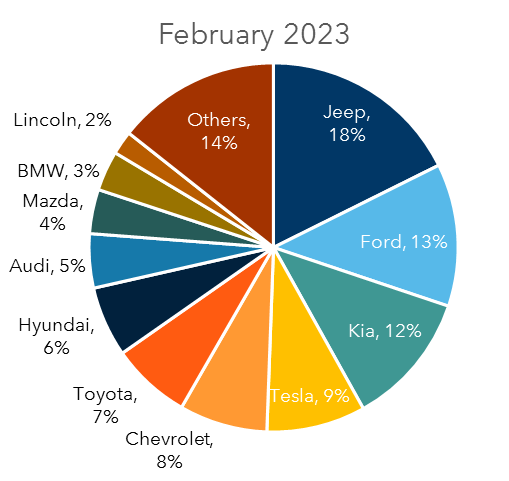

Figure ES-2. National ZEV Inventory by Automaker as a Percentage of Total Inventory

Text description

|

OEM |

Ford |

Jeep |

Lincoln |

Audi |

Chevrolet |

BMW |

Volkswagen |

Mercedes-Benz |

Nissan |

Volvo |

Others |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Percentage |

40% |

11% |

7% |

6% |

4% |

3% |

3% |

3% |

3% |

2% |

17% |

Text description

|

OEM |

Ford |

Jeep |

BMW |

Lincoln |

Audi |

Mercedes-Benz |

Hyundai |

Chevrolet |

Dodge |

Nissan |

Cadillac |

Mitsubishi |

Mazda |

Others |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Percentage |

34% |

12% |

6% |

5% |

5% |

4% |

4% |

4% |

4% |

3% |

2% |

2% |

2% |

14% |

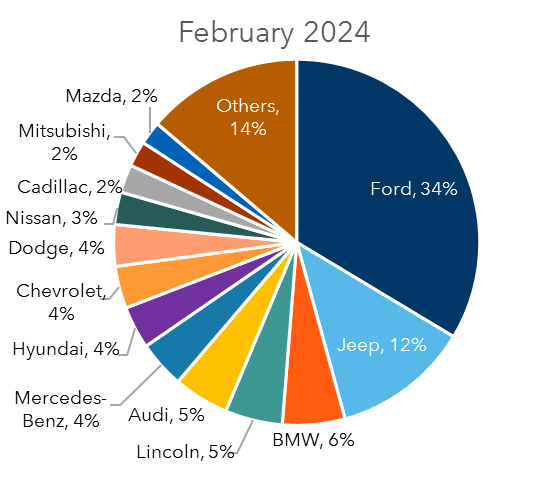

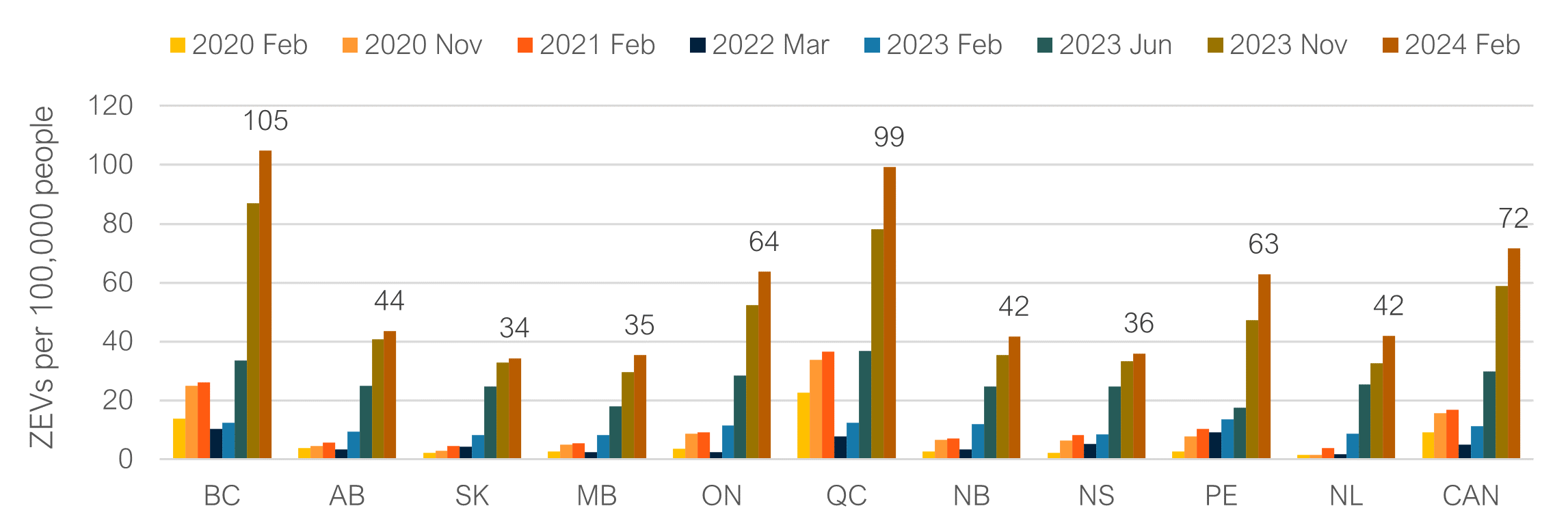

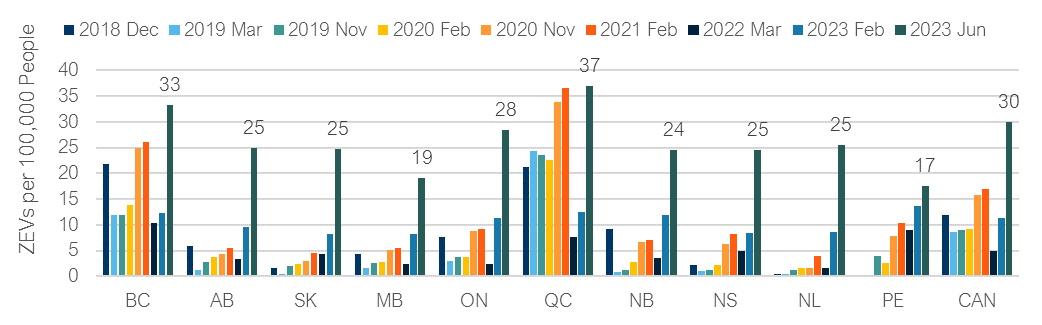

Inventory distribution is improving between provinces and automakers. As shown in the distribution of automakers above, 13 distinct automakers contributed more than 2% of total ZEV supply in February 2024. This compares to just 10 automakers in the three months prior. While inventories continue to be concentrated in BC, Ontario, and Quebec, availability based on population has improved significantly across every province when compared to the previous periods and reports as demonstrated by the continued increase in ZEVs available for purchase per capita below.

Figure ES-3. ZEVs Available for Purchase per 100,000 People

Text description

|

|

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

CAN |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

2020 Feb |

14 |

4 |

2 |

3 |

4 |

23 |

3 |

2 |

3 |

2 |

9 |

|

2020 Nov |

25 |

5 |

3 |

5 |

9 |

34 |

7 |

6 |

8 |

2 |

16 |

|

2021 Feb |

26 |

6 |

5 |

5 |

9 |

36 |

7 |

8 |

10 |

4 |

17 |

|

2022 Mar |

10 |

3 |

4 |

2 |

2 |

8 |

3 |

5 |

9 |

2 |

5 |

|

2023 Feb |

12 |

10 |

8 |

8 |

11 |

12 |

12 |

8 |

14 |

9 |

11 |

|

2023 Jun |

34 |

25 |

25 |

18 |

28 |

37 |

25 |

25 |

17 |

25 |

30 |

|

2023 Nov |

87 |

41 |

33 |

30 |

52 |

78 |

35 |

33 |

47 |

33 |

59 |

|

2024 Feb |

105 |

44 |

34 |

35 |

64 |

99 |

42 |

36 |

63 |

42 |

72 |

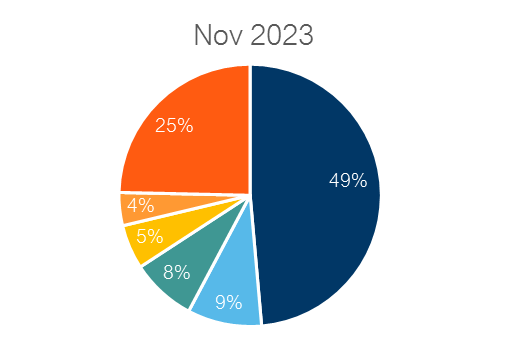

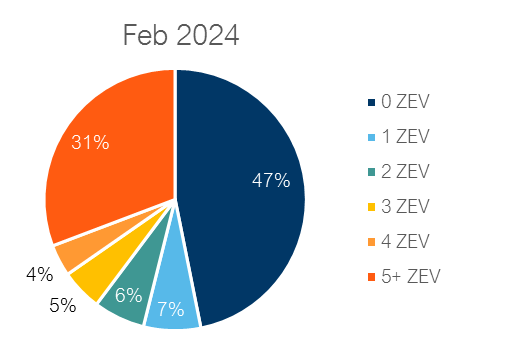

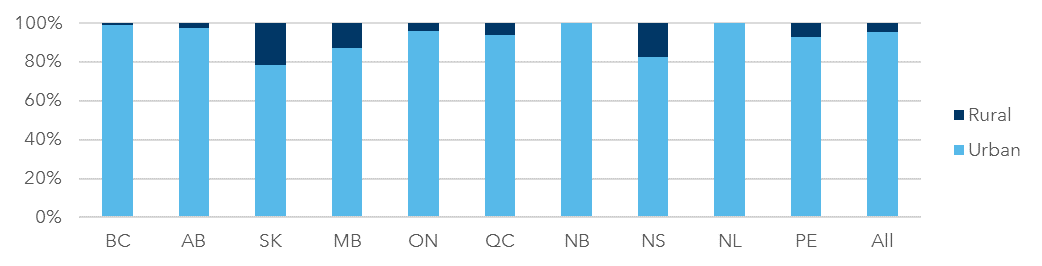

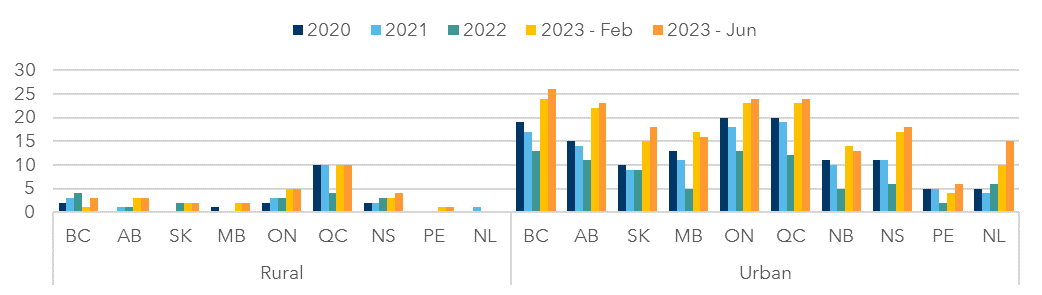

The most recent reporting period (February 2024) recorded a decrease in wait times and the smallest proportion of dealers with no zero-emission vehicles (ZEVs) in stock - 47% - since the inception of this report series. A review of availability by geography indicates that only 4% of the total ZEV inventory is in rural regions. This figure is notably disproportionate when contrasted with the 18% (estimated) of the Canadian populace living in these areas. However, it should be noted that rural areas typically have less access to charging infrastructure and are often in provinces/territories that don't offer their own ZEV incentives.

Figure ES-4. Expected Wait Times for Dealerships with Zero ZEVs Available

Text description

|

|

Less than 1 Month |

1-2 Months |

3-6 Months |

More than 6 Months |

|---|---|---|---|---|

|

2020 |

11 |

41 |

71 |

13 |

|

2021 |

20 |

36 |

53 |

48 |

|

2022 |

25 |

56 |

203 |

174 |

|

Feb 2023 |

31 |

51 |

96 |

598 |

|

Jun 2023 |

50 |

75 |

45 |

288 |

|

Nov 2023 |

25 |

42 |

55 |

265 |

|

Feb 2024 |

207 |

25 |

41 |

162 |

Finally, as outlined in our 2022 report, there continues to be a trend towards new automotive retail models when it comes to ZEV sales. Almost every new automaker and a growing list of existing automakers are shifting towards online retailing in parallel to their transition towards an increasingly electrified model lineup, including FordFootnote 1 and Volvo.Footnote 2 A consumer insight study by Google revealed that 6% of Canadian shoppers bought their new car online in 2022—a 6-fold increase relative to pre-pandemic times. More notably, it also revealed that 54% of buyers expect their next purchase to be contactless, from discovery to home delivery (online).Footnote 3 This growing trend towards online shopping will not only benefit online ZEV retailers but can also benefit any manufacturer that is willing to make the necessary investments to sell their vehicles online.

Overall, with improving levels of inventory, advancements in technology, and streamlined shopping experiences, the Canadian ZEV market continues to drive innovation and grow amid a variety of economic headwinds that have affected traditional vehicle sales over the past few years. The latest round of data underscores Canada's quickly increasing inventory levels for ZEVs.

Table of Contents

- Executive summary

- Introduction

- Context: electric mobility in Canada

- ZEV inventory: data and observations

- ZEV inventory levels

- Table 3-1. Vehicle inventory by province and automaker – November 2023

- Table 3-2. Vehicle inventory by province and automaker – February 2024

- Availability by province

- Availability by automaker

- Availability by geography (urban vs. rural)

- Inventory Relative to Sales

- Table 3-3. Days of supply by province and automaker – November 2023

- Table 3-4. Days of supply by province and automaker – February 2024

- Table 3-5. Days of supply by province and data collection period – all periods

- Results by Province

- Results by automaker

- ZEV model diversity

- Availability by dealership

- Wait times & dealer comments

- Conclusion

- Appendix A – February and June 2023 data

Introduction

This report summarizes the ninth and tenth Canada-wide primary data collection efforts to quantify the zero-emission vehicles (ZEVs) in inventory across the country on behalf of Transport Canada. The report presents data that was collected in two separate periods: November 2023 and February 2024. Dunsky has also collected similar datasets for eight previous periods: June 2023, February 2023, February 2022, February 2021, November 2020, February 2020, November 2019, and December 2018. The ZEV inventory data for the February and June 2023 periods are provided in Appendix A.

Methodology

The data presented in this report was collected through two primary means:

- AutomakersFootnote 4 online inventory databases. Where available, inventory data was collected directly through automaker websites. This was the case for 15 of the 29 automakers included in this study and for 13 out of 27 automakers in the February and June 2023 periods outlined in the appendix.

- Dealership phone surveys. For the remaining 14 automakers, individual dealerships were contacted by phone by researchers posing as interested buyers and asked how many of each zero-emission vehicle (ZEV) model were available to purchase at the dealership.

Results in this report are reflective of the data collected through these methods, the accuracy of which can vary based on the data collection method (explained in further detail below). Between these two methods, data on ZEV inventory levels were collected for 4,240 dealerships across Canada. In all cases, both plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) were counted (collectively referred to as ZEVs).

|

Automaker |

Data collection methodology |

Number of dealerships across Canada - 2023 |

Number of dealerships across Canada - 2024 |

|---|---|---|---|

|

Alfa Romeo |

Web |

Not collected |

16 |

|

Audi |

Web |

53 |

53 |

|

BMW |

Web |

52 |

52 |

|

Cadillac |

Web |

138 |

138 |

|

Chevrolet |

Web |

468 |

468 |

|

Chrysler |

Web |

483 |

487 |

|

Dodge |

Web |

Not collected |

393 |

|

Ford |

Web |

474 |

474 |

|

Genesis |

Phone |

30 |

30 |

|

Hyundai |

Phone |

220 |

220 |

|

Jaguar |

Phone |

34 |

34 |

|

Jeep |

Web |

369 |

390 |

|

Kia |

Phone |

182 |

182 |

|

Land Rover |

Phone |

31 |

31 |

|

Lexus |

Phone |

40 |

40 |

|

Lincoln |

Web |

92 |

92 |

|

Mazda |

Phone |

165 |

165 |

|

Mercedes-Benz |

Web |

57 |

57 |

|

Mini |

Web |

31 |

31 |

|

Mitsubishi |

Phone |

77 |

77 |

|

Nissan |

Phone |

201 |

200 |

|

Polestar |

Phone |

3 |

3 |

|

Porsche |

Web |

20 |

20 |

|

Subaru |

Phone |

105 |

105 |

|

Tesla |

Web |

20 |

27 |

|

Toyota |

Phone |

225 |

225 |

|

VinFast |

Phone |

8 |

9 |

|

Volkswagen |

Phone |

147 |

147 |

|

Volvo |

Web |

54 |

54 |

|

Total |

Web |

2,311 |

2,752 |

|

Total |

Phone |

1, 468 |

1, 468 |

|

Total |

All |

3,779 |

4,240 |

It should be noted that both web and phone survey data collection methods have limitations. The web-based data collection method is an efficient means of collecting a large amount of data. If the inventory database does not accurately reflect actual inventory, however, it may misrepresent the actual customer experience of shopping by suggesting there are either more or less ZEVs on the lot than is truly the case.

While the phone survey more closely approximates the customer shopping experience, the accuracy of the data collected through this method is reflective of the knowledge of, and information readily available to, the respondents fielding the questions. For example, automakers may offer several versions of the same vehicle with different powertrains, such as plug-in hybrid and conventional hybrid versions of the Hyundai Ioniq and Toyota Prius, which may introduce confusion. To mitigate this, phone survey staff were given clear descriptions of each powertrain configuration and warned of specific cases where there might be possible confusion between available vehicle models.

Structure of report

The remainder of this report is structured as follows:

- Context: electric mobility in Canada – presents an overview of the ZEV market and existing policies and programs across Canada to drive their uptake.

- ZEV inventory: data and observations – provides description and analysis of ZEV inventories by province and manufacturer, including absolute inventory levels, wait times, inventory relative to sales, split by drivetrain, and selection of makes and models. Inventory levels and choice are also split by geographies (urban vs. rural).

- Conclusion – summarizes key takeaways from this study.

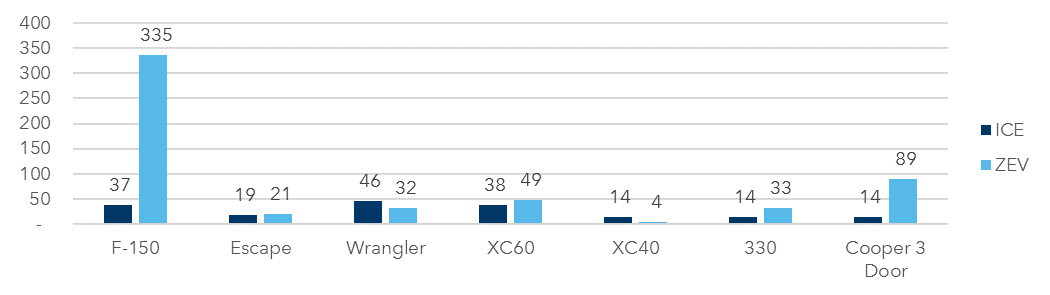

- Appendix A – outlines the ZEV inventory data & observations from the February and June 2023 data collection periods. It also provides a unique inventory comparison of internal combustion engine (ICE) vehicles to benchmark a selection of models to their ZEV counterparts, based on inventory levels and consideration of recent sales data.

Context: electric mobility in Canada

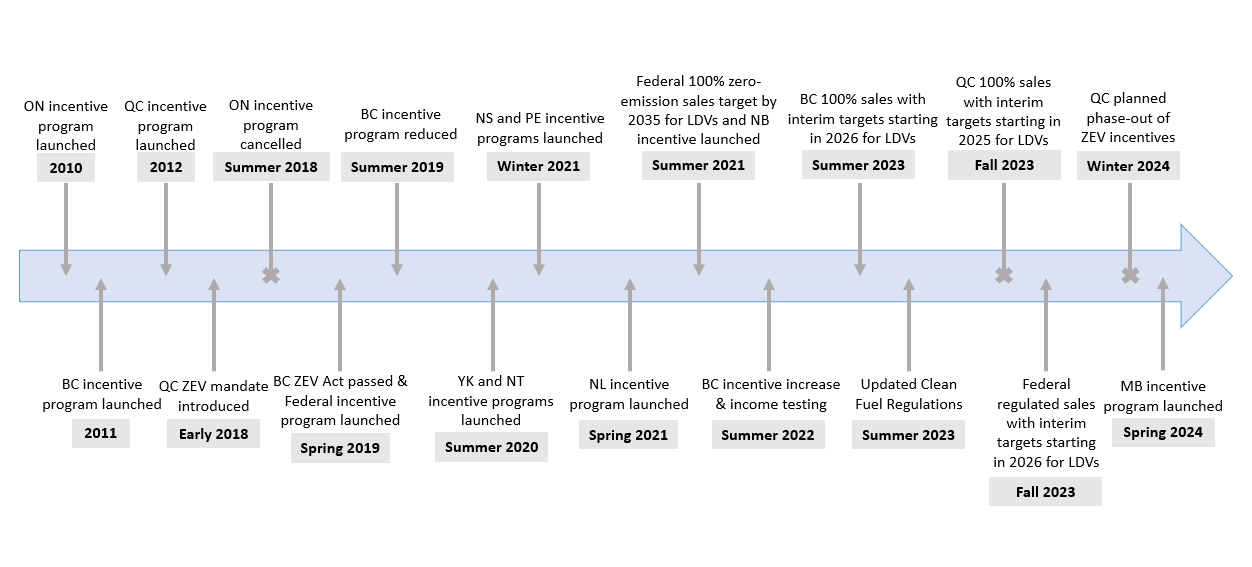

The timeline below highlights key provincial and federal policies related to ZEVs since 2010.

Figure 2-1. Timeline of key provincial and federal ZEV policies for light-duty vehicles

Text description

2010: ON incentive program launched

2011: BC incentive program launched

2012: QC incentive program launched

Early 2018: QC ZEV mandate introduced

Summer 2018: ON incentive program cancelled

Spring 2019: BC ZEV Act passed & Federal incentive program launched

Summer 2019: BC incentive program reduced

Summer 2020: YK and NT incentive programs launched

Winter 2021: NS and PE incentive programs launched

Spring 2021: NL incentive program launched

Summer 2021: Federal 100% zero-emission sales target by 2035 for LDVs and NB incentive launched

Summer 2022: BC incentive increase & income testing

Summer 2023: BC 100% sales with interim targets starting in 2026 for LDVs

Summer 2023: Updated Clean Fuel Regulations

Fall 2023: QC 100% sales with interim targets starting in 2025 for LDVs

Fall 2023: Federal regulated sales with interim targets starting in 2026 for LDVs

Winter 2024: QC planned phase-out of ZEV incentives

Spring 2024: MB incentive program launched

Since the last report (March 2022), Canada's light-duty ZEV policy environment has developed through modifications to existing policies and programs. In April 2022, Canada's federal Incentives for Zero-Emission Vehicles (iZEV) Program was extended and expanded to allow for the inclusion of larger vehicle models to be eligible for the Program. In August 2022, BC amended the Clean BC Go Electric incentive program by increasing the eligible incentive amount from a maximum of $3,000 to $4,000 and introduced income testing requirements to the Program. Footnote 5 In September 2023, Quebec revised its ZEV regulations to spur the auto industry to improve the supply of ZEVs with a requirement of annual ZEV sales at 22% by 2025, 85% by 2030 and 100% by 2035.Footnote 6 BC also made amendments to its ZEV Act in October 2023 to accelerate its ZEV targets such that automakers must meet annual ZEV percentage requirements, and 100% by 2035 (five years ahead of the original target).Footnote 7 Quebec recently noted in the release of its 2024-25 Budget that it plans to phase out Roulez Vert by 2027.Footnote 8 Lastly, Manitoba announced in its 2024-25 Budget that is it launching incentives for both new (up to $4,000) and used (up to $2,500) ZEVs retroactive to August 2023.Footnote 9 Alberta, Saskatchewan, and Ontario remain the only provinces that do not offer financial incentives for ZEVs.

Additionally, several key federal regulations have come into force which should continue accelerating ZEV adoption across the country. These include updates to the Clean Fuels Regulation, which came into effect in July 2023 (requiring carbon intensity of fuels to be reduced by less than 4% compared to 2016 levels), and a mandatory target set in June 2021 that all new light-duty cars and passenger trucks sales be zero-emissions by 2035. To help achieve this mandatory target the Federal Government released the Electric Vehicle Availability Standard in December of 2023, which established annual zero-emission vehicles requirements for manufactures and importers of new light-duty vehicles for the purpose of sale, including 20 percent (%) in model year 2026, 60% in model year 2030, and 100% in model year 2035 and beyond.Footnote 10

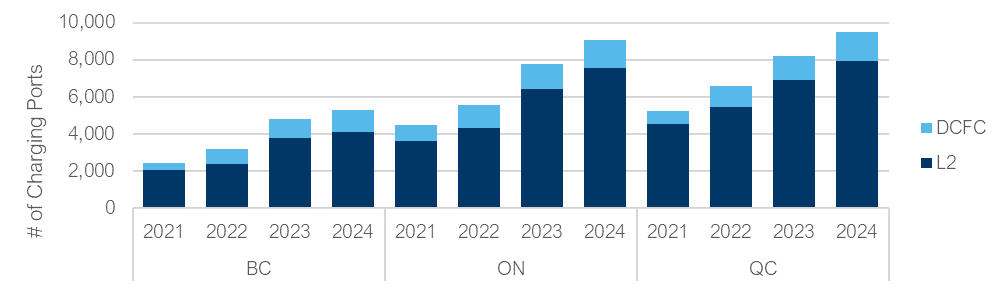

Public charging infrastructure has also continued to expand. While a 2024 vehicle owner study found that ZEV drivers do most of their vehicle charging at home,Footnote 11 public charging infrastructure is important for longer trips or for those without home charging access. It is therefore critical that these installations increase in line with, or faster than the rate of ZEV adoption – as this may otherwise discourage adoption. The figures below summarize the public electric vehicle charging infrastructure available in each province over the last year and a half.

Figure 2-2. Number of level 2 and DCFC ports by province: BC, ON, and QCFootnote 12

Text description

|

|

2021 |

2022 |

2023 |

2024 |

||||

|---|---|---|---|---|---|---|---|---|

|

|

L2 |

DCFC |

L2 |

DCFC |

L2 |

DCFC |

L2 |

DCFC |

|

BC |

2033 |

389 |

2363 |

837 |

3780 |

1021 |

4097 |

1180 |

|

ON |

3598 |

867 |

4335 |

1225 |

6413 |

1341 |

7558 |

1498 |

|

QC |

4540 |

710 |

5434 |

1138 |

6885 |

1342 |

7957 |

1550 |

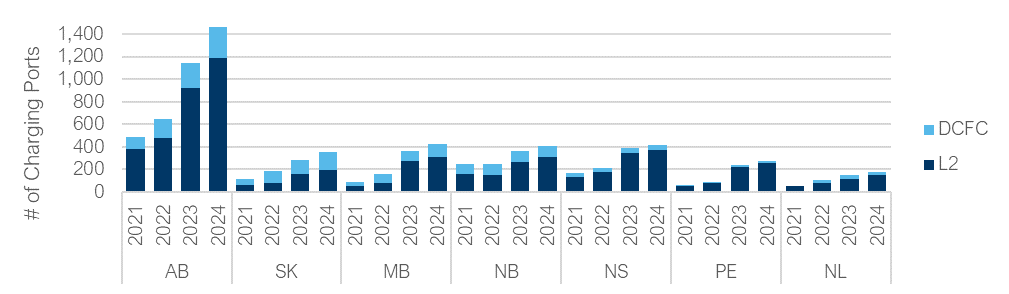

Figure 2-3. Number of level 2 and DCFC ports by province: AB, SK, MB, NB, NS, PE, NLFootnote 13

Text description

|

|

2021 |

2022 |

2023 |

2024 |

||||

|---|---|---|---|---|---|---|---|---|

|

|

L2 |

DCFC |

L2 |

DCFC |

L2 |

DCFC |

L2 |

DCFC |

|

AB |

381 |

108 |

477 |

174 |

924 |

220 |

1185 |

282 |

|

SK |

65 |

47 |

76 |

107 |

156 |

127 |

190 |

161 |

|

MB |

48 |

40 |

79 |

79 |

271 |

93 |

306 |

116 |

|

NB |

161 |

89 |

153 |

91 |

267 |

93 |

307 |

103 |

|

NS |

133 |

31 |

174 |

34 |

349 |

39 |

379 |

42 |

|

PE |

53 |

7 |

77 |

14 |

221 |

18 |

255 |

23 |

|

NL |

56 |

0 |

82 |

19 |

116 |

33 |

148 |

32 |

Since June 2023, market actors (including private corporations, municipal governments, utilities, and others, often with the support of Natural Resources Canada) have continued installing additional public charging infrastructure in all provinces, leading to a 15% increase for both Level 2 ports and Direct-Current Fast-Chargers (DCFC) ports Canada-wide.

The largest absolute increase in the total number of ports for a single province was in Quebec, where 1,072 Level 2 and 208 DCFC ports were installed between June 2023 and March 2024. The rate of total charger installations was greatest in Alberta (28%), followed by Saskatchewan (24%) and Newfoundland (21%).

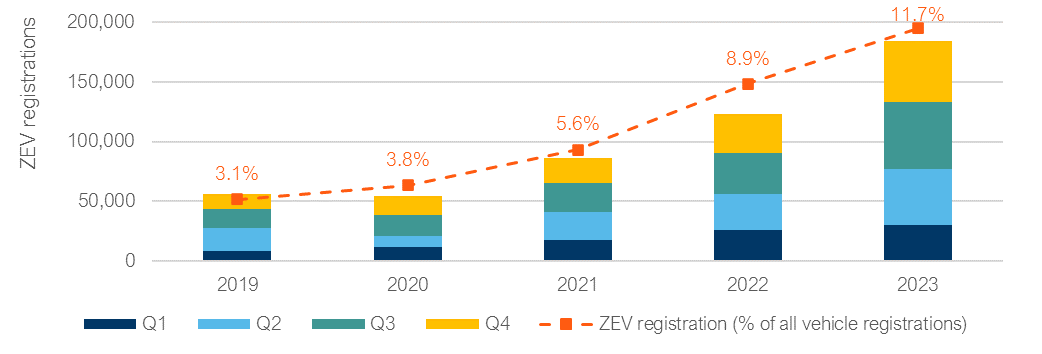

ZEV registrations and market trends

Total ZEV registrations as a percent of all vehicle registrations has steadily increased since 2017, reaching 11.7 % in 2023, as seen in Figure 2-4. With over 1.59 million vehicles registered in 2023, registrations are at their highest level since 2019, when over 1.83 million vehicles were registered. While still below pre-pandemic levels, 2023 registrations are notably higher than 2022, when only 1.41 million vehicles were registered due to supply chain issues and rising prices across certain automakers.Footnote 14 Overall, the fluctuation in yearly registrations did not affect the increased ZEV adoption trend shown below.

Figure 2-4. ZEV registrations in Canada since 2017 and as percentage of all new vehicle registrations14.

Text description

|

|

2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|

|

Q1 |

8275 |

11923 |

17285 |

26018 |

30533 |

|

Q2 |

19446 |

9203 |

24006 |

29832 |

46657 |

|

Q3 |

16186 |

17299 |

23962 |

34313 |

56232 |

|

Q4 |

12258 |

15928 |

20799 |

33399 |

51156 |

|

ZEV Registration % |

3.1% |

3.8% |

5.6% |

8.9% |

11.7% |

Canada's ZEV market was not isolated from the impact of global semiconductor chip shortage. Persisting throughout 2022, inventory levels dropped significantly for both ZEV and ICE vehicles, with one study revealing that dealerships across Canada saw a 79% reduction in 2022 inventory levels for all vehicle types. Footnote 15 The impacts of these supply chain disruptions persisted into 2023, as one report found inventory levels to be at 42% of pre-pandemic levels in the first quarter of 2023. However, as issues regarding semiconductor shortages continue to lessen, inventory levels in Canada appear to be recovering well. Footnote 16 Despite the volatility in yearly total vehicle sales, the Canadian ZEV market continued its strong growth, with 2023 sales increasing by 49% relative to 2022 - following a 44% increase from 2021 to 2022.Footnote 17

Large OEMs with popular ZEV models such as Tesla and Ford continue to significantly increase and invest in their ZEV manufacturing capabilities. Both automakers have also reduced their ZEV prices multiple times in 2023 and 2024, not only to become cost competitive with new ICE vehicles, but to also compete with the ever-growing selection of automakers that are now producing electric vehicles. Footnote 18 This new trend reverses some of the price increases these automakers had made throughout 2021 and 2022.

ZEV registrations in British Columbia, Ontario, and Quebec continued to drive nationwide registrations in 2023. 92% of 2023 ZEV registrations were in three provinces, with Quebec leading at 41%, followed by Ontario (27%), and BC (23%).Footnote 19

In 2023, Tesla's Model Y and Model 3 emerged as the best-selling models, with the Model Y surpassing the Model 3 to claim the top position, a shift from the previous year's rankings. The two Tesla's are followed by the Chevrolet Bolt EUV, the Mitsubishi Outlander, and Toyota's Rav4 Prime. The top five models accounted for 44% of total ZEV registrations in 2023, a decrease from 55% in 2022. The number of vehicles sold for the top five models for both 2023 and 2022 are shown below.

|

Model |

Powertrain |

2023 Registrations |

|---|---|---|

|

Tesla Model Y |

BEV |

34,660 |

|

Tesla Model 3 |

BEV |

19,217 |

|

Chevrolet Bolt EUV |

BEV |

11,003 |

|

Mitsubishi Outlander |

PHEV |

9,581 |

|

Toyota Rav4 Prime |

PHEV |

7,901 |

Source: S&P Global Mobility. 2023. New Vehicle Registration Data. Extracted on March 18th, 2024.

|

Model |

Powertrain |

2022 Registrations |

|---|---|---|

|

Tesla Model 3 |

BEV |

26,859 |

|

Tesla Model Y |

BEV |

25,409 |

|

Ford Mustang Mach-E |

BEV |

6,040 |

|

Hyundai Kona Electric |

BEV |

5,488 |

|

Hyundai Ioniq 5 |

BEV |

4,910 |

Source: S&P Global Mobility. 2023. New Vehicle Registration Data. Extracted on December 31, 2022.

Despite a slight contraction at the start of the year, the Canadian ZEV market has continued its overall growth in 2023. The first quarter of 2023 saw a decrease in ZEV market share, at 9.2%, compared to the last quarter of 2022 (10.2%). This was led by decreased volumes in Ontario and Quebec through lower registrations of both Tesla and Ford vehicles.Footnote 20 The second quarter of 2023 saw a recovery in registrations, with overall ZEV market share reaching 10.5%.Footnote 21 The growing market share trend continued into the third quarter, at which point ZEVs made up 13.4% of sales – a quarterly record.Footnote 22 The final quarter of the year saw ZEV registrations come in slightly lower, at 13.2%, which rounded out the year's registrations to 11.7%.Footnote 23

Notably, 2023 has seen the introduction of several new ZEV models in Canada, such as Vinfast's VF series and new offerings from Stellantis, like the Dodge Hornet and Alfa Romeo Tonale PHEVs. As evidenced by increasing ZEV registrations and the introduction of new vehicle models and price reductions of popular ZEV models like the Tesla Model 3, Model Y, and the Ford F-150 Lightning, ZEV demand in Canada is expected to continue to grow as the market further develops.

ZEV inventory: data and observations

This section presents the ZEV inventory data that was collected under this study and highlights observations from the data. The data is presented in five main subsections:

- ZEV inventory levels, where the absolute inventory numbers are presented by province and by automaker.

- Inventory relative to sales, where the data is presented in terms of “days of supply” based on the sales rate of each automaker.

- ZEV model diversity, where the number of distinct ZEV model options are presented by province and by automaker.

- Availability by dealership, with a focus on the number of ZEVs available in each dealership.

- Wait times, based on survey results from select automaker dealerships.

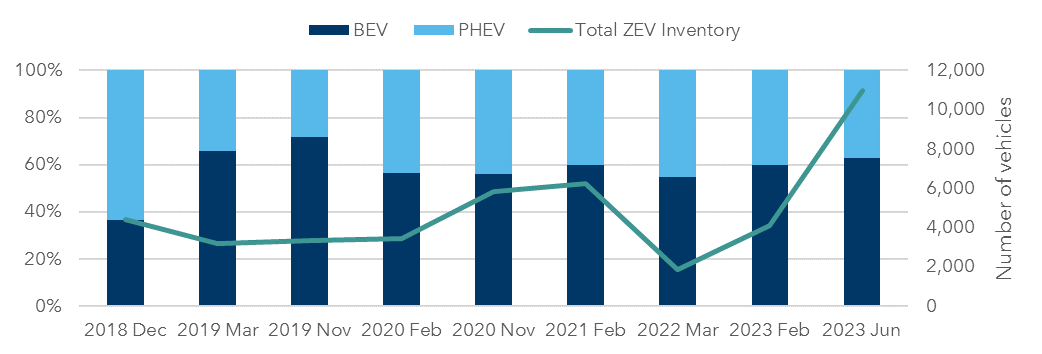

ZEV inventory levels

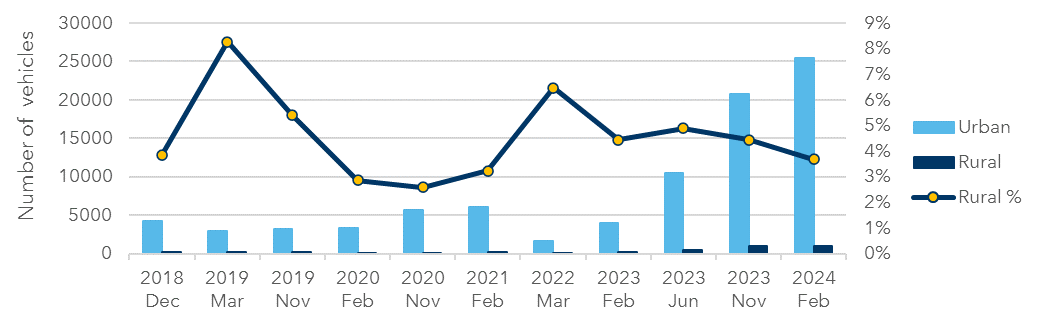

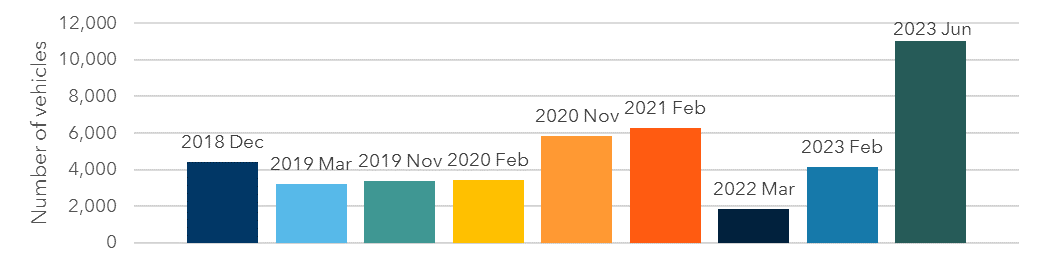

Figure 3-1 summarizes the ZEV inventory levels across Canada for each reporting period from December 2018 through February 2024. February 2024 showed the highest nationwide inventory available since the start of this analysis, reflecting a 21% increase over a three-month period (November 2023) and a six-fold increase over a year (February 2023). This is particularly significant considering that February historically has much lower sales volumes when compared with other months. While the year-over-year increase is notable, the February 2023 inventory was historically low, as levels were recovering from supply chain issues and general lack of model availability.

Figure 3-1. Vehicle inventory Canada-wide – all results

Text description

|

Time period |

2018 Dec |

2019 Mar |

2019 Nov |

2020 Feb |

2020 Nov |

2021 Feb |

2022 Mar |

2023 Feb |

2023 Jun |

2023 Nov |

2024 Feb |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Number of Vehicles |

4398 |

3193 |

3351 |

3414 |

5809 |

6241 |

1839 |

4143 |

11030 |

21786 |

26432 |

Table 31 and Table 32 provide detailed breakdowns of inventory results by province and automaker for each collection period. Inventory levels and make options increased significantly across provinces and geographic areas, both from November 2023 to February 2024 and relative to previous data collection periods. As of February 2024, 9 out of 29 automakers possessed ZEV inventory in all 10 provinces across Canada. This compares to six automakers in November 2023 and five in June 2023.

|

Automakers |

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Alfa Romeo |

22 |

19 |

|

13 |

55 |

19 |

|

|

|

|

128 |

|

Audi |

205 |

73 |

14 |

34 |

569 |

299 |

9 |

21 |

5 |

1,229 |

|

|

BMW |

276 |

74 |

3 |

199 |

154 |

4 |

1 |

2 |

713 |

||

|

Cadillac |

70 |

36 |

5 |

2 |

68 |

21 |

2 |

3 |

4 |

211 |

|

|

Chevrolet |

337 |

23 |

7 |

21 |

317 |

157 |

11 |

2 |

875 |

||

|

Chrysler |

11 |

11 |

2 |

25 |

66 |

1 |

7 |

123 |

|||

|

Dodge |

36 |

26 |

25 |

16 |

70 |

163 |

10 |

21 |

1 |

4 |

372 |

|

Ford |

1,510 |

497 |

97 |

196 |

2,933 |

3,173 |

117 |

100 |

37 |

55 |

8,715 |

|

Genesis |

7 |

6 |

3 |

3 |

36 |

73 |

2 |

3 |

133 |

||

|

Hyundai |

89 |

54 |

17 |

13 |

136 |

62 |

10 |

20 |

1 |

12 |

414 |

|

Jaguar |

5 |

3 |

1 |

14 |

4 |

2 |

29 |

||||

|

Jeep |

291 |

224 |

64 |

47 |

969 |

789 |

38 |

35 |

12 |

18 |

2,487 |

|

Kia |

56 |

71 |

8 |

10 |

86 |

75 |

9 |

5 |

1 |

6 |

327 |

|

Land Rover |

1 |

1 |

2 |

||||||||

|

Lexus |

8 |

3 |

5 |

15 |

31 |

||||||

|

Lincoln |

163 |

259 |

67 |

|

725 |

281 |

20 |

9 |

15 |

35 |

1,574 |

|

Mazda |

57 |

27 |

3 |

9 |

91 |

124 |

10 |

12 |

1 |

9 |

343 |

|

Mercedes |

175 |

24 |

15 |

|

298 |

138 |

7 |

7 |

|

1 |

665 |

|

Mini |

91 |

18 |

4 |

3 |

87 |

87 |

8 |

6 |

|

1 |

305 |

|

Mitsubishi |

35 |

34 |

2 |

|

78 |

21 |

2 |

3 |

|

2 |

177 |

|

Nissan |

167 |

7 |

2 |

2 |

112 |

285 |

|

|

1 |

|

576 |

|

Polestar |

13 |

|

|

|

|

16 |

|

|

|

|

29 |

|

Porsche |

53 |

69 |

3 |

7 |

54 |

62 |

1 |

249 |

|||

|

Subaru |

121 |

24 |

8 |

5 |

41 |

53 |

2 |

3 |

2 |

|

259 |

|

Tesla |

123 |

21 |

12 |

123 |

44 |

34 |

357 |

||||

|

Toyota |

73 |

5 |

5 |

125 |

208 |

||||||

|

VinFast |

18 |

|

|

|

35 |

|

|

|

|

|

53 |

|

Volkswagen |

266 |

59 |

9 |

11 |

83 |

232 |

15 |

20 |

|

7 |

702 |

|

Volvo |

73 |

74 |

6 |

|

235 |

100 |

9 |

|

|

3 |

500 |

|

November 2023 |

4,352 |

1,741 |

371 |

398 |

7,449 |

6,638 |

274 |

323 |

73 |

167 |

21,786 |

|

Automakers |

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Alfa Romeo |

42 |

20 |

|

15 |

118 |

144 |

|

|

|

|

339 |

|

Audi |

310 |

75 |

16 |

35 |

425 |

408 |

7 |

17 |

|

2 |

1,295 |

|

BMW |

477 |

97 |

|

|

494 |

387 |

3 |

1 |

|

1,459 |

|

|

Cadillac |

209 |

75 |

11 |

10 |

244 |

75 |

5 |

14 |

2 |

13 |

658 |

|

Chevrolet |

399 |

68 |

14 |

39 |

340 |

76 |

4 |

27 |

4 |

6 |

977 |

|

Chrysler |

26 |

7 |

2 |

3 |

138 |

97 |

4 |

19 |

|

|

296 |

|

Dodge |

114 |

78 |

40 |

13 |

254 |

412 |

20 |

24 |

8 |

8 |

971 |

|

Ford |

1,672 |

494 |

47 |

170 |

2,841 |

3,433 |

104 |

57 |

23 |

48 |

8,889 |

|

Genesis |

9 |

5 |

3 |

32 |

16 |

3 |

3 |

71 |

|||

|

Hyundai |

195 |

120 |

43 |

36 |

330 |

85 |

59 |

58 |

22 |

46 |

994 |

|

Jaguar |

|

|

|

|

5 |

|

|

|

|

|

5 |

|

Jeep |

498 |

268 |

80 |

51 |

1,267 |

961 |

27 |

31 |

8 |

17 |

3,208 |

|

Kia |

123 |

90 |

17 |

25 |

119 |

45 |

4 |

5 |

2 |

6 |

436 |

|

Land Rover |

33 |

|

|

4 |

5 |

|

|

|

|

42 |

|

|

Lexus |

33 |

1 |

|

|

2 |

14 |

|

|

|

|

50 |

|

Lincoln |

137 |

184 |

56 |

|

598 |

291 |

21 |

9 |

12 |

35 |

1,343 |

|

Mazda |

46 |

55 |

3 |

13 |

172 |

206 |

12 |

24 |

2 |

9 |

542 |

|

Mercedes |

295 |

30 |

13 |

|

483 |

245 |

11 |

21 |

|

4 |

1,102 |

|

Mini |

66 |

5 |

2 |

2 |

62 |

89 |

7 |

2 |

|

2 |

237 |

|

Mitsubishi |

65 |

63 |

16 |

31 |

231 |

126 |

30 |

9 |

12 |

12 |

595 |

|

Nissan |

85 |

5 |

|

2 |

186 |

479 |

|

1 |

1 |

|

759 |

|

Polestar |

1 |

|

|

|

|

15 |

|

|

|

|

16 |

|

Porsche |

72 |

38 |

3 |

5 |

62 |

90 |

3 |

|

|

273 |

|

|

Subaru |

69 |

18 |

7 |

7 |

42 |

196 |

2 |

4 |

1 |

|

346 |

|

Tesla |

68 |

20 |

12 |

|

110 |

79 |

19 |

|

|

308 |

|

|

Toyota |

121 |

13 |

2 |

|

45 |

82 |

3 |

1 |

|

1 |

268 |

|

VinFast |

14 |

|

|

|

50 |

3 |

|

|

|

|

67 |

|

Volkswagen |

93 |

|

|

14 |

131 |

163 |

|

|

|

2 |

403 |

|

Volvo |

|

|

|

|

272 |

211 |

|

|

|

|

483 |

|

February 2024 |

5,239 |

1,857 |

389 |

474 |

9,057 |

8,433 |

323 |

349 |

97 |

214 |

26,432 |

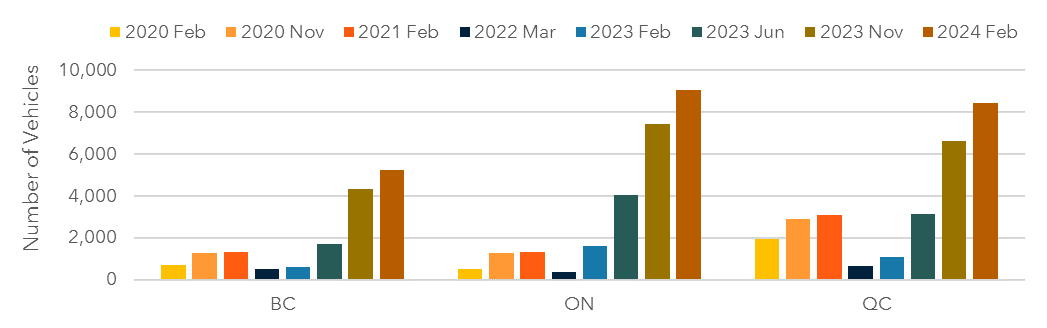

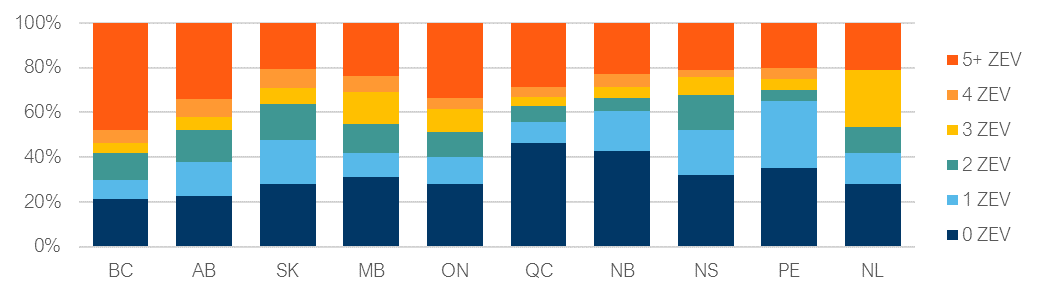

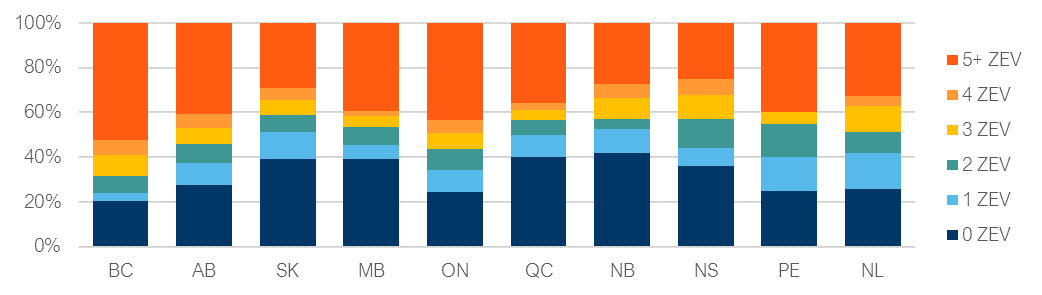

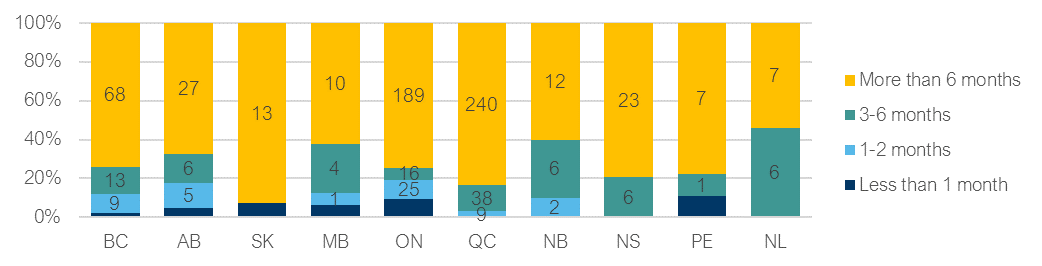

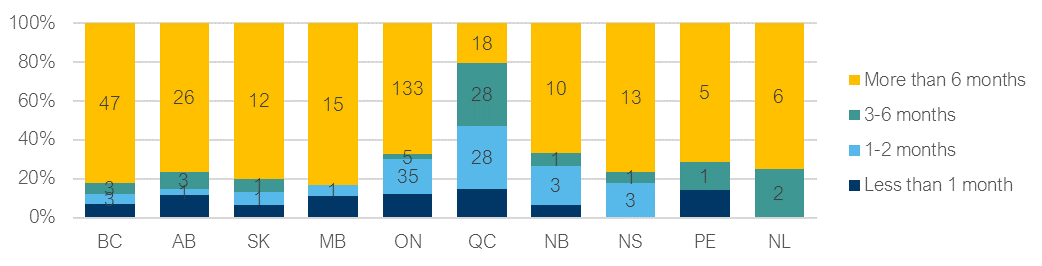

Availability by province

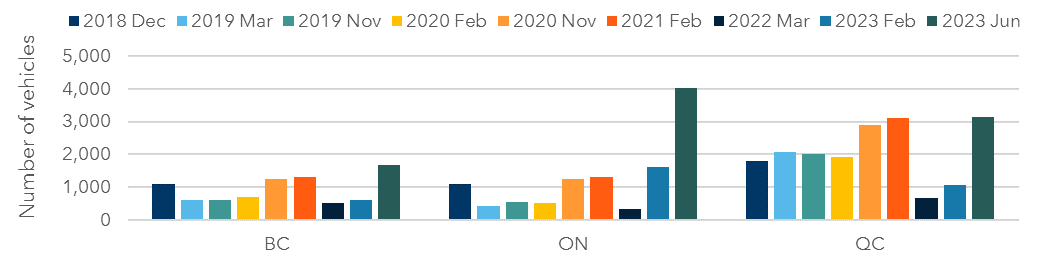

At the provincial level, the February 2024 inventory levels represent the highest inventory recorded for the three leading provinces – with the largest increase observed in Quebec. The concentration of ZEV inventory in Canada's three most populated provinces has increased for the November 2023 and February 2024 periods, averaging at 85% and 86%, respectively. This contrasts with the 80% concentration observed in the February and June 2023 data collections, 82% in 2022, 91% in 2021 and 92% in 2020. With the three major provinces making up about 75% of the total population in Canada, we consider this increased concentration in select provinces as a slight negative impact with regards to broader ZEV availability across Canada. The average inventory increase from February 2023 to February 2024 was 635% for the three provinces below.

Figure 3-2. Vehicle inventory by province – all results (BC, ON, QC).

Text description

|

|

2020 Feb |

2020 Nov |

2021 Feb |

2022 Mar |

2023 Feb |

2023 Jun |

2023 Nov |

2024 Feb |

|---|---|---|---|---|---|---|---|---|

|

BC |

690 |

1252 |

1307 |

516 |

617 |

1680 |

4352 |

5239 |

|

ON |

523 |

1253 |

1298 |

346 |

1621 |

4041 |

7499 |

9057 |

|

QC |

1923 |

2874 |

3102 |

656 |

1058 |

3135 |

6638 |

8843 |

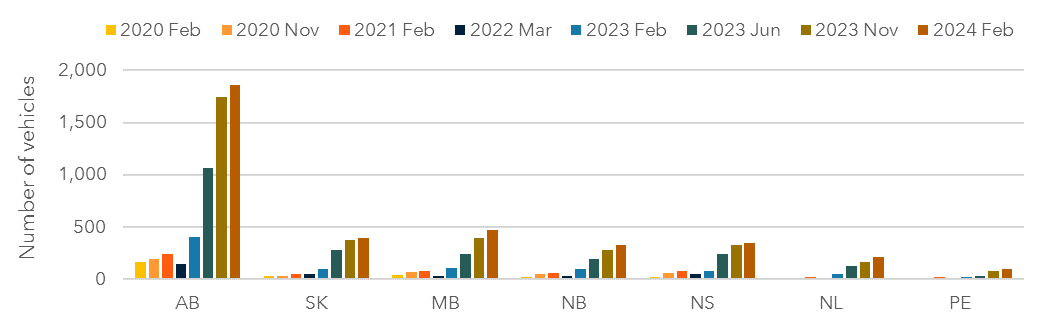

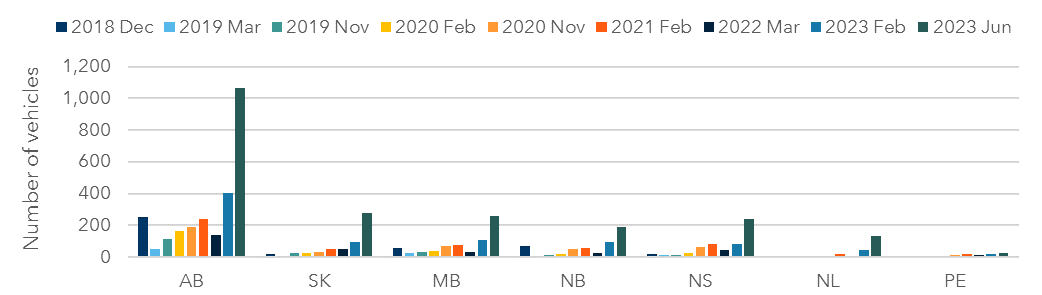

An increase in inventory was also apparent in other provinces across Canada. Every other province shown below saw their total inventory increase in the three months between November 2023 and February 2024 - with an average inventory increase of 17%. The average inventory increase from February 2023 to February 2024 was 333% for the provinces below.

Figure 3-3. Vehicle inventory by province – all results (AB, SK, MB, NB, NS, NL, PEI).

Text description

|

|

2020 Feb |

2021 Feb |

2022 Mar |

2023 Feb |

2023 Jun |

2023 Nov |

2024 Feb |

|---|---|---|---|---|---|---|---|

|

AB |

161 |

239 |

140 |

405 |

1063 |

1741 |

1857 |

|

SK |

26 |

51 |

48 |

93 |

279 |

371 |

389 |

|

MB |

36 |

73 |

33 |

110 |

243 |

398 |

474 |

|

NB |

21 |

55 |

27 |

92 |

192 |

274 |

323 |

|

NS |

22 |

80 |

50 |

82 |

240 |

323 |

349 |

|

NL |

8 |

20 |

9 |

44 |

130 |

167 |

214 |

|

PE |

4 |

16 |

14 |

21 |

27 |

73 |

97 |

To put these numbers into perspective, Figure 3-4 presents the inventory data between provinces normalized to population (based on 2021 Census data). As shown, every province across Canada increased their inventory levels over the last five data collection periods (since March 2022), with the most recent increases taking place in Canada's more densely populated provinces (with PEI being a positive outlier as it saw higher relative per capita growth than BC over the past year). As of February 2024, British Columbia leads in the number of ZEVs available per 100,000 people (105 ZEVs), followed by Quebec (99 ZEVs) and Ontario (64 ZEVs).

Figure 3-4. ZEVs available for purchase per 100,000 people

Text description

|

|

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

CAN |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

2020 Feb |

14 |

4 |

2 |

3 |

4 |

23 |

3 |

2 |

3 |

2 |

9 |

|

2020 Nov |

25 |

5 |

3 |

5 |

9 |

34 |

7 |

6 |

8 |

2 |

16 |

|

2021 Feb |

26 |

6 |

5 |

5 |

9 |

36 |

7 |

8 |

10 |

4 |

17 |

|

2022 Mar |

10 |

3 |

4 |

2 |

2 |

8 |

3 |

5 |

9 |

2 |

5 |

|

2023 Feb |

12 |

10 |

8 |

8 |

11 |

12 |

12 |

8 |

14 |

9 |

11 |

|

2023 Jun |

34 |

25 |

25 |

18 |

28 |

37 |

25 |

25 |

17 |

25 |

30 |

|

2023 Nov |

87 |

41 |

33 |

30 |

52 |

78 |

35 |

33 |

47 |

33 |

59 |

|

2024 Feb |

105 |

44 |

34 |

35 |

64 |

99 |

42 |

36 |

63 |

42 |

72 |

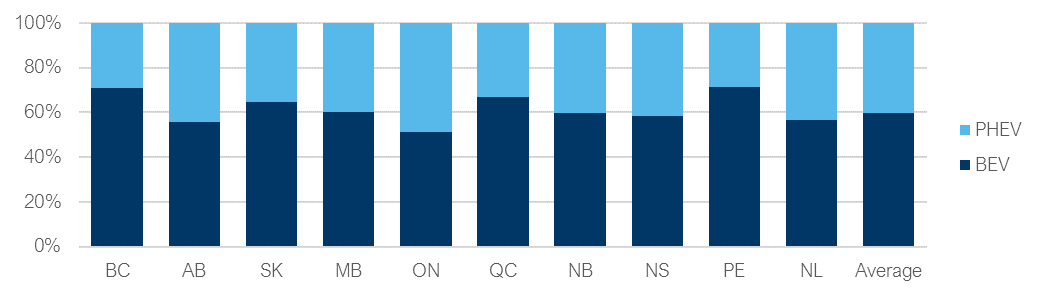

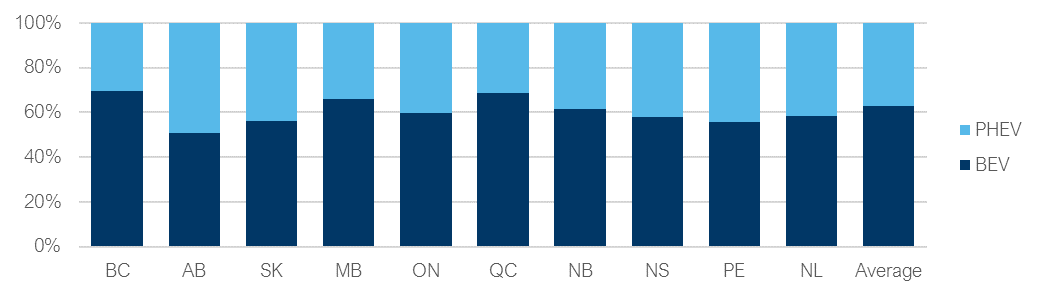

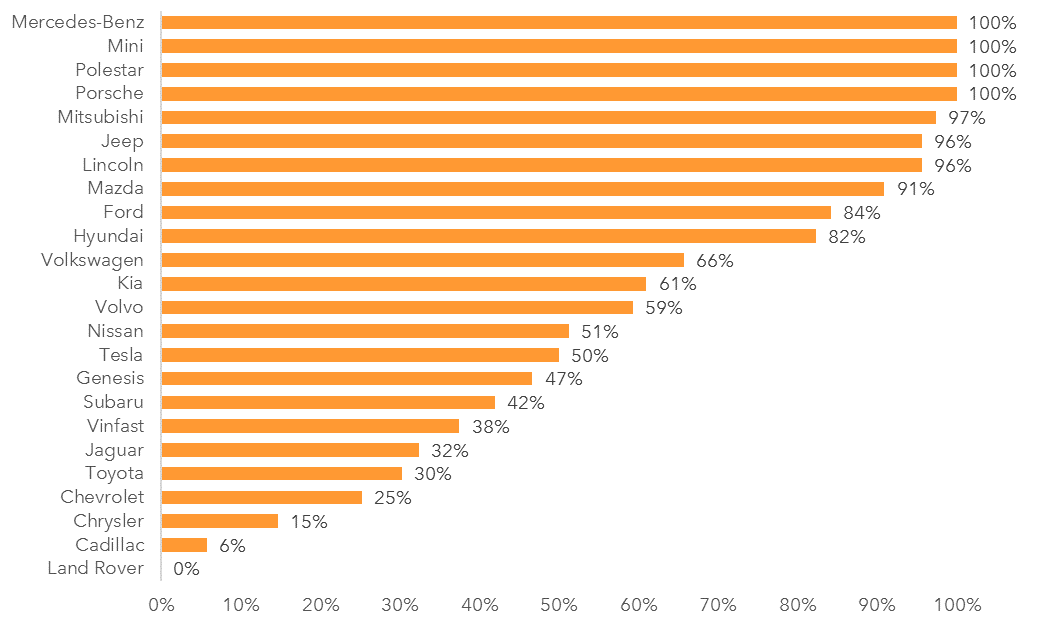

Availability by automaker

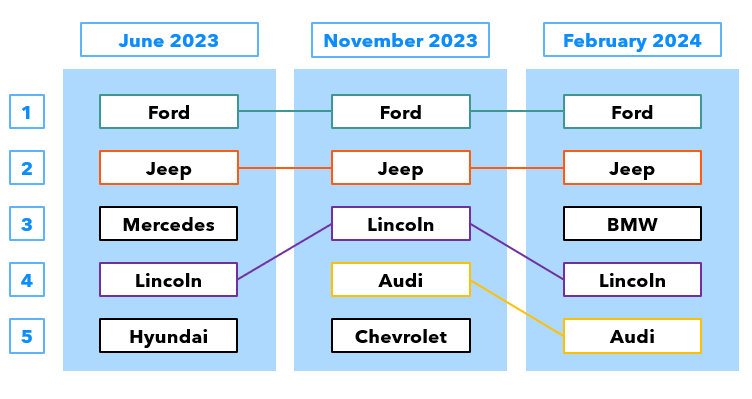

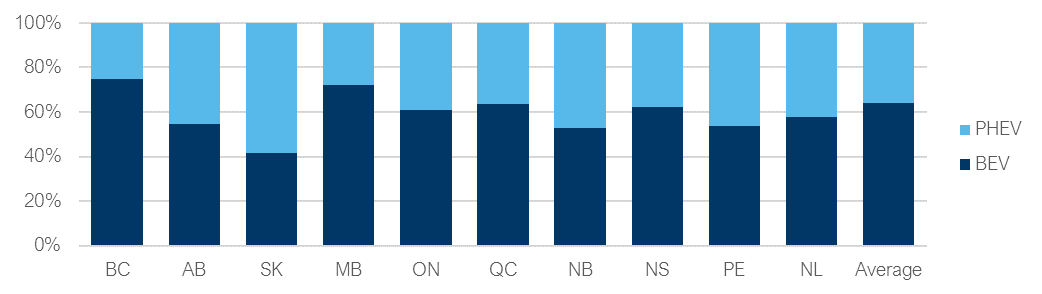

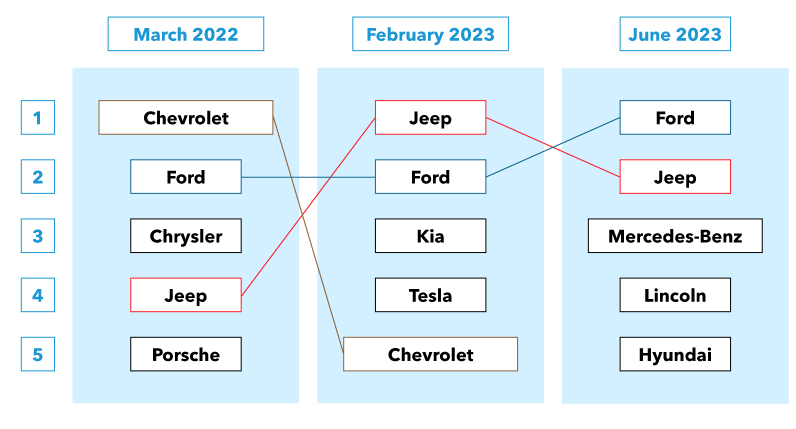

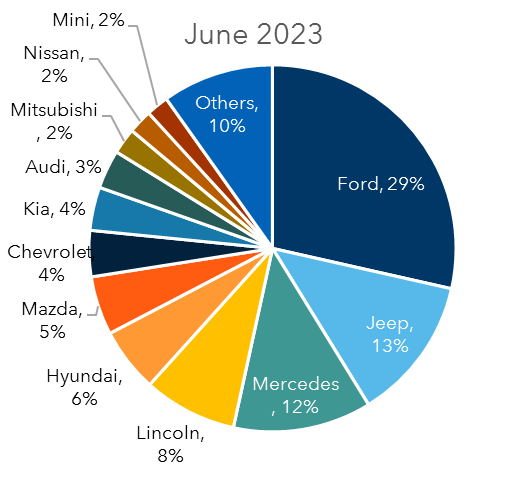

Inventory data from the November 2023 and February 2024 collection periods outline a steady trend in the distribution of ZEV availability across all automakers- with the top five ZEV automakers accounting for a 68% share of total inventories in November 2023 and 61% in February 2024. This compares to 67% in June 2023 and 58% in February 2023. Figure 3-5 below outlines the top 5 automakers by inventory availability for the three most recent data collection periods.

Figure 3-5. Top 5 Automakers by inventory availability.

Text description

June 2023

- Ford

- Jeep

- Mercedes

- Lincoln

- Hyundai

November 2023

- Ford

- Jeep

- Lincoln

- Audi

- Chevrolet

February 2024

- Ford

- Jeep

- BMW

- Lincoln

- Audi

As shown in the figure above, Ford, Jeep, and Lincoln are the only automakers that have stayed in the top five positions within the last three data collection periods. Ford's availability remains high across Canada amidst reports of increased sales and production of its EV models across North America in 2023.Footnote 24

Similarly, Jeep has been keeping its dealerships well stocked with its two plug-in hybrid vehicle offerings – the Wrangler 4xe and the Grand Cherokee 4xe - the former of which makes up almost 80% of the automaker's ZEV inventory across Canada.

BMW made up over 5% (1,459) of total ZEV inventory supply in February 2024 compared to just 3% (713) in November 2023 and just 1% (145) in June 2023. The significant increase in inventory in less than a year stems from BMW AG's strong EV demand outlook combined with efforts to catch up to Tesla and Chinese EV automakers that continue to pull away in the global EV sales race following aggressive price cuts throughout 2023.Footnote 25

Lincoln has consistently found itself within top five spots in terms of ZEV inventory over the past three data collection periods - ranging from 8% in June 2023, to 7% in November 2023 and most recently at 5% in February 2024.

With eight ZEV models targeting the luxury market, Audi has consistently contributed to a 5-6% range of Canada wide ZEV inventory over the past year (February 2023 to February 2024).

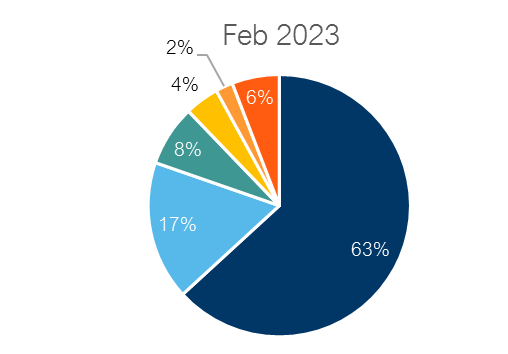

Figure 3-6. National ZEV inventory by automaker as a percentage of total inventory

Text description

|

OEM |

Ford |

Jeep |

Lincoln |

Audi |

Chevrolet |

BMW |

Volkswagen |

Mercedes-Benz |

Nissan |

Volvo |

Others |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Percentage |

40% |

11% |

7% |

6% |

4% |

3% |

3% |

3% |

3% |

2% |

17% |

Text description

|

OEM |

Ford |

Jeep |

BMW |

Lincoln |

Audi |

Mercedes-Benz |

Hyundai |

Chevrolet |

Dodge |

Nissan |

Cadillac |

Mitsubishi |

Mazda |

Others |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Percentage |

34% |

12% |

6% |

5% |

5% |

4% |

4% |

4% |

4% |

3% |

2% |

2% |

2% |

14% |

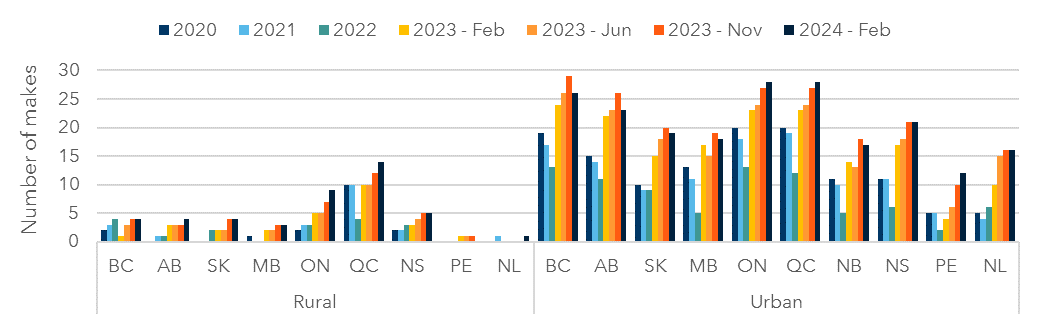

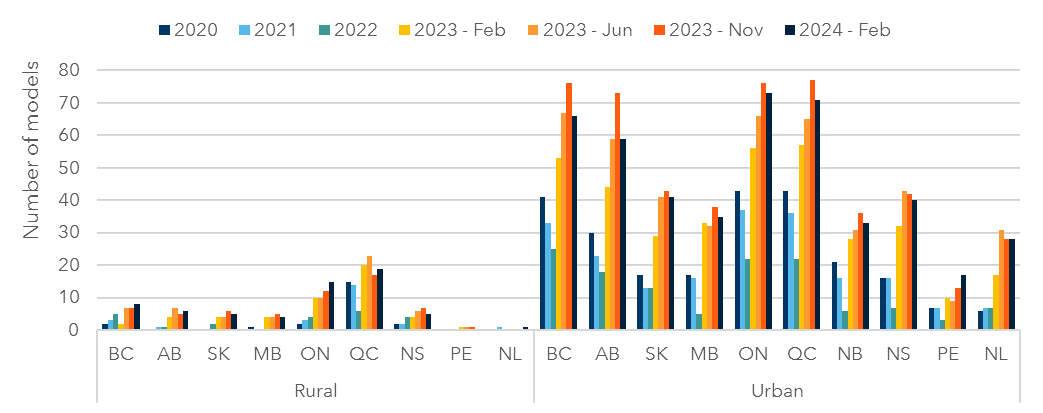

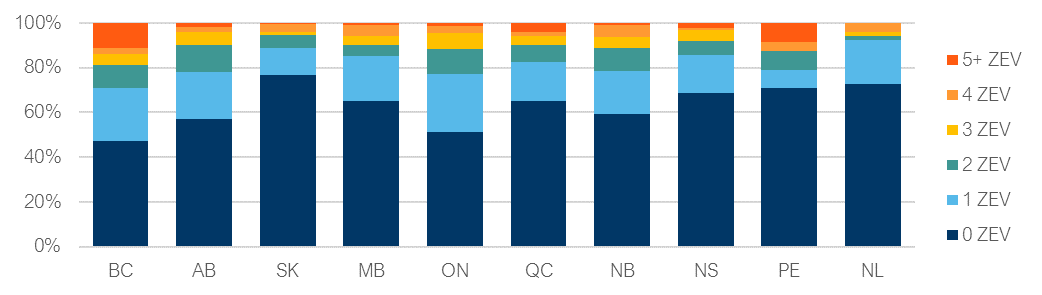

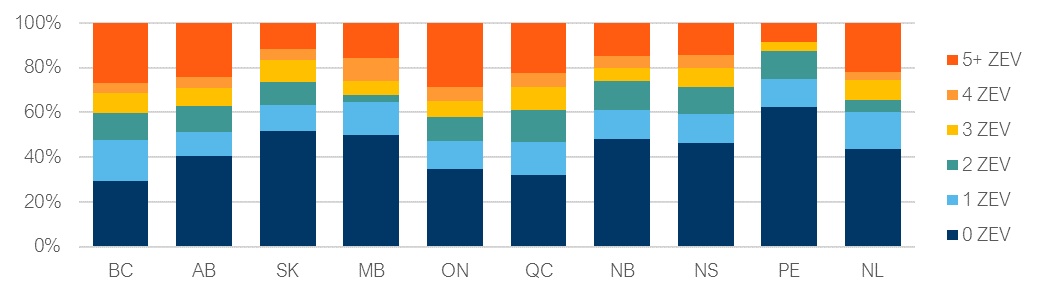

Availability by geography (urban vs. rural)

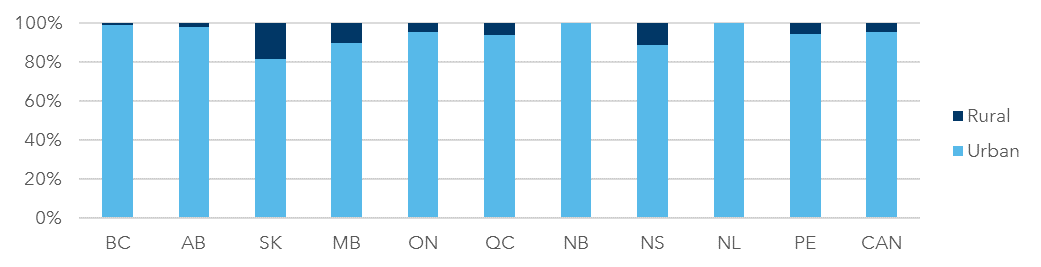

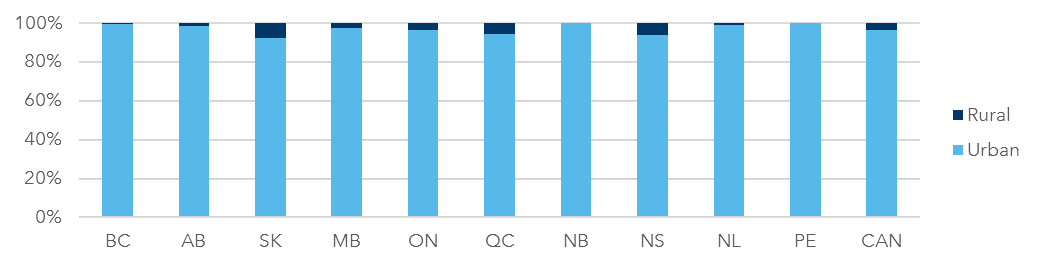

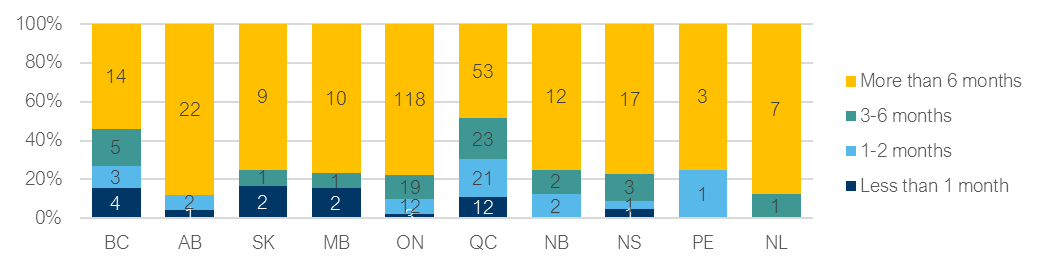

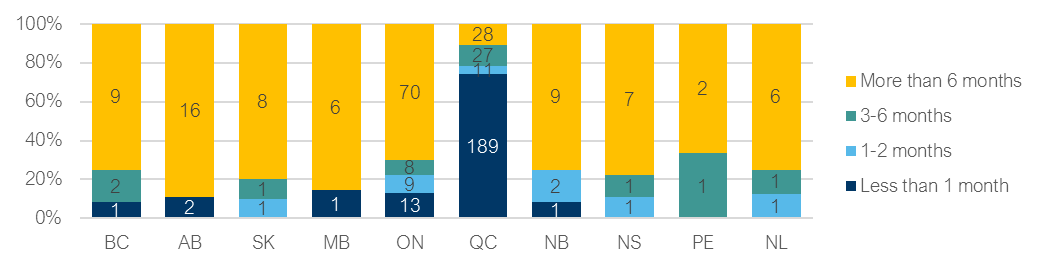

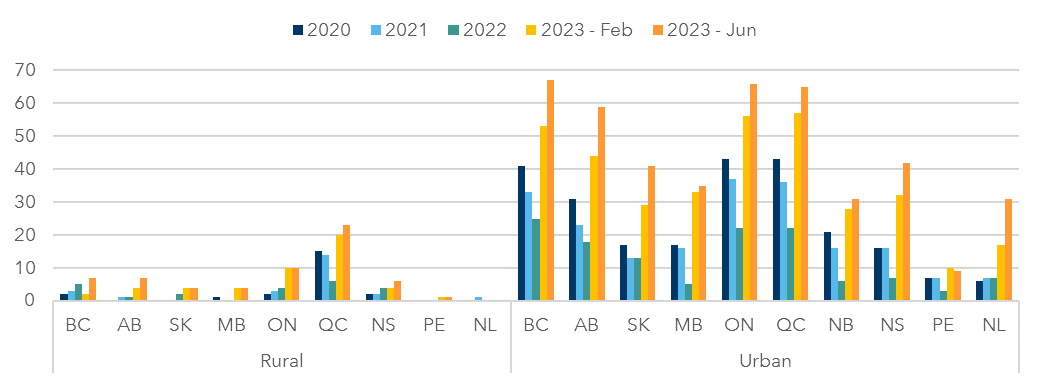

Inventory by geographic areas is shown for each data collection in Figure 3-7 and Figure 3-8, below. The key metric used to differentiate between urban and rural inventory was determined based on dealership postal codes, whereby postal codes containing 0s as the second character represent a rural area.Footnote 26 While this method is no longer used by Statistics Canada, which adopted the Population Centre and Rural Area Classification 2016 method to determine what constitutes a rural area versus an urban area (population centre), the postal code method is the most feasible and efficient way to collect this data in the context of this study.Footnote 27 It should be noted that this difference introduces some uncertainty relating to the data presented here.

Figure 3-7. ZEV inventory by geographic area – November 2023

Text description

|

|

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

NL |

PE |

CAN |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Urban |

99% |

98% |

81% |

90% |

95% |

94% |

100% |

89% |

100% |

95% |

96% |

|

Rural |

1 |

2% |

19% |

10% |

5% |

6% |

0% |

11% |

0% |

5% |

4% |

Figure 3-8. ZEV inventory by geographic area – February 2024

Text description

|

|

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

NL |

PE |

CAN |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Urban |

99% |

98% |

92% |

97% |

96% |

94% |

100% |

94% |

99% |

100% |

96% |

|

Rural |

1 |

2% |

8% |

3% |

4% |

6% |

0% |

6% |

1% |

0% |

4% |

As shown above, inventory levels by geographic area for both periods remained stable between November 2023 and February 2024 - with observable rural decreases shown in Saskatchewan, Manitoba, Nova Scotia, and Prince Edward Island in February. Overall, 18% of the Canadian provincial population is considered to live in rural areas with the provincial figures ranging from 13% (BC & ON) to 54% (PEI).Footnote 28

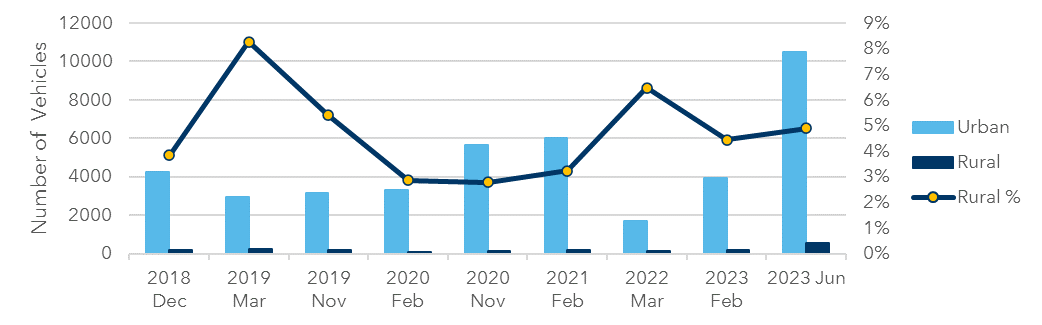

Figure 3-9. Inventory by geographic area and rural % inventory

Text description

|

|

2018 Dec |

2019 Mar |

2019 Nov |

2020 Feb |

2020 Nov |

2021 Feb |

2022 Mar |

2023 Feb |

2023 Jun |

2023 Nov |

2024 Feb |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Urban |

4229 |

2929 |

3170 |

3316 |

5658 |

6039 |

1720 |

3959 |

10490 |

20819 |

25457 |

|

Rural |

169 |

264 |

181 |

98 |

151 |

202 |

119 |

184 |

540 |

967 |

975 |

|

Rural % |

4% |

8% |

5% |

3% |

3% |

3% |

6% |

4% |

5% |

4% |

4% |

Figure 3-9 above outlines the change in urban vs rural inventory since December 2018 along with the percentage of total rural inventory across Canada. Rural inventory made up 3.8% of total inventory across Canada in February 2024. This compares to 4.4% in November 2023 and 4.9% in June 2023.

Inventory Relative to Sales

This section evaluates the adequacy of ZEV inventories using a common dealership inventory metric that combines inventory levels with historic vehicle sales rates: days of supply.

Days of supply

A metric for dealership inventory

Car dealerships use inventory management practices to balance the selection of vehicles available to customers with the demand for those vehicles. Days of supply is a common metric used to manage inventory, developed using historical sales data and used when determining which and how many models should be ordered. Using sales data, dealerships can calculate the number of a particular model of vehicle that are sold per day. These values are then used to fill orders for new vehicles to ensure that enough vehicles will be available to meet expected demand.

Dealerships will typically have guidelines for the minimum and maximum number of days they aim to stock vehicles for. Based on industry feedback, this report uses an optimal days of supply threshold range between 40 and 80.

For any given period “X”, the following equation is used to calculate the days of supply metric:

Days of supply(period X) = (Current inventoryperiod X / Number of vehicles soldperiod X × Number of days(period X)

Table 3-3 & Table 3-4 below summarize days of supply for inventory collected in November 2023 and February 2024 with sales data from October to December 2023. Table 3-5 summarizes the days of supply across all data collection periods, aggregated to the provincial level for each respective period. It should be noted that the days of supply metric may be of limited use for automakers given certain industry trends. In particular:

- As previously described, Tesla, VinFast, and Polestar use a factory-order model – an inventory model most seen in the luxury vehicle market – whereby they allow consumers to place customized orders instead of stocking a variety of vehicles for purchase on the lot. Given Tesla's high sales per day rates and low inventory model, as well as VinFast and Polestar's recent entry into the Canadian market, the days of supply metric will skew the aggregated calculations across provinces and Canada-wide.

- It is important to assess the days of supply metric in combination with the absolute inventory values presented in Table 3-1 and Table 3-2 to allow for a fulsome picture of how inventory is tracking with sales rates.

- When assessing EV markets, an apparent ‘over-supply' can be a result of low historical sales rather than high inventory levels. In these markets, a higher days of supply target may be warranted to recognize that historic sales are likely a poor indicator of true demand given the historic lack of availability.

The average days of supply for ZEVs across Canada was 47 days in February 2024, marking a significant increase in inventory levels across provinces and automakers relative to the previous year where the days of supply of ZEVs was 18 days (February 2023). The 47 days of supply for February 2024 is within the target supply range by traditional auto industry standards. Additional insights on the results by province and automaker are provided below.

Table 3-3. Days of supply by province and automaker – November 2023

|

Over-supply |

> 80 |

|

Target-supply |

|

|

Under-supply |

< 40 |

|

No inventory |

|

|

No sales data |

|

|

|

|

|

Automaker |

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

All |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Alfa Romeo |

96 |

350 |

|

239 |

153 |

22 |

|

|

|

|

82 |

|

Audi |

31 |

146 |

143 |

348 |

77 |

26 |

69 |

129 |

31 |

46 |

|

|

BMW |

59 |

77 |

55 |

35 |

30 |

61 |

8 |

31 |

42 |

||

|

Cadillac |

126 |

110 |

153 |

15 |

37 |

23 |

31 |

92 |

123 |

54 |

|

|

Chevrolet |

84 |

44 |

59 |

114 |

63 |

6 |

21 |

12 |

23 |

||

|

Chrysler |

32 |

84 |

34 |

31 |

23 |

107 |

35 |

||||

|

Dodge |

368 |

266 |

1,150 |

491 |

129 |

134 |

184 |

644 |

|

368 |

176 |

|

Ford |

175 |

216 |

319 |

225 |

243 |

146 |

127 |

133 |

170 |

169 |

181 |

|

Genesis |

13 |

42 |

46 |

46 |

28 |

118 |

138 |

47 |

|||

|

Hyundai |

12 |

22 |

36 |

16 |

12 |

2 |

11 |

12 |

3 |

25 |

8 |

|

Jaguar |

115 |

|

|

|

215 |

368 |

|

|

|

|

192 |

|

Jeep |

146 |

162 |

151 |

197 |

269 |

148 |

117 |

101 |

221 |

166 |

180 |

|

Kia |

12 |

65 |

46 |

16 |

16 |

5 |

18 |

18 |

8 |

24 |

11 |

|

Land Rover |

31 |

|

|

|

|

|

|

|

|

|

4 |

|

Lexus |

6 |

10 |

|

|

4 |

8 |

|

|

|

|

6 |

|

Lincoln |

714 |

1,702 |

3,082 |

|

981 |

631 |

460 |

414 |

1,380 |

|

925 |

|

Mazda |

56 |

104 |

69 |

75 |

50 |

35 |

131 |

65 |

31 |

138 |

48 |

|

Mercedes |

53 |

35 |

230 |

|

47 |

44 |

92 |

59 |

|

31 |

48 |

|

Mini |

147 |

237 |

368 |

|

133 |

98 |

736 |

92 |

|

|

129 |

|

Mitsubishi |

7 |

24 |

15 |

|

16 |

1 |

3 |

5 |

|

31 |

6 |

|

Nissan |

53 |

81 |

92 |

46 |

110 |

51 |

15 |

57 |

|||

|

Polestar |

14 |

3 |

4 |

||||||||

|

Porsche |

106 |

635 |

138 |

129 |

53 |

119 |

92 |

111 |

|||

|

Subaru |

114 |

147 |

736 |

58 |

99 |

14 |

46 |

55 |

184 |

46 |

|

|

Tesla |

3 |

3 |

22 |

|

2 |

1 |

|

24 |

|

|

2 |

|

Toyota |

8 |

7 |

1 |

4 |

5 |

||||||

|

VinFast |

41 |

38 |

21 |

||||||||

|

Volkswagen |

50 |

170 |

207 |

67 |

34 |

14 |

39 |

80 |

|

43 |

27 |

|

Volvo |

35 |

58 |

276 |

57 |

12 |

55 |

276 |

30 |

|||

|

AllFootnote 29 |

37 |

78 |

124 |

80 |

51 |

26 |

47 |

42 |

39 |

60 |

38 |

Table 3-4. Days of supply by province and automaker – February 2024

|

Over-supply |

> 80 |

|

Target-supply |

|

|

Under-supply |

< 40 |

|

No inventory |

|

|

No sales data |

|

|

|

|

|

Automaker |

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

All |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Alfa Romeo |

184 |

368 |

|

276 |

329 |

168 |

|

|

|

|

217 |

|

Audi |

47 |

150 |

164 |

358 |

58 |

36 |

54 |

104 |

12 |

49 |

|

|

BMW |

103 |

101 |

86 |

76 |

46 |

8 |

86 |

||||

|

Cadillac |

377 |

230 |

337 |

77 |

134 |

81 |

77 |

429 |

184 |

399 |

168 |

|

Chevrolet |

100 |

130 |

117 |

211 |

67 |

3 |

14 |

52 |

23 |

61 |

25 |

|

Chrysler |

75 |

54 |

184 |

189 |

46 |

92 |

291 |

84 |

|||

|

Dodge |

1,165 |

797 |

1,840 |

399 |

467 |

338 |

368 |

736 |

|

736 |

457 |

|

Ford |

194 |

214 |

154 |

196 |

235 |

158 |

113 |

76 |

106 |

147 |

185 |

|

Genesis |

17 |

77 |

46 |

25 |

26 |

138 |

25 |

||||

|

Hyundai |

26 |

49 |

90 |

44 |

28 |

3 |

63 |

34 |

72 |

94 |

18 |

|

Jaguar |

|

|

|

|

77 |

|

|

|

|

|

42 |

|

Jeep |

249 |

194 |

189 |

213 |

352 |

180 |

83 |

89 |

147 |

156 |

232 |

|

Kia |

27 |

83 |

98 |

41 |

22 |

3 |

8 |

18 |

15 |

24 |

15 |

|

Land Rover |

|

759 |

|

|

26 |

115 |

|

|

|

|

155 |

|

Lexus |

25 |

3 |

|

|

2 |

7 |

|

|

|

|

10 |

|

Lincoln |

600 |

1,209 |

2,576 |

|

809 |

653 |

483 |

414 |

1,104 |

|

787 |

|

Mazda |

45 |

211 |

69 |

109 |

95 |

58 |

158 |

130 |

61 |

138 |

75 |

|

Mercedes |

90 |

43 |

199 |

|

76 |

79 |

145 |

176 |

|

123 |

80 |

|

Mini |

107 |

66 |

184 |

|

95 |

100 |

644 |

31 |

|

|

100 |

|

Mitsubishi |

12 |

44 |

123 |

119 |

47 |

8 |

52 |

14 |

79 |

184 |

21 |

|

Nissan |

27 |

58 |

46 |

182 |

85 |

23 |

15 |

75 |

|||

|

Polestar |

1 |

3 |

2 |

||||||||

|

Porsche |

144 |

350 |

138 |

92 |

61 |

173 |

276 |

122 |

|||

|

Subaru |

65 |

110 |

644 |

81 |

102 |

52 |

46 |

74 |

92 |

62 |

|

|

Tesla |

2 |

3 |

22 |

|

2 |

2 |

|

13 |

|

|

2 |

|

Toyota |

13 |

18 |

12 |

13 |

3 |

11 |

2 |

7 |

6 |

||

|

VinFast |

32 |

54 |

2 |

26 |

|||||||

|

Volkswagen |

17 |

|

|

86 |

54 |

10 |

|

|

|

12 |

16 |

|

Volvo |

66 |

25 |

29 |

||||||||

|

AllFootnote 30 |

45 |

84 |

130 |

95 |

62 |

33 |

55 |

46 |

48 |

81 |

47 |

Table 3-5. Days of supply by province and data collection period – all periods

|

Over-supply |

> 80 |

|

Target-supply |

|

|

Under-supply |

< 40 |

|

No inventory |

|

|

No sales data |

|

|

|

|

|

Period |

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

All |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Feb 2024 |

45 |

84 |

130 |

95 |

62 |

33 |

55 |

46 |

48 |

81 |

47 |

|

Nov 2023 |

37 |

78 |

124 |

80 |

51 |

26 |

47 |

42 |

39 |

60 |

38 |

|

Jun 2023 |

13 |

51 |

92 |

56 |

27 |

14 |

32 |

35 |

14 |

41 |

20 |

|

Feb 2023 |

7 |

41 |

50 |

45 |

25 |

14 |

39 |

22 |

49 |

48 |

18 |

|

Mar 2022* Footnote 31 |

44 |

65 |

65 |

72 |

18 |

11 |

86 |

52 |

368 |

119 |

36 |

|

Feb 2021* |

67 |

120 |

177 |

119 |

98 |

49 |

109 |

130 |

147 |

86 |

62 |

|

Nov 2020* |

56 |

89 |

87 |

132 |

86 |

40 |

115 |

126 |

79 |

37 |

51 |

|

Feb 2020* |

19 |

47 |

53 |

50 |

22 |

29 |

47 |

43 |

28 |

67 |

26 |

|

Nov 2019* |

12 |

24 |

39 |

35 |

16 |

24 |

16 |

20 |

20 |

31 |

19 |

|

Nov 2018* |

49 |

100 |

87 |

128 |

23 |

37 |

501 |

115 |

0 |

56 |

36 |

|

* Excludes Tesla and days of supply numbers are based on a simple average (as opposed to weighted). |

|||||||||||

Results by Province

Supply days by province continue to vary across the country. Amidst a streak of record inventory levels over the last three data collection periods, February 2024 inventory saw 47 average days of supply for ZEV vehicles across Canada – putting it within target supply for the first time since 2021. Quebec was the only province considered to be under-supplied, with 33 days of ZEV supply in the latest data collection period. This contrasts with SK, MB, AB, and NL, which were each considered as oversupplied with 130, 95, 84, and 81 days of supply, respectively.

By comparison, November 2023 inventory saw 38 average days of supply for ZEV vehicles – falling just shy of the target-supply range of 40-80. Despite having a lower average day of supply relative to February 2024, more than half of the provinces saw their supply of ZEVs within the target range. Conversely, QC, BC, and PEI were each considered undersupplied in November, whereas SK was the only oversupplied province.

Results by automaker

It should be noted that the days of supply metric has limited use when assessing EV markets. An apparent ‘over-supply' can be a result of low historic sales rather than high inventory levels.

The make with the highest days of supply across Canada in February 2024 was Lincoln, at 787 days, whereas Tesla and Polestar both had the lowest days of ZEV supply at just two days. Assessed on a Canada-wide basis, Audi, Jaguar, Mazda, Mercedes-Benz, Nissan, and Subaru were the only automakers within the target days of supply range. Eleven automakers, managed to meet or exceed demand (as measured through days of supply), resulting in an over-supply Canada-wide. Among these 11, Dodge and Lincoln both saw oversupplies in every province they operate in. The remaining 12 automakers fell short of the 40-80 days of supply target range.

Of note, Tesla's high sales values paired with low inventory values (due to their factory-order model) results in skewing province-wide and Canada-wide days of supply calculations. Tesla's performance also highlights that having ZEVs available in inventory is not essential for achieving high ZEV sales, at least for some segments of the market.

ZEV model diversity

Availability by province

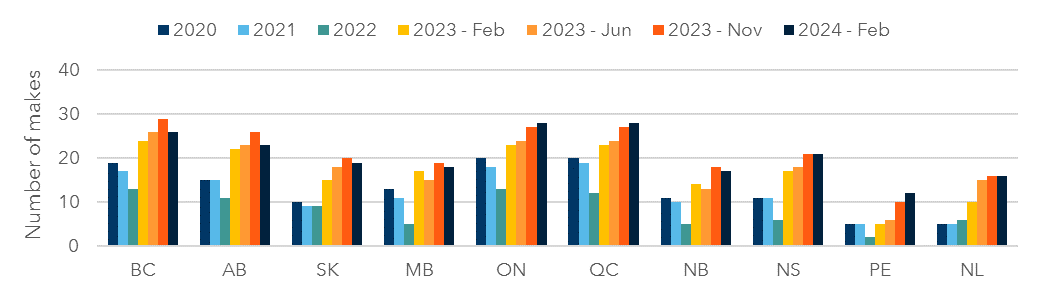

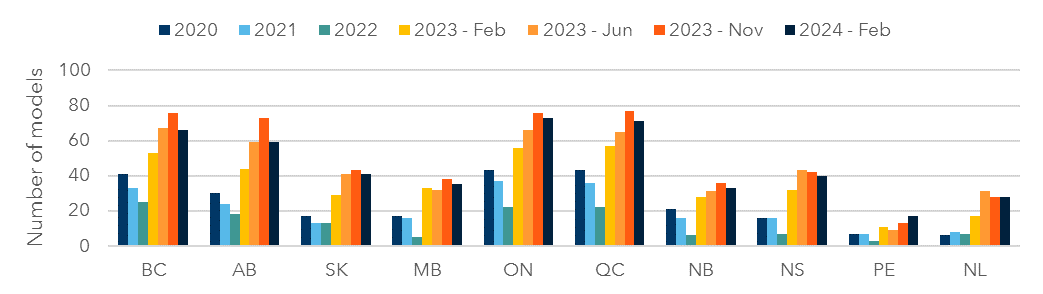

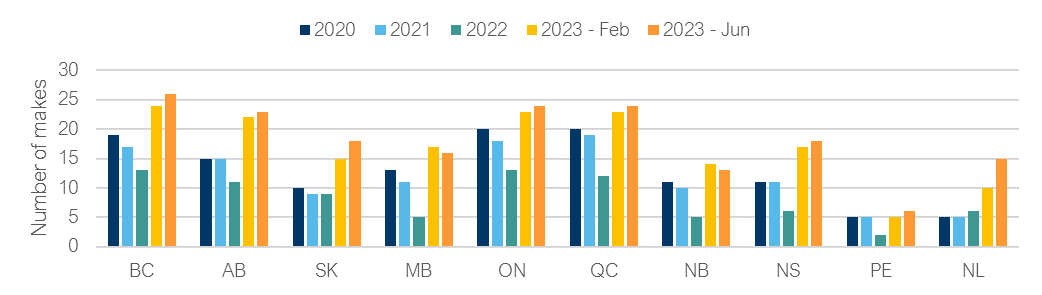

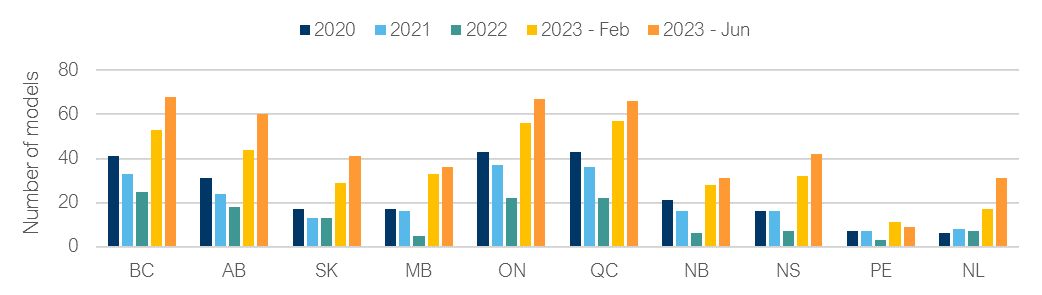

The number of unique ZEV makes and models available in each province are shown in Figure 3-10 and Figure 3-11 below, highlighting the selection available to consumers. The number of makes available by province increased when compared to previous years, reversing the historical downward trend most provinces saw from 2020 through 2022. Like previous years, Canada's three most populated provinces— British Columbia, Ontario, and Quebec—lead with the greatest ZEV selections for customers, both in terms of makes and models.

Over the past year (February 2023 to 2024), every province saw make and model availabilities increase. From November 2023 to February 2024, five provinces (BC, AB, SK, MB, NB) saw their make availabilities marginally decrease with the remaining provinces staying flat (NS, NL) or slightly increasing (ON, QC, PE).

Regarding models, eight provinces (BC, AB, SK, MB, ON, QC, NB, NS) saw their availabilities decrease from November 2023 to February 2024, whereas PE saw an increase of four models and NL was flat.

Figure 3-10. Number of makes available by province

Text description

|

|

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

|---|---|---|---|---|---|---|---|---|---|---|

|

2020 |

19 |

15 |

10 |

13 |

20 |

20 |

11 |

11 |

5 |

5 |

|

2021 |

17 |

15 |

9 |

11 |

18 |

19 |

10 |

11 |

5 |

5 |

|

2022 |

13 |

11 |

9 |

5 |

13 |

12 |

5 |

6 |

2 |

6 |

|

2023-Feb |

24 |

22 |

15 |

17 |

23 |

23 |

14 |

17 |

5 |

10 |

|

2023-Jun |

26 |

23 |

18 |

15 |

24 |

24 |

13 |

18 |

6 |

15 |

|

2023-Nov |

29 |

26 |

20 |

19 |

27 |

27 |

18 |

21 |

10 |

16 |

|

2024-Feb |

26 |

23 |

19 |

18 |

28 |

28 |

17 |

21 |

12 |

16 |

Figure 3-11. Number of models available by province

Text description

|

|

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

|---|---|---|---|---|---|---|---|---|---|---|

|

2020 |

41 |

30 |

17 |

17 |

43 |

43 |

21 |

16 |

7 |

6 |

|

2021 |

33 |

24 |

13 |

16 |

37 |

36 |

16 |

16 |

7 |

8 |

|

2022 |

25 |

18 |

13 |

5 |

22 |

22 |

6 |

7 |

3 |

7 |

|

2023-Feb |

53 |

44 |

29 |

33 |

56 |

57 |

28 |

32 |

11 |

17 |

|

2023-Jun |

67 |

59 |

41 |

32 |

66 |

65 |

31 |

43 |

9 |

31 |

|

2023-Nov |

76 |

73 |

43 |

38 |

76 |

77 |

36 |

42 |

13 |

28 |

|

2024-Feb |

66 |

59 |

41 |

35 |

73 |

71 |

33 |

40 |

17 |

28 |

Compared to previous years, the number of makes and models available to ZEV shoppers in the last two data collection periods has improved significantly from the lows observed in 2022. This can be attributed to a rebound in inventories across Canada along with new models coming onto the market. Overall, half of the provinces had the same or more brands to purchase from in February 2024 relative to November 2023.

Conversely, model optionality decreased slightly in every province in February 2024 expect for PE and NL. This is most likely due to inventory rollover of 2023 models that were available in November 2023 while the updated 2024 version of these models may not have yet been available in certain provinces in February 2024.

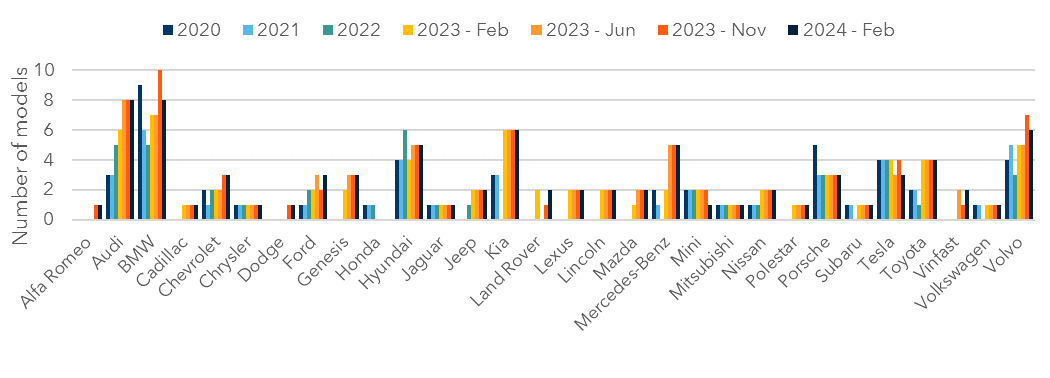

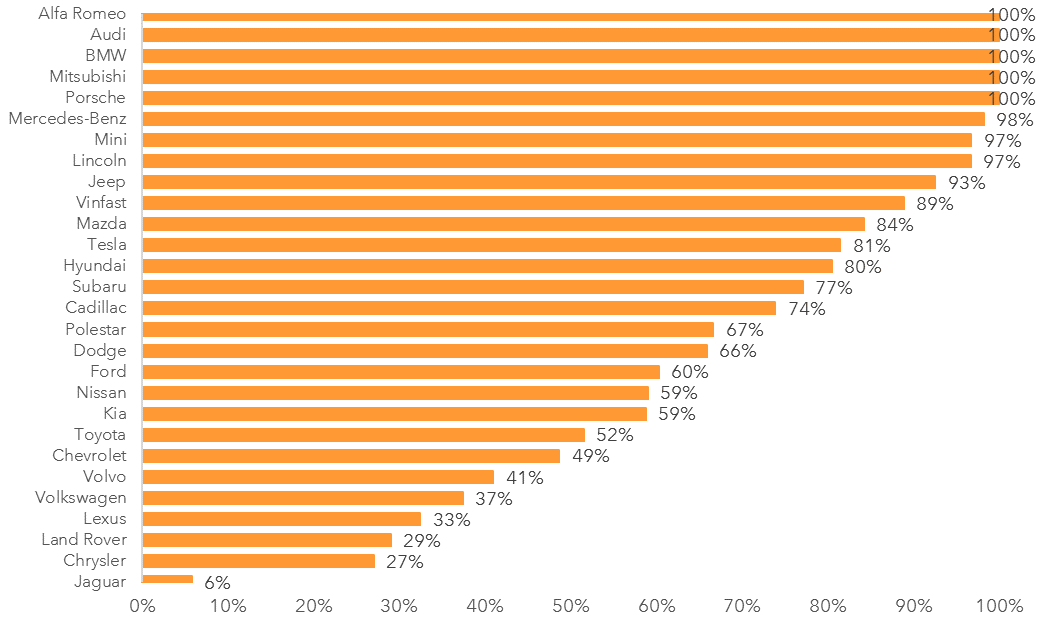

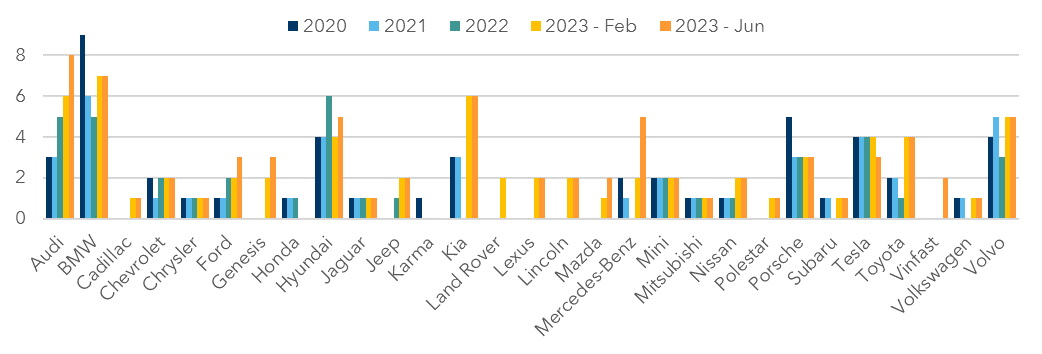

Availability by automaker

The number of unique models available in inventory from each automaker is shown in Figure 3-12, below. Based on the two latest data collection periods, availability of different automaker models has stabilized with more than two-thirds of automakers maintaining the same number of models available since June 2023. Audi and BMW each had eight different models available in February 2024, whereas BMW had a total of 10 models on offer in November 2023.

BMW, Mini, Tesla, and Volvo were the only makes that saw their February 2024 model options decrease relative to November 2023. Whereas Ford, Land Rover, and VinFast were the only manufacturers that saw their model options increase (each by one model).

Figure 3-12. Number of ZEV models available in dealership inventory by automaker across Canada

Text description

|

|

2020 |

2021 |

2022 |

2023-Feb |

2023-Jun |

2023-Nov |

2024-Feb |

|---|---|---|---|---|---|---|---|

|

Alfa Romeo |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

|

Audi |

3 |

3 |

5 |

6 |

8 |

8 |

8 |

|

BMW |

9 |

6 |

5 |

7 |

7 |

10 |

8 |

|

Cadillac |

0 |

0 |

0 |

1 |

1 |

1 |

1 |

|

Chevrolet |

2 |

1 |

2 |

2 |

2 |

3 |

3 |

|

Chrysler |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

|

Dodge |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

|

Ford |

1 |

1 |

2 |

2 |

3 |

2 |

3 |

|

Genesis |

0 |

0 |

0 |