In Canada, the polluter pays. When it comes to ship-source oil spills or incidents of chemicals and other dangerous goods, shipowners and compensation funds financed by industry are responsible for covering the costs of eligible losses and damage.

Shipowners are liable (responsible) up to a limit based on the size of their ship. Once that limit has been reached, more compensation is available through national and international funds set up to cover eligible claims of loss and damage. These funds are financed by levies placed on cargo owners.

Levies can vary from year to year and depend on the amount of product Canada receives (imports and shipped within Canada), and sometimes exports every year. To make sure there’s enough money to cover all eligible losses and damage, every year the Marine Liability Act requires cargo owning companies and their representatives to report the type of product, and amount of product they received or exported, to Transport Canada.

On this page

- Who needs to report?

- Information to report

- How to submit an information return report

- Additional details for people who need to report

- How your report helps us prepare for oil and chemical spills

- Contact

Who needs to report?

The Marine Liability and Information Returns Regulations list what needs to be reported and who needs to report it.

Who submits an information return depends on 3 things:

- whether the product has been transported by sea

- how much of the product is being received or exported, and

- what type of product is being transported (persistent oil, non-persistent oil, or another bulk hazardous or noxious substance)

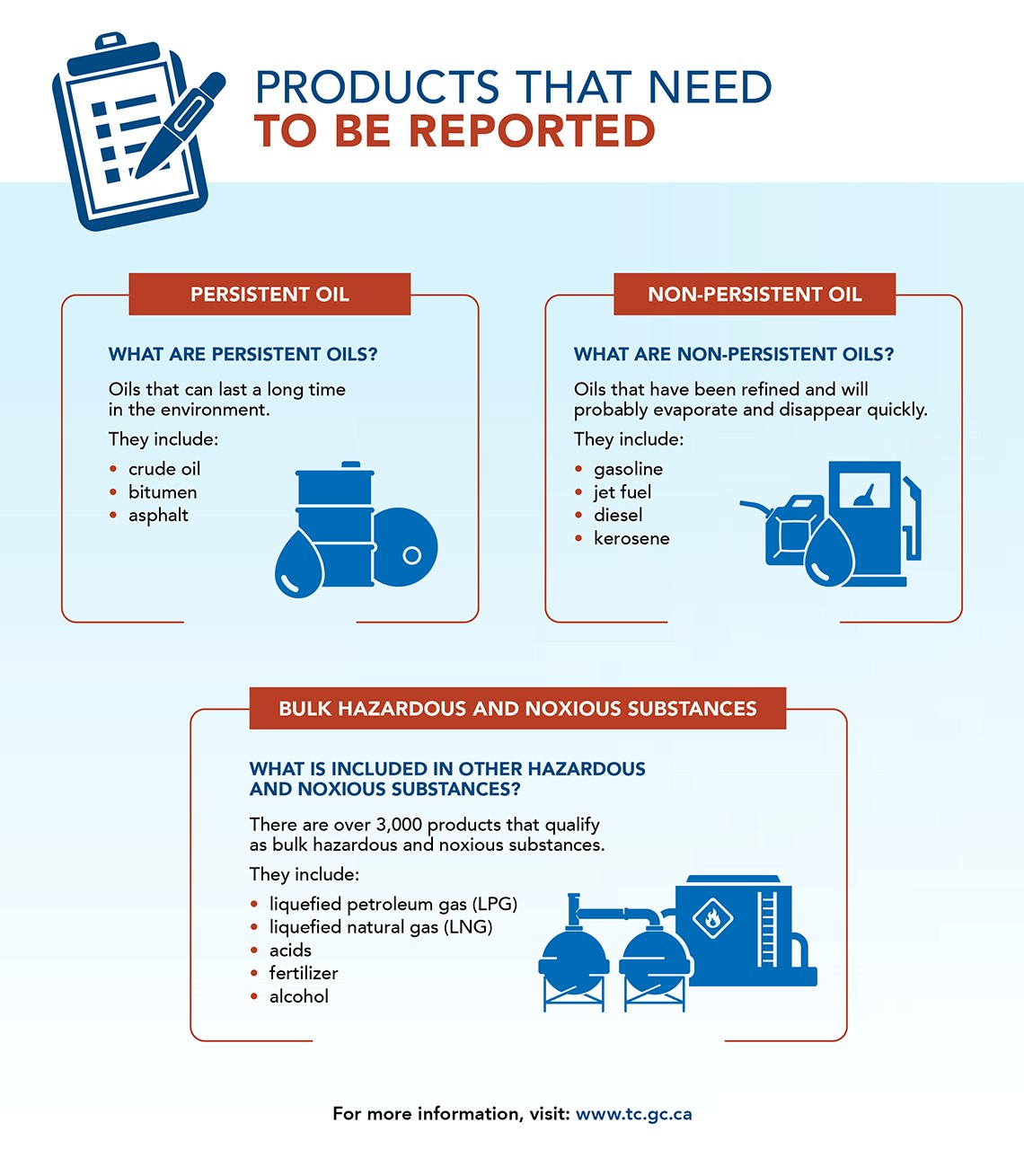

Products that need to be reported

Products that need to be reported

| Product | Description |

|---|---|

| Persistent oil |

Persistent oils are oils that can last a long time in the environment. They include:

|

| Non-persistent oil |

Non-persistent oil are oils that have been refined and will probably evaporate and disappear quickly. They include:

|

| Bulk hazardous and noxious substances |

There are over 3,000 products that qualify as bulk hazardous and noxious substances. They include:

|

Know if you need to submit a report

Know if you need to submit a report

| If | Then |

|---|---|

| You received more than 150,000 tonnes of persistent oil in Canada by sea | You must submit an annual report |

| You exported more than 150,000 tonnes of persistent oil in Canada by sea | You must submit an annual report |

| You received more than 150,000 tonnes of persistent oil in Canada that was transported by sea to a port in the United States and then imported into Canada by rail, pipeline or road transportation | You must submit an annual report |

| You received more than 17,000 tonnes of non-persistent oil in Canada by sea | You must submit an annual report |

| You exported more than 17,000 tonnes of non-persistent oil from Canada by sea | You must submit an annual report |

| You received more than 17,000 tonnes of liquefied petroleum gas in Canada by sea | You must submit an annual report |

| You received any amount of liquefied natural gas (LNG) in Canada by sea | You must submit an annual report |

| You received more than 17,000 tonnes of any other bulk hazardous or noxious substance in Canada by sea | You must submit an annual report |

| You exported or received any hazardous or noxious substance carried in packaged form or containers | You don’t need to submit an annual report |

Still not sure if you need to report?

You can find more details, including reporting exceptions, below. You can also use our flow chart.

Complete list of bulk hazardous and noxious substances that must be reported

Information to report

Your annual information return report needs to include:

- the product type

- the total quantity of each product that was received or exported in the calendar year

- your company contact information, like: name, mailing address, email address, phone number

- if the product was received or exported through a storage terminal owned and/or operated by a different company (the agent), the name of the agent, the type and quantity of product received

- if you own and/or operate a storage terminal and received or exported products on behalf of another company (the principal), the name of the principal, the type and quantity of the product received

You should only submit one report per company, including all subsidiaries, each year.

How to submit an information return report

Transport Canada has designed a system to make reporting easy.

Submit your report online through the HNS and Oil Electronic Reporting System.

Deadline

Reports need to be submitted by February 28 every year.

So, if you received persistent oil by sea in 2021, you need to report that information by February 28, 2022.

If you can’t submit your report on time, please contact Transport Canada right away and wait for instructions. If you don’t submit a report, or knowingly submit false information, you can be fined up to $250,000.

Additional details for people who need to report

If you need to submit a report, please review this section beforehand. This section includes important details.

Internal waters

Products received in or exported from Canada that only transit via internal waters don’t need to be reported.

In Eastern Canada, it can be hard to know where Canada’s internal waters end and the sea begins. The boundary between internal waters and the sea is at Anticosti Island. Products that move east of the boundary are considered to be transported by sea.

For example, a product leaving from Montréal, moving past Anticosti Island, and arriving at its final destination in Newfoundland would be considered as transported by sea. A product moving from Montreal to Chicago would only transit internal waters.

Products in transit

A shipment may move through many ports, storage terminals, or tankers when transported by sea to its final destination.

Non-persistent oil and other bulk hazardous and noxious substances are only counted once they reach their final destination by sea. There is no limit on the amount of time a product can be stored as long as you plan to transport it, at some point.

Every time you receive or export persistent oil within Canada, that counts toward your annual total and you must report if you are above the threshold.

Example: A shipment of 20,000 tonnes of non-persistent oil is shipped from Hamilton to Montréal where it’s transferred to a storage terminal. It’s then put on another ship and you receive it in St. John’s. The shipment won’t be put on another ship. This is considered its final destination. You must report this information.

Used and/or transformed substances

Persistent oil, non-persistent oil, and other bulk hazardous and noxious substances that have been refined, processed, or used in manufacturing and then shipped to a new location count toward annual totals when it’s received before and after it’s transformed.

Example: A Saint John refinery receives 150,000 tonnes of persistent oil. The refiner must report this information. It’s converted to 50,000 tonnes of non-persistent oil at the refinery and shipped to a Montréal terminal. This information must be reported by the Montréal terminal.

Agents and principals

The reporting requirements for non-persistent oil and other bulk hazardous and noxious substances apply to all agents and principals.

This means that even if you receive a product on behalf of someone else, you must report that information. If someone receives a product on your behalf, you must report that information.

If you’re an agent, you must report the name of the principal and the type and quantity of product received on the principal’s behalf.

If you’re a principal, you must report the name of the agent and the type and quantity of product received by the agent on your behalf.

Example: An independent storage terminal (agent) in Canada receives 17,000 tonnes of non-persistent oil by sea for another company (principal) located in Canada. Both the agent and the principal must report that information.

Affiliates

All affiliates need to combine the annual totals they receive and/or export. The total will determine whether or not you need to report.

How your report helps us prepare for oil and chemical spills

By submitting your information return report, you’re helping Canada prepare for oil and chemical spills.

There are several funds that compensate people for loss and damage from spills, even when the cause of the spill isn’t known. These include Canada’s Ship-Source Oil Pollution Fund, and several international funds:

- 1992 International Oil Pollution Compensation (IOPC) Fund

- Supplementary Fund, and

- Hazardous and Noxious Substance Fund (not yet in force)

The amount of money government and industry pays into these funds is based on the information you submit in your reports, namely how much oil and chemicals Canada received and exported in a year.

Contact

If you need more information or have any questions please email us: TC.HNS-SNPD.TC@tc.gc.ca.