1.1 Summary Information

1.1.1 Raison d'être and Responsibilities

Parliament has declared that "a competitive, economic and efficient national transportation system that meets the highest practicable safety and security standards and contributes to a sustainable environment and makes the best use of all modes of transportation at the lowest total cost is essential to serve the needs of its users, advance the well-being of Canadians and enable competitiveness and economic growth in both urban and rural areas throughout Canada". [1]

Transport Canada's mission is to serve the public interest through the promotion of a safe and secure, efficient and environmentally responsible transportation system in Canada, one that provides access to markets for natural resources, agricultural products and manufactured goods, and supports service industries. It meets the challenges posed by topography and geography, linking communities and reducing the negative effects of the distance that separates people. These vital roles reflect transportation's interdependent relationship with all sectors of the economy and society.

Our Vision

A transportation system in Canada that is recognized worldwide as safe and secure, efficient and environmentally responsible.

Our vision of a sustainable transportation system integrates and balances social, economic and environmental objectives. It is guided by these three principles:

- the highest possible safety and security of life and property, supported by performance-based standards and regulations when necessary;

- the efficient movement of people and goods to support economic prosperity and a sustainable quality of life, based on competitive markets and targeted use of regulation and government funding; and

- respect for the environmental legacy of future generations of Canadians, guided by environmental assessment and planning processes in transportation decisions and selective use of regulation and government funding.

Many organizations at several levels of government, as well as transportation service providers and users, play their part in Canada's transportation system. Transport Canada develops the federal Government's Canada-wide transportation policies and programs. We directly administer over 50 laws related to transportation, and we also share the administration of many others. We use various policies, programs, legislative measures, regulations and guidelines to meet the expectations of Canadians, and we ensure compliance through appropriate enforcement systems.

The federal Government, with Transport Canada in the lead, has sole responsibility for matters such as aviation safety and security; for other matters we share responsibility with provincial, territorial and municipal governments. We must also work with trading partners and in international organizations to understand and harmonize policy and administrative frameworks, so as to protect Canadian users of the global transportation system while encouraging efficiency.

In areas for which Transport Canada does not have direct responsibility – for example, for building and maintaining road networks – we use strategic funding and partnerships to promote safe, efficient and environmentally responsible movement of people and goods into and across the country. In this way, we play a leadership role to ensure that all parts of the transportation system across Canada and world-wide work together effectively and efficiently. We also report on the state of transportation in Canada, as required under the Canada Transportation Act.

Transport Canada is part of the Transport, Infrastructure and Communities Portfolio which includes:

- the departments of Transport Canada and Infrastructure Canada;

- 43 shared governance organizations, for example, 21 airport and 17 port authorities across Canada, the St. Lawrence Seaway Management Corporation, NAV Canada and the Buffalo and Fort Erie Bridge Authority;

- 11 Crown corporations, such as the four Pilotage Authorities, VIA Rail Canada, the Canadian Air Transport Security Authority, and Canada Post Corporation; and

- three administrative tribunals/agencies - the Transportation Appeal Tribunal of Canada, the Canadian Transportation Agency, and the Ship-source Oil Pollution Fund.

Together, these organizations contribute to Canada's competitiveness by ensuring an efficient transportation system to make the economy stronger; keeping our transportation system safe and secure; protecting the environment; and improving the quality of life in our cities and communities.

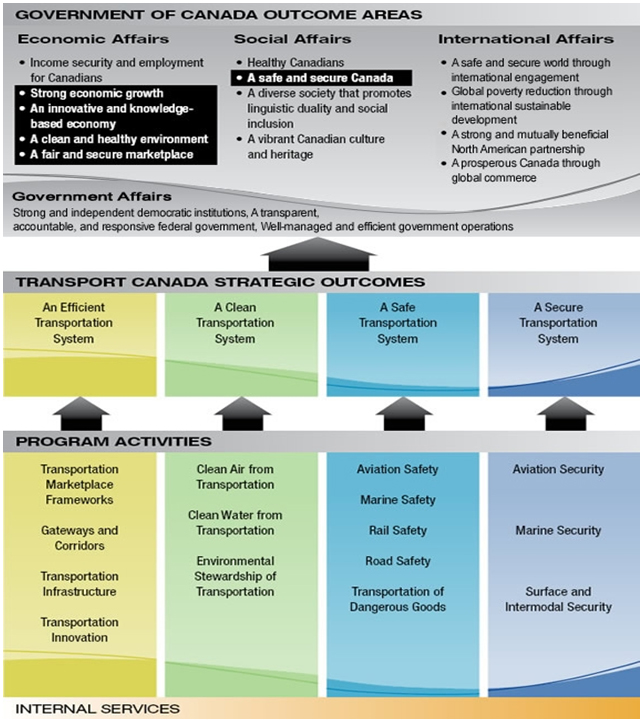

1.1.2 Strategic Outcomes and Program Activity Architecture

As illustrated in Figure 1, Transport Canada's Program Activity Architecture includes 15 program activities that contribute to achieving the four departmental strategic outcomes:

- an efficient transportation system;

- a clean transportation system;

- a safe transportation system; and

- a secure transportation system.

The sixteenth program activity, Internal Services, supports all four strategic outcomes. These four strategic outcomes specifically contribute to five Government of Canada [2] outcomes. Section II of this report explains how Transport Canada's strategic outcomes and program activities contribute to these outcomes areas.

Figure 1: Transport Canada Program Activity Architecture

1.2 Contribution of Departmental Priorities to Strategic Outcomes

Transport Canada identified three operational priorities [3] and one management priority [4] for 2011-12. These priorities are aligned with the department's Corporate Risk Profile [5]. Each priority relates to one or more of Transport Canada's Strategic Outcomes, which collectively describe our mandate and core business. The 2011-12 operational and management priorities are aligned with Government of Canada commitments.

Accomplishments in support of these departmental priorities are described in the following tables.

This report labels first-time priorities as "new," priorities committed to in the first or second fiscal year before this report as "previously committed to", and older commitments as "ongoing".

| Priority | Type | Linkages to Strategic Outcome(s) |

|---|---|---|

| Create an oversight framework that will ensure Transport Canada's legislation, regulations and regulatory initiatives are modern, streamlined and effective | New | All Strategic Outcomes |

|

Summary of Accomplishments

Work in Progress

|

||

| Priority | Type | Linkages to Strategic Outcome(s) |

|---|---|---|

| Assess the transportation policy framework | New | All Strategic Outcomes |

|

Summary of Accomplishments

Work in Progress

|

||

| Priority | Type | Linkages to Strategic Outcome(s) |

|---|---|---|

| Increase security for air passengers, air cargo and airport workers | Previously Committed to | A Secure Transportation System |

|

Summary of Accomplishments

Work in Progress

|

||

| Priority | Type | Linkages to Strategic Outcome(s) |

|---|---|---|

| Continue to improve governance within Transport Canada | Previously Committed to | All Strategic Outcomes |

|

Summary of Accomplishments

Work in Progress

|

||

1.3 Risk Analysis

1.3.1 Operating Environment

Transportation connects all of Canada's social and economic activities. It provides market access for suppliers and consumers of natural resources and agricultural goods, manufactured products and services, and it provides access to work and leisure activities for Canadians and visitors. Transportation links communities across Canada, in diverse and sometimes extreme conditions. Because of the extensive scope of Canada's transportation system, it is potentially vulnerable to serious challenges, which could have uncertain or even catastrophic impacts.

Furthermore, risks are introduced into the transportation system because of its complex structure, including multiple jurisdictions interacting with private-sector stakeholders and users. Such complexity requires Transport Canada to manage risk effectively – to the extent possible to identify and analyze risk, and to develop suitable mitigation strategies – in order to achieve its strategic outcomes.

1.3.2 Risk Management Approach

Transport Canada continues to adopt a strong risk management governance structure, as outlined in our Integrated Risk Management Policy. It is an important tool for making informed decisions and arriving at realistic analyses of how to address risk. Its objective is to promote the systematic integration of risk management practices in order to respond to known risk and uncertainty.

Sharing of risk information between the different strategic planning and functional sectors is done through the Departmental Risk Management Working Group, which has representation from all groups and regions. This forum also serves to review, contribute to and promote department-wide integrated risk management initiatives. A Centre of Expertise in Risk Management has been established to provide ongoing support to management and employees in promoting a consistent approach to risk identification, assessment and response. The integrated analysis of risk for the department in turn builds confidence within the department and among stakeholders.

The Corporate Risk Profile provides a clear snapshot of our key risks. It focuses management attention and action on what matters most, and identifies potential areas of opportunity. We currently review it twice per year, at the start of the planning process and at mid-year. We also adjust the Corporate Risk Profile, as appropriate, to reflect the consequences of risk response activities and changes in our operating conditions as they arise.

1.3.3 Key Risk Areas and Risk Responses

Through an environmental scan and department-wide consultations, Transport Canada identified four key risk areas for our 2011 Corporate Risk Profile. We assessed these risks based on the likelihood of occurrence, combined with their potential impact on our capacity or ability to achieve our strategic outcomes. We identified mitigation measures that are being implemented. The four key risk areas are: (1) transportation system efficiency; (2) oversight effectiveness and efficiency; (3) security threat/ incident response capability; and, (4) change management.

Figure 2: Transport Canada's Corporate Risk Profile (as revised in February 2012)

The specific risk responses associated with the 2011 Corporate Risk Profile are all on track. A number of the risk responses are fully implemented or have now become ongoing activities.

(1) Transportation System Efficiency: Transport Canada may not be able to sufficiently influence the efficiency and competitiveness of Canada's transportation system.

Canada's transportation system operates under many public and private-sector jurisdictions. It must be safe and secure, yet efficient and reliable, because Canadians rely on it to move people and goods across vast distances and to world markets by air, sea and land.

To respond to efficiency risk factors, Transport Canada supports significant strategic investments in transportation infrastructure through extensive engagement with stakeholders, innovative partnerships and rigorous review processes. Risk-based analysis of projects reduces the administrative burden within the department and on low-risk recipients. In addition, work continues to renew the Transportation Policy Framework.

(2) Oversight Effectiveness and Efficiency: Transport Canada's oversight of the national transportation system may not be sufficiently flexible and adaptable to address ever-changing conditions.

Transport Canada is the sole regulator for safety, security and protection from pollution for several transportation modes, and it shares regulatory responsibilities for other modes and in other fields. It is also a significant funding partner. To meet the needs of Canadians, Transport Canada's policy, program and regulatory mechanisms must respond to current operational realities, as well as international trends and obligations.

We have put in place a governance structure and clear lines of accountability, roles and responsibilities to respond to risks affecting regulatory oversight activities. The senior Committee on Legislative and Regulatory Affairs has been established, supported by a risk-based regulatory priority management system. We have drafted or applied several regulatory adjustments. We are also developing guidance procedures for monitoring and surveillance, and updating the regulatory framework with partner jurisdictions. Significant improvements to safety management systems continue through the Inspectorate Advisory Board, and technical training tools are being developed. Management Action Plans to address findings of risk-based audits and evaluations are in progress. For example, an audit of Marine Safety Delegated Programs, completed in January 2011, found that a better-structured and rigorous system of functional direction and compliance oversight should be implemented. The audit recommended that specific initiatives being undertaken and their key elements be documented, and that a monitoring framework be implemented. Some 60 percent of the deliverables of the Management Action Plan were completed in 2011-12. We expect to complete most of the remaining work in the coming year.

(3) Security Threat/Incident Response Capability: Transport Canada may not always be in a position to respond to a major transportation security threat or incident in an effective and timely manner.

International and public confidence in the security of Canada's transportation infrastructure is critical, and requires the cooperation of many different participants to achieve. Risk factors include unclear or misunderstood roles and responsibilities for third-party organizations on which Transport Canada relies for intelligence and time-sensitive information, and the complexity of potential national and international security events.

To respond, Transport Canada is continually improving how we assess, monitor and define priority risks and evolving threats. We are also clarifying roles and responsibilities with external partners by developing incident and emergency plans, and by participating in joint exercises. For example:

- we developed a departmental Strategic Emergency Management Plan;

- we put the Aviation Security Incident Management Plan into effect;

- we are enhancing the Air Cargo Security Program;

- we are developing a National Civil Aviation Security Program;

- we are developing measures for the security of transportation of dangerous goods by rail and truck; and,

- we are strengthening the security of higher risk international bridges and tunnels.

(4) Change Management: Transport Canada may not have the capacity to manage change efficiently in its departmental culture, systems and controls.

Transport Canada must manage change effectively and respond to rapid change to achieve our strategic outcomes. Major risk factors include changing demographics, and constrained financial and people resources. In fact, senior management changed the likelihood of the Change Management risk from "Likely" to "Almost Certain" in February, 2012, in light of growing constraints on resources.

A key response to the challenge of managing change is to build confidence and coherence between our new governance structure and current functional and regional practices, while encouraging results-based management. Transport Canada improved governance by enhancing our capacity to make the best use of resources. Our new Integrated Planning Process, introduced in September 2011, now fully incorporates financial and non-financial information in a one-pass approach that provides better support for efforts to achieve departmental priorities and strategic outcomes. Human Resources tools are being developed for change management in the context of demographic transition and funding pressures.

1.4 Summary of Performance

In 2011-12, Transport Canada's progress in achieving departmental priorities has made Canada's transportation network safer, more secure, efficient and sustainable. We enhanced security for air passengers and cargo, as well as for airport workers. The oversight framework for all modes and regions of Canada is more robust and responsive, and the transportation policy framework is being renewed.

Since 2006, almost $6 billion has been committed to Canada's gateways and trade corridors from a variety of sources, including Transport Canada, leveraging significant public and private investments. These infrastructure investments across the country enable fast and efficient movement of goods into the world marketplace, and they will strengthen Canada's long-term economic competitiveness. Improved infrastructure at airports, ports and railway crossings also provide an immediate and long lasting improvement to the well-being of Canadians and international travellers.

1.4.1 Financial Resources

To support its mandate, Transport Canada received and used the following resources:

| Planned Spending | Total Authorities* | Actual Spending* |

|---|---|---|

| * Excludes amount deemed appropriated to Shared Services Canada | ||

|

1,590 |

1,694 |

1,281 |

Note, variance explanations are provided in the Summary of Performance Tables, by Strategic Outcome and Internal Services, below.

1.4.2 Human Resources

| Planned | Actual | Difference |

|---|---|---|

|

5,346 |

5,045 |

301 |

1.4.3 Transport Canada's Contribution to the Federal Sustainable Development Strategy

The Federal Sustainable Development Strategy outlines the Government of Canada's commitment to improving the transparency of environmental decision-making by articulating its key strategic environmental goals and targets. Transport Canada ensures that consideration of these outcomes is an integral part of its decision-making processes.

Transport Canada contributes to the following themes: I - Addressing Climate Change and Air Quality; II - Maintaining Water Quality and Availability; III - Protecting Nature; and, IV - Shrinking the Environmental Footprint – Beginning with Government, as denoted by the visual identifiers and associated program activities below:

Program Activity 1.4: Transportation Innovation

Program Activity 2.1: Clean Air from Transportation

Program Activity 1.4: Transportation Innovation

Program Activity 2.2: Clean Water from Transportation

Program Activity 2.2: Clean Water from Transportation

Program Activity 2.3: Environmental Stewardship of Transportation.

During 2011-12, Transport Canada considered the environmental effects of initiatives subject to the Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals. Through the strategic environmental assessment process, departmental initiatives were found to have positive and/or negative environmental effects on goals and targets in all four of the Themes. Further information on the results of the strategic environmental assessments is available at Transport Canada's Strategic Environmental Assessment page.

For further information on Transport Canada's activities to support sustainable development and strategic environmental assessments, please visit Transport Canada's Sustainable Development Strategy site. For complete information on the Federal Sustainable Development Strategy, please visit Environment Canada's website.

1.4.4 Summary of Performance Tables, by Strategic Outcome and Internal Services

Strategic Outcome 1: An Efficient Transportation System

| Performance Indicators | Targets | 2011-12 Performance |

|---|---|---|

| Transportation sector productivity level (Index) | Increase by 2.5 percent to 5 percent relative to 2009 baseline (Productivity Index > 113 in 2014) | Transportation business-sector productivity increased by 3.9 percent from 2009 to 2010. (For-hire trucking was not included, as figures are being updated). This was primarily due to an increase in transportation output as demand returned following the reduction in economic activity in 2009. |

| Transportation sector cost level (Index) | Growth in unit costs does not exceed 11 percent over a 5-year horizon (Cost Index < 111 in 2014) | Unit costs for the same subset decreased by 1.1 percent. The decrease was due to a reduction in the unit cost of capital as well as other materials and services. |

| Program Activity | 2010-11 Actual Spending ($ millions) | 2011-12 ($ millions) | Alignment to

Government of Canada Outcomes |

|||

|---|---|---|---|---|---|---|

| Main

Estimates |

Planned

Spending |

Total

Authorities |

Actual

Spending |

|||

| * Due to rounding, columns may not add to the totals shown. | ||||||

| Transportation Marketplace Frameworks | 10 | 9 | 9 | 10 | 10 | A fair and secure marketplace |

| Gateways and Corridors | 243 | 541 | 544 | 542 | 200 | Strong economic growth |

| Transportation Infrastructure | 282 | 291 | 334 | 384 | 366 | Strong economic growth |

| Transportation Innovation | 11 | 14 | 14 | 15 | 11 | An innovative and knowledge-based economy |

| Total* | 546 | 854 | 901 | 951 | 587 | |

Information on Significant Variances (between Total Authorities and Actual Spending)

Gateways and Corridors: Delays in Asia-Pacific Gateway and Corridor Initiative projects accounted for $257 million of the variance. The major contributing factors for the delays include complex project approvals, the difficulties private sector recipients faced in proceeding after the economic recession, and challenging multi-stakeholder collaboration.

Delays in Gateways and Border Crossings Fund projects accounted for $61 million. Many factors influenced these delays, including challenges in project design, property acquisition difficulties, complex environmental approvals and adverse weather conditions.

In addition, challenges in negotiations with the industrial property owners of land parcels within the Detroit River International Crossing plaza footprint have delayed property acquisition. This caused Transport Canada to delay several utility relocation studies until the negotiations are further advanced which accounted for a variance of $23.7 million.

Transportation Infrastructure: The variance of $18 million is due to many factors, including delays in negotiating contribution agreements, as well as lower costs for the appraisal and disposal of assets and real property. In particular, the Highway 5 project delays caused by technical challenges and design changes under the Outaouais Road Agreement accounted for $12.7 million. These funds will be moved to future years to complete the projects.

Transportation Innovation: The $3.6-million variance is primarily due to delays in approving and signing contribution agreements with recipients under the Security and Prosperity Partnership program, which accounted for $2.1 million, and a variance of $1.4 million related to various intelligent transportation systems projects under the Strategic Highway Infrastructure Program.

Strategic Outcome 2: A Clean Transportation System

| Performance Indicators | Targets | 2011-12 Performance |

|---|---|---|

| Transportation sector greenhouse gas emissions (tonnes of CO2 equivalent) | Greenhouse gas ( GHG ) emission levels from the transportation sector consistent with Government of Canada targets in "Turning the Corner" | Based on the most recent available information, transportation-related GHG emissions decreased slightly in 2010 compared to 2005 (from 170 megatonnes ( Mt ) of CO2 equivalent in 2005 to 166 Mt in 2010). [6] |

| Percentage of transportation sector air pollutants reduction | Level of air pollutants from the transportation sector reduced consistent with targets to be established under the "Clean Air Agenda" | Between 2005 and 2010 [7], transportation-related emissions of air pollutants have shown a steady decline, mainly due to on-road vehicle regulatory initiatives and vehicle fleet renewal. During that period, emissions decreased for fine particulate matter (by 10 percent), sulphur oxides (by 14 percent), nitrogen oxides (by 10 percent), volatile organic compounds (by 17 percent), and carbon monoxide (by 8 percent). |

| Program Activity | 2010-11 Actual Spending ($ millions) | 2011-12 ($ millions) | Alignment to

Government of Canada Outcomes |

|||

|---|---|---|---|---|---|---|

| Main

Estimates |

Planned

Spending |

Total

Authorities |

Actual

Spending |

|||

| * Due to rounding, columns may not add to the totals shown. | ||||||

| Clean Air from Transportation | 17 | 5 | 5 | 16 | 14 | A clean and healthy environment |

| Clean Water from Transportation | 8 | 6 | 6 | 6 | 7 | A clean and healthy environment |

| Environmental Stewardship | 40 | 7 | 7 | 34 | 23 | A clean and healthy environment |

| Total* | 65 | 18 | 18 | 56 | 44 | |

Information on Significant Variances (between Total Authorities and Actual Spending)

Clean Air from Transportation: A variance of $2 million is primarily attributed to delays in adopting the Next Generation of Clean Air measures that were approved in 2011-12.

Clean Water from Transportation: The $1-million variance is mainly due to Transport Canada's decision to continue to deliver the National Aerial Surveillance Program (see section 2.2.2), and the advancement of the Hazardous and Noxious Substances Regime, as well as the Environmental Response Risk Assessments.

Environmental Stewardship of Transportation: The $11 million variance is attributed to delays in environmental remediation activities funded from the Federal Contaminated Sites Action Plan due to factors such as challenges in investigative work, project design, weather conditions and tendering delays. These funds have been moved to future years to complete the projects.

Strategic Outcome 3: A Safe Transportation System

| Performance Indicators | Targets | 2011-12 Performance |

|---|---|---|

| Number/rate of accidents or fatalities by mode | Maintain or improve accident/fatality rates by mode, based on each mode’s strategic objectives |

All modes maintained or improved their accident/fatality rate based on their baseline data. There was a 3 percent increase in reported accidents and there were no deaths relating to the transportation of dangerous goods. Additional data can be found in the Transportation in Canada 2011 report. |

| Program Activity | 2010-11 Actual Spending ($ millions) | 2011-12 ($ millions) | Alignment to

Government of Canada Outcomes |

|||

|---|---|---|---|---|---|---|

| Main

Estimates |

Planned

Spending |

Total

Authorities |

Actual

Spending |

|||

| * Due to rounding, columns may not add to the totals shown. | ||||||

| Aviation Safety | 211 | 249 | 253 | 244 | 222 | Safe and secure Canada |

| Marine Safety | 83 | 72 | 74 | 75 | 76 | Safe and secure Canada |

| Rail Safety | 31 | 37 | 38 | 38 | 33 | Safe and secure Canada |

| Road Safety | 42 | 24 | 24 | 26 | 24 | Safe and secure Canada |

| Transportation of Dangerous Goods | 14 | 13 | 13 | 14 | 14 | Safe and secure Canada |

| Total* | 381 | 395 | 402 | 397 | 368 | |

Information on Significant Variances (between Total Authorities and Actual Spending)

Aviation Safety: The variance of $22 million is largely the result of a $16.1 million surplus in the Airports Capital Assistance Program, mostly due to delays in signing the agreement with the Province of Quebec, as well as delays in project start-ups. A further surplus of $3.8 million is due to lower-than-expected operating costs.

Rail Safety: A $3.9-million surplus in the Grade Crossing Improvement Program is due to delays in completing various projects and lower-than-expected project costs.

Strategic Outcome 4: A Secure Transportation System

| Performance Indicators | Targets | 2011-12 Performance |

|---|---|---|

| Number of Canadian Regulatory Framework adjustments | Two | Two in Aviation Security:

|

| Percentage of Canadians reporting to be confident in the security of the transportation system | Maintain or improve confidence in the security of the transportation system, based on the strategic objectives of each mode | Transport Canada did not collect public confidence data in 2011-12. |

| Program Activity | 2010-11 Actual Spending ($ millions) | 2011-12 ($ millions) | Alignment to

Government of Canada Outcomes |

|||

|---|---|---|---|---|---|---|

| Main

Estimates |

Planned

Spending |

Total

Authorities |

Actual

Spending |

|||

| * Due to rounding, columns may not add to the totals shown. | ||||||

| Aviation Security | 43 | 50 | 51 | 46 | 43 | Safe and secure Canada |

| Marine Security | 20 | 22 | 22 | 20 | 18 | Safe and secure Canada |

| Surface and Intermodal Security | 7 | 6 | 7 | 6 | 6 | Safe and secure Canada |

| Total* | 70 | 78 | 80 | 73 | 67 | |

Information on Significant Variances (between Total Authorities and Actual Spending)

Aviation Security: A $3.5-million surplus resulted mainly from delays under the Air Cargo program in testing screening equipment with the U.S. Transportation Security Administration, and a reduced requirement for professional services.

Marine Security: A surplus of $2.1 million is due in part to a surplus in the Marine Security Coordination Fund.

Program Activity: Internal Services

| Performance Indicators | Targets | 2011-12 Performance |

|---|---|---|

| Satisfaction rate of Internal Services clients | Satisfaction rate equal or superior to 85 percent | Actual Results

89.1 percent of respondents agreed or strongly agreed that they are satisfied with the timeliness of responses. 87.5 percent of respondents agreed or strongly agreed that the quality of service met the needs of their organization. |

| Program Activity | 2010-11 Actual Spending ($ millions) | 2011-12 ($ millions) | ||||

|---|---|---|---|---|---|---|

| Main

Estimates |

Planned

Spending |

Total

Authorities* |

Actual

Spending* |

|||

| *Excludes amount deemed appropriated to Shared Services Canada.

**Due to rounding, columns may not add to the totals shown. |

||||||

| Internal Services | 227 | 185 | 189 | 217 | 215 | |

| Total** | 227 | 185 | 189 | 217 | 215 | |

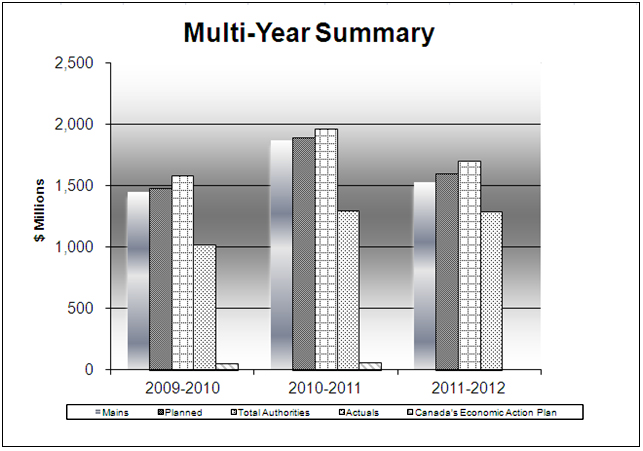

1.5 Expenditure Profile

Figure 3 shows Transport Canada's expenditures (planned, authorized and actual) from 2009-10 to 2011-12. The difference in actual spending, from $1,012 million in 2009-10 to $1,281 million in 2011-12, is attributed in part to a change in the method of accounting for Airport Authorities lease payments. This change does not, however, affect the overall gross amount available to the department. [8] The rest of the increase in actual spending is the addition of major initiatives within the department over the same period, such as the Asia-Pacific Gateway Corridor Initiative and the Gateways and Border Crossings Fund.

Figure 3: Spending Trend for Transport Canada

1.6 Estimates by Vote

For information on Transport Canada's organizational votes and statutory expenditures, please see the Public Accounts of Canada 2012 (Volume II). An electronic version of the Public Accounts 2012 is available on the Public Works and Government Services Canada's website.