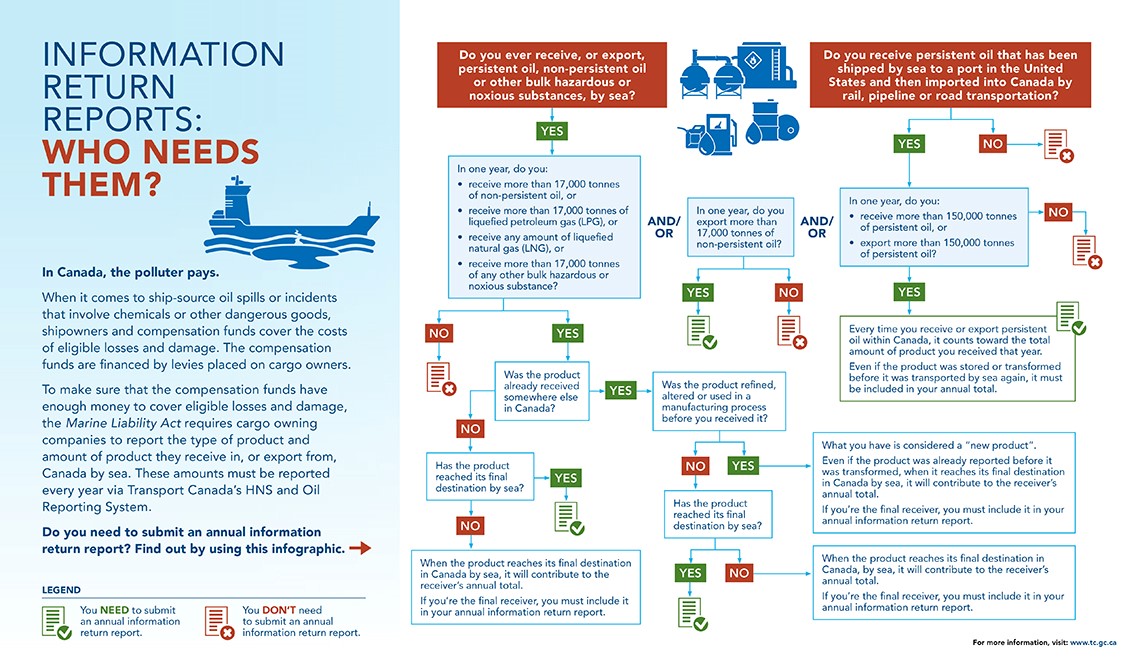

In Canada, the polluter pays.

When it comes to ship-source oil spills or incidents of chemicals and other dangerous goods, shipowners and compensation funds cover the costs of eligible losses and damage. The compensation funds are financed by levies placed on cargo owners.

To make sure that the compensation funds have enough money to cover eligible losses and damage, the Marine Liability Act requires cargo owning companies and their representatives to report the type of product and amount of product they receive in, or export from, Canada by sea. These amounts must be reported every year via Transport Canada’s Oil and Hazardous and Noxious Substances (HNS) Reporting System.

On this page

- Do I need to submit annual information return report?

- Do you ever receive or export persistent oil, non-persistent oil or other bulk hazardous and noxious substances (HNS) by sea?

- How much product do you receive?

- Product types

Do I need to submit an annual information return report?

Do you ever receive or export persistent oil, non-persistent oil or other bulk hazardous and noxious substances (HNS) by sea?

If yes, you may need to submit an annual information return report depending on how much of that product you receive or export.

If no, then you don’t need to submit an information return report - unless you receive products that have been shipped by sea to a port in the United States, and then imported into Canada by rail, pipeline or road you may need to submit an annual information return report depending on how much of that product you receive or export.

How much product do you receive?

If in one year you receive:

- more than 150,000 tonnes of persistent oil, or

- more than 17,000 tonnes of non-persistent oil, or

- more than 17,000 tonnes of liquid petroleum gas (LPG), or

- any amount of liquefied natural gas (LNG), or

- more than 17,000 tonnes of any other bulk hazardous and noxious substances

and/or you export:

- more than 17,000 tonnes of non-persistent oil, or

- more than 150,000 tonnes of persistent oil

You may need to submit an annual information return report. You can find out by reading the sections specific to the type of product you transport.

If you don’t, then you don’t have to submit an information return report. Note, all affiliates need to combine the annual totals they receive and/or export.

Product types

Persistent oil

If in one year you receive or export more than 150,000 tonnes of persistent oil transported by sea, you’ll need to provide an annual information return report. Every time you receive or export persistent oil within Canada, that counts toward your annual total. Even if the product was stored or transformed before it was transported by sea again, it must be included in your annual total.

Non-persistent oil that is exported

If in one year you receive more than 17,000 tonnes of non-persistent oil transported by sea, you need to submit an annual information return report.

Bulk HNS including non-persistent oil, LPG and LNG

If in one year you:

- receive more than 17,000 tonnes of non-persistent oil, or

- receive more than 17,000 tonnes of liquid petroleum gas (LPG), or

- receive any amount of liquefied natural gas (LNG), or

- receive more than 17,000 tonnes of any other bulk hazardous or noxious substance

transported by sea, please determine if the product was already received by sea somewhere in Canada.

If the product was already received by sea somewhere else in Canada, please read the transformation section.

If the product was not already received by sea somewhere in Canada, please read the final destination section.

Has the product reached its final destination by sea?

Please determine if the product has reached its final destination by sea.

If yes, you need to submit an annual information return report.

If no, when the product reaches its final destination in Canada by sea it will contribute to the receiver’s annual total. If you’re the final receiver, you must include it in your annual information return report.

Was the product refined altered, transformed or used in a manufacturing process before you received it?

Please determine if the product was refined, altered, transformed or used in a manufacturing process before you received it.

If yes, what you have is considered a “new product.” Even if the product was already reported before it was transformed, when it reaches its final destination in Canada by sea, it will contribute to the receiver’s annual total. If you’re the final receiver, you must include it in your annual information return report.

If no, please read the final destination section.

Still unsure? Please email us: TC.HNS-SNPD.TC@tc.gc.ca.