On this page

- A Message from the Honourable Omar Alghabra Minister of Transport

- National Supply Chain Summit

- National Supply Chain Summit January 31st, 2022: industry participants list

A Message from the Honourable Omar Alghabra Minister of Transport

The past few years have been unlike any in recent history, in terms of scope and scale of impact on global supply chains. As a result of production slowdowns, changes in consumer behaviour, lingering uncertainty caused by the COVID-19 pandemic, and extreme weather events caused by a changing climate, the impacts on the day-to-day lives of Canadians and our economy have been significant.

That is why, on January 31, 2022, I was pleased to host a virtual National Supply Chain Summit with a number of key business leaders and associations, along with several of my Cabinet colleagues – the Honourable Marie-Claude Bibeau, Minister of Agriculture and Agri-Food, the Honourable Carla Qualtrough, Minister of Employment, Workforce Development and Disability Inclusion, the Honourable François-Philippe Champagne, Minister of Innovation, Science and Industry, the Honourable Seamus O’Regan Jr., Minister of Labour, and the Honourable Mary Ng, Minister of International Trade, Export Promotion, Small Business and Economic Development.

The broad level of interest, representation, and meaningful interventions made at the Summit speaks to the importance of supply chains to Canada’s economic recovery and the ongoing need to protect the health and safety of Canadians.

The complex challenges facing our supply chains are not uniquely Canadian – they are global. In fact, shortly after the roundtable, Russia’s unprovoked and unjustified invasion of Ukraine has added another major shock to global supply chains. And there are unique Canadian dimensions to the supply chain challenges we face – but we can take pride in the efforts of our workers and businesses who have stepped up to keep our people and goods moving, shelves stocked and critical supplies sent to where they are needed most, even in the face of tragedy, most recently with the flooding in the Lower Mainland of British Columbia.

The National Supply Chain Summit was the starting point in a national conversation to identify and execute actions together to strengthen our supply chains and make them more resilient in the face of future adversity. The insight we gained at the National Supply Chain Summit helped to inform our investments in Budget 2022 dedicated to strengthening Canada’s supply chains. Our government recognizes that efficient and resilient supply chains are key to expanding Canada’s economic capacity and productivity to drive long-term growth. I am confident that with the continued collaboration of public and private sectors, Canada will continue to prosper.

I wish to personally thank all of the participants and those who continue to contribute to this important conversation and development of solutions.

Honourable Omar Alghabra, P.C., M.P.

National Supply Chain Summit

Context

Global supply chains, underpinned by the transportation networks that support them, have faced unprecedented challenges from concurrent supply and demand shocks, and labour disruptions and shortages from the on-going COVID-19 pandemic. In many cases vulnerabilities that existed pre-pandemic have been exacerbated. These unprecedented pressures, coupled with disruptions resulting from climate change, have brought into focus the urgency of initiating a conversation about the central role that supply chains and logistics play in the day-to-day lives of Canadians. It is clear that we need to build more resiliency and adaptability into our transportation supply chains in order to sustain economic growth and remain internationally competitive trade partners.

Despite the series of challenges posed by COVID-19, Canada has had success in keeping goods and the economy moving. The Government of Canada has been taking steps to improve outcomes, including targeted investments through the National Trade Corridors Fund (NTCF), work supporting the Ports Modernization Review, enhanced data transparency regulations, and implementing vaccine mandates to protect Canadian workers.

Ministers emphasized the importance of coming together to find solutions to challenges and committed to ongoing dialogue with stakeholders to identify actions and solutions to build more resilient supply chains.

Format

A theme-based National Summit was held via Zoom on January 31, 2022. Since then, a series of sectoral and regional roundtables were held from February to June 2022, whereby participants were given guidance questions in advance to frame the discussion:

- What do you see as the most critical challenges or barriers facing Canada’s supply chain efficiency and resiliency that warrant priority action to improve Canada’s economic recovery and what specific supply chain challenges could be addressed by pursuing greater innovation in the transportation sector?

- How can we better leverage investments in transportation infrastructure for improved performance outcomes and supply chain resiliency – especially in light of changing climate and economic shocks?

- Where are our best opportunities for new collaboration, innovation and leveraging digital solutions to optimize existing infrastructure, increase capacity and improve system performance?

(Theme) New Partnership Models and Economic Growth Opportunities

Context

Businesses and workers have played a critical role in keeping crucial goods and supplies moving during the pandemic, which is key to supporting resiliency. Domestic manufacturers and businesses have experienced delays due to global production shutdowns and trade restrictions due to COVID-19. At the same time, Canadian businesses have had to pivot to support domestic needs in critical supplies, including for export. A strong, robust trade framework is key to ensuring Canadian exports have access to international markets, and that crucial goods, such as key components and strategic materials, continue to flow into Canada to sustain manufacturing and production. This includes the vital trade relationship Canada has with the US and its importance to reinforcing our supply chain security, including a roadmap for a renewed US-Canada partnership, including in key sectors such as clean technologies and critical minerals.

Key Takeaways

It was broadly recognized that the public and private sectors have shared roles/responsibilities for improving outcomes, including the need for continued investments and improvements in infrastructure that can better withstand disruption and risks from climate change. Furthermore, there was a broad recognition that Canadian businesses need access to skilled labour that can keep up with, and adapt to, the realities of new employment models, including timely solutions that include training, reskilling and foreign workers to fill critical gaps.

Regulatory burden and ease of conducting business was recognized as a priority, particularly during a crisis whereby the risks are high for increasing the costs of doing business. This also extends to the administration of border regulations and red tape tied to new measures being implemented globally, due to the pandemic, and increased regulatory complexity. This impacts business flows both ways – imports and our ability to export. There were calls for reviews of what is critical to protect our national security and public health and opportunities for regulatory harmonization across all levels of government and with the US, including an examination of border measures and clarity from CBSA to reduce complexity.

The growing importance of digital solutions and data was recognized as key to better understand freight movements, bottlenecks and facilitate better planning across the supply chain, which could help inform a new national supply chain/freight/manufacturing strategy and/or Supply Chain Commissioner to lead efforts into future infrastructure, governance and operational requirements, and focusing on key sectors, including access to new growth markets; and the meaningful inclusion of Indigenous businesses in supply chain strategies.

(Theme) Transportation Supply Chains and Infrastructure

Context

Transportation plays an outsized role in supporting critical supply chains globally and keeps Canadians connected, including rural and remote communities. The recent flooding in British Columbia underscores the need for better future-proofing of our communities and critical infrastructure, given how intertwined they are, with the greatest complexity in the most heavily populated areas. Resilient infrastructure that can withstand a changing climate, along with mitigation and adaption strategies, is becoming a precondition to supporting our critical supply chains and sustaining Canada’s competitiveness.

Key Takeaways

There was a consensus on the need for better planning and integration at all levels – from companies to government, in order to tackle the challenges at scale. This includes stimulating public-private funding and investments in critical infrastructure and a need for policy coherence across government, particularly as we look to exploit new opportunities (EVs or advanced batteries), but also in the context of promoting new innovations to decarbonize transportation (e.g. green shipping corridors).

It was also suggested that an analysis of National Trade Corridor Fund investments be conducted to evaluate their effectiveness in reducing bottlenecks as well as the overall strategic approach to infrastructure investments. Factors, such as the shortage of industrial lands near ports, were identified as exacerbating Canada’s vulnerability to current global supply chain challenges. It was recommended that Canada consider leveraging inland logistics hubs to help mitigate risks and congestion at ports, in addition to bolstering the strategic importance of Canada’s ports systems to trade and fostering greener and more innovative port solutions that better integrate with the rest of marine the supply chain/trade corridors.

There was also a recognition that the North faces unique challenges and accelerating impacts due to climate change, necessitating greater attention to northern airport infrastructure and futureproofing the air sector against further disruptions, particularly where air travel is the sole connection to remote and Indigenous communities.

More integrated planning and the need to take a broader supply chain view were common themes across all of the sessions, thereby validating the need for a broader strategy.

(Theme) Skills and Labour

Context

One of the most acute impacts of the COVID-19 pandemic has been the skills and labour shortages facing a number of sectors of the economy. The Government has put in place several programs, economy-wide, to help during the pandemic, as well as new programs and policies to address labour and skills challenges, including specifically for the transportation sector – the Sectoral Workforce Solutions Program was announced, in this regard. The importance of training and skills is recognized, as well as the need for ongoing and continued recruitment, particularly to industries suffering severe shortages, including transportation.

Key Takeaways

There was a broad consensus that one of the most challenging areas for the business community has been addressing acute labour shortages -- at all skill levels and across all sectors -- while navigating complex rules (global, regional and local) while at the same time trying to leverage cross-cutting tools like training/upskilling, standards and immigration programs.

Workers are also seeking better protection, given the impact of COVID-19 on their mental health (and that of employers), as well as ongoing uncertainty. There was also emphasis placed on the need to better link skills, labour and trade opportunities across sectors, prioritizing the reskilling of Canadian workers and under-represented Canadians. And, while there was a general recognition of the role of digital and data solutions to upskill workers, there was also an identified need to improve Canada’s cybersecurity to better protect supply chains.

It was generally recognized that shortages of truck drivers have impacts for all sectors, and the need for common standards across sectors was identified as a means to reduce barriers and fill labour gaps.

(Theme) Supply Chain Innovation

Context

It is evident that new approaches and innovation in supply chains are required to improve Canadian competitiveness and support robust economic recovery. Globally, countries are adapting to new trade realities, including renewed focus on regional and critical supply chains, especially in sectors experiencing shortages such as microprocessors and critical minerals. At the same time, countries are also seized with the transition to greener economies – including a movement towards the greening of supply chains in Canada, which has transformative potential in the way we do business. Examples of leading sectors for innovation in Canada include: artificial intelligence, advanced bio-manufacturing, and Canada’s Superclusters.

Key Takeaways

There was broad consensus on the need for digital and technology adoption across all sectors, including AI and automation to improve supply chain performance. This would allow innovation developed in one sector to be adopted on a wider scale to spur innovation where it is lagging. There is also a need to harness data and provide information in real time to support trade, performance, and supply chain intelligence.

Examples were provided of emerging Canadian opportunities in areas like critical minerals where Canadian innovation can play a role; however, at the same time noting the need to address concerns over human rights practices in other jurisdictions, along with due diligence in integrated global supply chains.

It was recognized that greening of Canadian supply chains is key to broader shared objectives of resiliency and adaptation; the role of hydrogen, bio- and alternate fuels to greening transportation supply chains and transitioning to less carbon intensive activities. This was key to making improvements at port facilities and operations, inland logistics and underutilization of shipping assets and lanes (short-sea shipping in the St. Lawrence for example).

The need for policy coherence across government was reiterated, both to reduce regulatory impediment, (customs, border issues) and to promote new opportunities, such as electric vehicles, potential battery production, and in the extraction of critical minerals, while protecting national interests, along with linked strategies to investments in critical infrastructure.

(Theme) Agriculture and Agri-food

Context

The impacts of the global pandemic and climate change on the agriculture and agri-food industry and transportation infrastructure have been particularly acute, with food shortages being experienced globally, labour shortages and disruption to transportation services, including a North America-wide lack of access to empty containers.

Key Takeaways

The lack of access of empty containers for this sector was identified as a key issue, limiting value-added growth opportunities and exports. There was a broad level of support for the creation of a task force to examine the complex issues that led to the rise of shortages – including the perception that Canadian exporters are being hit harder than U.S. counterparts – and an examination of competition issues in containerized freight was welcomed.

There was a desire to see solutions that could include process controls, increased data and information sharing among stakeholders to improve decision making and planning – especially for SMEs who are disadvantaged.

Canada’s small market size can result in a competitive disadvantage for Canadian businesses relative their competitors and translate into substantial cost increases and supply chain delays, in addition to reputational risks. There was consensus that a coordinated Canadian strategy is required to manage the cumulative complex issues and mitigate risks – at sectoral and cross-sectoral levels and within all aspects of supply chains. It was noted that critical transportations services costs have increased to levels that are prohibitive.

In addition, it was proposed that collaborative emergency management is required for major disruptive events, including better coordination between jurisdictions for contingency and resiliency planning.

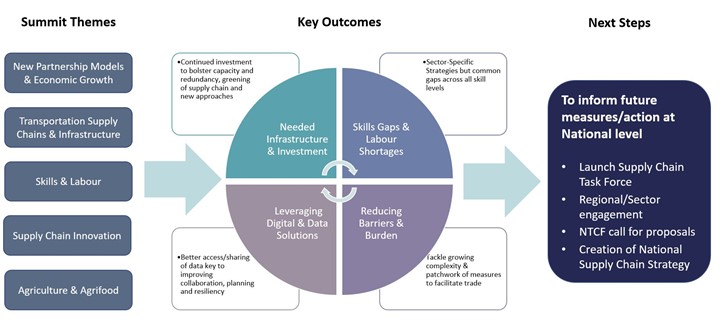

Summary and Next Steps

The Summit and the sectoral roundtables were the first in a series of conversations to inform next steps, including upcoming regional roundtables to be hosted by Parliamentary Secretaries in the coming weeks. In addition, the Minister of Transport has announced his intention to create a Supply Chain Task Force to help further inform recommendations and closer examination of technical issues, whose work will be guided by this feedback.

In the meantime, stakeholders can submit ideas or views via an online portal.

National Supply Chain Summit January 31st, 2022: industry participants list

- Aerospace Industries Association of Canada

- Air Transport Association of Canada

- Animal Nutrition Association of Canada

- Association des employeurs maritimes (Montréal)

- Association of Canadian Port Authorities

- Association of Equipment Manufacturers

- BC Marine Terminal Operators Association

- BC Maritime Employers Association

- Canada’s Building Trades Unions

- Canadian Agricultural Human Resources Council

- Canadian Airports Council

- Canadian Apparel Federation

- Canadian Association of Importers and Exporters

- Canadian Canola Growers Association

- Canadian Cattlemen’s Association

- Canadian Council for Aboriginal Business

- Canadian Federation of Agriculture

- Canadian Federation of Independent Business

- Canadian Federation of Independent Grocers

- Canadian International Freight Forwarders Association

- Canadian Labour Congress

- Canadian Manufacturers and Exporters

- Canadian Meat Council

- Canadian National Railway

- Canadian Pacific Railway

- Canadian Pork Council

- Canadian Poultry and Egg Processors Council

- Canadian Produce Marketing Association

- Canadian Tire Corporation

- Canadian Trucking Alliance

- CANDO Rail

- Canola Council of Canada

- Cargill Ltd.

- Cargojet

- Chamber of Commerce

- Chamber of Marine Commerce

- Chamber of Shipping

- E3 Metals

- Excellence in Manufacturing Consortium

- Fednav

- FETCO

- Food and Beverage Canada

- Food Health and Consumer Products of Canada

- Forest Products Association of Canada

- Freight Management Association of Canada

- Gateway Advisors Limited

- Halifax Port Authority

- ILWU

- Loblaw

- Mining Association of Canada

- Montréal Port Authority

- Next Generation Manufacturing

- Pearson Airport

- Prince Rupert Port Authority

- Private Motor Truck Council of Canada

- Pulse Canada

- Railway Association of Canada

- Ray-Mont Logistics

- Retail Council of Canada

- Richardson International Limited

- Soy Canada

- Supply Chain Canada

- Trucking HR Canada

- Vancouver Fraser Port Authority

- Walmart Canada

- WESTAC

- Western Canadian Shippers’ Coalition