Container supply chain

The fluidity of the import containers supply chain was challenged in the first half of 2022 amid high demand, limited capacity, and several disruptive events, before easing in the second half of the year due to softer macro-economic conditions.

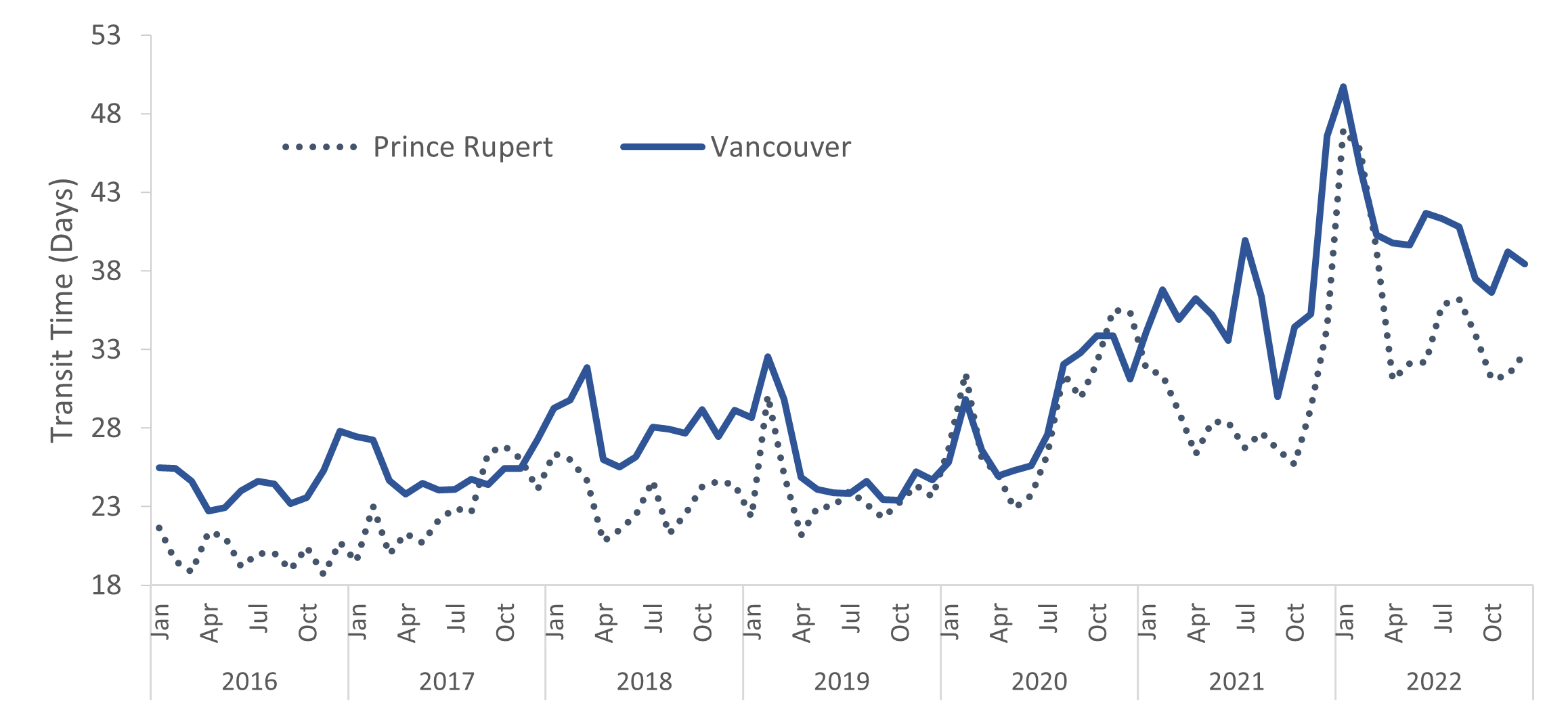

The average end-to-end transit time to import a container from Shanghai to Toronto via West Coast ports was 39.9 days in 2022, above the 3-year average of 30.0 days. Transit time peaked in January 2022, averaging 47.0 days when transiting via the Port of Vancouver and 49.7 days via the Port of Prince Rupert. The British Columbia flooding in November 2021 led to significant transportation challenges in the province in the following months, which increased transit time at ports. There was an improvement in performance in the second half of 2022 as transportation networks recovered from disruption and congestion challenges. Container dwelling at West Coast ports remained high but anchoring decreased which led to an easing of overall transit time. Despite these challenges, Canadian ports remained time-competitive with their U.S. counterparts.

On Canada’s East Coast, container end-to-end transit time from Antwerp to Toronto averaged 24.2 days in 2022, 5 days above the 3-year average of 19.6 days. This increase was largely a result of high demand, uncertainty, and significant congestion at intermodal yards in Central Canada hindering the ability to move containers off port terminals to transit inland. Nearing the end of 2022, transit times on the East Coast started returning to normal levels decreasing to just over 20 days.

With the alleviation of supply chain challenges and congestion in 2022, container freight rates started to decrease after the sharp peaks recorded at the end of 2021 and the beginning of 2022. Container freight rates on the West Coast saw the largest decrease in 2022, hovering close to pre-pandemic levels at the end of 2022. Container freight rates on the East Coast have been decreasing throughout the year but remained up to three times higher than pre-COVID levels on some shipping lanes at the end of 2022, due to a higher demand for East Coast ports.

Grain supply chain

The Western Canada’s grain harvest was 73.7 million tonnes for the 2022-23 crop year, 50% more than the previous year when drought and bad weather conditions led to a much smaller crop (49.2 million tonnes). Grain volumes transported in the system have also rebounded with rail shipments from the Prairies up 34.0% and exports from western ports up 51.0% for the 21 first weeks of the 2022-2023 crop year.

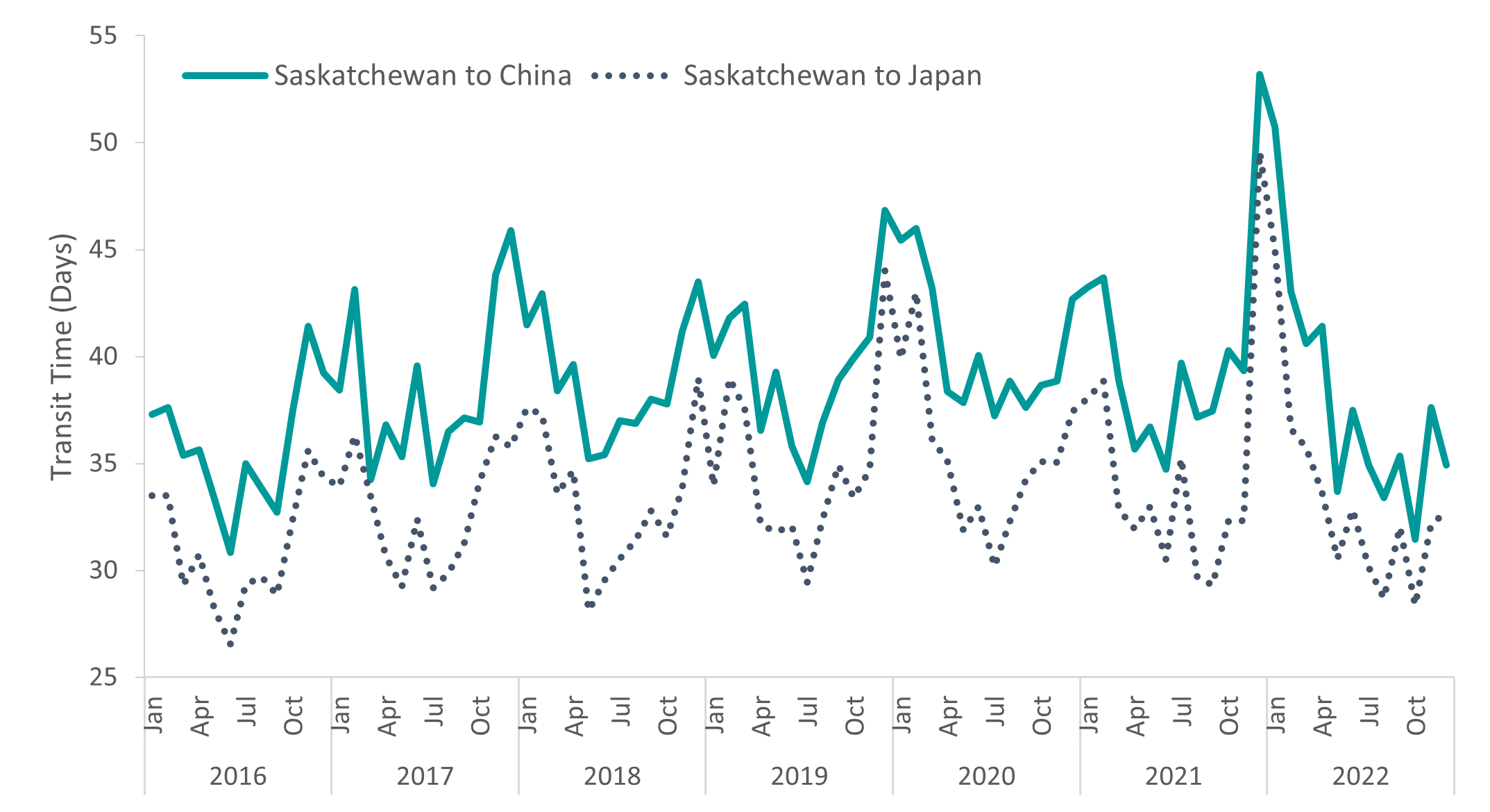

The performance of the Western grain supply chain measured using the end-to-end transit time to ship grain from Saskatchewan to Asia through the Port of Vancouver has stayed relatively stable over the last couple of years, with some seasonal changes including times peaking in winter months.

In December 2021 and January 2022, end-to-end grain transit time peaked to respectively 53.2 and 50.7 days for the route from Saskatchewan to China, due to the impacts of the British Columbia floodings. Despite the congestion at the beginning of the year, the end-to-end transit time for grain from Saskatchewan to Asia via the Port of Vancouver averaged 37.9 days in 2022 for the grain going to China, below the 3-year average of 39.9 days. For the grain going to Japan, the 2022 end-to-end transit time averaged 33.2 days, slightly below the 3-year average of 34.8 days.