Table of Contents

Organizational Profile

Appropriate Minister: The Honourable Lisa Raitt, Minister of Transport

Institutional Head: Louis Lévesque, Deputy Minister

Ministerial portfolio: Transport Canada

Transport Canada is part of the Transport Canada Portfolio, which includes:

- Transport Canada;

- Shared governance organizations (e.g., the St. Lawrence Seaway Management Corporation);

- Crown corporations (e.g., the Great Lakes Pilotage Authority, Canada Post Corporation); and

- Administrative tribunals/agencies (e.g., the Transportation Appeal Tribunal of Canada).

Grouping these organizations into one portfolio allows for integrated decision-making on transportation issues.

Enabling Instrument: Department of Transport ActEndnote ii (R.S., 1985, c. T-18)

Transport Canada administers over 50 laws related to transportationEndnote ii and also shares the administration of many others. Justice Canada is the federal department responsible for maintaining the Consolidated Statutes of CanadaEndnote iii, and provides access to the full text of federal acts and regulations.

Year of incorporation / Commencement: 1936

Organizational Context

Raison d'être

The movement of people and goods lies at the cornerstone of our modern and interconnected world. Canadians expect to be able to travel and expedite goods locally, across the country or around the world in an efficient, clean, safe and secure manner. Canada’s transportation system meets the challenges posed by topography and geography, linking communities and reducing the effects of the distance that separates people. These vital roles reflect transportation’s interdependent relationship with all sectors of the economy and society.

OUR VISION

A transportation system in Canada that is recognized worldwide as safe and secure, efficient and environmentally responsible.

Transport Canada’s vision of a sustainable transportation system integrates social, economic and environmental objectives. Our vision’s three guiding principles are to work towards:

- the highest possible safety and security of life and property, supported by performance-based standards and regulations;

- the efficient movement of people and goods to support economic prosperity and a sustainable quality of life, based on competitive markets and targeted use of regulation and government funding; and

- respect of the environmental legacy of future generations of Canadians, guided by environmental assessment and planning processes in transportation decisions and selective use of regulation and government funding.

Responsibilities

Transport Canada 2015-16 Report on Plans and PrioritiesEndnote iv is responsible for the Government of Canada’s transportation policies and programs. The Department develops legislative and regulatory frameworks, and conducts transportation oversight through legislative, regulatory, surveillance and enforcement activities. While not directly responsible for all aspects or modes of transportation, the Department plays a leadership role to ensure that all parts of the transportation system across Canada work together effectively.

Transport Canada has sole responsibility for matters such as aviation safety and security; for other matters, we share responsibility with other government departments, and provincial, territorial and municipal governments. We also work with trading partners and international organizations to understand and harmonize policy and administrative frameworks, so as to protect Canadian users of the global transportation system while encouraging efficiency.

In areas for which Transport Canada does not have direct responsibility—for example, for building and maintaining road networks—we use strategic funding and partnerships to promote the safe, efficient and environmentally responsible movement of people and goods into and across the country. In this way, we play a leadership role to ensure that all parts of the transportation system across Canada and worldwide work together effectively and efficiently.

Strategic Outcomes and Program Alignment Architecture (PAA)

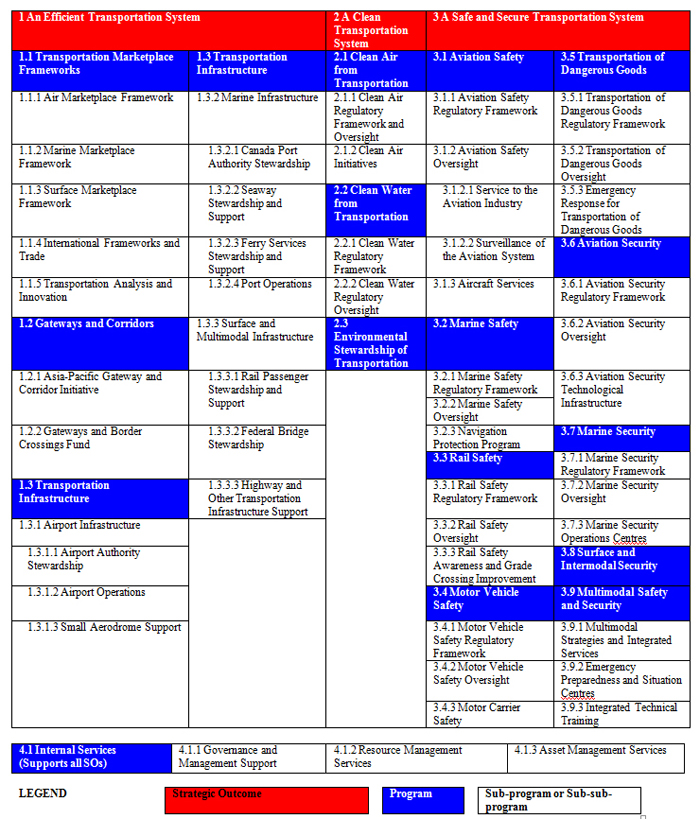

As illustrated in Figure 1, Transport Canada’s 2015–16 Program Alignment Architecture includes 15 Programs that contribute to achieving the following three Departmental Strategic Outcomes:

- An efficient transportation system;

- A clean transportation system; and

- A safe and secure transportation system.

The 16th Program, Internal Services, supports all three strategic outcomes.

Figure 1: Transport Canada 2015–16 Program Alignment Architecture (PAA)

[Text Version of Figure 1: Transport Canada 2015–16 Program Alignment Architecture (PAA)]

Organizational Priorities

Transport Canada has identified five priorities for 2015–16. They align with Government of Canada (GoC) priorities, support the achievement of our Strategic Outcomes and help the department address risks. Over the course of the year, senior management will pay special attention to the plans developed to meet these priorities and achieve results.

| Priority | TypeFootnote 1 | Strategic Outcomes and Programs |

|---|---|---|

|

Refine and strengthen Transport Canada's safety and security oversight |

Ongoing |

SO3 A Safe and Secure Transportation System (All Programs) |

| Description | ||

|

Why is this a priority? A safe and secure transportation system moves people and goods across Canada and to international destinations without loss of life, injury or damage to property. By refining and strengthening Transport Canada's oversight function, the Department will be better able to work with the transportation industry to uphold a culture of safety and security. What are the plans for meeting this priority?

|

||

| Priority | Type | Strategic Outcomes and Programs |

|---|---|---|

|

Continue to contribute to the Government’s Responsible Resource Development and Sustainable agenda |

Previously Committed |

SO2 A Clean Transportation System (All Programs) SO3 A Safe and Secure Transportation System (Programs 3.2 and 3.9) |

| Description | ||

|

Why is this a priority? The Government of Canada is taking steps to ensure that Canada develops its natural resources in a way that protects the environment, while contributing to continued economic growth and job creation. What are the plans for meeting this priority?

|

||

| Priority | Type | Strategic Outcomes and Programs |

|---|---|---|

|

Improve Canada’s competitiveness and critical transportation infrastructure |

Ongoing |

SO1 An Efficient Transportation System (Program 1.1 and 1.2) SO3 A Safe and Secure Transportation System (Program 3.6) |

| Description | ||

|

Why is this a priority? An efficient transportation system supports trade and economic prosperity which contributes to Canadians’ quality of life. Having the right policy framework and adequate infrastructure for our key trade corridors is essential for the transportation system. What are the plans for meeting this priority?

|

||

| Priority | Type | Strategic Outcomes and Programs |

|---|---|---|

|

Ensure that Transport Canada’s policies, programs and activities will meet the needs of the transportation system in the long term |

Ongoing |

SO1 An Efficient Transportation System (All Programs) SO2 A Clean Transportation System (All Programs) SO3 A Safe and Secure Transportation System (Program 3.6) Program 4.1 Internal Services |

| Description | ||

|

Why is this a priority? Transportation is essential for Canada’s social and economic prosperity. This priority will ensure that our approaches continue to be relevant, meet the needs of the transportation sector and consider social, economic and environmental objectives.

|

||

| Priority | Type | Strategic Outcomes and Programs |

|---|---|---|

|

Adopt the Government of Canada’s efficiency and renewal measures |

Previously Committed |

All SOs and Programs |

| Description | ||

|

Why is this a priority? The Government of Canada recognizes the need to adapt to the world’s rapid rate of change that values innovation, agility and productivity, with the dual goals of improved service and greater efficiency. What are the plans for meeting this priority?

|

||

Risk Analysis

Operational Context

This subsection outlines the external and internal risk and opportunity drivers that we expect will affect Canada’s transportation system over the 2015–16 planning horizon. They were identified through an environmental scan as part of our integrated planning and reporting process.

In the years ahead, pressures such as demographic shifts, access to natural resources, fiscal constraints, environmental protection, and general global geopolitical and economic turbulence will present challenges and opportunities for our transportation system, such as accessibility and the development of the North.

Changing climate and more extreme weather events may result in damage and disruption to transportation infrastructure and operations. Resource development will continue, as well as pressure from Canadian producers/ shippers and international trade partners for improved system resilience. Web and mobile technologies, as well as access to government and partner data, can help to increase work productivity and efficiency and flexibility, improve engagement and knowledge transfer, and provide accurate and timely delivery of information and services to citizens and clients.

Transport Canada has a strong safety record. However, safety and security practices and mechanisms must address shifting conditions and requirements in an agile manner, including harmonization among transportation modes, where appropriate. Security threats, affecting all modes of the transportation system, as well as cyber attacks and phishing, will require continued vigilance. To maintain public confidence towards transportation, governments and industry will need to adapt quickly to changes in the environment.

Key Risks and Risk Responses

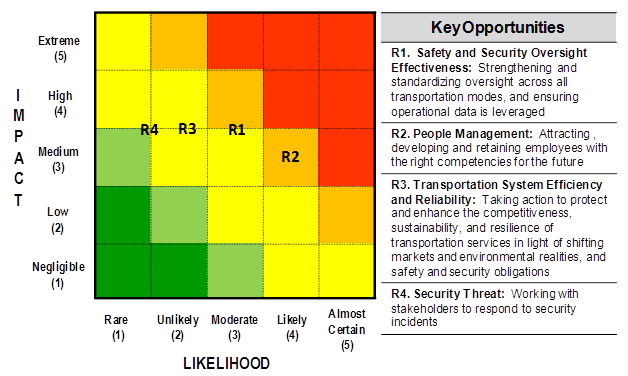

Risk management is integrated in all facets of Transport Canada’s activities. The analysis of opportunities and challenges that could affect Canada’s transportation system sets the context in which Transport Canada must identify the range of possible risks and opportunities, assess the likelihood and potential impacts of adverse or favourable events, and develop responses to the threats and opportunities that may affect the delivery of Transport Canada’s mandate. The opportunities and risks that have the most significant potential to affect the department’s objectives are identified in the Corporate Risk Profile (CRP).

Transport Canada identified four key opportunity areas in its current CRP. The Department has also identified and implemented mitigation measures, or risk responses. The identification of opportunities and risks and the development of responses contribute to making decisions related to setting departmental priorities, planning, allocating resources, developing policies and managing programs. The figure below shows four key opportunity areas and their residual impact and likelihood placement, taking into account mitigation measures, should the opportunities not be realized:

Transport Canada's Corporate Risk Profile, September 2014

[Text Version of Transport Canada's Corporate Risk Profile September 2014]

The table below presents the key elements of our risk response strategy:

| Opportunity Area | Risk Response Strategy | Link to Program Alignment Architecture |

|---|---|---|

|

R1. Safety and Security Oversight Effectiveness |

The regulatory framework must remain current and our internal governance and processes must adequately support oversight of the national transportation system. Oversight also requires ensuring accountability and effective management by all partners in the safety/ security chain, including operators who have primary responsibility for transportation. Key responses include:

|

SO3 – A safe and secure transportation system |

|

R2. People Management |

Transport Canada must attract, develop and retain the right people with the right skills at the right time, to ensure the delivery of key programs in all of Transport Canada’s Strategic Outcomes. Key responses include:

|

Across all three SOs and Internal Services |

|

R3. Transportation System Efficiency and Reliability |

With continuing economic uncertainty and shifting trade patterns, strategic gateways and corridors must be efficient and internationally competitive to support Canada’s economic growth. Any decrease in services to shippers and travellers may hamper economic development and have significant impacts on our competitive position and economic growth. Key responses include:

|

SO1 – An efficient transportation system SO2 – A clean transportation system |

|

R4. Security Threat |

International and public confidence in the security of Canada’s transportation infrastructure is essential to Canada’s economy. Security threats to human health and safety that could lead to death and/or injury to the public, and the destruction of key infrastructure sites have the potential for extreme impact. Key responses include:

|

SO3 – A safe and secure transportation system |

Planned Expenditures

The following financial resources table provides a summary of the total planned spending for Transport Canada for the next three fiscal years. For more details on Planned Spending, including adjustments, please visit Transport Canada’s website.

| 2015–16

Main Estimates |

2015–16

Planned Spending |

2016–17

Planned Spending |

2017–18

Planned Spending |

|---|---|---|---|

| 1,615,012,278 | 1,615,012,278 | 1,026,195,218 | 1,138,086,905 |

The following human resources table provides a summary of the total planned human resources for Transport Canada for the next three fiscal years.

| 2015-16 | 2016-17 | 2017-18 |

|---|---|---|

| 5,243 | 5,051 | 5,003 |

Budgetary Planning Summary for Strategic Outcomes and Programs (dollars)

The following tables present:

- the planned spending for 2015–16 and for the next two fiscal years, by Program, in support of each Strategic Outcome;

- the total Departmental spending for all Programs for 2012–13 and 2013–14, and forecasted spending for 2014–15; and

- the Strategic Outcomes 1, 2 and 3 and Program contribution alignments to the Government of Canada outcomes.

| Strategic Outcomes, Programs and Internal Services | Government of Canada Outcomes | 2012-13 Expenditures | 2013-14 Expenditures | 2014-15 Forecast Spending | 2015-16 Main Estimates | 2015-16 Planned Spending | 2016-17 Planned Spending | 2017-18 Planned Spending |

|---|---|---|---|---|---|---|---|---|

| Strategic Outcome 1: An Efficient Transportation System | ||||||||

| 1.1 Transportation Marketplace Frameworks | A fair and secure marketplace | 9,041,585 | 11,917,295 | 28, 901,855 | 24,473,890 | 24,473,890 | 21,393,723 | 21,405,670 |

| 1.2 Gateways and Corridors | Strong economic growth | 395,779,632 | 336,988,453 | 506,001,664 | 576,569,290 | 576,569,290 | 110,140,965 | 282,399,187 |

| 1.3 Transportation Infrastructure | Strong economic growth | 309,656,203 | 363,848,205 | 481,781,278 | 399,495,001 | 399,495,001 | 350,031,572 | 301,848,075 |

| 1.4 Transportation Analysis and InnovationFootnote * | 9,471,905 | 12,885,608 | 0 | 0 | 0 | 0 | 0 | |

| Strategic Outcome 1 Subtotal | 723,949,325 | 725,639,561 | 1,016,684,797 | 1,000,538,181 | 1,000,538,181 | 481,566,260 | 605,652,932 | |

| Strategic Outcome 2: A Clean Transportation System | ||||||||

| 2.1 Clean Air from transportation | A clean and healthy environment | 18,760,359 | 27,755,589 | 24,265,637 | 29,417,677 | 29,417,677 | 4,506,789 | 1,501,789 |

| 2.2 Clean Water from transportation | A clean and healthy environment | 6,947,514 | 16,198,195 | 25,584,834 | 31,902,400 | 31,902,400 | 26,896,996 | 16,766,856 |

| 2.3 Environmental Stewardship of transportation. | A clean and healthy environment | 20,059,193 | 29,431,954 | 49,716,328 | 33,906,726 | 33,906,726 | 10,734,397 | 10,734,397 |

| Strategic Outcome 2 Subtotal | 45,767,066 | 73,385,738 | 99,566,799 | 95,226,803 | 95,226,803 | 42,138,182 | 29,003,042 | |

| Strategic Outcome 3: A Safe and Secure Transportation System | ||||||||

| 3.1 Aviation Safety | A safe and secure Canada | 198,628,602 | 184,628,770 | 191,114,700 | 173,447,956 | 173,447,956 | 172,861,136 | 169,835,759 |

| 3.2 Marine Safety | A safe and secure Canada | 56,492,575 | 59,638,305 | 74,620,988 | 57,475,536 | 57,475,536 | 53,463,452 | 52,892,836 |

| 3.3 Rail Safety | A safe and secure Canada | 34,213,510 | 29,250,946 | 37,340,655 | 35,707,671 | 35,707,671 | 35,525,338 | 35,054,167 |

| 3.4 Motor Vehicle Safety | A safe and secure Canada | 22,458,347 | 26,152,233 | 24,918,896 | 22,723,248 | 22,723,248 | 20,089,942 | 20,384,666 |

| 3.5 Transportation of Dangerous Goods | A safe and secure Canada | 12,756,370 | 14,663,095 | 22,528,987 | 15,322,623 | 15,322,623 | 15,279,721 | 15,437,993 |

| 3.6 Aviation Security | A safe and secure Canada | 33,706,392 | 29,743,295 | 33,398,475 | 29,791,738 | 29,791,738 | 29,516,367 | 29,516,367 |

| 3.7 Marine Security | A safe and secure Canada | 14,005,041 | 12,331,970 | 15,125,397 | 12,872,129 | 12,872,129 | 12,782,279 | 12,782,279 |

| 3.8 Surface and Intermodal Security | A safe and secure Canada | 3,967,849 | 4,280,788 | 5,056,078 | 4,703,731 | 4,703,731 | 4,573,144 | 4,573,144 |

| 3.9 Multimodal Safety and Security | A safe and secure Canada | 0 | 10,722,526 | 20,426,098 | 10,890,897 | 10,890,897 | 10,785,344 | 10,785,344 |

| Strategic Outcome 3 Subtotal | 376,228,686 | 371,411,928 | 424,530,274 | 362,935,529 | 362,935,529 | 354,876,723 | 351,262,555 | |

| Internal Services Subtotal | 186,533,092 | 170,195,608 | 171,930,733 | 156,311,765 | 156,311,765 | 147,614,053 | 152,168,376 | |

| Total | 1,332,478,169 | 1,340,632,835 | 1,712,712,604 | 1,615,012,278 | 1,615,012,278 | 1,026,195,218 | 1,138,086,905 | |

Note: Includes funding for all votes and statutory items. A trend analysis and an explanation of variances follows.

Trend Analysis

An Efficient Transportation System

Planned spending in An Efficient Transportation System is mostly impacted by changes in project cash flows for the Asia Pacific Gateways and Corridors Initiative and the Gateways and Border Crossings Fund (GBCF). Funding levels for these programs normally fluctuate based on planned projects and, with the exception of an increase in 2017-18 as a result of planned expenditures for one GBCF project, funding levels start decreasing in 2015-16 as the programs reach their end date. Planned spending for Transportation Infrastructure peaks in 2014–15 due to the purchase of a replacement ferry vessel, subsequently declining in 2016–17 and 2017–18 as a result of expected decreases in statutory payments to the St. Lawrence Seaway Management Corporation. Fluctuations in other years are mostly related to changes in port divestiture project cash flows.

A Clean Transportation System

Planned spending for A Clean Transportation System varies over the planning horizon as a result of changes in funding levels for various initiatives. Planned spending for the Federal Contaminated Sites Action Plan (Environmental Stewardship of Transportation) and the Next Generation of Clean Transportation (Clean Air from Transportation) ends March 31, 2016. Funding for the Smart Oceans Contribution Program (Clean Water from Transportation) ends March 31, 2017.

A Safe and Secure Transportation System

Planned spending for A Safe and Secure Transportation System decreases as a result of the transfer of funding to Shared Services Canada, the implementation of cost saving measures announced in Budget 2012, and some internal reallocations of funding to centralize administrative functions and better align expenditures with Transport Canada’s Program Alignment Architecture. Spending can also vary from year to year as a result of changes in the type and number of investment projects undertaken each year and the varying demand for transfer payments programs. There was an overall spike in the forecast spending of 2014–15 due to the salary costs from the liquidation of severance pay and a one-time cost related to the transition to pay-in-arrears by the Government of Canada. Forecast spending in 2014-15 has also spiked in Marine Safety, Transportation of Dangerous Goods and Multimodal Safety and Security as a result of expected increased activity in these areas. The Department undertakes annual reviews of program resource requirements as part of the planning process and reallocates funding internally as required. Operating and Grants and Contribution funding remain fairly consistent after 2015-16 and variances in planned spending are mostly related to changes in cash flows for Capital projects.

Internal Services

Planned spending for Internal Services decreases in future years mostly as a result of the transfer of funding to Shared Services Canada and the implementation of cost saving measures announced in Budget 2012. There was an overall spike in the forecast spending of 2014–15 due to the salary costs from the liquidation of severance pay and a one-time cost related to the transition to pay-in-arrears by the Government of Canada.

Alignment to Government of Canada Outcomes

Alignment of 2015-16 Planned Spending With the Whole-of-Government FrameworkEndnote vi (dollars)

| Government of Canada Spending Area | Government of Canada Outcome | Total Planned Spending |

|---|---|---|

| Economic affairs | Strong economic growth | 976,064,291 |

| A clean and healthy environment | 95,226,803 | |

| A fair and secure marketplace | 24,473,890 | |

| Social affairs | A safe and secure Canada | 362,935,529 |

| International affairs | Not applicable | 0 |

| Government affairs | Not applicable | 0 |

Departmental Spending Trend

For the 2015–16 fiscal year, Transport Canada plans to spend $1,615 million to meet the expected results of its program activities and to contribute to its strategic outcomes. This represents a net decrease in planned spending of $80 million over the 2014-2015 forecast spending level of $1,712 million.

The decrease from 2014–15 to 2015–16 is the result of reduced spending plans which had included a one-time cost for the purchase of a replacement ferry vessel, as well as salary costs from the liquidation of severance pay and a one-time cost related to the movement to pay-in-arrears. This decrease is offset by an increase in Grants and Contributions funding primarily related to a planned increase in spending for the Gateways and Border Crossings Fund.

Overall, spending plans decline after 2015–16 mostly as a result of a reduction in planned spending for the Asia Pacific Gateway and Corridor Initiative and the Gateways and Border Crossings Fund (GBCF) as well as spending on environmental initiatives such as the Next Generation of Clean Transportation and the Federal Contaminated Sites Action Plan as these initiatives reach their maturity dates. There is a slight increase in spending in 2017–18 as a result of planned expenditures for one GBCF project.

Figure 2 Spending Trend for Transport Canada

[Text Version of Figure 2 Spending Trend for Transport Canada]

Estimates by Vote

For information on Transport Canada’s organizational appropriations, consult the 2015–16 Main Estimates on the Treasury Board of Canada Secretariat website.Endnote vi